What is the operating profit rate.?What indicators must be seen in the income statement?

One of the most important metrics in the income statement (Income Statement) is earnings per share (EPS), and a closer look at the details reveals that operating margin (Operating Margin) is the key to improving a company's profitability。

One of the most important metrics in the income statement (Income Statement) is earnings per share (EPS), which reflects a company's profitability。

Further exploration of the details of earnings per share, in fact, can be found in the key to improve the profitability of enterprises - operating margin (Operating Margin)。This indicator, which excludes out-of-business profits, better reflects the company's ability to make money in its own industry and can also help investors understand the soundness of its operations.。

What is Operating Profit Margin??

Operating Margin (Operating Margin or Operating Profit Margin), also known as the profit margin, refers to the percentage of a company's operating income earned by the industry, reflecting the company's ability to operate in the industry.。Simply put, it's how much profit a company can make for every dollar of revenue (Revenue) it generates.。

In some companies, the source of profit may come from outside the industry, so it is not clear from earnings per share alone whether the source of profit comes from the core business.

The calculation of operating profit margin, on the other hand, excludes out-of-business profits and takes into account all expenses other than the costs required to produce the product, including management and sales expenses, and the calculated value is closer to the profitability of the enterprise itself, allowing investors to directly understand the profitability of the enterprise through the industry (core business).。

For a healthy enterprise, only the industry can make a steady profit, is the source of the establishment of the upward development of the stock price.。

Formula for calculating operating profit margin

Operating profit margin is calculated by dividing operating profit (Operating Income) by operating income (Revenue).。The higher the value, the better the management and sales ability of the enterprise, and the higher the profit ratio.。

Operating Profit (Operating Income) is the result of deducting operating costs and operating expenses from revenue, where Cost of Goods Sold (COGS) refers to the cost of manufacturing a product or providing a service, including raw material costs, labor costs, manufacturing costs and other related expenses.。

Operating expenses (Operating Expenses), on the other hand, are overhead costs required in the manufacture of products, including management, sales, and research and development related to operations, such as.

Selling and distribution expenses: employee salaries, utilities, gas, store rent and advertising expenses。

Administrative expenses: expenses of various departments and service fees。

Research and Development Expenses (R & D Expenses): The cost of investing in research on new products, new technologies, new processes, new patents, improved production technologies and processes, etc.。

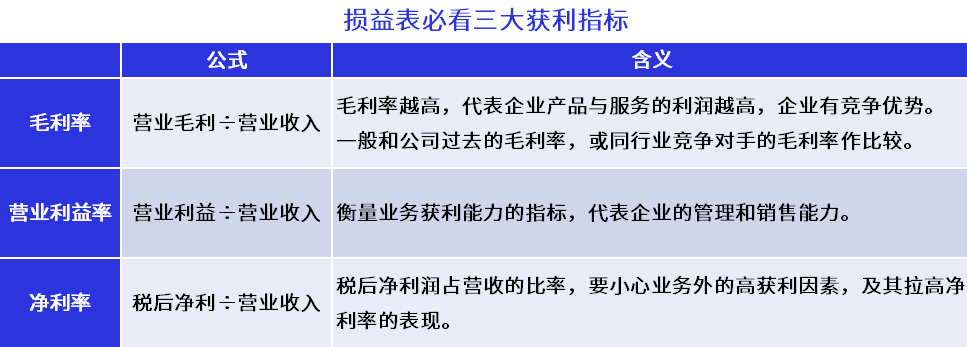

The relationship between operating margin and gross margin and net margin.

The profit of a business comes from the operating income generated by the sale of products or the provision of services in the industry, so a good revenue is the basis for all profits.。When looking at a company's income statement, the first thing to notice is whether the company's revenue continues to grow in order to have a chance to drive up profitability。However, not revenue growth, earnings will grow with it, and further observation of the information provided by other indicators is needed.。

Indicator 1: Gross Margin Gross Profit Margin

When the product is sold, the operating income is not really that much money, you have to deduct the cost of manufacturing, and the rest will be gross profit.。

The higher the gross margin, the more profitable the products and services that represent the business。Generally speaking, companies with high gross margins represent a high competitive advantage and may have key technologies, unique products, or good cost control; while companies with low gross margins represent their companies with less competitive products and are prone to small profits but quick turnover.。

Indicator 2: Operating Margin

Operating profit margin shows the profitability of a company's own operations, the higher the operating profit margin, the better the management and sales ability of the company, the stronger the profitability of the industry;。

Indicator 3: Net Profit Margin

Operating margins only take into account the ability of the industry to make a lot of money, and most companies have investments outside of the industry, so they generate outside profits or losses。

Therefore, operating profit plus out-of-business income (Other Income) and expenses (Expenses), you can get the net profit before tax (Profit Before Tax) results.。Finally, the income tax (Income Tax Expense) deduction, you can get after-tax net profit (Profit After Tax), that is, the company sold products or services, the final profit, but also the company can bag safe profit.。

The higher the net interest rate of a business, the stronger the profitability.。However, if investors only see the higher the net interest rate and think the business is very profitable, they may fall into the profit trap。Sometimes a company's net interest rate is high because higher out-of-business profits drive up the net interest rate。In fact, it's not because the industry is profitable and may even lose money。This is not a good investment goal.。

If a company's revenue continues to grow and its earnings continue to improve, it is a long-term solution for the company.。If you add in the fact that you can continue to make money outside of the industry, the company should be quite profitable.。

The income statement must look at the three major profit indicators.

SUMMARY

Operating profit margin is an important indicator used to assess the profitability of an enterprise's own operations, and it is the long-term solution for an enterprise to continue to use its business to earn more money.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.