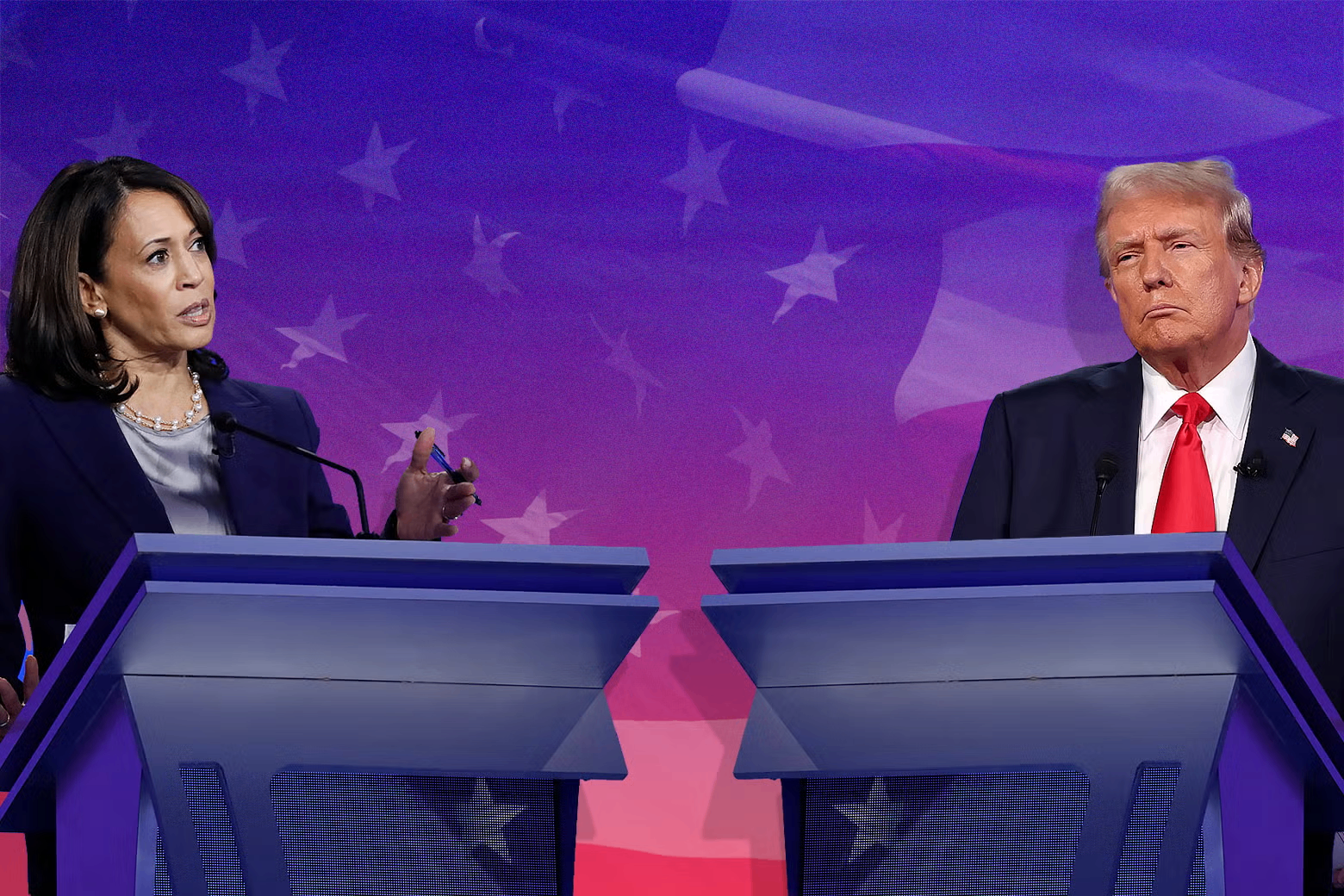

特朗普与哈里斯对美联储的首次降息怎么看?

共和党候选人特朗普的对此次降息的看法偏负面,认为要么经济状况非常糟糕,要么就是政治操弄。而民主党候选人哈里斯则对降息表示欢迎。

9月18日,美联储宣布将政策利率区间下调50个基点至4.75%-5.00%。在距离选举日仅剩七周的情况下,美联储宣布大幅降息,两位候选人对此都有何评论?

特朗普对降息动机表示怀疑

共和党候选人特朗普的对此次降息的看法偏负面。

“我猜,如果他们不只是在玩弄政治,那么削减这么多就说明经济状况非常糟糕。”特朗普说,“要么经济状况非常糟糕,要么他们在玩弄政治,但这次的削减幅度很大。”

特朗普的观点和美联储的表述相反。在美联储的9月利率决议后的记者会上,美联储主席鲍威尔强调称,美国经济总体强劲,并已朝着我们的目标取得了重大进展。

今年上半年,美国GDP的年率增速为2.2%,鲍威尔称,现有数据显示,第三季度的增长速度将与上半年大致相同。

特朗普的支持者也认为这次降息掺杂了政治动机。对冲基金亿万富翁约翰·保尔森(John Paulson)是共和党总统候选人特朗普的主要捐款人,他在一份声明中表示:“传统上,美联储不会在选举前夕降息,本世纪唯一一次降息是在2008年金融危机之后,当时需要采取重大行动。我们今天没有遇到类似的情况。”

他进一步指出,“这一决定不禁让人怀疑,美联储是否有意在这一时机为副总统哈里斯的竞选造势。美联储声称自己凌驾于政治之上,但今天采取行动的时机让人对其说法产生怀疑。”

值得注意的是,鲍威尔是在特朗普担任总统的时候被提拔为美联储主席的,但后来双方却经常发生意见分歧。

最近几周,特朗普还直言,总统应该对美联储处理利率和货币政策有更多发言权。这意味着特朗普希望颠覆美联储长期以来保持的独立性。他还表示,如果他今年赢得大选,他不会再任命鲍威尔为美联储主席。

哈里斯认为降息是个利好

与特朗普的“怀疑论”相反,民主党候选人哈里斯则对降息表示欢迎。

哈里斯在一份声明中表示,这一决定“对承受高物价冲击的美国人来说是个好消息”。

哈里斯补充道:“我知道对于许多中产阶级和工薪家庭来说,物价仍然太高,当我作为总统,我的首要任务就是降低医疗保健、住房和食品杂货等日常需求的成本。”

哈里斯还借此抨击特朗普。她表示,这与特朗普当总统的做法完全相反。虽然他提议为亿万富翁和大公司减税,但他的计划将通过对家庭依赖的商品(如汽油、食品和服装)征收特朗普税,使家庭每年的支出增加近4,000美元。

不过,哈里斯的此番言论也暴露出,拜登当任总统期间,通货膨胀给美国家庭带来的沉重打击。

作为现任总统,拜登也在一份声明中表达了和哈里斯类似的观点。他认为美联储四年多来的首次降息是对抗通货膨胀的 “重要时刻”。

“通胀和利率正在下降,而经济依然强劲。”拜登表示,"批评者说这不可能发生——但我们的政策正在降低成本并创造就业。”

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。