For Credit Suisse to worry about UBS Q1 net profit cut year-on-year! Acquisition is expected to be completed in the second quarter

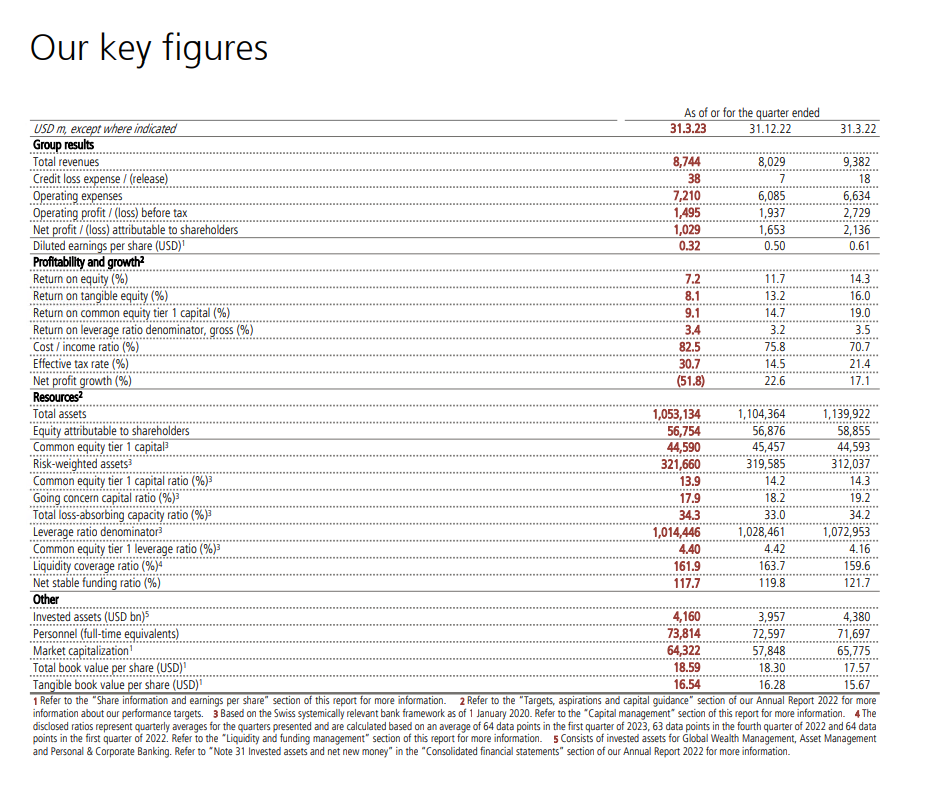

On April 25, UBS announced its first quarter 2023 results。UBS Q1 total revenue of 87.$4.4 billion, down 7% YoY; net profit attributable to shareholders was 10.$2.9 billion, down 52% year-over-year and well below analysts' consensus of 17.$500 million; diluted EPS of 0.$32, compared to 0.$61, down nearly half。

On April 25, UBS announced its first quarter 2023 results。UBS Q1 total revenue of 87.$4.4 billion, down 7% YoY; pre-tax operating profit of 14.$9.5 billion, down 45% YoY; net profit attributable to shareholders was 10.$2.9 billion, down 52% year-over-year and well below analysts' consensus of 17.$500 million; diluted EPS of 0.$32, compared to 0.$61, down nearly half。

Regarding UBS's dismal earnings in the first quarter, it was mainly caused by the bank setting aside more funds for its distressed mortgage business in order to swallow troubled rival Credit Suisse.。

But the world's largest wealth manager also reported strong inflows of about $42 billion.。Its flagship wealth management unit received $28 billion in net additions, a quarter of which came in late March after it announced it would buy Credit Suisse.。

The company reported a slight year-over-year decline in the unit's pre-tax profit and revenue.。The company said deposit income increased due to higher interest rates, but at the same time, some customers switched to lower-margin products.。

UBS chief executive Sergio Ermotti also said "challenging" economic conditions had dampened sentiment among the bank's customers, warning that it could take four years to complete the matter as the bank begins to consolidate acquisitions, meaning there are difficulties ahead.。

"We need time," Elmoti said in an online video.。"Things will be hard.。"

Switzerland's biggest bank is trying to tackle problems dating back to the global financial crisis once and for all, highlighting its vulnerability as it takes on the daunting task of absorbing Credit Suisse.。A long list of challenges for Credit Suisse includes dealing with the domestic backlash against the deal。

UBS said concerns about the global banking sector persisted and customer activity was "likely to remain subdued in the second quarter," but added that higher interest rates would boost lending revenues.。

Scandal-ridden Credit Suisse stumbles after customers leave in droves amid global banking turmoil。Under a deal hastily orchestrated by the Swiss government, UBS agreed to buy the company for 3 billion francs and take losses of up to 5 billion francs.。

Credit Suisse said on Monday that 61 billion Swiss francs ($68 billion) of assets flowed out of the bank in the first quarter and that outflows continued, adding to the challenges UBS faces.。

Stale bad debt

UBS made an additional provision of 6.$6.5 billion to cover litigation costs for U.S. mortgage-backed securities that played a central role in the global financial crisis。

In the five years to 2007, UBS was the issuer and underwriter of U.S. mortgage-backed securities, according to UBS's 2022 Annual Report.。

However, in November 2018, the U.S. Department of Justice filed a lawsuit in 2018 accusing UBS of deceiving investors into buying tens of billions of dollars worth of risky mortgage-backed securities that contributed to the 2008 financial crisis.。The U.S. Department of Justice says UBS is accused of misleading investors about the quality of billions of dollars of subprime loans and other high-risk mortgages that backed 40 securities sales。The deals later proved to be a "catastrophic failure."。UBS subsequently lost a lawsuit over the matter.。

Elmoti said: "We are in intensive discussions with the US Department of Justice, and I am pleased that we have made progress in resolving the legacy of 15 years ago.。"。

It is worth noting that, due to various obstacles, UBS said it expects the acquisition of Credit Suisse to be completed in the second quarter of this year (it is reported that it may be completed in May)。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.