美联储12月利率决议:仍旧按兵不动 降息已开始进入视野

对于未来的降息路径,鲍威尔指出,降息已开始进入视野,决策者正在思考、讨论何时降息合适。鲍威尔还称,即使没有出现经济衰退,美联储也愿意降息。

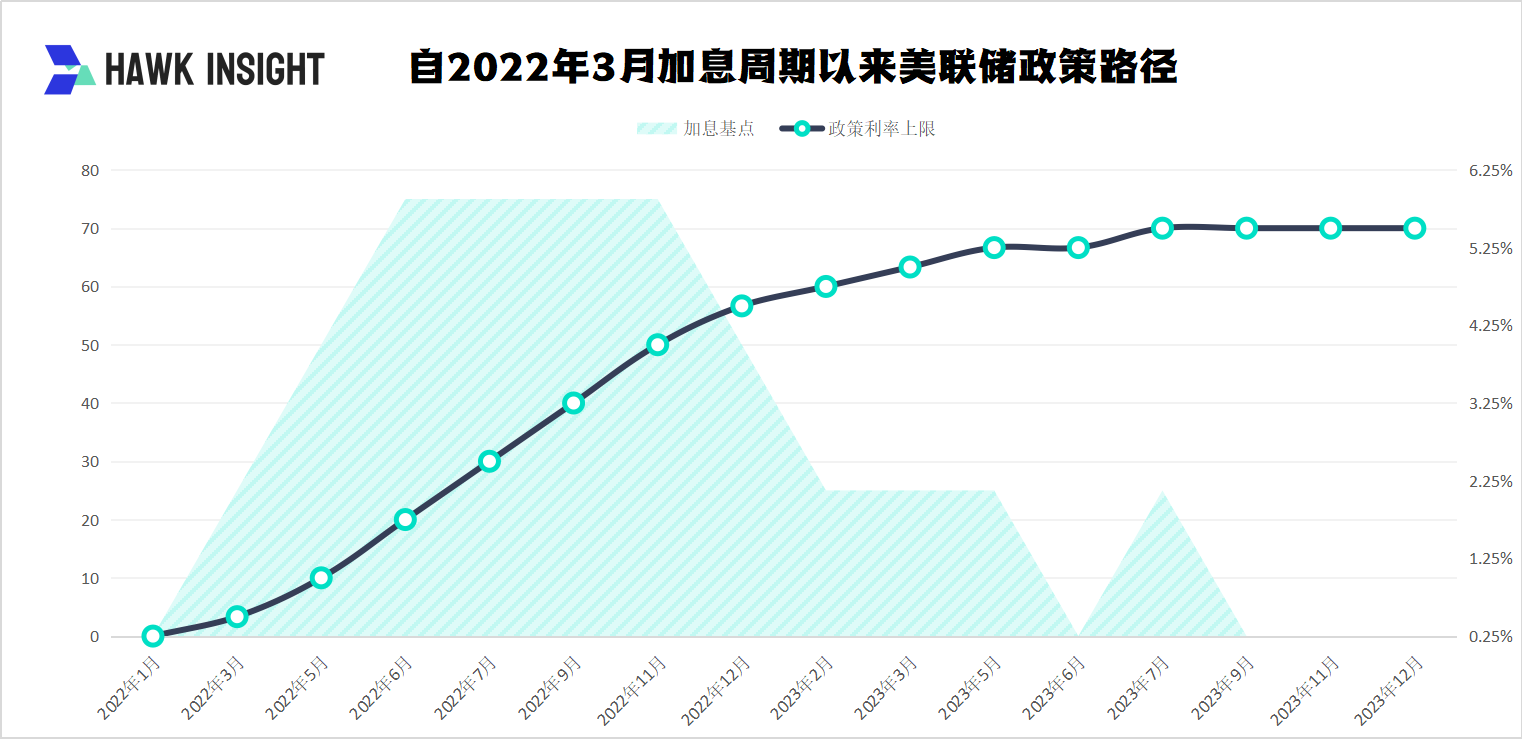

美东时间12月13日,美联储公布了年内最后一份利率决议。根据公告,FOMC决定将联邦基金利率目标区间维持在5.25%-5.5%。这是美联储连续第三次维持利率不变,符合市场预期。

同时,美联储一并宣布,继续维持其他政策利率。将存款准备金利率维持在5.4%;将隔夜回购利率维持在5.5%;将隔夜逆回购利率维持在5.3%;将一级信贷利率维持在5.5%,均符合市场预期。缩表方面,美联储继续维持原有计划,每月被动缩减600亿美元国债和350亿美元机构债券和MBS。

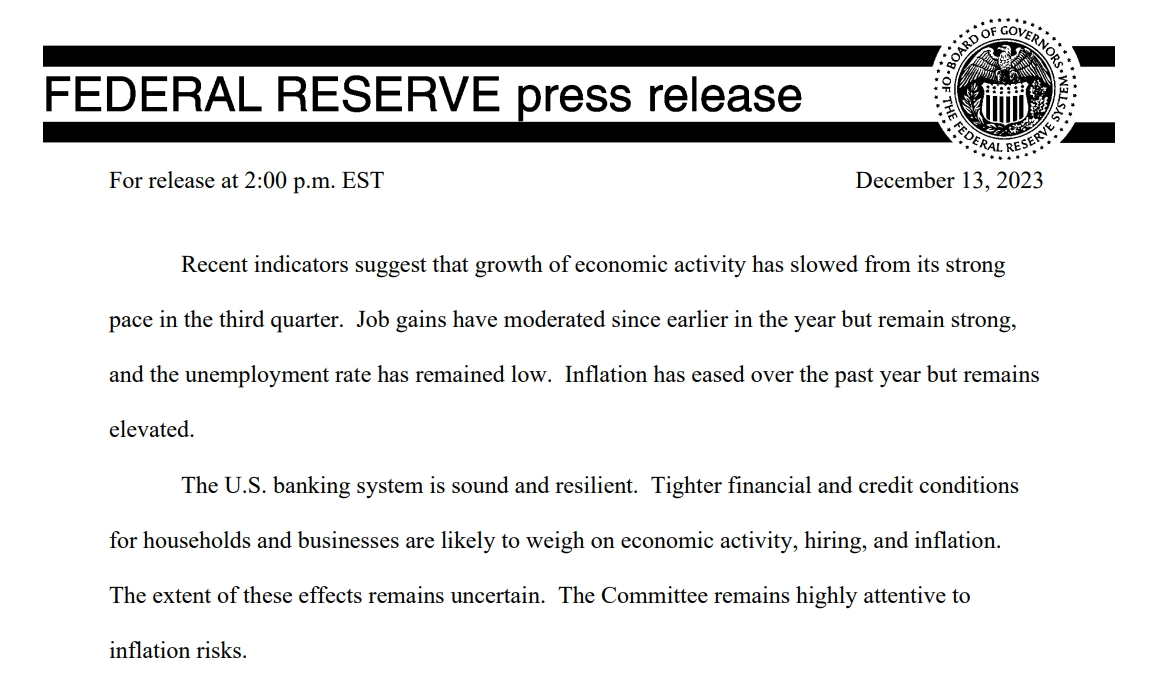

12月利率决议公告:新增许多鸽派措辞

具体来看决议公告,美联储在经济和政策描述部分整体变化不大,但新增了许多鸽派措辞。例如,在描述经济增长速度方面,美联储有意提出“增长较三季度放缓”;在通胀方面,美联储旗帜鲜明地指出“过去一年,通胀已经有所降温”;最重要的是,在货币政策的描述部分,美联储表示,未来在确定“任何”(any)额外的政策巩固的程度上,委员会将综合考虑各方因素制定政策。

但是,美联储也表示,在评估适当的货币政策立场时,委员会将继续监测新信息对经济前景的影响。美联储称,如果出现可能阻碍委员会目标实现的风险,委员会将准备酌情调整货币政策立场。委员会的评估将考虑广泛的信息,包括劳动力市场状况、通胀压力和通胀预期以及金融和国际进展。

受消息影响,当日美股三大指数大幅上涨,均触及52周新高,道指创下历史新高。其中,道指上涨512.30点,收于37,090.24点,涨幅为1.40%。这是该指数首次收于37,000点以上,超过了2022年1月创下的纪录。道指盘中最高触及37,094.85点。标准普尔500指数上涨1.37%,收于4707.09点,这也是该指数自2022年1月以来首次突破4700点。纳斯达克综合指数上涨1.38%,收报14733.96点。

债券市场方面,10年期会议决定公布后,10年期美债收益率下行18bp至4.02%,本轮美债收益率自10月19日高点的4.98%至今回落接近100bp。利差逻辑下,美元指数走弱。

美联储12月经济展望:2024年累计降息75BP

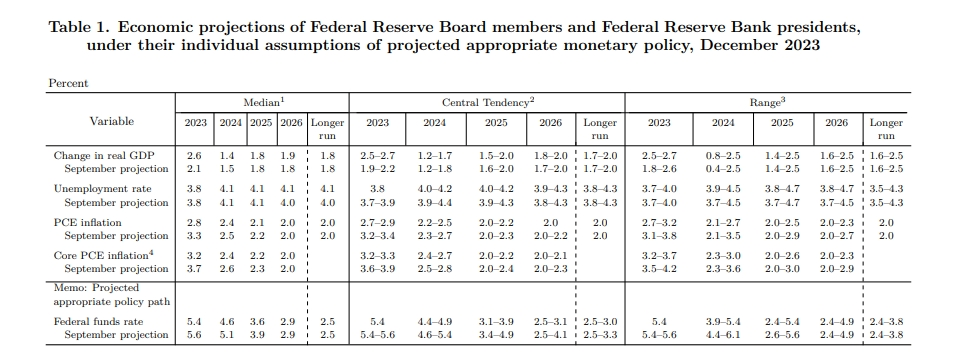

在美联储本次披露的12月经济展望中,相较9月而言也有诸多变化。总体而言,美联储官员们对2024年的美国经济总体保持乐观,并预计会在明年开启多次降息。

经济增长方面,美联储大幅上修了美国2023年的经济增长预测,由2.1%上调至2.6%,并小幅下修了2024年美国的经济增长预测0.1个百分点至1.4%。

通胀方面,美联储大幅下修了2023年美国的PCE通胀预测和核心PCE通胀预测,均下修了0.5个百分点,分别2.8%和3.2%;同时小幅下修了2024年美国的PCE通胀预测和核心PCE通胀预测,分别至2.4%和2.4%,下修幅度为0.1-0.2个百分点。美联储给出的通胀目标为2%。

就业方面,在就业市场韧性背景下,美联储将2024和2025年失业率均保持在4.1%,2026年失业率上调至4.1%,接近于美联储认为的自然失业率水平(4%)。

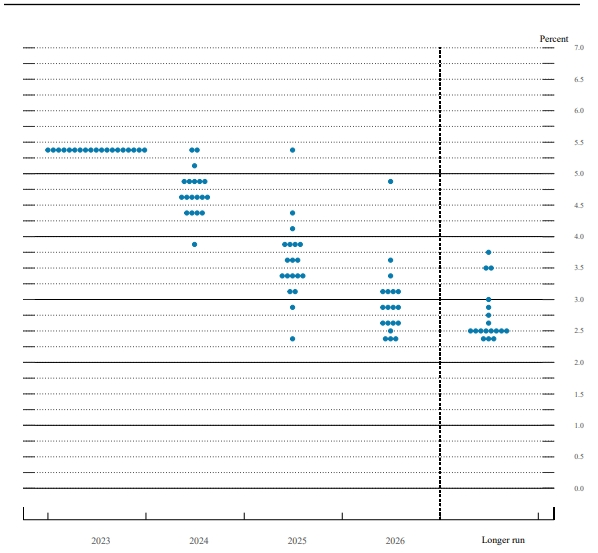

市场关注的利率方面,根据本次点阵图,美联储官员们对2024年的政策利率预测中值为4.5-4.75%,对应累计降息达75BP;2025年利率预测中值在3.5-3.75%,对应年内累计降息100BP;2026年政策利率预测中值为2.75-3%,仍高于2.5%的长期利率水平。

虽然美联储对降息日程还未明确提及,但根据CME“美联储观察”:美联储明年2月维持利率在5.25%-5.50%区间不变的概率为83.5%,加息25个基点的概率为0%,降息25个基点的概率为16.5%。到明年3月维持利率不变的概率为20.9%,累计降息25个基点的概率为66.7%,累计降息50个基点的概率为12.4%。

鲍威尔:降息已开始进入视野 货币政策制定不考虑政治事件

在本次新闻发布会上,鲍威尔的态度相较之前明显转鸽。

对于本次利率决议,鲍威尔称,目前委员会正在谨慎行事,不能明确排除目前加息的可能性,该观点和议息声明保持一致。鲍威尔表示,利率水平已进入限制性领域,不过,如果条件适当的话,准备进一步收紧货币政策,决策者不希望排除进一步加息的可能性,但鲍威尔自己认为明年加息的可能性很小。评论称,美联储可能在短期内不会急于调整基准利率。

对于通胀,鲍威尔表示,委员会仍然致力于将通胀率降至2%的目标,通胀虽然仍然很高,但已经显著缓解,我们对这一进展表示欢迎,但还需要看到更多。“民意调查显示,普通美国人仍然生活在高物价中,这是人们不乐见的事情。”

对于未来的降息路径,鲍威尔指出,降息已开始进入视野,决策者正在思考、讨论何时降息合适。展望未来,降息已不可避免地成为了一个主题。“什么时候开始放松现有的政策限制是合适的,这个问题开始出现在人们的视野中,这显然是全球都在讨论的一个主题,也是我们今天在会议上讨论的一个主题。”

鲍威尔还称,即使没有出现经济衰退,美联储也愿意降息。且不会等到2%通胀率再降息,因为那将会太晚,会超过目标,政策需要一段时间才能影响到经济。

对于软着陆的提法,鲍威尔认为,现在几乎没有理由认为经济会陷入衰退,但不能排除明年出现意外事件,这种可能性总是存在的,而若出现经济衰退将严重影响降息决策。如果能在不导致失业率大幅上升的情况下将通胀率降至2%,那就有资格称之为“经济软着陆”,但鲍威尔显然还没有准备好宣布这一胜利。

对于劳动力市场,鲍威尔称:"就业增长依然强劲,但考虑到人口增长和劳动力参与率,就业增长正在回落至更可持续的水平,劳动力严重短缺的时代已经过去。"

2024年即将是美国的大选年,鲍威尔强调:“委员们不考虑政治事件....我们不能那样做,联邦公开市场委员会只关注经济方面,从而决定货币政策。目前,顽固的高物价和美联储激进的高利率使美国现任总统拜登的支持率出现下滑,三天前,他曾呼吁美联储不要因为强劲的就业数据进一步加息,这标志着拜登罕见地对美联储的政策制定发表评论。

附:美联储12月利率决议声明全文

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。