The US economy may be falling into a "PMI trap."

On the one hand, the continuation of economic uncertainty in the United States has hindered the distribution of new orders, which has dragged down the PMI index.。On the other hand, when the PMI index falls, it will bring relatively pessimistic economic expectations to the market, affecting future PMI data.。

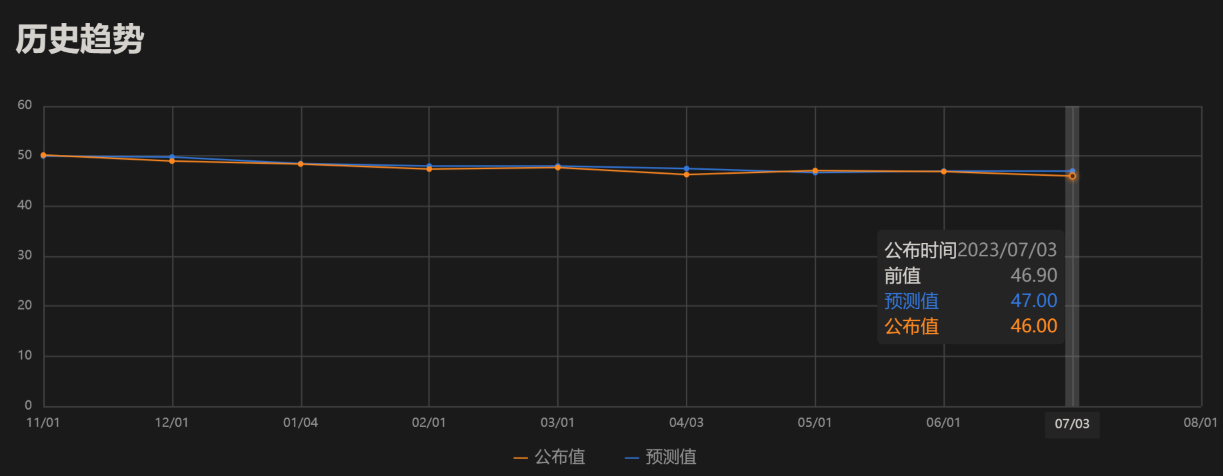

On July 3, local time, the Institute for Supply Management (ISM) released the U.S. Manufacturing Purchasing Managers Index (PMI) for June.。Data show that the US manufacturing PMI index recorded 46 in June, lower than the forecast of 47 and the previous value of 46.9, and is below the 50 glory line。

June job cuts the most since the outbreak resumed

According to statistics, the U.S. ISM manufacturing PMI has been in contraction for eight consecutive months, hitting a new low since May 2020, with the longest contraction since 2008-2009.。For months, the Manufacturing Business Survey Committee (Manufacturing Business Survey Committee) has repeatedly predicted that the U.S. economy will record a strong performance in the second half of the year, but the weaker-than-expected demand side has somewhat dampened the agency's optimistic outlook.。

In addition, employment indicators, which had previously boosted the market, also recorded a contraction in yesterday's report。According to ISM data, the June employment index fell 3.3 points to 48..1%, also below the boom-bust line, which may signal a possible cooling of the U.S. labor market.。

With regard to this contraction in employment data, some analysts have pointed out that the reasons behind this can be attributed to the fact that employers have different expectations of the economic outlook.。Entering the second half of the year, some companies believe that the economy may return to growth, so they are willing to try to maintain the current number of employees。For others, however, they are constrained by previously mandated business plans, and the quickest way to stay in line with labor budgets is to lay off workers。

Timothy Fiore, president of the American Institute of Supply Management, said: "We saw more layoffs in June than at any time since the outbreak resumed.。This is the first time I've seen companies incorporate layoffs as part of their workforce management, rather than stagnant hiring and natural churn.。"

The U.S. economy may have entered a vicious circle.

In terms of important sub-items, the price index fell slightly, down 2% from the previous value..4 percentage points to 41.8%, the marginal inflation pressure has slowed down。However, according to the report, many Americans still have limited spending on goods, and the direction of consumption is gradually shifting to services.。In addition, there are many consumers who adhere to the concept of saving consumption, because the still high inflation has affected their income。

In addition, another manufacturing PMI data released by Markit earlier in the day showed that the U.S. Markit manufacturing PMI recorded a final value of 46 in June..3, in line with the previously announced initial value, the lowest since December 2022。Among them, the final value of the new orders sub-index fell to 42..9, falling for the second month in a row, also reflecting sluggish demand。

The downturn on the demand side has caused concern among economists.。Chris Williamson, chief business economist at Standard & Poor's Global Market Intelligence, said the health of U.S. manufacturing deteriorated sharply in June, adding to fears that the economy could slip into recession in the second half of the year.。He also noted that leading to the bleak outlook was a severe drop in demand for commodities, with new orders falling at the worst rate since the global financial crisis in 2009.。Businesses report that customers are becoming more cautious about spending due to rising living costs, rising interest rates, growing concerns about the economic outlook and a shift in spending to services。

With weak demand, manufacturers, suppliers and customers are looking to cut warehouse inventories。U.S. June customer inventories index down 5, data show.2% to 46.2%, has entered the "too low" (too low) range。

In this regard, Fiori said that the U.S. economy has entered a vicious circle similar to the "PMI trap."。On the one hand, the continuation of economic uncertainty in the United States has hindered the distribution of new orders, which has dragged down the PMI index.。On the other hand, when the PMI index falls, it will bring relatively pessimistic economic expectations to the market, which will prevent companies from retaining their labor and reducing investment capital expenditures, which in turn will affect production and affect future PMI data.。

Wall Street bigwigs warn: investors to lower market expectations

After a surprisingly strong first half, with the outlook unclear, there are already warnings from Wall Street bigwigs hoping investors will lower market expectations。

Earlier this year, Steve Blitz, chief U.S. economist at TS Lombard, a leading independent economic and investment research firm, had accurately predicted in advance that something was wrong with the U.S. banking industry, and Blitz recently noted that the long-anticipated U.S. recession could come in the coming months。

Nikolaos Panigirtzoglou, global market strategist at JPMorgan Chase, said: "The stock market performed well in the first half of the year because there was no recession in the United States.。Tech stock trading has turned into a painful trade for institutional investors, causing them to surrender。The background of the first half creates vulnerability for the second half of the year, as it means that if there is a recession in the United States, there will be a fairly sudden correction in the market.。"

Bridgewater Co-Chief Investment Officer Greg Jensen also warned investors in a recent interview.。He noted that for the stock market to bounce back from now on, you would have to lower interest rates fairly quickly when corporate earnings are pretty good, and that "the Fed seems to be a little more realistic than the market in terms of what to do."。He also said that the current level of policy tightening is fast and high compared to history, and that any similar tightening in the past has led to a severe recession.。

Separately, Goldman Sachs analysts also said in a note that while the S & P 500 may have more upside, investors should consider some downside protections in the face of recession risk。The bank predicts that the S & P 500 will rise 7 percent to 4,700 over the next 12 months, but economists at Goldman Sachs also estimate that there is a one-in-four chance that the U.S. economy will fall into recession during that time.。

The bank also said that if a recession occurs, the S & P 500 will fall to 3,400 and investors should be prepared。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.