Extreme Rabbit Express has been ranked first in Southeast Asia in HKEx's table delivery operation.

According to a document disclosed by the HKEx on June 26, Extreme Rabbit Express Global Limited (listing name: Extreme Rabbit Express) has been listed on the HKEx.。The co-sponsors are Morgan Stanley, Bank of America Securities and CICC.。

According to the HKEx's June 26 disclosure document, Extreme Rabbit Express Global Limited (hereinafter referred to as "Extreme Rabbit Express") has submitted a statement to the HKEx, and the joint sponsors are Morgan Stanley, Bank of America Securities and CICC.。

Company Profile

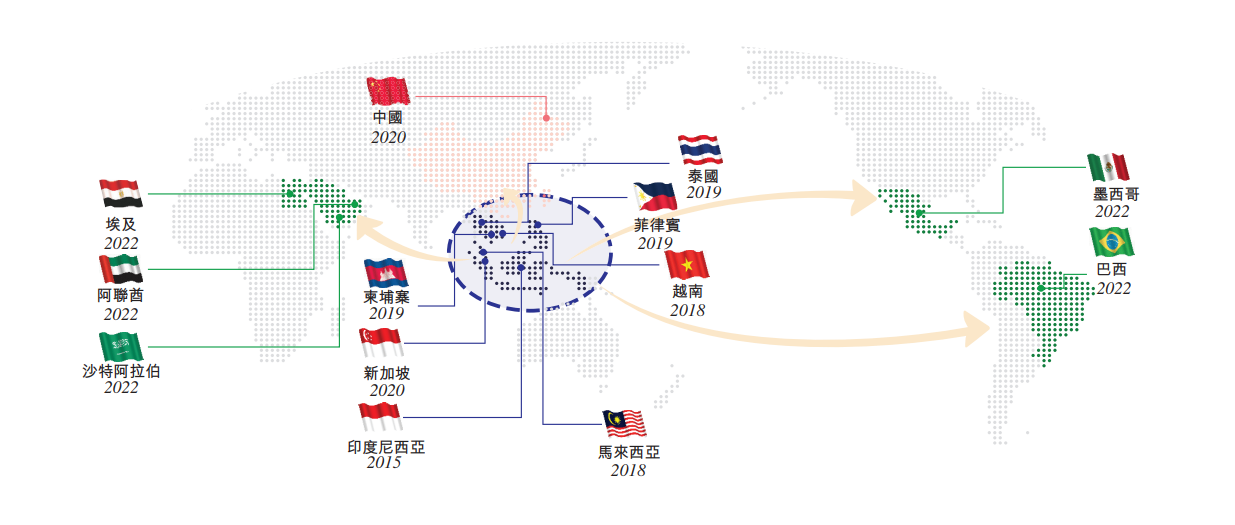

According to the disclosure documents, the business started in Indonesia in 2015 and expanded to other Southeast Asian countries such as Vietnam, Malaysia, the Philippines, Thailand, Cambodia and Singapore.。In 2020, the company entered the Chinese express delivery market, with a geographical coverage of more than 98% in China's counties.。

According to Frost Sullivan, in 2022, the global annual parcel volume of polar rabbit express was 14.6 billion, an increase of 39% from 10.5 billion in 2021..0%, an increase of 350 from 3.2 billion in 2020.6%。

As e-commerce penetration continues to increase in Southeast Asia and China, the company will benefit from the huge e-commerce market。The company provides express delivery solutions for leading e-commerce platforms to help them enter new markets。The company also provides express delivery services to merchants and consumers on leading e-commerce platforms such as Shopee, Lazada, Tokopedia, Pinduoduo, Taobao, Tmall, Shein and Noon, as well as short video and live broadcast platforms such as TikTok, Douyin and Kuaishou.。

At present, the company's business revenue sources mainly include courier services, cross-border services and other services.。

Express service:

● Services provided to network partners' pick-up outlets, including sorting, long-distance transportation, delivery and other related network management services。Receipt fee based on package weight and route to end recipient's destination。In addition, the Company charges network partners for initial operational training and other initial services.。

● Provision of services to non-listed operating entities of regional agents, including technical system support, training, logo and brand name usage rights, and general network planning services。Charges for network services to the operating entity of the regional agent based on parcel volume。

● Provide services to corporate or individual customers, and then charge customers based on package volume, weight, route to the final recipient's destination, and other services。

● Payment collection service。In the reform service, the company is generally engaged by customers (usually online shopping e-commerce platforms or online merchants) to collect cash payments from end-users on their behalf, and then pay cash to such customers, and charge a percentage of the service fee for cash payments, as a value-added service in addition to courier services.。

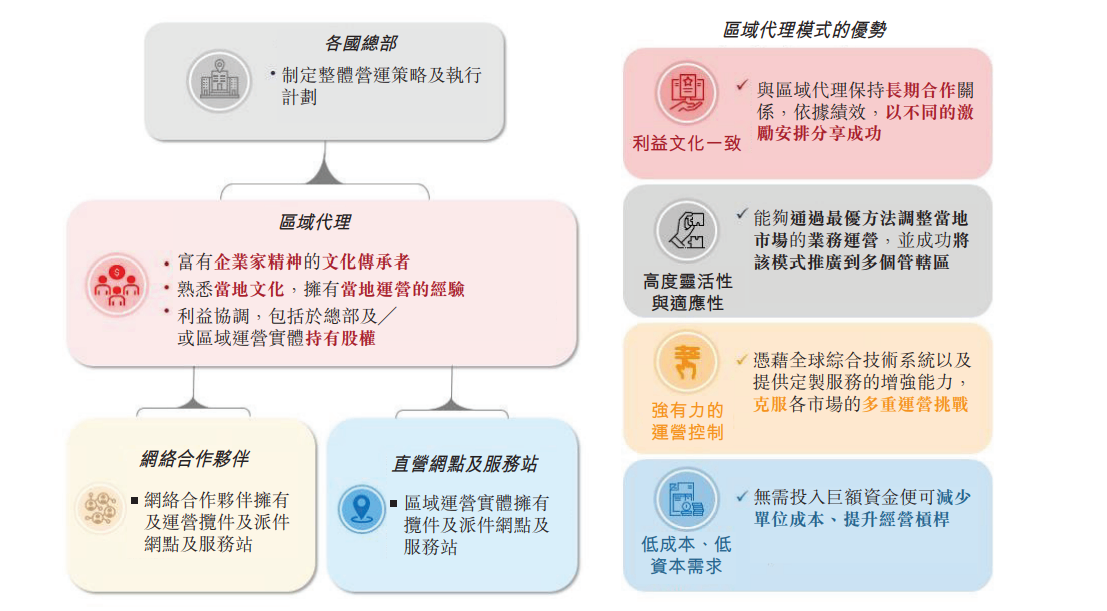

Cross-border services: Revenue from these services is recognized through the company's performance obligations and over time.。

In cross-border services, companies build a highly adaptable business model through regional agents。As shown in the figure, the Group headquarters is responsible for developing the overall operating strategy and execution plan for each market, the regional agent is responsible for the day-to-day management of regional operations, and manages the network partners through the appropriate regional operating entity.。Management responsibilities of regional agents include establishing local operations, sales and marketing, customer service and training of staff and network partners。The company is currently the only courier operator in Southeast Asia and China that has successfully adopted this model on a large scale.。

As of December 31, 2022, the Company had 104 regional agents and approximately 9,600 network partners.。As of the end of last year, the company operated 280 transfer centers with more than 8,100 trunk transport vehicles, including more than 4,020 owned trunk transport vehicles and about 3,800 trunk routes, as well as more than 21,000 pick-up and dispatch outlets.。

Other services: This revenue includes the sale of materials such as polar rabbit brand express packaging supplies and clothing.。

It is worth noting that the JMS system, a common technical framework, has been developed and built by Pole Rabbit Express to provide technical support for its business.。The company also independently develops and maintains an address database, and builds a nine-character address system based on the database.。As of December 31, 2022, the Company is the only large courier service provider in Southeast Asia that uses nine-character code technology and proprietary address databases on a large scale.。The development of new technologies is inseparable from the efforts of R & D personnel, with a global R & D team of 1,899 as of 31 December 2022.。

Market size

In 2021-2022, Pole Rabbit Express is the number one courier operator in Southeast Asia by parcel volume, with a CAGR of 47 in parcel volume from 2020 to 2022..6%。The company's market share in Southeast Asia in 2022 was 22.5%。

The compound annual growth rate of the company's parcel volume in China from 2020 to 2022 is 140.2%。In 2022, the company will be in China with 12,025.6 million packages account for 10.9% market share。

In 2022, the company will also expand into other large and high-growth markets around the world, such as Saudi Arabia, the United Arab Emirates, Mexico, Brazil and Egypt.。

As a global logistics service provider, the company's delivery services span 13 countries, including the world's fastest growing emerging markets.。The Company is rapidly expanding its business in these markets and generating gross losses, operating losses and net operating cash outflows。

Financial Overview

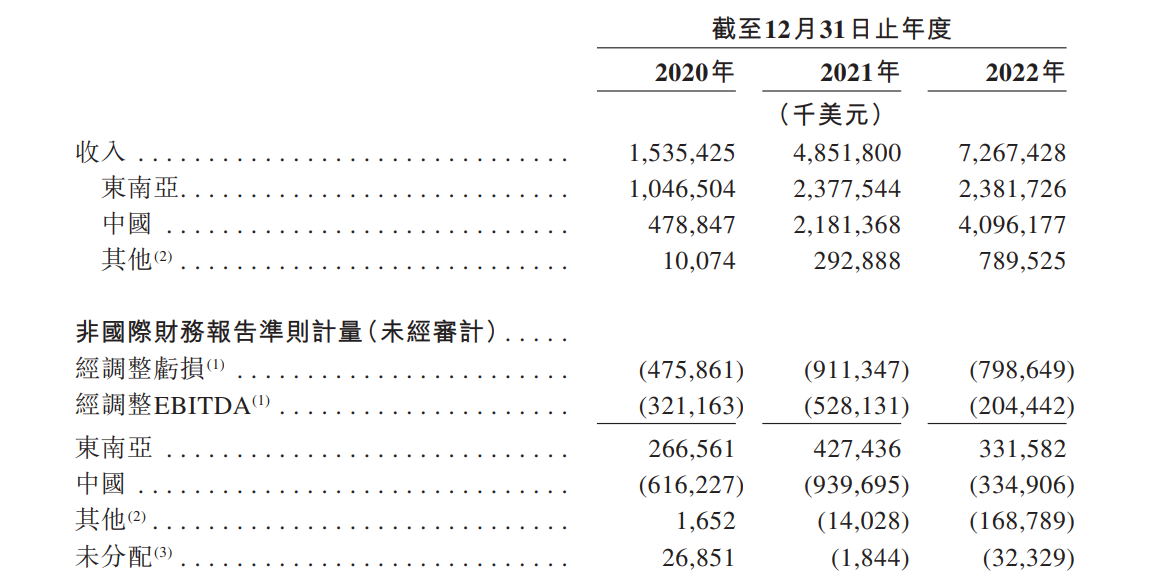

The company is 48 in 2021..$5.2 billion, compared to 15% in 2020.$3.5 billion YoY up 216.0%。2022 revenue is 72.$6.7 billion, up 49.8%。The average growth rate for 2020-2022 is 132.9%。

The company's performance varies across markets。During 2020-22, the Company achieved adjusted EBITDA earnings in Southeast Asia, but experienced varying degrees of losses in China and other markets.。The Company's overall adjusted EBITDA loss narrowed in 2022 as revenue grew。

Use of funds

The company expects that the funds raised will be used to (1) expand its logistics network, upgrade infrastructure and strengthen sorting and warehousing capacity and capacity in Southeast Asia and other existing markets; (2) explore new markets and expand the scope of services; (3) research and development and technological innovation.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.