国际油价跌至近5个月低点 后市仍面临三大下行压力

展望后市,国际油价仍旧面临较大的下行压力。

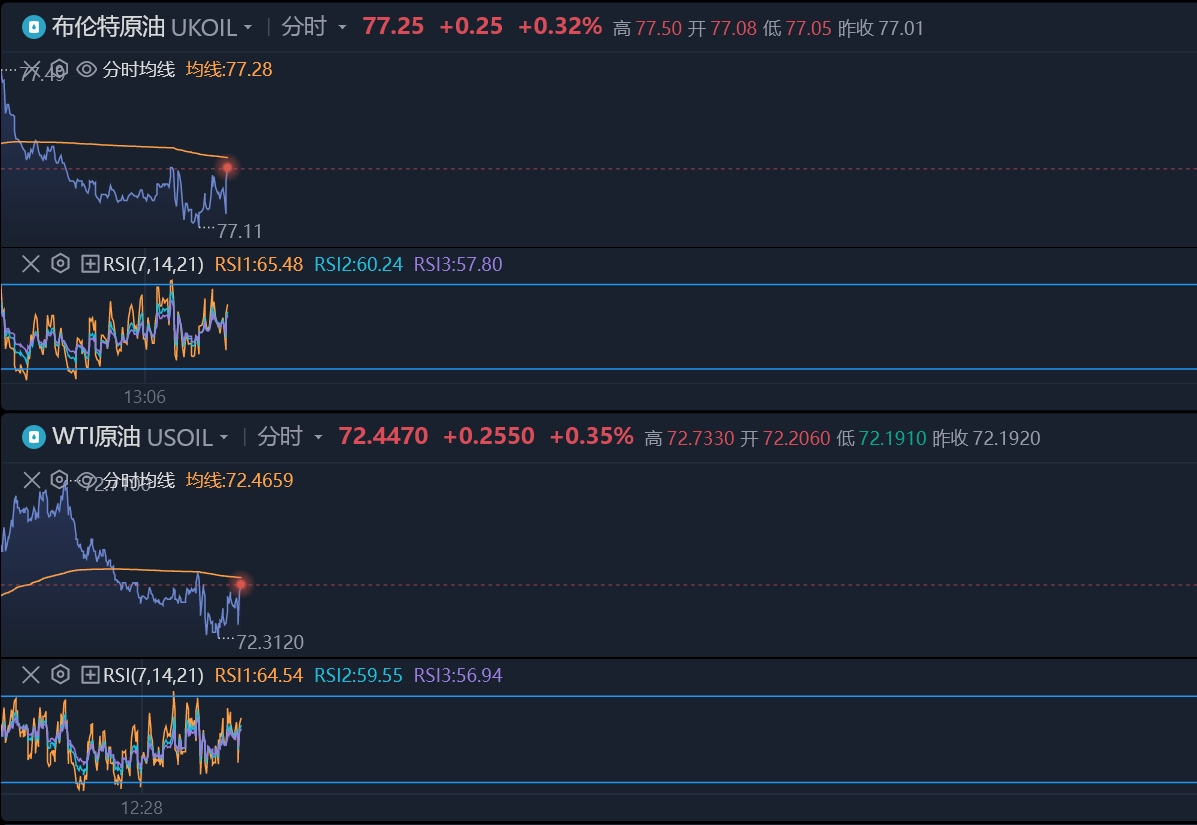

12月6日,国际油价反弹,现布伦特油涨0.32%,报77.25美元/桶;WTI原油涨0.35%,报72.44美元/桶。

API原油库存不降反增 油价小幅跳水

昨日,因担忧OPEC+减产力度不足以及需求萎靡,国际油价连续第四个交易日下跌,盘中刷新五个月低点。其中,布伦特原油期货报收77.20美元/桶,下跌0.83美元/桶,跌幅1.06%;WTI原油收跌0.72美元/桶,跌幅1.0%,收报72.32美元/桶。这是自7月6日以来两种国际原油基准的最低收盘价,对于WTI原油而言,这也是该品种自5月以来首次连续四日下跌。

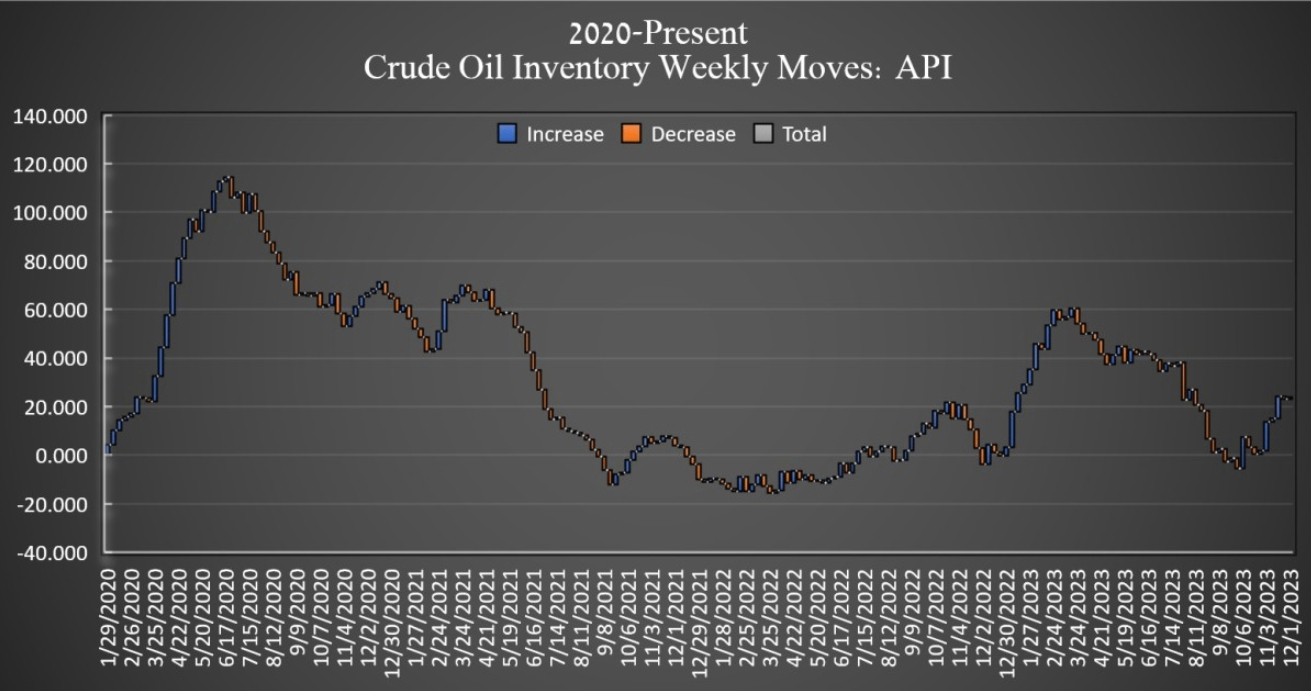

周二,美国公布了至12月1日当周API原油库存。数据显示,库存不降反增,预期为减少226.7万桶,实际为增加59.4万桶,前值为减少81.7万桶,对油价形成压力。根据报告,原油成品油全面累库,尤其是库欣库存大幅增加,强化了对原油市场供给压力的现实担忧。另外,还有消息称,沙特也对输往亚洲的原油官方价格进行了下调,也体现油市在需求不振方面的压力。API数据公布后,油价小幅跳水。

正值油价面临压力之际,美国也来“趁火打劫”,高调宣布补给原油库存。本周,美国能源部副部长戴维·特克(David Turk)表示,美国将尽可能多地回购石油储备。市场预计,美国预计将在明年2月补充大约400万桶的石油储备,补充计划并非在明年夏季。

未来国际油价将面临三大隐忧

展望后市,国际油价仍旧面临较大的下行压力。

第一,市场仍对OPEC+的减产情况保持疑虑,如何重新建立投资者对其信心将是OPEC+在未来面临的一大挑战。目前,包括伊拉克、哈萨克斯坦等多国宣称产量数据在11月出现了下滑,但本次减产行为对市场的预期改善作用非常有限。俄罗斯也宣称OPEC+将随时准备在2024年第一季度深化石油减产,但仍然无法阻止油价下跌。StoneX金融市场分析师菲奥娜·辛科塔(Fiona Cincotta)表示:“该协议的自愿部分让市场质疑供应减少是否真正生效。”

第二,根据美国最新的就业数据,美国的经济已经出现明显的放缓迹象,这对本就不振的油市需求再生打击。根据昨日公布的美国10月JOLTS职位空缺,该数据已经降至2021年初以来的最低水平。美联储在本月公布的褐皮书也称,美国有许多地区的经济活动已经出现放缓迹象。值得注意的是,劳动力市场放缓和通胀消退也引发了人们的乐观情绪,市场押注美联储将在12月结束加息周期,未来较低的利率可能会降低消费者借款购买商品和服务的成本,从而增加对石油的需求。

第三,本周金融市场大幅动荡,各类资产普遍下行,市场情绪较为悲观,也进一步加大了投资者看空油价后市预期。知名外汇资讯网站ForexLive货币分析师兼客户教育总监格雷格·米哈洛夫斯基(Greg Michalowski)表示,昨日美油的最高价达到75美元。最低价为72.66美元。11月份的最低价为72.22美元。若跌破该价位,则看跌倾向将增强。

他还称,上周,WTI原油价格最高价飙升至 79.56 美元。这使该价格超过了2023年全年交易区间的50%,即79.30美元。然而,该势头很快减弱,WTI原油不仅跌破了50%的回撤位,还跌破了78.05美元的200天移动均线。随后的下行走势也跌破了2023年全年交易区间的 61.8%回撤位75.59 美元——对于寻求更多下行动力的卖家来说,这一水平现在是上行目标(也是风险水平)。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。