New Year's Greeting: Thailand strives to boost economy, promote debt restructuring of SMEs

Thailand's economic survey released by the OECD shows that the country now needs bold reforms to consolidate its recovery and enhance economic inclusiveness, and the Thai government is moving to promote debt restructuring for small and medium-sized enterprises.。

Thailand has made remarkable economic and social progress in recent decades.。According to the latest OECD Economic Survey: Thailand 2023, Thailand now needs bold reforms to solidify its recovery and strengthen economic inclusiveness.。

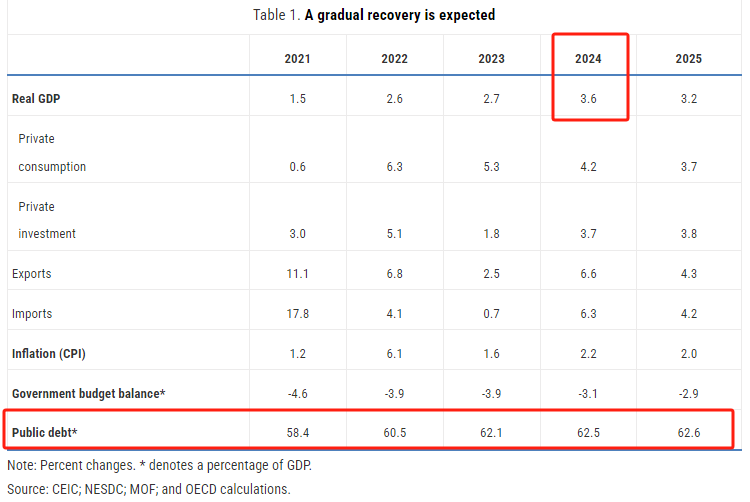

The report shows that since the outbreak of the neo-crown epidemic, the Thai economy is expected to continue its gradual recovery, boosted by a strong rebound in tourism, and GDP is expected to grow by 3% in 2024..6%。

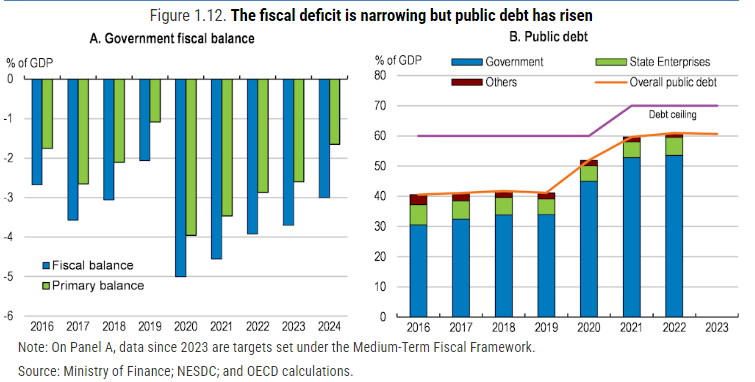

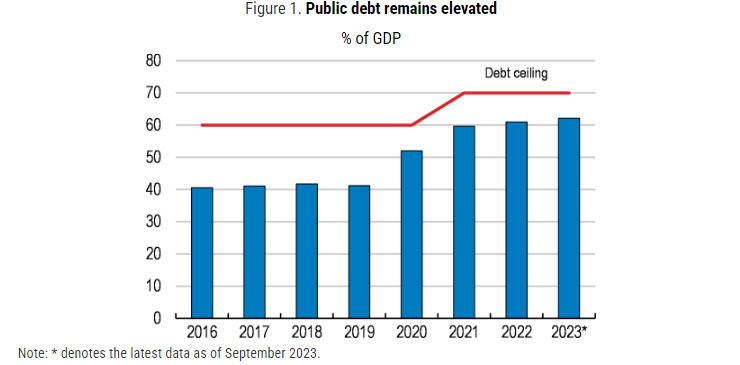

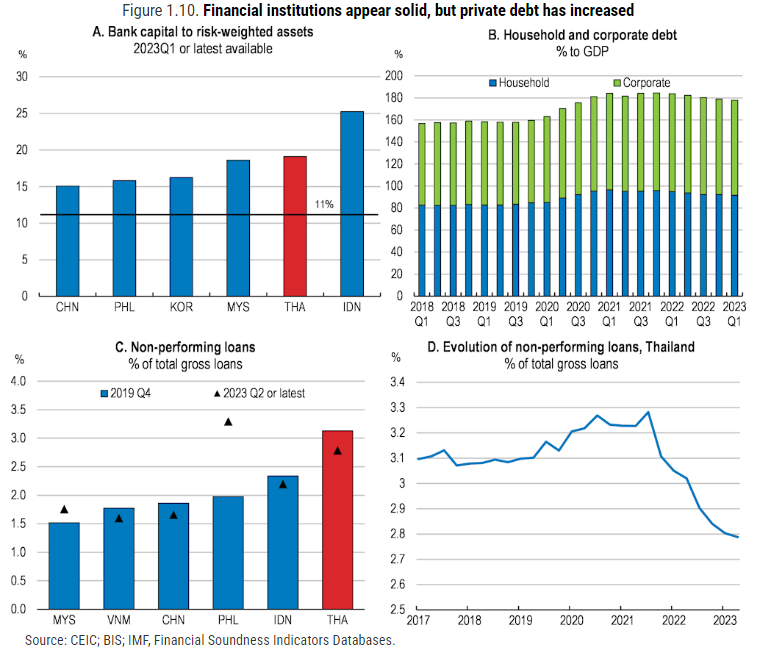

Strong financial support helped avoid a sharp contraction during the epidemic, but the country's public debt has increased rapidly in recent years and fiscal consolidation should continue at a gradual pace, the OECD said.。

Continued fiscal consolidation will strengthen domestic debt sustainability and support monetary policy, which should remain tight to reduce inflationary pressures.。Emergency support for families during the outbreak should be phased out, supplemented by regular social security to support those most in need.。

Through this Thai economic survey, the OECD found that private consumption is expected to remain strong despite the gradual elimination of government relief measures and high levels of household debt。Also, even if weak global demand drags down exports, this will change as the number of tourists increases。

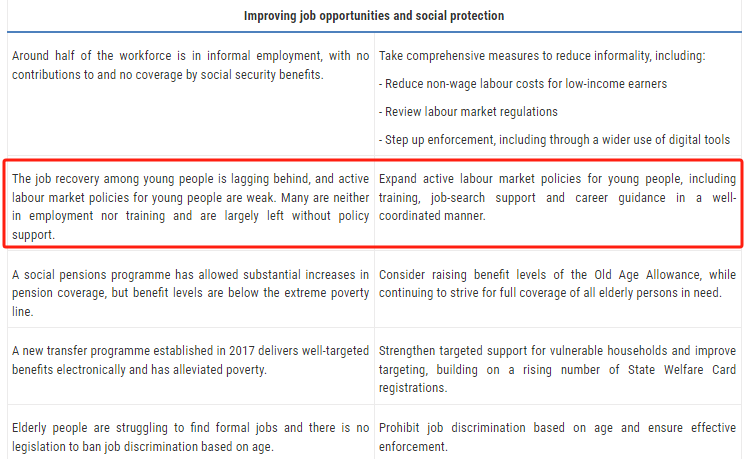

In addition, while the labour market is recovering, young people are not fully benefiting from the recovery.。Thailand is currently facing a number of key structural challenges, including an ageing population, digital transformation, global value chain restructuring and green transformation.。And with a declining working-age population, further action to increase productivity is key to raising national income levels。

Recently, the Thai cabinet approved the 2024 fiscal year budget, of which the government spent $100 billion, an increase of 9.3%。Since then, the Economic and Social Development Commission of Thailand (NESDC) has conducted a large-scale inspection of the economy, household debt, household income and the operating potential of small and medium-sized enterprises (SMEs).。

However, in a similar way to the OECD report, Thailand is mired in debt.。

It is reported that Thai Prime Minister Srettha Thavisin (Srettha Thavisin) has previously said that informal debt is like modern slavery, the country has put it on the agenda and will introduce a series of measures to deal with it.。For example, the agencies will work with the Ministry of the Interior (MOI) and the National Police Agency (TNPD) to prevent disorderly lending.。

In addition, there is assistance to debtors in reconciling disputes and preventing and cracking down on injustices such as intimidation in the debt collection process.。Once mediation is completed, the Government can assist in debt restructuring。

Household debt is estimated to be more than 90 percent of Thailand's gross domestic product (GDP), and informal debt is conservatively estimated at 50 billion baht (about $1,459,854,000).。

Today, Thailand's SME Debt Suspension and Relief Program has been launched to address the debt crisis of SMEs.。

According to Thai government spokesman Chai Wacharonke, the board of directors of the Thai Credit Guarantee Corporation (TCG), a state-owned professional financial institution under the Ministry of Finance (MOF), recently approved and implemented two assistance measures for SMEs.。

- Effective January 1, 2024, SMEs affected by the epidemic may suspend debt repayment for an 18-month period ending June 30, 2025.。

Eligible SME debtors include debtors that are more than 90 days past due or debtors of non-performing loans, including individuals, legal persons, and SME debtors participating in TCG debt restructuring plans and assistance measures.。

The contract amount for the former must not exceed 10 million baht (about 285,000 U.S. dollars), while the latter needs to be eligible for the project within three months.。

From January 1, 2024 to June 30, principalWillDecrease by 15%。

Chai said the six-month measure is expected to help about 5,000 small or retail debtors get out of trouble faster and return to the debt system.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.