铝价回调致中国铝业Q1营收同比跌逾两成! 各大行仍对中国铝后市表乐观

中国铝业于昨日晚间公布2023年第一季度报告,报告称,公司一季度营业收入为662.79亿元人民币,同比减少17.60%。

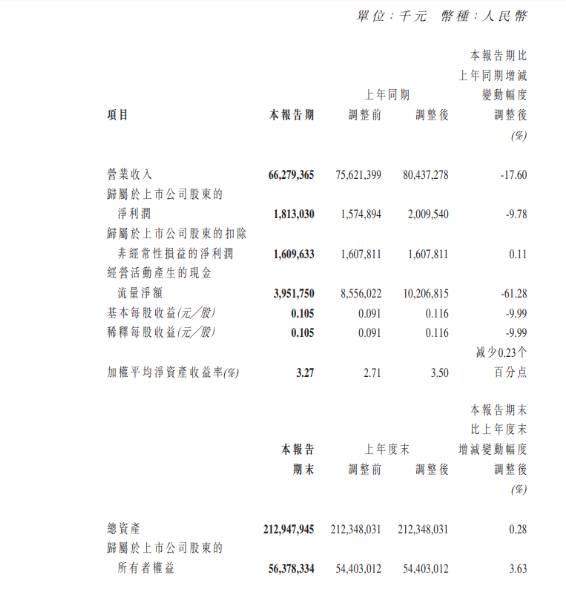

4月25日晚间,中国铝业公布了其2023年第一季度业绩报告。报告数据显示,中国铝业一季度营业收入为662.79亿元(人民币,下同),同比减少17.6%;归属于上市公司股东的净利润为18.13亿元,同比减少9.78%;归属于上市公司股东的扣除非经常性损益的净利润为16.10亿元,同比增长0.11%,每股收益为0.105元。

受此消息影响,今日中国铝业开盘一度下探至4.39港元,后于尾盘上升。截至收盘,中国铝业报4.51港元,日内涨幅为1.58%。

对于中国铝业的一季报,美银证券发布研究报告称,按中国会计准则计算,该公司首季盈利同比下跌10%至18.13亿元人民币,高于该行预期。美银认为主要是受到氧化铝利润率反弹及其他非经营项目所带动的。

美银还表示,近期行业数据显示,煤炭价格下跌,加上云南产能恢复延迟的预期增强,令4月至今第二季度铝利润率有所回升,考虑到今年房地产完工需求好过预期,对中国铝市场仍保持乐观。同时美银预计今年中国铝价将达到每吨1.9万元人民币,利润为每吨2,000元人民币,而氧化铝利润预期达到每吨400元人民币,故维持对中国铝业H股的“买入”评级,并予其目标价5.5港元。

汇丰也发布研究报告表示,中国铝业今年一季度盈利高于该行预期,主要得益于税务支出及少数股东权益下降所带动。汇丰认为,该公司现价已很大程度上反映了供应紧缩和中国潜在需求复苏的正面因素,维持其H股“持有”评级,并将其目标价由4.6港元小幅上调至4.7港元。

值得注意的是,今年以来北向资金加仓的前十大国企中,中国铝业榜上有名。截至上周五,中国铝业于十大北向加仓国企中位列第七。含电解铝在内的有色金属行业成为了北向资金加仓的一大主要方向。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。