波音可能遭受扩大调查 红海动荡似乎不影响油轮

开盘前快速复习昨日盘势!美股航海王,每日 3 分钟帮你分析美股走势与大小事!

▏盘前美股即时新闻

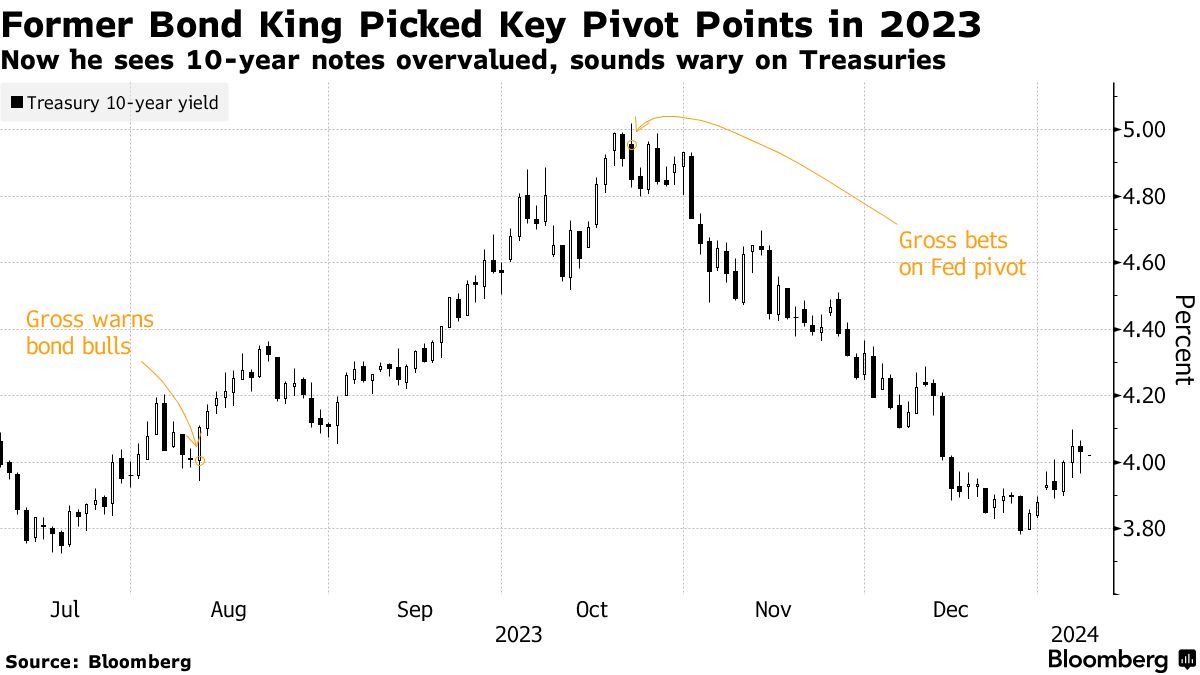

《01》老债王警告美债被高估

被称为「老债王」的太平洋投资管理公司创始人 Bill Gross 表示,10 年期美国公债被「高估」了,他现在正远离美国公债,如果需要购买债券,殖利率 1.8% 的美国抗通膨保值债券是更好的选择。此外 Bill Gross 还指出,短期债券可能更适合对债市有兴趣的投资人,他坚信 10 年期 / 2 年期美国公债殖利率差将回归正值。

《02》监管机构不排除扩大调查波音其他机型

《彭博》报导,在上周发生波音(BA)Max 9 机舱门脱落事件后,美国联邦航空管理局已停飞 Max 9 并命令航空公司进行检查,包括阿拉斯加航空(ALK)、联合航空(UAL)在内的多家航空公司都发现螺栓松动,导致美国联邦航空管理局考虑将调查范围扩大到 Max 9 机型以外,这可能会让停飞时间延长。波音则向各家航空公司发布了需要进行哪些检查的指引,以防止再次发生类似意外。

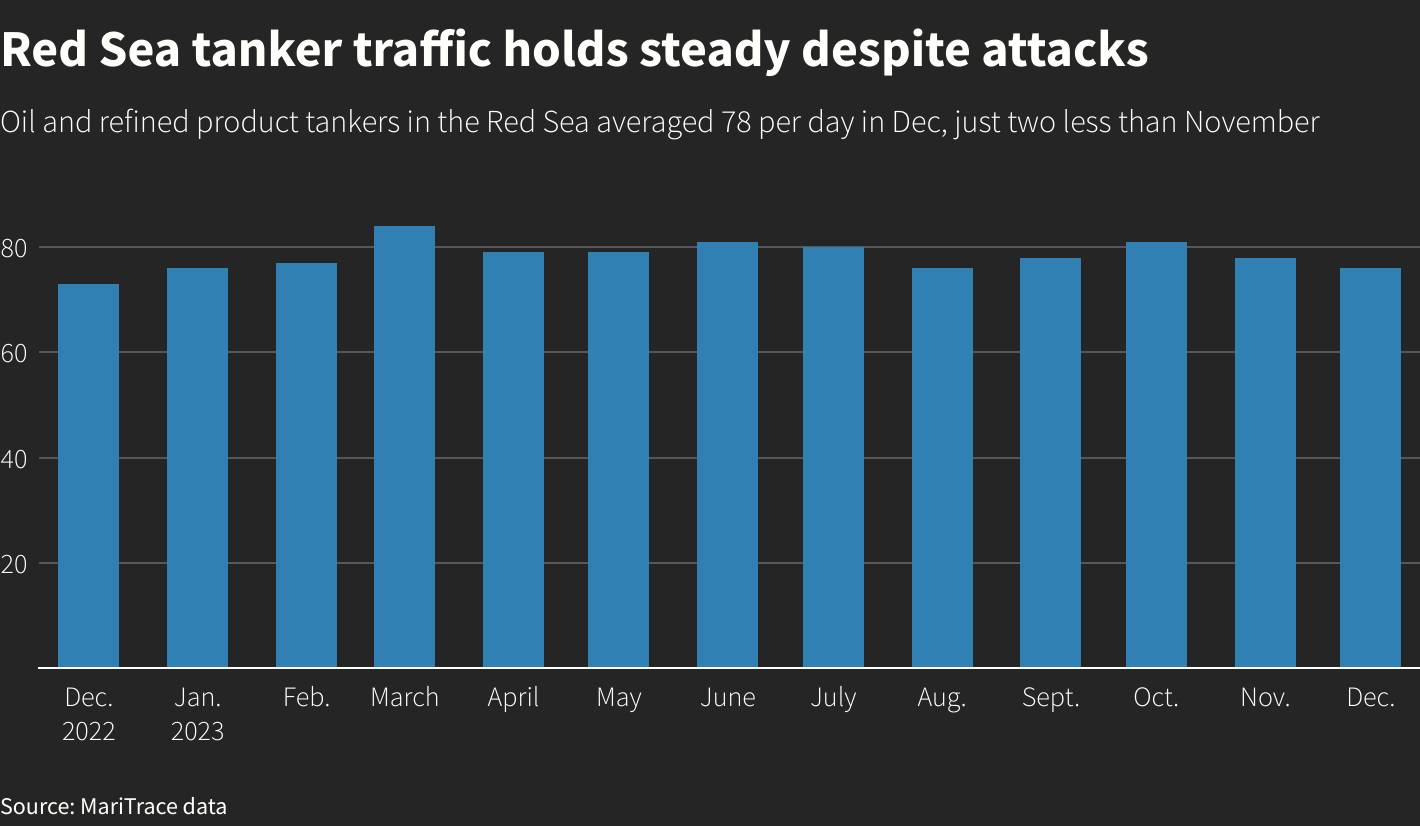

《03》大量油轮仍冒险通过红海

由于胡塞武装份子的袭击,许多货柜船已经改变航线绕道,但船只追踪数据显示,去年 12 月在红海的油轮数量仍保持稳定,尽管攻击事件大幅推高了运输成本和保险费,对于石油运输的影响似乎比市场担心的还要小。去年 12 月通行红海的油轮数只短暂下降,平均每天仍有 76 艘油轮通过,这数字仅比 11 月份的平均值少 2 艘,比起 2023 年前 11 个月的平均值也只低了 3 艘。

《04》三星 Q4 初步业绩不如预期

《04》三星 Q4 初步业绩不如预期

三星电子周二发布 Q4 初步财报,预计营收年减 -4.9% 至 67 兆韩元,低于市场预期的 69.9 兆,营业利润年减 -35% 至 2.8 兆韩元,未达市场预期的 3.6 兆,不过如果跟 Q3 相比,营收仅下滑 -0.6%,营业利润则是季增 15.2%。三星将业绩不如预期归咎于智慧型手机需求复苏缓慢、代工业务回温力道不足,但受惠于市场对高阶记忆体晶片的需求不断增长,记忆体部门较上一季显著改善。

《05》美国铝业将削减产能以节省成本

美国铝业公司(AA)周二宣布,计划在 2024 年全面削减位于澳洲 Kwinana 的氧化铝精炼厂产量,这项削减成本的措施将于 Q2 开始进行,并预计会产生 1.8~2 亿美元的重组费用。美国铝业表示,本次减产将包括分阶段裁员,预计 2024 年该厂的员工人数将从年初约 800 人减少到约 250 人,2025 年可能还会进一步裁员。

《06》惠普企业即将收购 Juniper Networks

《华尔街日报》报导,惠普企业(HPE)接近达成收购网路通讯设备公司 Juniper Networks(瞻博网路,JNPR),这项价值 130 美元的交易最快可能会在本周公布。Juniper Networks 主要是销售路由器和交换器等通讯设备,另外还拥有 Mist AI 业务,透过 AI 技术来改善用户的网路体验。Juniper Networks 盘前飙升逾 +20%,惠普企业则下跌约-9%。

《更多》

* 英伟达(NVDA)在消费性电子展(CES)上推出 NVIDIA Avatar Cloud Engine(ACE)服务,让游戏开发商将最先进的生成式 AI 模型运用于创造游戏内的虚拟角色,可以客制化多语言语音及模拟脸部动画

* 在 OpenAI「宫斗戏」落幕后,微软(MSFT)与 OpenAI 建立起紧密的合作关系,欧盟监管机构周二表示,正在研究是否应该依据欧盟的合并规范(并购标准)对微软进行审查

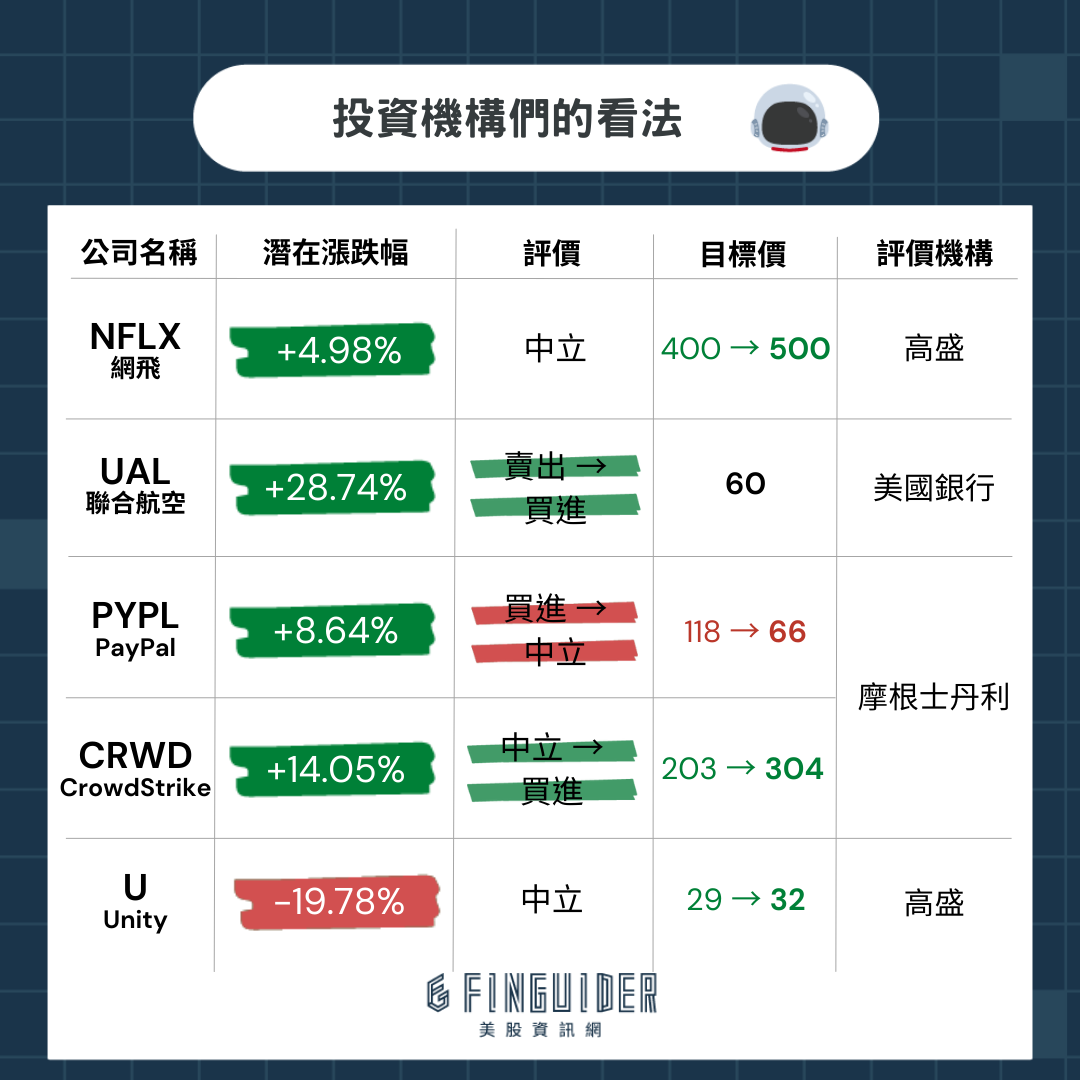

* 摩根士丹利将 CrowdStrike(CRWD)从「中立」上调至「买进」,目标价也从 203 美元上调至 304 美元,隐含 +14% 潜在涨幅,大摩认为这家网路安全公司的需求正在改善,并且拥有前景光明的 AI 平台

* 受惠于 AI 浪潮带动高频宽记忆体(HBM)需求激增,SK 海力士 CEO 认为,公司的市值可望在未来三年内翻倍增长,而且随著需求回升,SK 海力士正考虑是否在 Q1 提高 DRAM 产能

* 木头姐 Cathie Wood 仍对 SEC 将批准比特币现货 ETF 抱持乐观态度,预计这将吸引大量来自机构部门的投资,不会发生「买在预期、卖在现实」的状况

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。