Five Best Small and Micro Stocks

Many small-cap and micro-cap stocks are often less well-known, which can lead to greater volatility but also potentially higher returns.

Many small-cap and micro-cap stocks are often less well-known, which can lead to greater volatility but also potentially higher returns. Many of these companies fall into this category because their stock prices have experienced significant declines in recent years, yet there is always the possibility of rapid recovery.

Thorough research and understanding of the associated risks are crucial when considering investing in small-cap or micro-cap stocks. Compared to large-cap stocks, small-cap stocks typically exhibit higher volatility and are more susceptible to negative news or events. However, for those willing to take on greater risk, small-cap and micro-cap stocks may offer significant return potential.

Each of the selected stocks has the ability to grow its market value, even having had larger market caps in the past. Indeed, Asos reached a market cap of nearly $7.7 billion in 2017. These selected companies are also well-known in their respective industries, having demonstrated steady performance over the years, navigating through economic uncertainties and thriving in prosperous years.

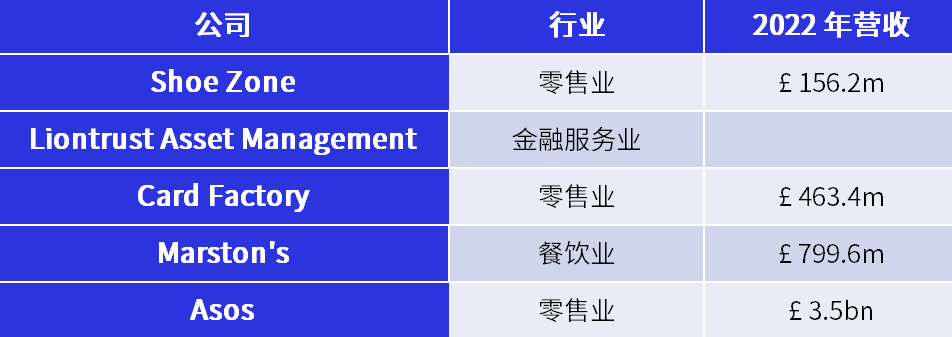

Shoe Zone (LON: SHOE)

Shoe Zone focuses on providing low-cost footwear products to the British public, with over 500 stores in its market. Companies in the low-cost sector often perform well during challenging times and rising inflation, as we've seen with the performance of this stock over the past year or two.

Shoe Zone has been committed to lean management, cost control, and driving revenue growth. Potential risks may arise from competition, as investors may have already priced these in.

Liontrust Asset Management (LON: LION)

Liontrust Asset Management is a UK-based asset management company and is a constituent of the FTSE 250 index. The company has a strong track record, growing the assets it manages from £1.3 billion at the end of the 2010/11 fiscal year to £31.4 billion as of March 31, 2023.

The company's fund management covers global equities, global fixed income, sustainable investing, and multi-asset investment portfolios.

Card Factory (LON: CARD)

Card Factory is a UK-based specialist retailer of greeting cards, decorations, and gifts. It operates over 1,000 stores in the UK, with a strong online presence as well.

The company's revenue has continued to grow over the years, expanding its high street presence across the UK. Card Factory's growth has been driven by several factors, including its strong value proposition, wide product range, and convenient locations.

Looking ahead, Card Factory is well-positioned with a stable financial outlook, and the company continues to invest in its online shopping channels.

Marston's (LON: MARS)

Marston's is a well-known UK pub chain, operating around 1,500 pubs. The company's revenue has been impacted by the COVID-19 lockdown measures in the UK, leading to a continued decline in its stock price, along with other factors such as rising costs affecting its operations.

Despite the challenges, MARS remains optimistic, noting in its recent earnings update that operating profit should exceed initial expectations for the current fiscal year. The company has also been working to reduce its debt.

Asos (LON: ASC)

Back in 2018, Asos reached a price of 7,770 pence per share, far surpassing levels considered small-cap at that time. Fast forward a few years, the company's stock price is now well below 400/500 pence, placing its market cap in the realm of small-cap stocks.

This online fashion retailer has been impacted by consumer headwinds such as inflation and rising interest rates, as well as increasing competition from online clothing companies selling at lower prices. However, Asos is working to turn the tide, making it a potential investment for those who believe in the current management's ability to navigate the turbulent waters.

Why Invest in Small Caps?

While all investments carry risk, investing in small and micro-cap companies may be seen as riskier. However, with increased risk comes greater potential for returns, though investors should always be aware that nothing is guaranteed.

While some companies in this category are small and growing rapidly, offering investors the opportunity to participate in potential long-term growth, others may have reached dizzying heights, prompting investors to bet on a potential turnaround. Some investors may describe this as buying low and hoping to see a turnaround. Nevertheless, thorough research is crucial.

Considerations

High Risk, High Potential Returns: Like small-cap and micro-cap stocks elsewhere, those in the UK are often considered riskier than large-cap stocks as they are often less known and more volatile. However, they also have the potential for higher returns. Over the long term, small-cap stocks tend to outperform large-cap stocks.

Limited Liquidity: In some cases, particularly with micro-cap stocks, smaller stocks may be difficult to buy and sell due to lower trading activity. You may end up paying higher prices to buy stocks, and may also have to accept selling at lower prices.

More Research Needed: Given the nature of small-cap companies, there is often less information available about them, and investment bank analysts may not cover them. Therefore, more research may be needed before investing. This means paying attention to and reading company filings, analyst reports, and industry news is crucial.

Profitability: Most small-cap stocks may not be profitable as they are still developing their businesses, meaning it's unlikely you'll receive any dividends. Even if a company is profitable at this stage of its development, it's likely to reinvest these funds back into the business. Additionally, try to inves

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.