However, Bin emphasized in his latest outlook that the structural growth in AI computing power demand has not yet peaked.

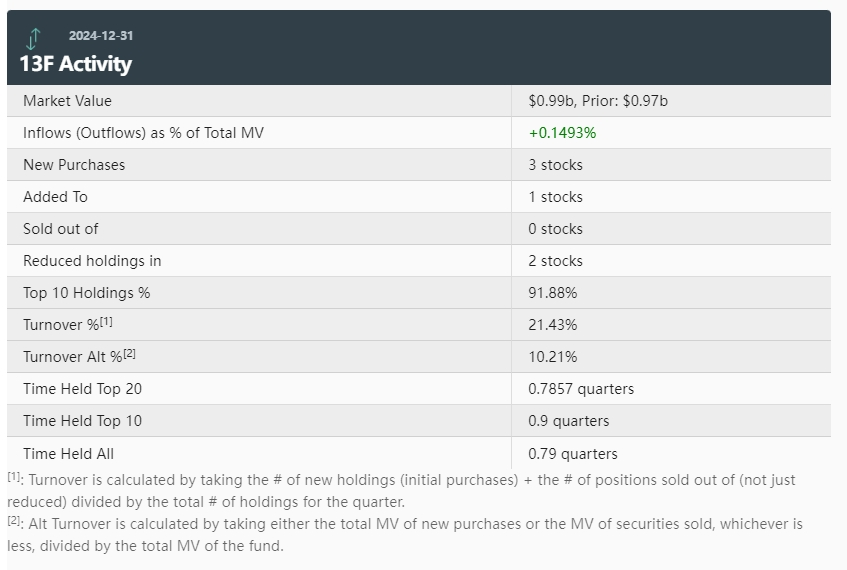

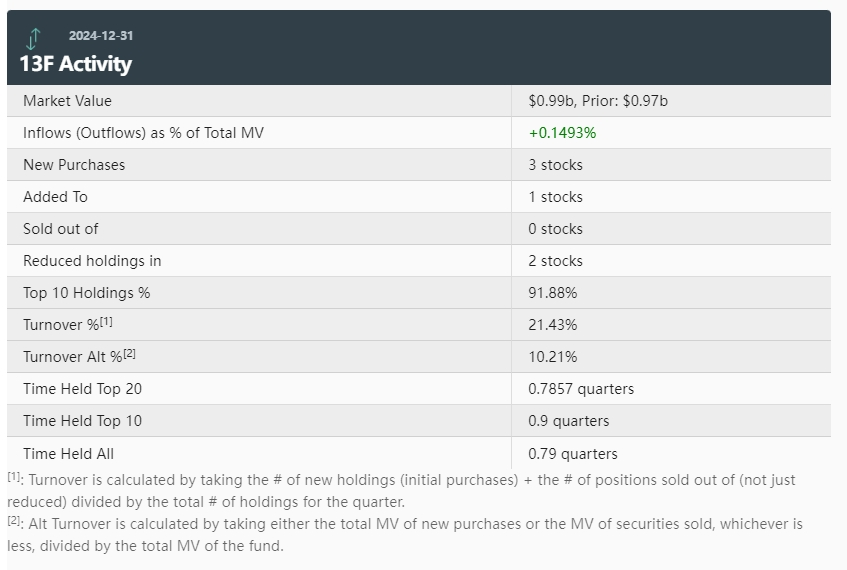

On February 10, 2025, Oriental Harbor Investment Fund, a subsidiary of well-known private equity manager Dan Bin, submitted U.S. stock position data as of the end of the fourth quarter of 2024 to the U.S. Securities and Exchange Commission (SEC).

The disclosure showed that the total market value of the fund's holdings reached US$995 million, a slight increase of 2.7% from US$969 million at the end of the third quarter, continuing its stable layout in global capital markets.Despite the complex and ever-changing market environment, Dongfang Harbor continues to consolidate its core configuration in the field of artificial intelligence (AI) through flexible position adjustment and strategic focus, while increasing its exploration of emerging technology application scenarios.

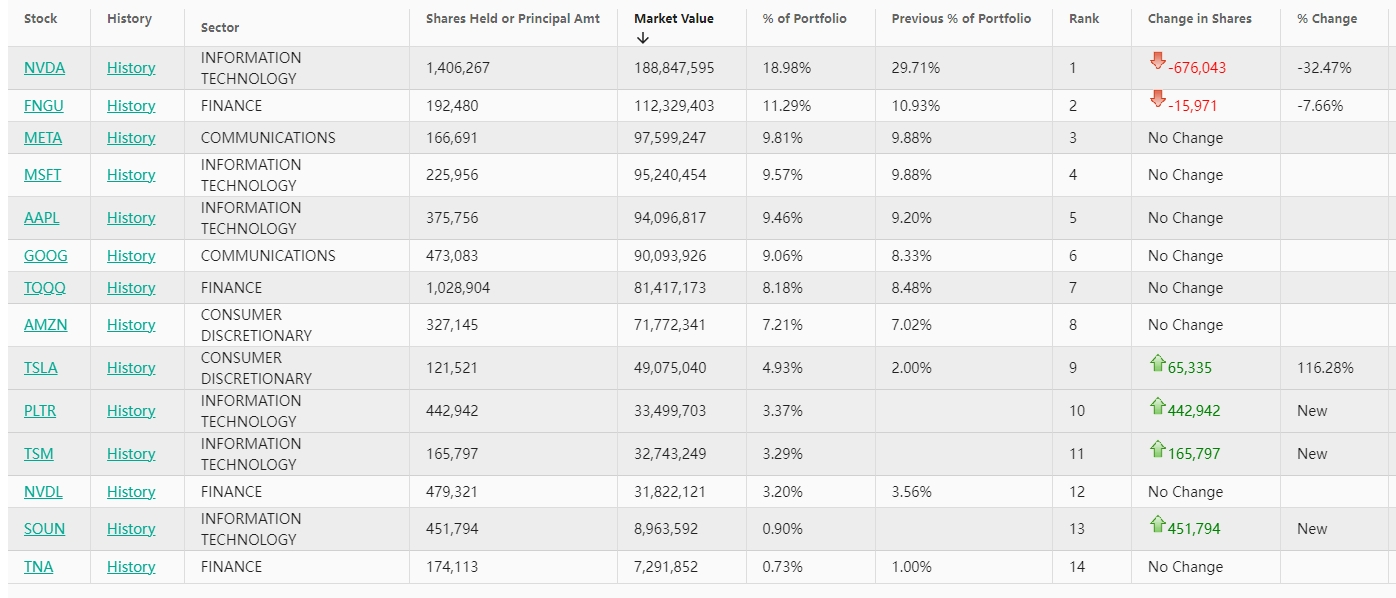

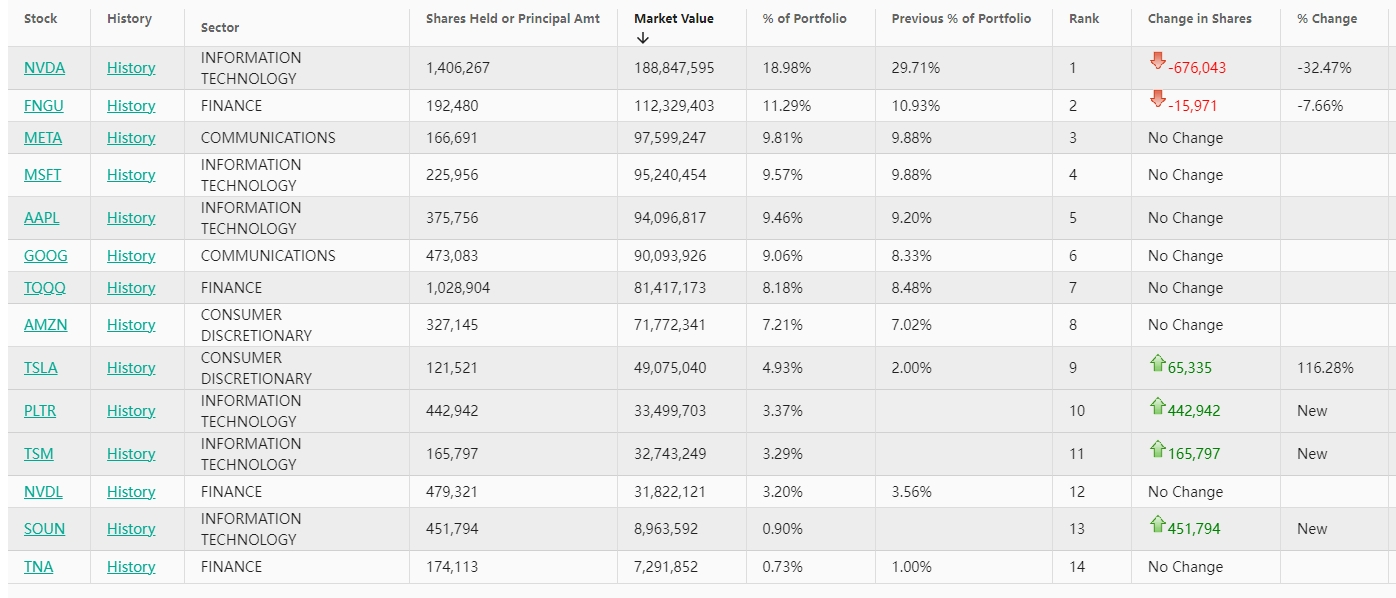

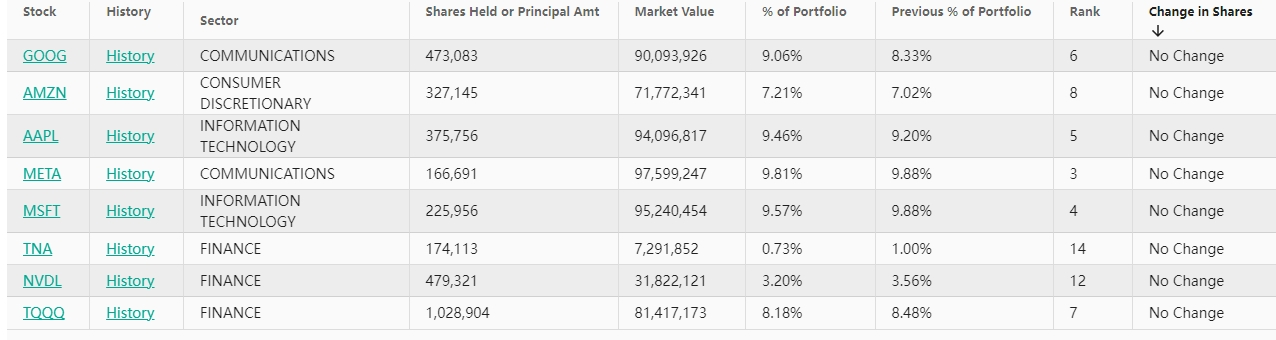

In terms of position structure, Nvidia still ranks among the fund's largest holdings with a market value of US$189 million. Although it suffered a significant reduction of 676,000 shares in the fourth quarter, its shareholding dropped from 2.0823 million shares to 1.4063 million shares, a decrease of 32.5%.This operation reflects Dan Bin's cautious attitude towards Nvidia's high short-term valuation, but his long-term confidence has not diminished.Nvidia has a cumulative increase of more than 170% in 2024. As the core infrastructure of AI computing power, its GPU products continue to benefit from the explosive growth in global AI training and reasoning demand, which has also become an important logic for Dongfang Harbor's previous heavy position.However, Bin emphasized in his latest outlook that the structural growth in demand for AI computing power has not yet peaked, and the popularity of the reasoning era may further push up demand for high-end GPUs, in sharp contrast to the market's worried "demand decline theory."

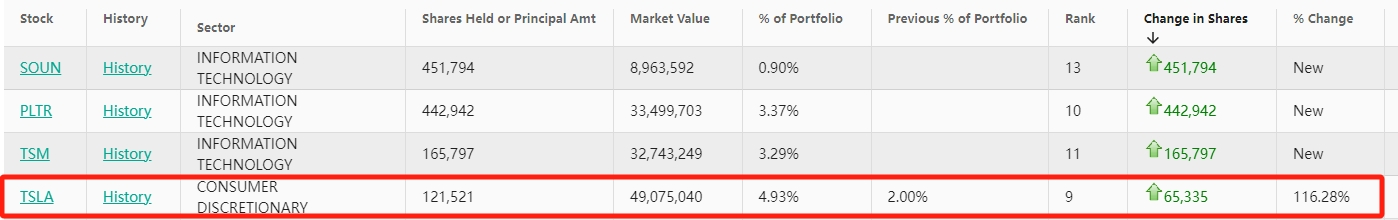

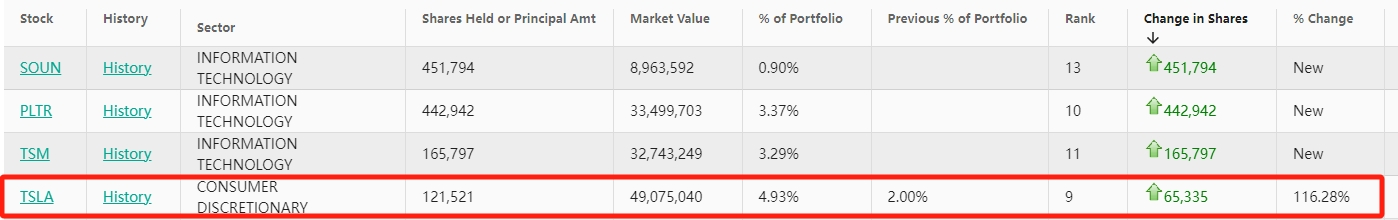

In contrast to its reduction in Nvidia, Oriental Harbor significantly increased its position in Tesla in the fourth quarter, increasing its shareholding from 56,200 shares to 121,500 shares, an increase of 116%.This adjustment highlights the fund's long-term optimism about technological iteration and market penetration improvement in the electric vehicle industry.Tesla's cross-border deployment in the fields of autonomous driving, energy storage and humanoid robots is regarded as a key carrier for AI technology to be implemented in the real economy.

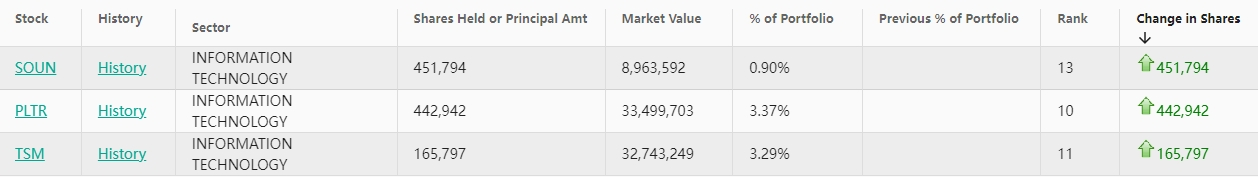

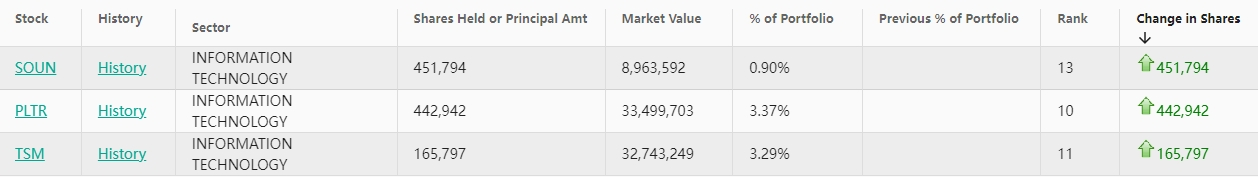

In addition, the three targets of the fund's new positions-big data analysis giant Palantir, global semiconductor OEM leader TSMC and voice interaction technology company SoundHound AI-further complement its coverage in the AI industry chain.Palantir relies on government and corporate data insight services to build a moat, TSMC benefits from the continuous increase in advanced process chips, and SoundHound AI's breakthroughs in natural language processing may open up growth space for it in intelligent customer service and Internet of Things scenarios.

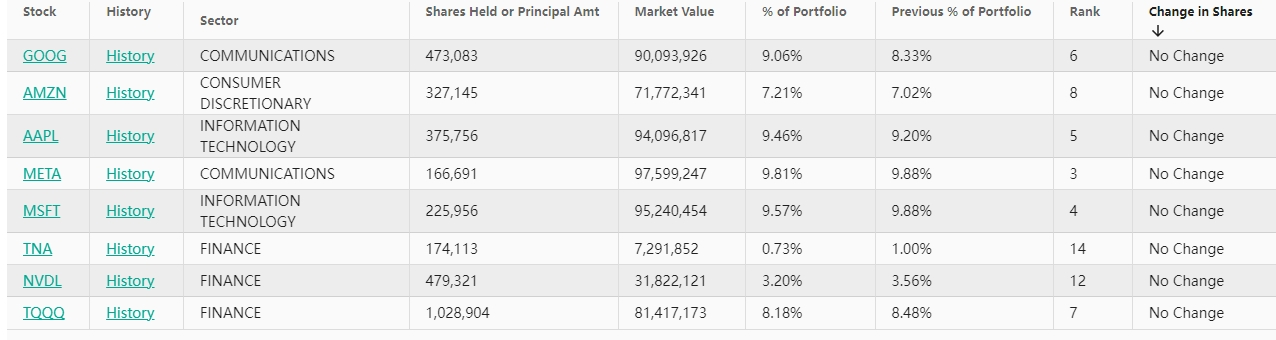

In terms of position stability, Oriental Harbor's positions in technology giants such as Meta, Microsoft, and Apple remain unchanged. The top five major positions are Nvidia, triple long FANG+ Index ETN, Meta, Microsoft and Apple, accounting for a total of more than 60% of the total fund size.This "core + satellite" combination strategy not only captures the excess returns of the FANG+ index through leveraged ETFs, but also uses the liquidity of leading technology stocks to resist market fluctuations, reflecting Dan Bin's investment philosophy of "focusing on the main channel and taking into account flexibility".It is worth mentioning that the fund has not adjusted its positions on the 3x long Nasdaq 100ETF and the 2x long Nvidia ETF, indicating its optimistic expectations for the overall trend of the U.S. stock technology sector.

In terms of performance, Oriental Harbor Overseas Fund ranked third in the Morgan Hedge global hedge fund list with a yield of 46.99% in 2024. The revenue of many products it manages exceeded 50% during the year, and it has won the annual title of 10 billion private equity for two consecutive years. Champion.Behind this achievement, in addition to the contribution of Nvidia, it is also inseparable from the precise layout of the Nasdaq 100 Index-the index will increase by nearly 25% in 2024, and the position of the 3 times leveraged ETF TQQQ further amplifies beta gains.However, Bin admitted on social media that in the global asset management competition, the China team needs to continue to improve from a longer cycle perspective, and its concept of "holding a great company for a long time" has withstood the test in volatile markets.

Looking forward to 2025, Bin reiterated in the "Oriental Harbor 2024 Annual Report and Outlook" that artificial intelligence remains the most transformative investment opportunity in the world.He predicted that AI applications will take the lead in breaking through from B-side software agentization, and the intelligent transformation of traditional industries such as medical care and finance will spawn a new batch of unicorns; and the market's concern that "model cost reduction leads to shrinking computing power demand" is actually a misjudgment, and the scale of reasoning requirements may actually push up the purchase of high-end GPUs.However, he warned about the current high valuations of U.S. stocks: the dynamic P/E ratio of the Nasdaq 100 index in the next 12 months will reach 27 times, and the S & P 500 index will be 22 times, both close to 20-year highs.Coupled with geopolitical risks and tightening pressure on global liquidity, market volatility may increase significantly in 2025.In this regard, he suggested that investors increase their cash ratio, use protective option tools, and prioritize the allocation of market leaders with reasonable valuations.

It is noteworthy that Bin's risk warnings did not weaken his long-term belief in AI.In his view, the value realization of AI companies needs to go through the full cycle of "technological breakthroughs-commercial implementation-profit release". Investors need to penetrate short-term valuation fluctuations and focus on companies that truly have the ability to transform profits.This strategy of "remaining prudent while optimistic" may become the key to Eastern Harbor's excess returns in the next stage.