Zhuhai Wanda Business Management Prospectus Fails for Three Times If It Is Not Listed Before the End of the Year, Wanda Will Pay 30 Billion

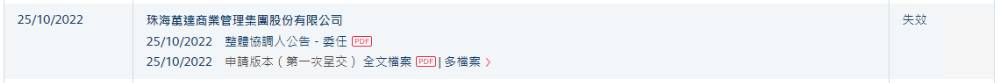

On April 25, according to HKEx information, the prospectus status of Zhuhai Wanda Commercial Management Group Co.。This prospectus was filed on October 25, 2022 and has expired for six months as of the early morning of April 25, 2023, which is the third consecutive prospectus filed by Zhuhai Wanda Commercial Management.。

On April 25, according to HKEx information, the prospectus status of Zhuhai Wanda Commercial Management Group Co.。

Wang Jianlin's "Encountered a Little Difficulty" Zhuhai Wanda Business Management Goes to Hong Kong for Listing

In this regard, Wanda said that according to the Hong Kong listing rules, the Hong Kong Stock Exchange believes that the original application or re-submission within three months after the expiration of six months is a continuation of the original application.。Therefore, the current failure of the listing application materials does not affect the company's listing process on the Hong Kong Stock Exchange, the company will update the submission of the application materials as soon as possible in accordance with the requirements of the Hong Kong Stock Exchange, the current listing progress in an orderly manner.。

On Friday, it was reported that Wang Jianlin, chairman of Wanda Group, admitted at a management meeting that the company faced some difficulties, including the postponement of the initial public offering of Wanda Commercial Management, a subsidiary of the group.。

According to public information, on October 21, 2021, Zhuhai Wanda Commercial Management submitted a prospectus to the Hong Kong Stock Exchange, intending to issue shares globally for investment acquisition and expansion of the property under management, renovation of the scene and hardware, strategic investment, etc., but the prospectus expired on April 21, 2022.。Since then, Zhuhai Wanda Commercial Management has again submitted a prospectus to the HKEx and has not yet entered the hearing stage.。

This prospectus was filed on October 25, 2022 and has expired for six months as of the early morning of April 25, 2023, which is the third consecutive prospectus filed by Zhuhai Wanda Commercial Management.。

Wanda Business Management's 2022 Revenue Grows 7 Year - on - Year.4% If Wanda is not listed before the end of the year, it will pay the repurchase amount.

According to Wanda Business Management Group's 2022 results, Wanda Business Management's 2022 revenue is 553.100 million yuan, 99% of the annual plan.6%, YoY growth 7.4%; rental income 508.500 million yuan, up 8% year-on-year;.7%; rental collection rate of 100%; opening of 55 Wanda Plaza, 100% of the annual plan.。

On March 21, the China Securities Regulatory Commission issued a letter of inquiry on the application documents for the public offering of corporate bonds by Dalian Wanda Commercial to professional investors, focusing on the progress of its subsidiary Zhuhai Wanda Commercial Management's listing in Hong Kong.。According to the inquiry letter, if the company does not successfully go public by the end of 2023, Wanda will have to pay about RMB30 billion in equity repurchases to pre-listing investors.。The CSRC asked Wanda Commercial Management to further explain the progress of the listing of its subsidiary Zhuhai Wanda and assess the impact of the above matters on the company's short-term solvency.。

Wanda is already working to get approval from domestic regulators.。Last week, according to a list on the China Securities Regulatory Commission's website, the agency had already marked Zhuhai Wanda's application as "received," and according to regulatory requirements, companies listed abroad need to apply to the CSRC for registration.。It is reported that the SEC will take about 20 working days to process corporate filing applications。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.