Every SU7 sold results in a loss of 6,800 yuan? A total loss of 4.1 billion in the car-making business? Xiaomi responds.

Fitch Ratings expects Xiaomi's electric car business to struggle to turn a profit for at least the next three years.

On April 15th, the well-known investment bank Citigroup released a research report, estimating that the delivery volume of Xiaomi's SU7 will reach 5,000 to 6,000 units in April, with a full-year delivery volume of approximately 55,000 to 70,000 units. Currently, the waiting time for the Xiaomi SU7 delivery is as long as six months; if the production capacity cannot keep up with the demand, Xiaomi may encounter growth issues similar to those faced by Xiaopeng's G6 last year.

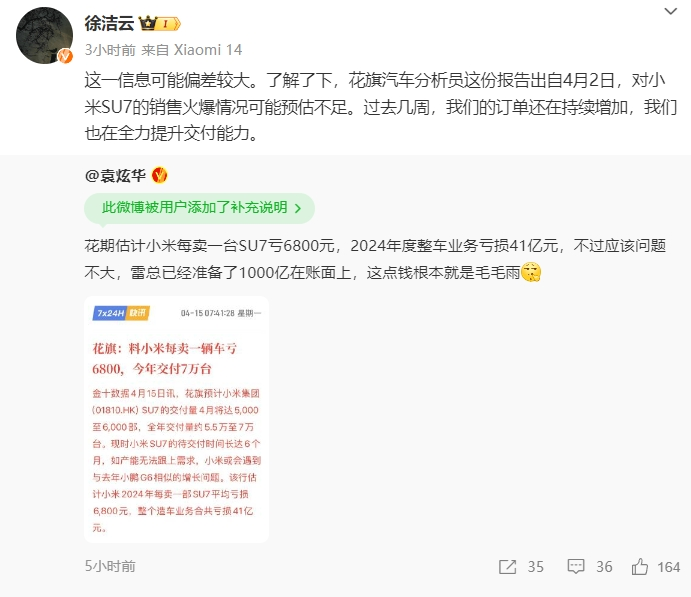

The bank also stated that it expects Xiaomi to incur an average loss of 6,800 yuan for each SU7 sold in 2024, with the entire car-making business suffering a total loss of 4.1 billion yuan.

In response to this, Xiaomi Group's Special Assistant to the Chairman and Deputy General Manager of the China Market Department, Xu Jie Yun, stated on Weibo, "This information may be significantly off. I've looked into it, and the Citigroup car analyst's report dated April 2nd may have underestimated the explosive sales situation of the Xiaomi SU7. Over the past few weeks, our orders have continued to increase, and we are doing our best to enhance our delivery capabilities."

Xiaomi did not provide further responses to other forecasts made by Citigroup.

Lei Jun: Xiaomi cars "lose money with each unit sold"

Regarding the issue of losses, Li Xiang, the chairman of Ideal Automobile, previously stated that after reaching a revenue scale of hundreds of billions, a product gross margin of 15%-25% is a benchmark requirement for a healthy surviving car company.

Fitch Ratings predicts that Xiaomi's electric vehicle business will find it difficult to achieve profitability for at least the next three years. As production scales up, Xiaomi's sales, marketing, and administrative expenses, as well as operating capital requirements, will also increase, in addition to R&D expenditures and capital expenditures for expanding production capacity.

Affected by the losses in the electric vehicle business and the rising costs of smartphone components, Fitch expects Xiaomi's EBITDA margin to drop from 9.2% last year to 6.0-6.5% in the next two years.

At the Xiaomi SU7 launch event, Lei Jun stated that the car "loses money with each unit sold," "229,000 yuan was our original pricing, and the top version was originally priced at 350,000 yuan, but the price reduction by car companies caught us off guard, so we decided to be sincere to the end, with the standard version priced 30,000 yuan lower than the Tesla Model 3, and the Max version priced at 299,000 yuan."

In the face of this "tough battle," Xiaomi is clearly prepared. Xiaomi Group's annual report for 2023 shows that as of December 31, 2023, the group's cash reserves amounted to 136.3 billion yuan, with R&D expenses for the car exceeding 10 billion yuan. Lei Jun stated that Xiaomi has sufficient cash reserves to cope with any fierce competition in the next five years. If possible, Xiaomi will further accumulate cash.

Sun Shaojun: Daily production of Xiaomi SU7 will increase to over 400 units

In terms of production capacity, several agencies predict that Xiaomi's car delivery volume in 2024 is expected to reach 60,000 to 80,000 units.

Sun Shaojun, the founder of Chefans, stated yesterday that the locked order volume for the Xiaomi SU7 has exceeded 60,000, with a large order cancellation rate of about 55%. He also revealed that Xiaomi SU7's production capacity will be increased this week, with the daily production expected to rise to over 400 units.

Fitch believes that there is still uncertainty about whether Xiaomi can successfully expand its production capacity. Considering the current intense competition in the industry, it is too early to judge whether Xiaomi's electric vehicle products and strategies will be successful in the medium term.

A research report from China Post Securities shows that the entry of Huawei and Xiaomi will accelerate competition in the car market. It can be seen that a domestic sales volume of 300,000 vehicles in 2023 is a watershed. According to the current monthly sales data of over 30,000 for Wenjie, it is highly likely that Wenjie's sales volume this year will exceed 300,000 units, ranking among the top shares of domestic new energy vehicle brands. From the data of over 80,000 locked orders in the 24-hour period for Xiaomi, Xiaomi's sales heat is very high, currently mainly constrained by the bottleneck of production capacity.

It is understood that Xiaomi's car factory currently has six major workshops, including the traditional car factory's stamping, body, painting, and assembly workshops, as well as Xiaomi's unique casting and battery workshops. Currently, the annual production capacity of Xiaomi's car super factory phase I is about 150,000 vehicles. The second phase of Xiaomi's car super factory is also planned and is expected to start construction in 2024 and be completed in 2025.

Previously, according to media reports, the monthly production of Xiaomi SU7 was around 8,000 units.

It is worth noting that yesterday, Xiaomi announced that the SU7 model will start a 24-hour limited-time configuration change at 9 am on April 19th. Users who have locked orders for non-founder's edition can make changes through the Xiaomi Car App. If the configuration is successful, the production plan will be rearranged, and the estimated delivery time will be recalculated."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.