iPhone 15 Series Sells Poor in China?Cook's second visit to China goes deep into the "fruit chain" line

Apple will report fiscal fourth-quarter results in early November, and analysts widely expect the company's revenue to fall 1% from the same period last year.。Apple's stock is showing signs of decline ahead of earnings, having fallen for five consecutive sessions。

Apple reports results soon, but its share price has recently shown signs of decline。Apple shares fell 0 on Thursday (October 19).38%, and this is the company's fifth consecutive day of declines。

iPhone 15 series sales are poor in China, and MacBook shipments are down 30% for the year.

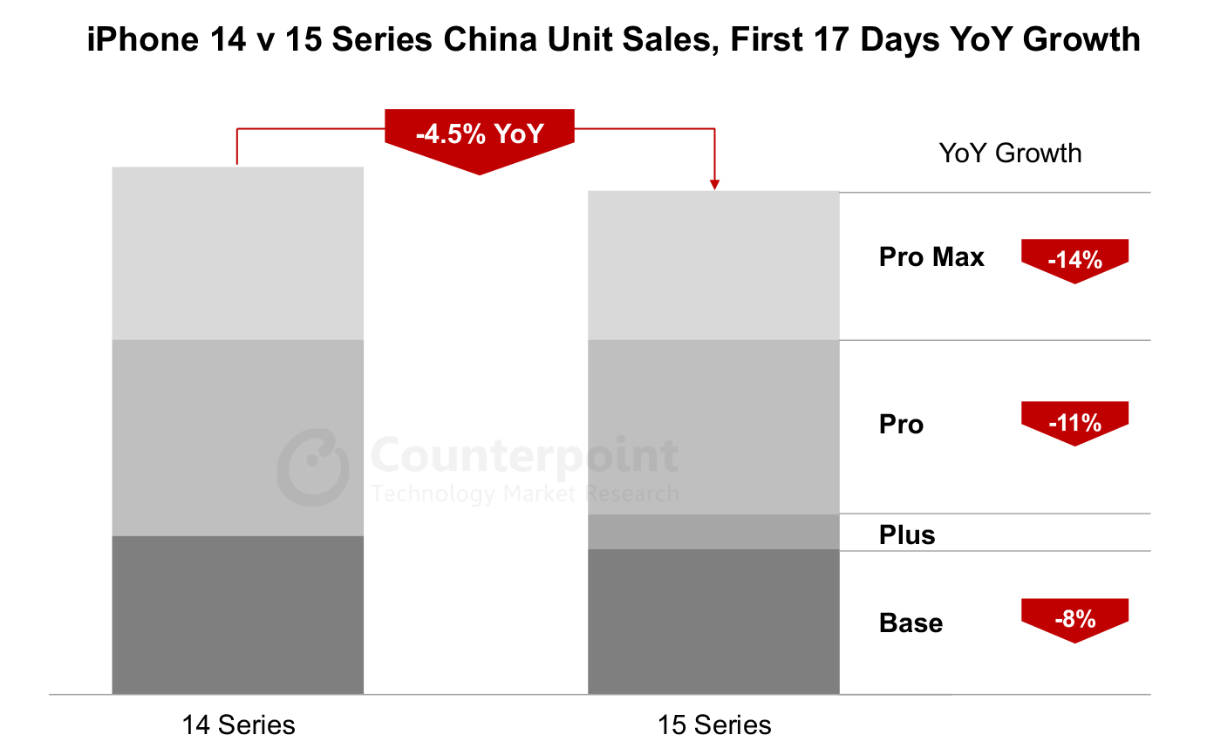

According to preliminary data from Counterpoint Research's weekly smartphone sales tracking report, sales of the iPhone 15 series fell 17 days after it went on sale in China compared to last year's iPhone 14..5%。

Senior analyst Mengmeng Zhang said: "The overall poor performance of the iPhone 15 series in China reflects the overall decline in consumer spending.。But the short pre-holiday shopping period, coupled with the Pro Max supply mismatch (consumers don't like the blue model), may delay some demand until the fourth quarter。"

However, iPhone 15 sales figures in the US are in stark contrast to those in China。Preliminary data show double-digit growth in overall iPhone 15 sales nine days after launch in the United States, with solid demand for the base, Pro and Pro Max models in particular.。

Jeff Fieldhack, director of North American research, believes that the iPhone 15's hot sales in the United States is a positive sign that can mitigate the negative impact of Apple's data in the Chinese market.。"

Still, the iPhone 15's cold sales in China have led some agencies to start adjusting their estimates for the series' shipments.。Jibang Consulting estimates that the total number of iPhone production in the whole year is about 2.2-2.2.5 billion units, a decrease of about 5% year-on-year。According to media reports, Apple has told parts makers that this year's iPhone production forecast is only flat at 2022 levels, with iPhone 15 series production at around 85 million units.。

In addition to the iPhone, industry insiders have raised warnings about Apple's declining MacBook shipments.。

On October 18, well-known Apple analyst Guo Mingyi said that based on supply chain shipments, Apple's MacBook shipments are expected to fall 25-35% year-on-year in the fourth quarter, and are expected to ship about 17 million MacBook units in 2023, down about 30% year-on-year.。With no new products in the fourth quarter of this year, MacBook shipment momentum will be significantly lower than in previous seasons。According to Guo, the key reason why Apple has not released new products is that Apple needs to clear its inventory and reformulate its new product and sales strategy for 2024.。In addition, Apple hopes that the M3 processor can boost MacBook shipments in 2024, but whether the strategy will work remains to be seen。

Growth Outlook Unclear, Big Banks Revisit Apple Stock Ratings

On October 19, Morgan Stanley released a research report saying that it is expected that Apple's quarterly (fourth quarter) results for the quarter ending September will be in line with market expectations, but the supply of new iPhone models is blocked and the dollar is strong, which may make the quarter ending December (first quarter of next fiscal year) guidance lower than market expectations, so Damo maintains Apple's "overweight" rating, but lowers the company's target price from $215 to $210。

Damo expects Apple's fourth-quarter revenue of $89.9 billion, earnings per share of 1.$39, 0-1% higher than the average market forecast。Meanwhile, the bank forecast Apple's revenue for the first quarter of next fiscal year at $123.8 billion, with earnings per share of 2.$13, down 5% and 9% from earlier forecasts, respectively, but still slightly above market forecasts。

Damore also believes Apple's results will not be a catalyst for its share price, but remains constructive over the next 12 months and expects the market's forecast for the stock to be raised.。Morgan Stanley analysts also cut their iPhone sales forecast for the quarter by 8%。He also believes that the focus of attention before the end of the year includes whether the demand for iPhone 15 can be sustained, the situation of China's business, the performance of service revenue, and the progress of Google's suspected monopoly case.。

In addition, KeyBanc Capital Markets recently downgraded Apple's rating from "overweight" to "in line with the industry."。Apple's stock valuation is now near an all-time high, the company said, while expecting sales growth to likely slow.。Analyst Brandon Nispel wrote in a note that sales in the U.S. market could be in trouble amid a challenging iPhone upgrade cycle amid slowing consumer spending.。In addition, Apple's expectations of re-accelerating growth in international markets may be too aggressive。

Nispel believes that while early demand for the iPhone 15 Pro Max was better than expected, it seems to reflect the shift from the iPhone 15 Pro to the iPhone 15 Pro Max.。Although this will help increase the average selling price, it will have little impact on overall sales。

"We expect to experience a fourth consecutive year-over-year decline in the U.S. in the fourth quarter of fiscal 2023 and likely to extend into the first quarter of 2024."。Nispel added, "We expect Apple's revenue to grow by 3% in fiscal 2024..5%, compared to the consensus expectation of more than 6%, and we have a more moderate view of revenue across all Apple divisions。"

Apple will report fiscal fourth-quarter results in early November, and analysts widely expect the company's revenue to fall 1% from the same period last year.。Over the same period, the overall revenue of the S & P 500 technology sector is expected to grow by 1..5%。

According to media statistics, Apple's current consensus rating (representing the ratio of buy, hold and sell ratings) has fallen 9% from its peak in December last year.。Fewer than two-thirds of the analysts tracked gave a "buy" rating, which is by far the lowest percentage among large stocks.。

James Abate, chief investment officer at Center Asset Management, believes Apple's weak growth and high stock costs are creating a disconnect that is hard to ignore。

Abate said in an interview: "Apple's growth rate is the weakest among large companies, but the stock has not fallen to the level of the previous period of no growth.。Abate believes that because of Apple's "systemic" importance to the stock market, investors should hedge Apple's valuation risk through put options.。

Apple's shares have fallen 10 percent since the end of July, while the Nasdaq 100 has fallen 5 percent over the same period..6%。As the largest component of the S & P 500, Apple accounts for 7% of the index's weighting..More than 1%, the recent decline has wiped more than $320 billion off Apple's market value。

Michael Kirkbride, portfolio manager at Evercore Wealth Management, said: "There are always challenges, but this does seem to be a trickier period (for Apple), especially with the P / E ratio at the high end of the historical range.。Apple has a P / E ratio of 26..6 times, above multiples of the Nasdaq 100 and its long-term average。Kirkbride added: "We are very cautious about increasing our position but are willing to buy at a lower price.。"

Still, Kirkbride said Apple deserves to be trusted, given its ability to weather challenging times in the past.。"Apple remains the world's top brand, it has unparalleled supply chain expertise, and its free cash flow means return on capital unlike any other company."。It's worth it to stick to that。"

Cook visited China on the second day of the year, in-depth "fruit chain" line

In the face of iPhone sales challenges in China, Apple CEO Tim Cook (Tim Cook) recently came to China again, this is his second visit to China this year。

On October 18, Cook came to Lixun Precision, located in Jiashan, Zhejiang Province, to go deep into the first-line factory of the famous "fruit chain."。It is understood that Cook's visit to the Lixun precision factory is mainly responsible for the production of Apple Watch and iPhone 15 Pro Max, etc.。Lixun Precision Chairman Wang Laichun accompanied the visit。

In addition to visiting the factory, Cook also went to the Apple sales store in Taikoo Li, Chengdu, to participate in activities related to "King of Glory" and interact with store employees and consumers.。In addition, Cook also went to Beijing to meet with the Chinese Minister of Commerce and other officials。

Cook's visit to China again highlights the importance it attaches to its China business。According to Apple's fiscal 2022 data, China is Apple's largest production base in the world, and Apple assembles and produces 95% of iPhones, AirPods, Macs and iPads in China.。In addition, the Chinese market is another big market for Apple after the United States, and its importance is self-evident.。

Apple previously held a leading position in China's high-end model market, but now that advantage is showing signs of collapse。The emergence of the Huawei Mate 60 series has significantly affected the sales of the iPhone 15 series。In addition, Xiaomi, OPPO and other mobile phones in recent years are also constantly in the impact of high-end models, Apple's mobile phone market share is likely to be further compressed.。

Industry insiders believe that Cook's trip to China, visiting Apple's industrial chain factory, is clearly to boost Apple's confidence in China's business and consolidate its local business map.。Cook went from the production side of Apple to the sales side to gain insight into the production and sales of its products in China。

The visit of Apple executives can obviously increase the enthusiasm of enterprises in the local area.。But the sale of the product will eventually return to the product itself.。Apple has previously built a "moat" of the high-end mobile phone market with a number of technologies, but in the past two years, "nothing new" has become a big label for Apple's new models.。In the increasingly fierce market competition for high-end models, if you want to impress consumers and increase market share, Apple may have to show more "sincerity."。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.