How To Trade Consistently Every Day?

Tired of days with losses wipping out previous profits?If you follow the next steps you'll stop having losses trading and start winning.

In trading, we all aim to achieve continuous profits and see our account balance growing. However, losses are inevitable in trading, and sometimes these losses can be substantial, potentially wiping out all weekly or monthly profits in a single trade. While this situation is not uncommon, the good news is that by taking certain measures, you can improve this situation and enhance your trading performance.

Randomness of Trading Results

No one can accurately predict the result of the next trade. The outcome of any particular trade is random, much like flipping a coin, where you cannot foresee whether the result will be a win or a loss. Consider the following simple example:

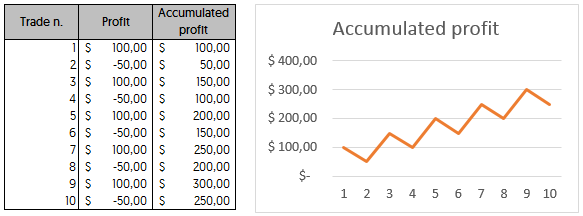

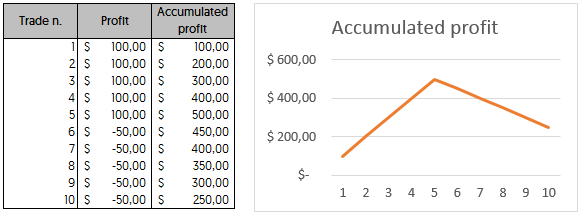

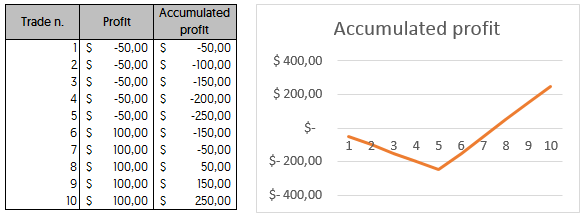

Assume your trading strategy has a 50% success rate and a 50% failure rate with your stop loss. Each successful trade yields a profit of $100, while each failure results in a loss of $50. Let's look at three different trading scenarios:

- Scenario A: The results alternate between wins and losses. At some point, you may see a peak profit of $300, but after completing 10 trades, your final profit is $250.

- Scenario B: You win the first 5 trades consecutively and then lose the next 5 trades consecutively. At some point, you may see a peak profit of $500, but the final result is still a $250 profit.

- Scenario C: You lose the first 5 trades consecutively and then win the next 5 trades consecutively. At one point, your losses might drop to -$250, but the final profit remains at $250.

From these scenarios, we can conclude that regardless of the results between your first and last trades, if you maintain a consistent trading approach, the final result will be similar. In these scenarios, the final profit is always $250. Therefore, you need to know how to calculate the maximum trade size to ensure your account can grow steadily without losing margin during drawdowns or risking a margin call.

Embracing Risk

To succeed in trading, you must embrace risk. This means fully accepting the outcome of any particular trade or set of trades. If you feel uneasy or worried about losses when opening a trade, you haven't fully embraced the risk. True acceptance of risk occurs when you have no psychological burden regarding the potential win or loss of the next trade.

Even if you are highly proficient in chart analysis, failing to accept risk or having the wrong mindset may still result in long-term losses. Embracing risk brings you one step closer to success.

Impact of External Factors on Trading Mindset

External factors can also influence your trading mindset. For example:

- If you have had an argument with a family member, it is best not to trade that day.

- If you are at odds with a friend or are feeling down, avoid trading.

- If you have encountered a traffic accident or are otherwise emotionally disturbed, refrain from trading.

- If you are worried about your family's finances and need funds urgently, do not trade.

These situations can affect your decision-making in trading, so only trade when you are calm and emotionally stable.

Avoiding Overtrading

Overtrading is a common issue in trading. Traders should set a daily maximum loss limit and stop trading once that limit is reached. Also, define a maximum number of trades per day, and stop trading once that number is reached, even if you haven't hit the loss limit.

Setting Trading Goals

Your trading plan should include daily profit targets, but this does not mean you need to trade recklessly to hit the target. Treat the daily target as a trigger to stop trading. Once you reach the target, conclude your trading for the day and take a break. If you reach your target with the first trade, but your plan allows for more trades, do not continue trading just because the target has been met.

Conclusion

Trading is a game of probabilities. The result of individual trades is not as important as the overall result from a series of trades. Adhering to your trading plan will lead to consistent long-term profitability. If you follow your trading plan and incur losses on a given day, that day is still a success because you adhered to your plan. Conversely, not following your trading plan, even if you make a profit on that day, will damage your account in the long run.

Ensure your trading plan covers everything needed to achieve profitability. Consistency and adherence to your trading plan will greatly increase your chances of long-term success.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.