游戏驿站迎来大涨!“散户逼空华尔街”的戏码将再度上演?

周一(6月3日),游戏驿站开盘价为40.19美元,涨幅接近70%。随后游戏驿站的涨幅有所回落,周一收盘报28美元,上涨21%。

2021年,一场“散户逼空华尔街”的战役受到全球关注。时隔三年,随着当时事件的主人公卷土重来,一场新的多空大战也在逼近。

2021年,有对冲基金认为,游戏驿站(GameStop)这种实体游戏商店的模式正在走下坡路,因而想通过做空游戏驿站来赚取巨额利润。与此同时,一位名为Keith Gill的投资者,用DeepF-Value的网名在Reddit上号召散户买入股票对抗卖空者。此外,Keith Gill还在X和YouTube上用Roaring Kitty的网名继续宣扬买入游戏驿站股票。

在他的号召下,一群散户交易员联合起来共同对抗卖空游戏驿站的对冲基金。许多Reddit用户在WallStreetBets论坛上组织起来,分享表情包和歌曲模仿,大肆宣扬购买 游戏驿站股票。他们还开始支持其他被大量做空的股票,例如AMC。

由此,“散户逼空华尔街”的戏码正式上演。在这轮交易狂潮中,游戏驿站的股价一度飙升了超20倍,最后不少空头被迫平仓。

在沉寂三年之后,Keith Gill在5月中旬发布了一张男人向前倾的图片,引发外界猜测——Gill回来了,而且他要来真的了。

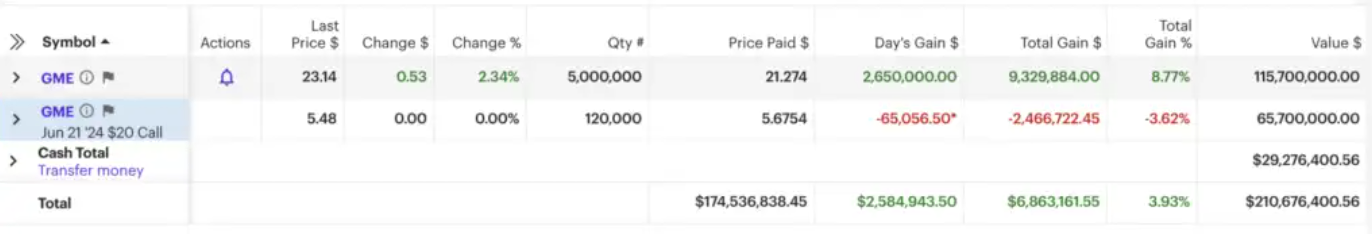

上周日(6月2日)晚间,Gill再次在社交媒体上发出一张图片,这一次他发的是他的持仓。根据Redditr/SuperStonk论坛上发布的账户快照,截至上周五(5月31日),Gill持有500万股游戏驿站股票,价值1.157亿美元,平均购买价格为21.27美元,该股上周五收于23.14美元。此外,他还持有120,000份游戏驿站的看涨期权,行权价为20美元,6月21日到期,每份期权的购买价格约为5.68美元。

Gill重返社交媒体引发了游戏驿站股价的飙升。上个月,游戏驿站曾在八天内上涨了490%,但在接下来的三天里回吐了大部分涨幅。

周一(6月3日),游戏驿站开盘价为40.19美元,涨幅接近70%。随后游戏驿站的涨幅有所回落,周一收盘报28美元,上涨21%。

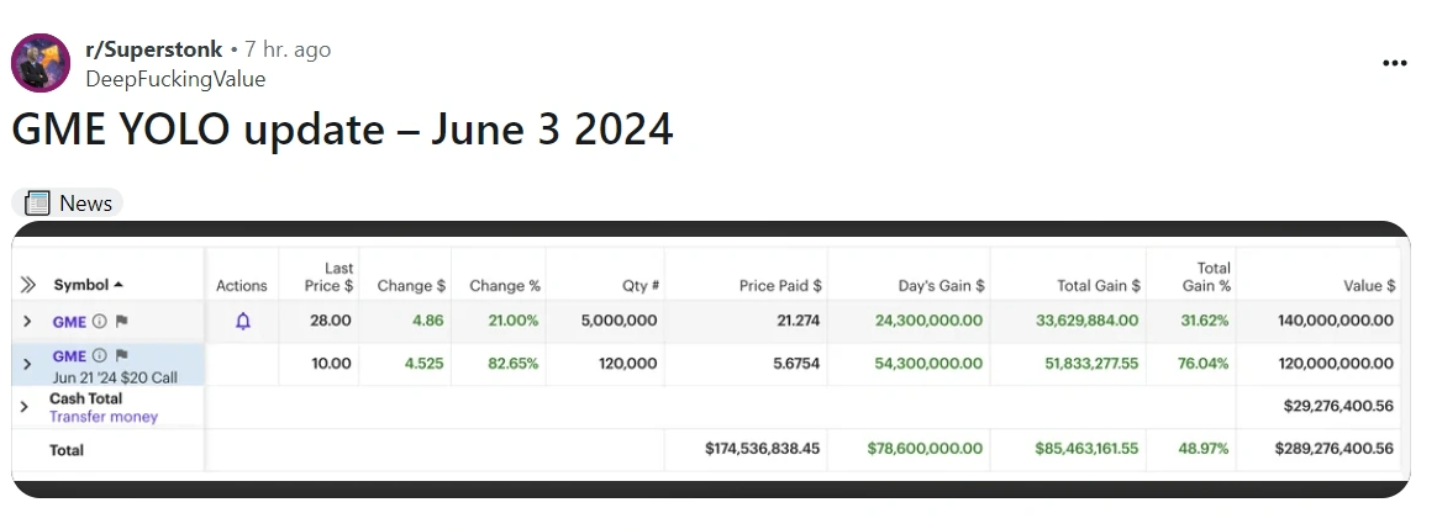

周一收盘后,Gill再次在Reddit上更新了他的持仓。截图显示,他持有的游戏驿站股票在周一单日浮盈31.62%,期权单日浮盈76.04%,仅仅一天就大赚7,860万美元。如果按照周一开盘来算,Gill的浮盈更加可观。

在Gill回归之后,新的一场多空大战似乎已经逼近。

在2021年被Gill率领的多头击败的空头香橼研究公司创始人Andrew Left近日公开表示将再度做空游戏驿站。上个月,Left就宣布其持有游戏驿站的空头头寸。近日他表示,其已经回补了5月的空头仓位。

根据现在游戏驿站的涨势,多头还是占了上风。

据数据分析公司Ortex Technologies数据,周一游戏驿站的飙升使得该股的空头的账面亏损或近10亿美元。据了解,当前游戏驿站的空头仓位为5,760万股,占流通股的18.4%。

不过,现在好戏才刚刚开始,这一场多空大战最终结果如何,让我们拭目以待。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。