澳大利亚8月通胀数据“喜人” 但市场却反应平平

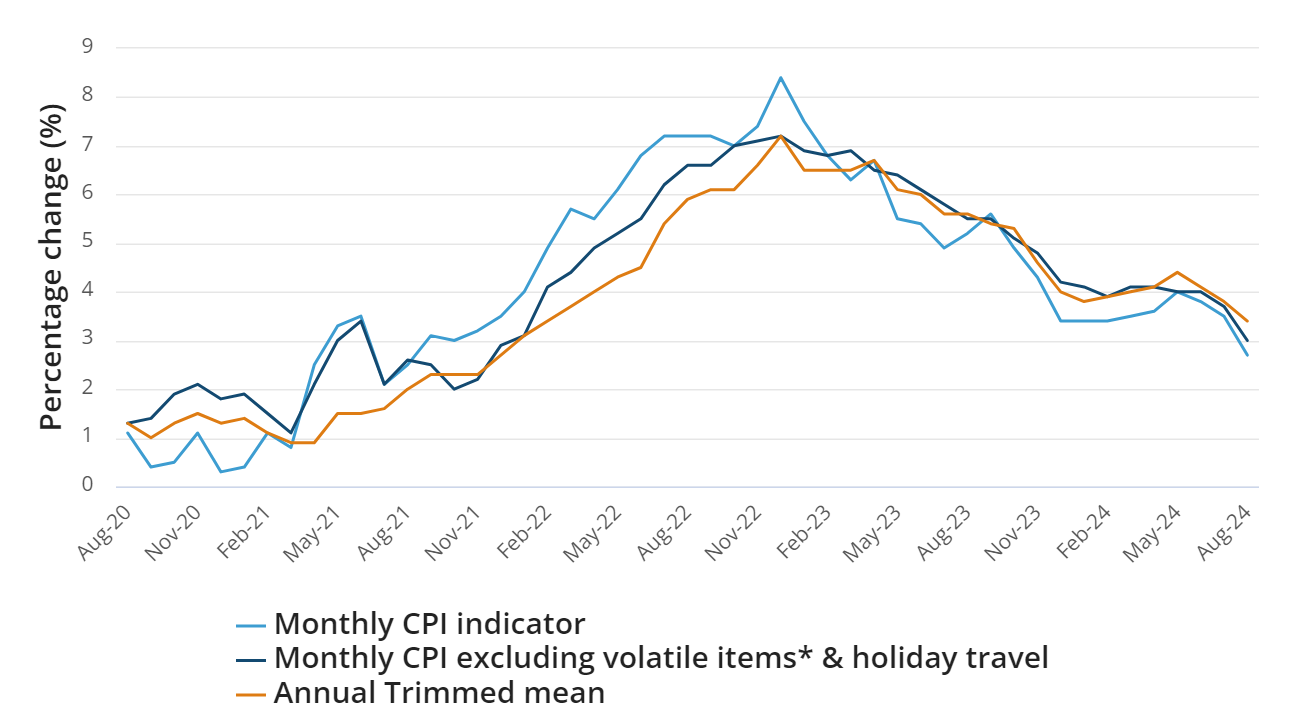

周三,澳大利亚统计局公布的数据显示,8月份该国月度消费者价格指数(CPI)同比上涨2.7%,低于7月份的3.5%,符合市场预期。

周三,澳大利亚统计局公布的数据显示,8月份该国月度消费者价格指数(CPI)同比上涨2.7%,低于7月份的3.5%,符合市场预期。

8月份,剔除波动性项目和假日旅行的月度CPI指标年化涨幅冲7月份的3.7%降至3%,来到央行的2-3%目标区间的上限。

同时,核心通胀指标也从7月份的3.8%放缓至3.4%。澳大利亚央行预计,到今年年底,该指数将达到3.5%。

通胀率大幅下降很大程度上得益于政府采取的能源补贴等措施。根据澳大利亚统计局的数据,8月电费的较去年同期下降了17.9%,创下了有记录以来的最大降幅。此外,汽车燃料也比一年前下降了7.6%。

对于澳大利亚政府来说,这是一份不错的通胀数据表。总体通胀率降至三年来的最低水平,核心通胀率也降至2022年初以来的最低水平。

尽管数据不错,但市场却对此反应平平。澳元兑美元小幅回落,最新交易价为0.6882美元。对政策敏感的三年期债券期货几乎没有变动,报96.63。

前一日,澳洲联储(RBA)继续将现金利率目标维持在4.35%不变,连续第六次按兵不动。

在声明中,澳洲联储表示,虽然总体通胀率将在一段时间内下降,但潜在通胀率更能反映通胀势头,且目前来看仍然过高。并强调,“在董事会确信通胀率正在持续向目标区间移动之前,政策需要足够严格。”

澳洲联储传递出来的信息很明确,即市场仍然不会在短期内看到央行降息。

在通胀数据出来后,澳大利亚财政部长Jim Chalmers对最新的通胀数据表示谨慎乐观。他表示“这些数据令人振奋、鼓舞人心,值得欢迎”,但仍然需要保持警惕,并指出通胀趋势可能不稳定。

Chalmers新闻发布会上表示:“我们不会太过激动,因为我们知道月度数字可能会波动。通货膨胀并不总是呈直线变化。”

“真正重要的是,正如澳大利亚央行不断提醒我们的那样,基础通胀率能否持续回归目标。”穆迪分析公司经济学家Harry Murphy Cruise表示,“这还有一段距离,但8月份的数据表明,通胀势头正在朝着正确的方向发展。”

鉴于澳洲联储的鹰派措辞,市场普遍认为澳大利亚的降息周期不会太早开启。经济学家普遍预计,澳洲联储要到明年2月份才会开启降息。

IG分析师Tony Sycamore表示:“如果第三季度数据也呈现出基础通胀下降的趋势,我们可能会看到澳大利亚央行在11月会议上采取更为温和的基调,可能为12月降息25个基点铺平道路。”

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。