Three White Soldiers Candlestick Pattern - What Is And How To Trade

Learn all about the Three White Soldiers candlestick pattern.What is, how to trade, and all the best trading strategies.

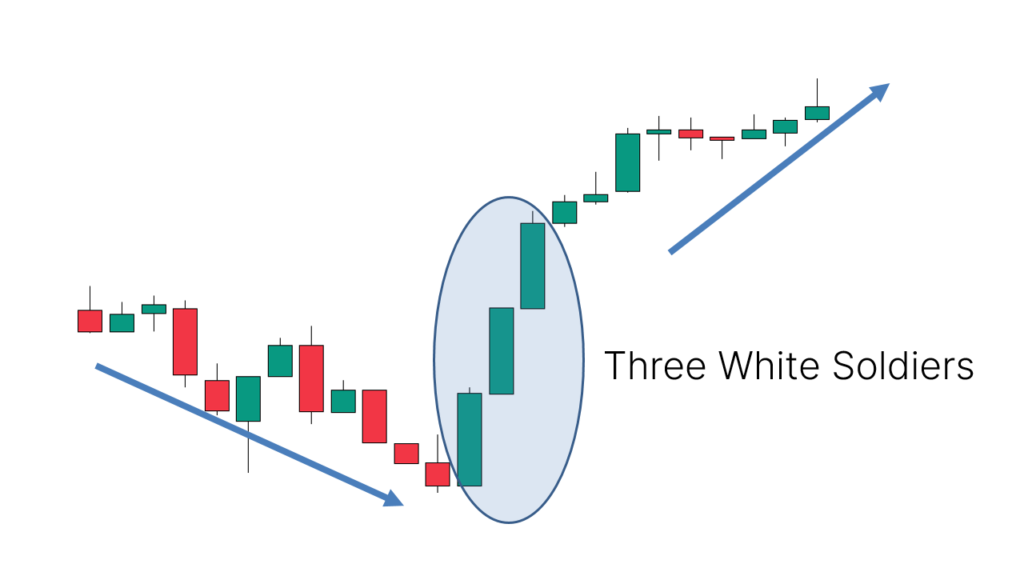

The "Three White Soldiers" is a classic bullish reversal candlestick pattern widely used in technical analysis. It typically appears after a period of price decline, signaling a potential upward trend. Here’s a detailed explanation of this candlestick pattern, including its definition, identification, variations, and trading strategies.

What Is the "Three White Soldiers" Candlestick Pattern?

The "Three White Soldiers" is a bullish reversal pattern consisting of three consecutive bullish candlesticks. This pattern usually follows a downtrend and indicates a potential reversal to an upward trend. It contrasts with the "Three Black Crows" pattern, which is a bearish reversal pattern.

Key Features:

- Bullish Signal: Indicates a possible shift to an upward trend following its appearance.

- Reversal Pattern: Typically forms after a downtrend, signaling the end of the current downtrend.

How to Identify the "Three White Soldiers" Candlestick Pattern

The "Three White Soldiers" pattern consists of:

- Three Consecutive Bullish Candles: Each candle is bullish, meaning the closing price is higher than the opening price.

- Large Bodies: Each candlestick should have a large body, reflecting strong buying pressure.

- Small or Non-existent Wicks: Ideally, the candlesticks should have small or no upper and lower shadows.

_2219840501_602.png)

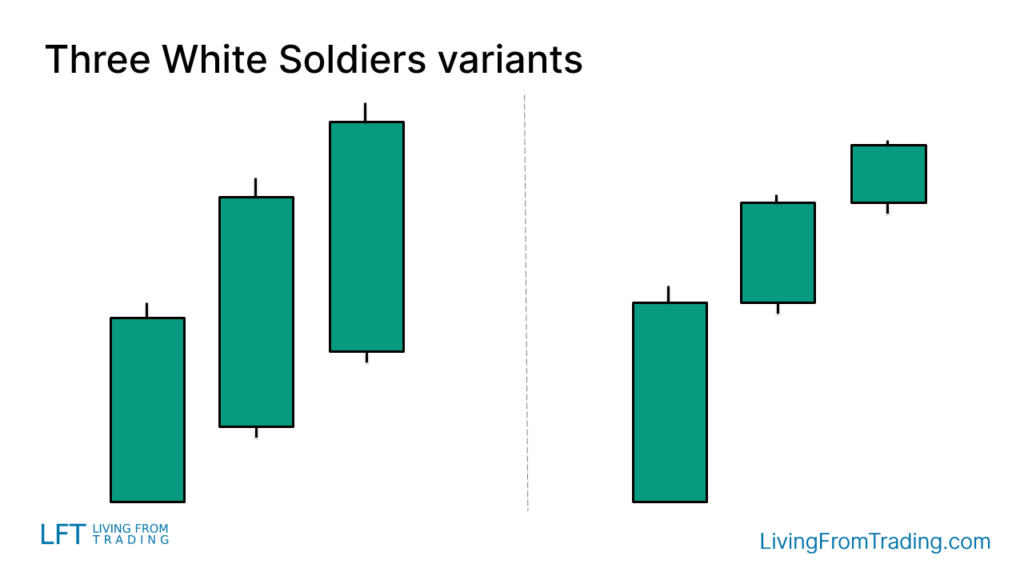

Variants of the "Three White Soldiers" Candlestick Pattern

The pattern may vary slightly:

- Gaps Between Candles: There may be a noticeable gap between the close of one candle and the open of the next.

- Decreasing Candle Sizes: The size of the candles may gradually decrease, but the overall pattern remains valid.

How to Trade

Trading Signal: The validity of the pattern depends not only on its shape but also on its location. Ideally, the pattern should appear after a downtrend. A conservative buy signal is when the high of the third candlestick is broken.

Stop Loss Setting: To protect your trade, set a stop loss on the opposite side of the pattern, ensuring risk management.

Trading Strategies

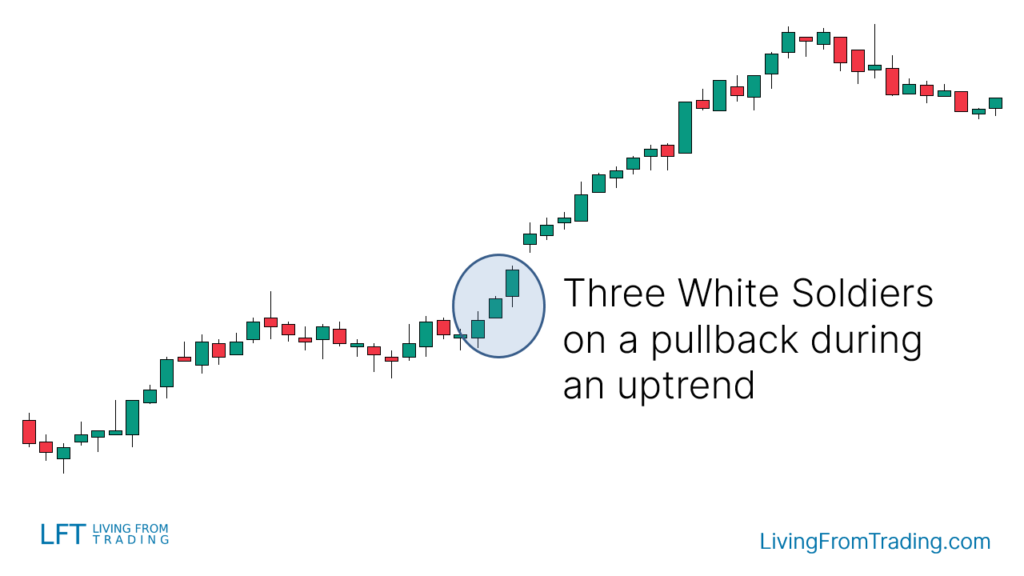

Strategy 1: Pullbacks on Naked Charts

- Market Condition: Ideal during an uptrend. Wait for a pullback and then spot the "Three White Soldiers."

- Trading Signal: Indicates the end of the pullback and the start of a new upward move.

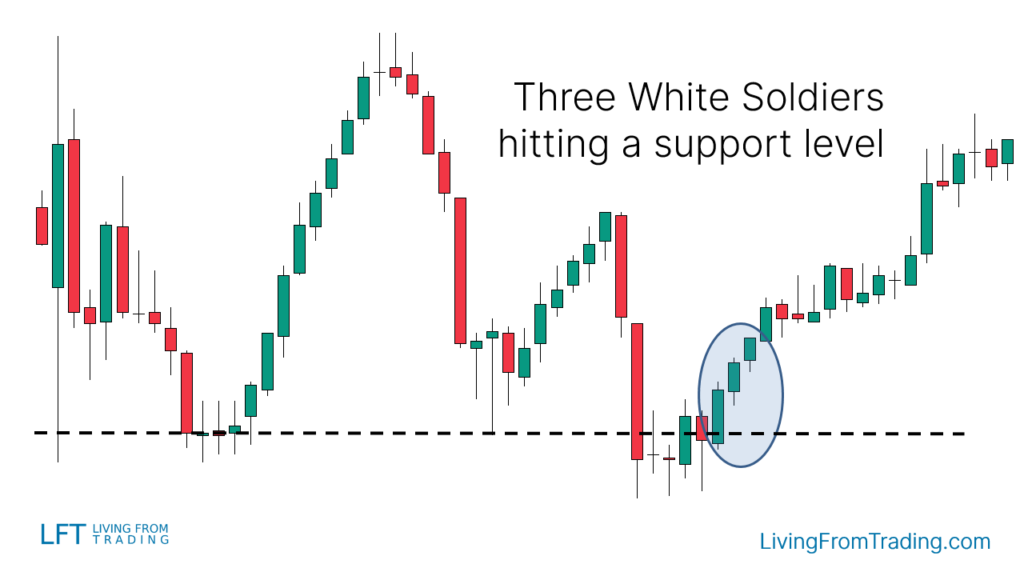

Strategy 2: Trading with Support Levels

- Support Levels: Mark support levels on the chart.

- Trading Signal: When the price declines to support and forms "Three White Soldiers," buy when the high of the pattern is breached.

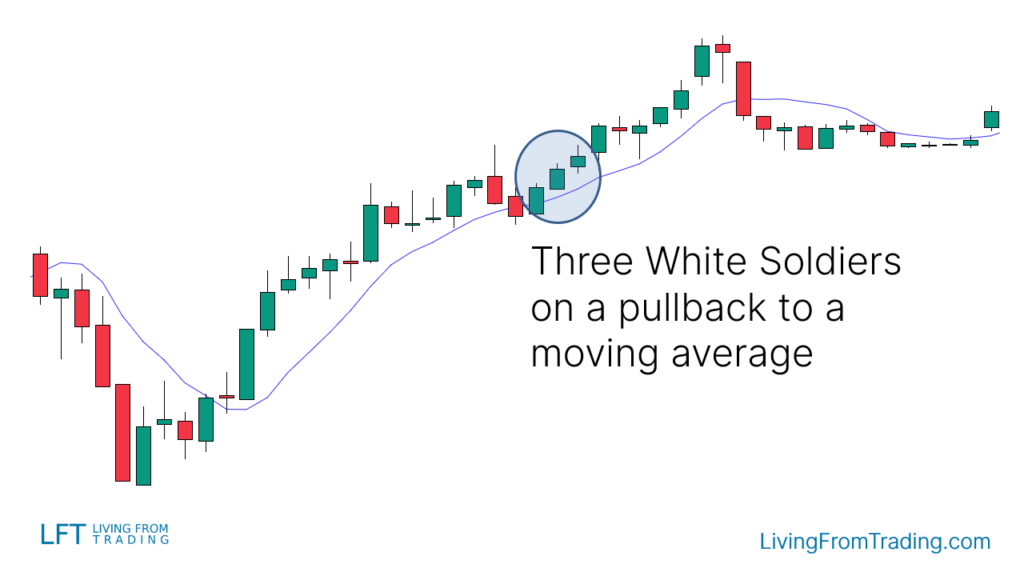

Strategy 3: Trading with Moving Averages

- Moving Averages: Useful for trading trends. Look for pullbacks to a moving average during an uptrend.

- Trading Signal: Buy when "Three White Soldiers" appears at or near the moving average.

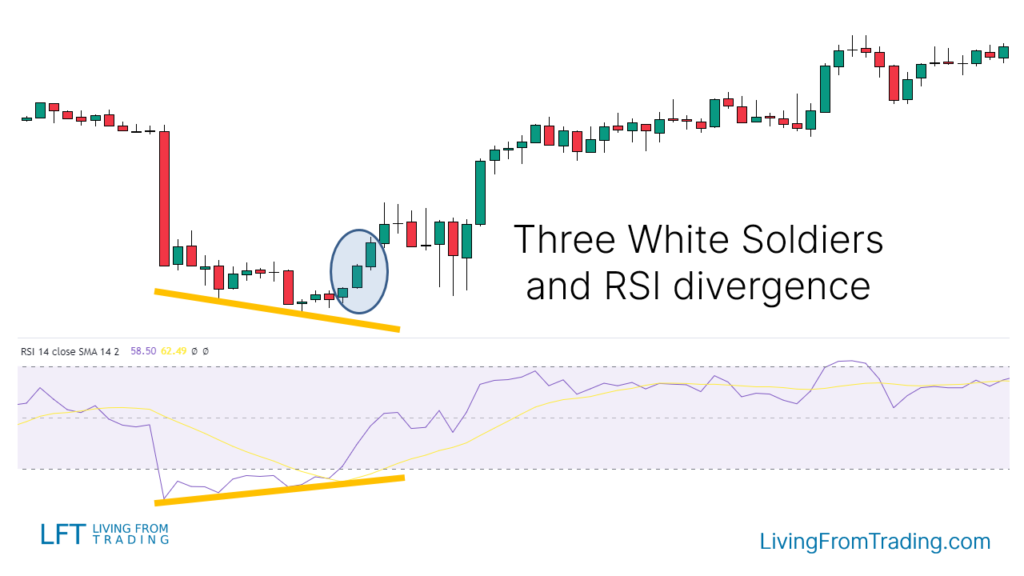

Strategy 4: Trading with RSI Divergences

- RSI Divergence: Look for bullish divergences where the price makes lower lows but RSI makes higher lows.

- Trading Signal: Buy when "Three White Soldiers" forms at a lower price low aligned with RSI higher low.

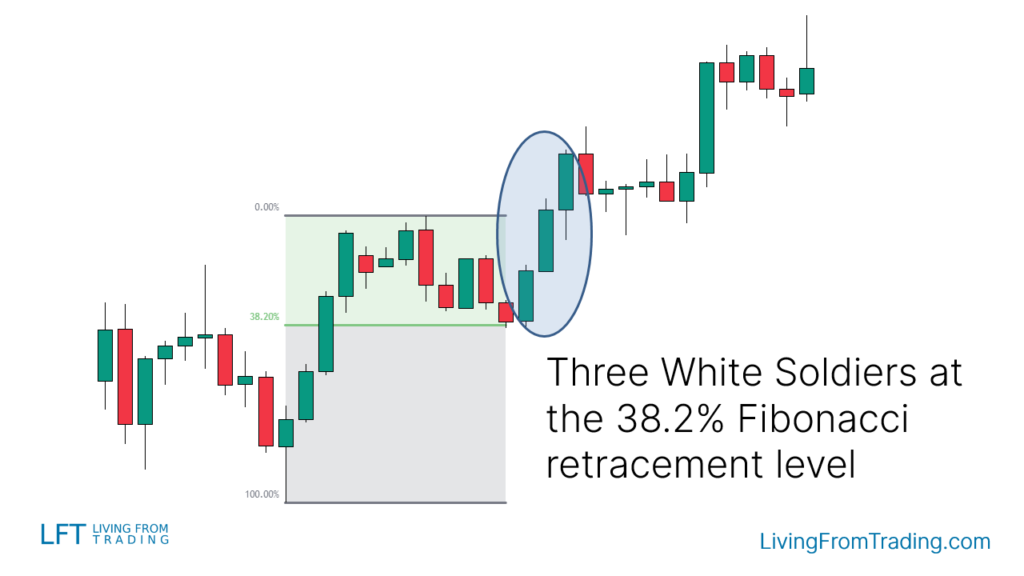

Strategy 5: Trading with Fibonacci Retracements

- Fibonacci Tool: Use Fibonacci retracement levels to find potential reversal points.

- Trading Signal: Buy when the price hits a Fibonacci level and forms "Three White Soldiers."

Strategy 6: Trading with Pivot Points

- Pivot Points: Automatic support and resistance levels.

- Trading Signal: Buy when "Three White Soldiers" forms at or near a pivot point level.

Summary

"Three White Soldiers" pattern has an 84% success rate. This high success rate indicates that the pattern is a reliable indicator of bullish reversals.

The "Three White Soldiers" is a powerful bullish reversal signal. By identifying the pattern's key features and applying various trading strategies, traders can effectively utilize it in their trading decisions. Understanding its success rate and combining it with other technical analysis tools can enhance trading accuracy and success.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.