瑞士央行降息25基点 鸽派措辞强烈

乔丹表示,瑞士的通胀压力已大幅下降,瑞士央行已准备好再次降息。

9月26日,瑞士央行宣布,再次降息25个基点——这是瑞士央行今年第三次降息,呼应了欧洲央行和美联储开启的全球降息周期。

本次瑞士央行降息符合市场预期。在公布决议之前,相关市场已经将降息 25 个基点的概率设定为 55%。同时,在路透组织的民意调查中,32位分析师中的30位,都预料到了本次降息行动。

在降息了25个基点之后,瑞士央行的政策利率来到1.00%,为2023年年初以来的最低水平。本次决定也是瑞士央行主席托马斯·乔丹(Thomas Jordan)12年任内的最后一次利率决议。

决议公布后,乔丹表示,瑞士的通胀压力已大幅下降,瑞士央行已准备好再次降息。他称,未来几个季度可能有必要进一步下调瑞士央行的政策利率,以确保中期物价稳定。

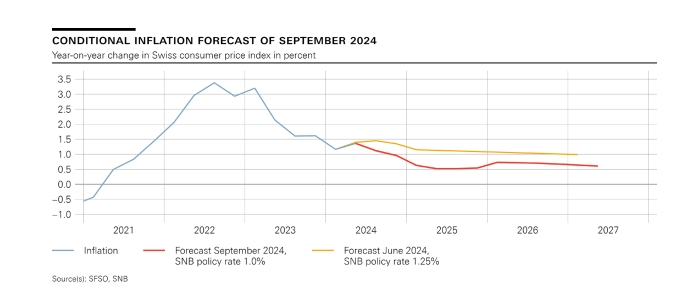

和决议一起公布的,还有瑞士央行的经济预测。该行下调了瑞士2025年和2026年的通胀预期,并预测2027年第二季度,瑞士的消费价格增长为0.6%。近期,瑞士的通胀水平表现良好,在8月进一步放缓至1.1%,在过去15个月中,该数据一直保持在央行0.2%的目标范围内。

最近几周,瑞士法郎也步入了上行通道。8月初,瑞郎兑欧元的汇率来到了9年高点,加剧了瑞士出口贸易商所面临的困难。令人意外的是,在宣布降息25基点之后,瑞士法郎仍然走强。

对于本次瑞士央行的降息行为,荷兰国际集团(ING)高级经济学家夏洛特·蒙彼利埃(Charlotte Montpellier)表示,瑞士央行降息25点是“最鸽派的做法”。她说,瑞士央行不仅明确表示可能有必要进一步降息,而且还大幅下调了通胀预期,政策幅度远超预期。

J Safra Sarasin的首席经济学家卡特森·朱丽丝(Karsten Junius)也称,瑞士央行的做法比市场预期的更为鸽派。他说,瑞士央行在本次决议中对未来政策做出了最强烈的暗示,这打破了以往的沟通模式。瑞士央行明确提出未来可能需要进一步降息,以应对不理想的低通胀,这个措辞是强烈的。

瑞士央行公布了降息之后,投资者重新将目光放回美国的经济数据。今日晚间,美国将公布一系列经济数据,包括当周初请失业金人数变动、美国8月耐用品订单月率初值以及市场关注的美国二季度GDP终值。

本交易日还将迎来多位美联储官员讲话。昨日,美联储理事阿迪利亚纳·库格勒(Adriana Kugler)表示,她预计通胀不会降至美联储2%目标之下,她指出虽然一些不包括住房的通胀指标低于目标,但目标针对的是总体通胀指标,后者正接近但仍高于2%。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。