Wealth Broker holds brokerage licenses from ASIC in Australia and FSPR in New Zealand. It meets international compliance standards and is a formal platform trusted by global investors.

With the development of the global economy and the increasing complexity of investment markets, investors have an increasingly urgent need for diversified asset management.As a leading digital one-stop investment and wealth management platform, Wealth Broker not only meets the needs of investors, but also provides global investors with a reliable investment tool.

Why choose Wealth Broker Platform?

Wealth Broker is not only an innovative investment tool, but also a platform with a solid compliance foundation and advanced technical support.By partnering with leading financial institutions around the world, Wealth Broker is committed to providing investors with comprehensive and professional investment management services.

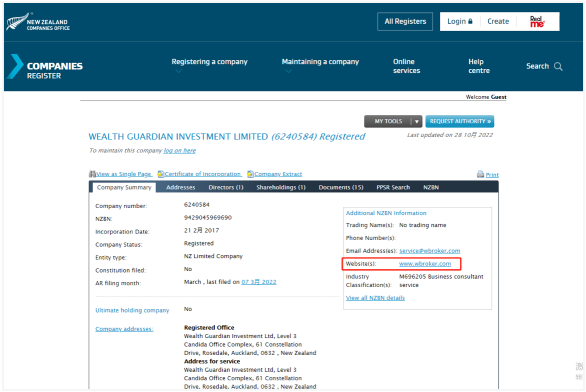

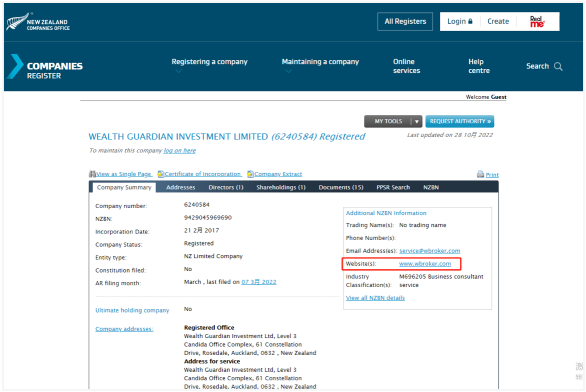

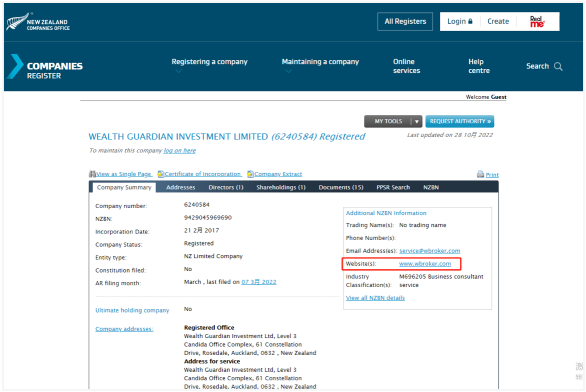

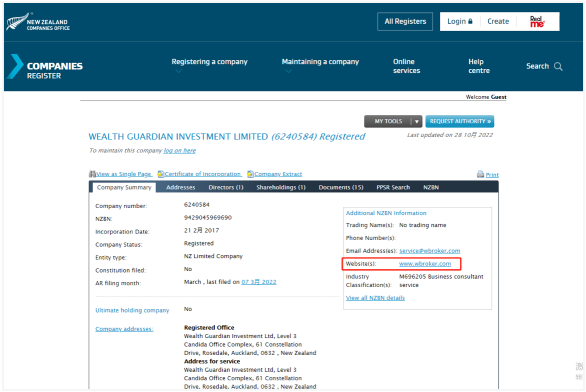

Compliance and international certification

Compliance is one of the core competencies of any financial platform.The Wealth Broker platform has a brokerage license issued by Australia ASIC and New Zealand FSPR, which complies with international financial regulatory standards and ensures that the platform operates within a transparent and legal framework.The acquisition of these licenses provides strong protection for investors so that they can invest with confidence.

In addition, Wealth Broker has established in-depth cooperative relationships with a number of internationally renowned exchanges and asset management companies, such as the Australian Stock Exchange and Morgan Stanley, which not only enhances the platform's risk management capabilities, but also ensures the platform's global business compliance., further enhancing customer trust.

Multi-asset management and AI investment

The Wealth Broker platform supports multiple asset classes, including stocks, bonds, public funds, private equity funds, structured products, virtual assets, etc., and can meet the needs of different investors.Whether it is traditional financial products or emerging digital currencies, users can easily manage investment through this platform.

In order to help investors better allocate assets, Wealth Broker has also launched AI investment services.AI Investment Consulting provides tailor-made asset allocation suggestions to each user by analyzing investors 'risk appetite and historical investment data.Combining market trends and real-time data, AI consulting not only helps users optimize their investment portfolios, but also achieves effective risk management and greatly improves investment efficiency.

User experience for Wealth Broker platform

Wealth Broker not only has outstanding performance in technology and compliance, but its innovation in user experience is also worth mentioning.The design of the platform always revolves around "simplicity" and "security", striving to simplify complex financial products and operating processes and lower the threshold for investment.

Simple and easy-to-use interface

Wealth Broker's App interface is simple and intuitive, allowing users to easily complete opening accounts, deposit funds, and transaction operations on their mobile phones.Even newcomers to investment for the first time can get started quickly.In addition, the platform provides 24-hour uninterrupted AI customer service to answer users 'questions at any time to ensure a smooth and worry-free investment process.

Fast account opening and automatic deposit

Wealth Broker provides users with a 10-minute fast account opening service, avoiding the cumbersome account opening process of traditional brokerages.In addition, users can also enjoy a 24-hour automatic deposit service, which makes the flow of funds more flexible and efficient, and users can conduct transactions at any time.

Innovation and Future of Wealth Broker Platform

In addition to traditional financial services, Wealth Broker also continuously improves the innovation and user experience of the platform by introducing artificial intelligence technology.For example, AI information analysis functions provide users with real-time market trend forecasts, helping investors quickly capture market opportunities and make informed investment decisions.At the same time, the platform has also launched an IPO research and reporting assistant to help investors efficiently read and analyze research reports and further improve the accuracy of investment decisions.

The technological upgrade of the platform is not limited to investment services, but also covers innovation in compliance and transparency.Wealth Broker has strengthened the platform's risk management system by working with leading financial institutions and exchanges around the world to ensure the security of users 'funds and information.

Frequently Asked Questions (FAQ)

Is the Wealth Broker platform reliable?

Wealth Broker holds brokerage licenses from ASIC in Australia and FSPR in New Zealand. It meets international compliance standards and is a formal platform trusted by global investors.The platform cooperates with a number of international financial institutions to ensure the safety and transparency of investors 'funds.

What investment products does Wealth Broker support?

The Wealth Broker platform not only supports traditional financial products such as stocks, bonds, and funds, but also provides emerging investment categories such as virtual assets.Investors can choose the most suitable investment method based on their own needs.

How does Wealth Broker's AI consultant work?

Wealth Broker's AI consultants collect users 'investment preferences, risk tolerance and trading history data, and use algorithms and market analysis to provide users with personalized portfolio suggestions to help users achieve optimal asset allocation.

Is it convenient to use the Wealth Broker platform?

The Wealth Broker platform provides an easy-to-use operation interface that allows users to quickly complete operations such as account opening, transaction, and fund transfer.In addition, the platform also provides 24-hour AI customer service support to ensure a smooth investment experience for users.