Singapore wants to issue more monetary policy to promote economic recovery under global inflation

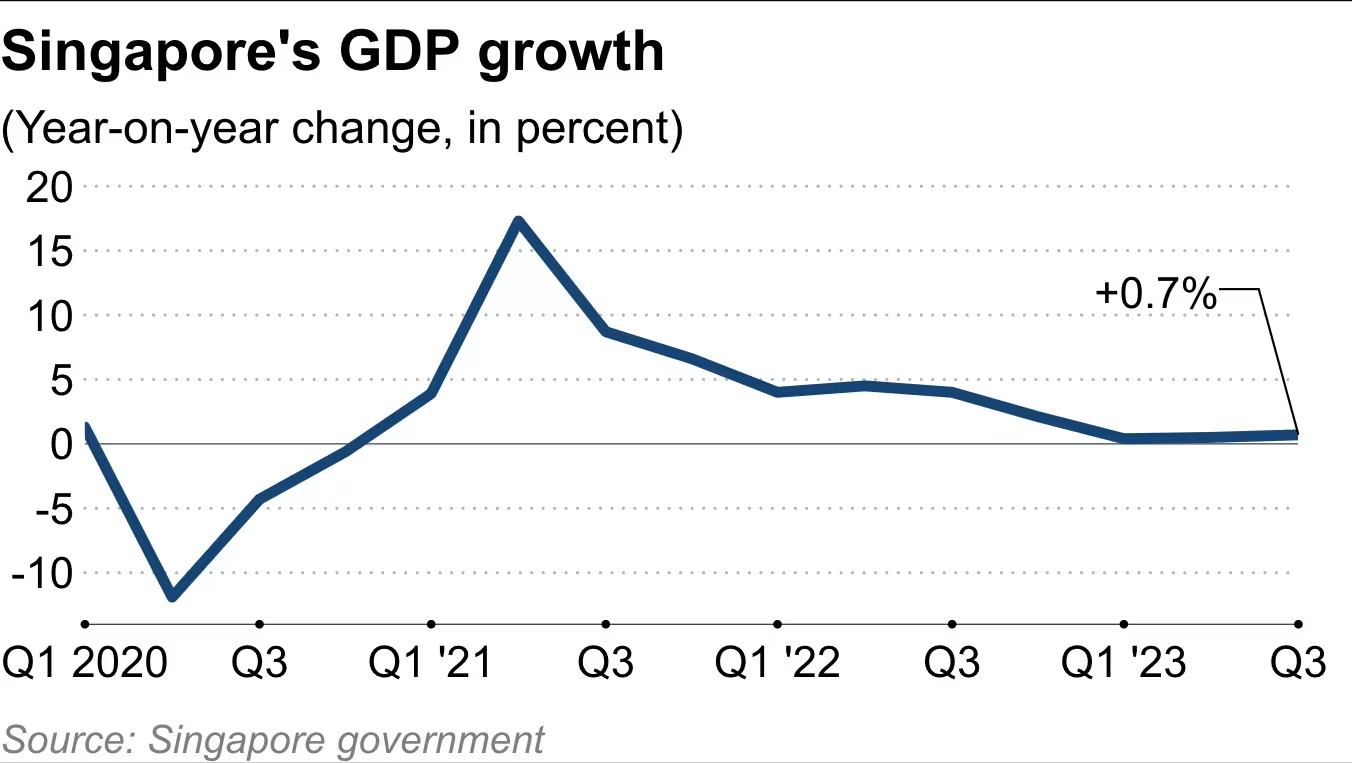

Singapore will start issuing additional monetary policy in 2024, four times a year, with GDP growth rising to zero in the third quarter of this year..7%。

Singapore's central bank announced on Friday (October 13) that it will release its monetary policy quarterly from next year in a bid to strengthen communication with markets in the context of global inflation.。

The Monetary Authority of Singapore (MAS) currently holds regular monetary policy meetings twice a year in April and October, but the central bank has increased its flexibility to assess and discuss policy in view of the current unprecedented global inflation.。It is reported that the post-issuance monetary policy is released in January, April, July and October each year.。

"This is a reflection of the HKMA's continued strengthening of monetary policy communication, which continues to adhere to the medium-term direction in policymaking to ensure low and stable inflation," the source said.。"

In 2022, Singapore's central bank took two non-cyclical tightening measures to curb prices.。In April, Singapore's central bank kept monetary policy steady for the first time in two years.。

On Friday, the Monetary Authority of Singapore kept its second edition of monetary policy unchanged this year in a bid to strike a balance between economic recovery and controlling inflation, saying "Singapore's GDP growth is expected to gradually improve in 2024."。However, the global economic outlook remains uncertain and the domestic economic recovery may be weaker than expected. "。

Meanwhile, Singapore's core inflation (excluding private transport and accommodation costs) has been slowing this year, with the latest August data showing a year-on-year rise of 3 per cent..4%, while inflation in January and February was 5.5%。

However, higher oil prices could push up inflation in this trade-dependent economy.。With another increase in the goods and services tax in January next year and recent increases in public transport fares and water prices, Singapore's overall inflation rate is likely to remain high.。

Singapore's monetary policy is not centered on interest rates, but on exchange rates, allowing the local currency to appreciate or depreciate against the currencies of its major trading partners in order to stabilize prices.。

The HKMA said: "Continued appreciation of the policy band is necessary to curb imported inflation and domestic costs, thereby ensuring price stability over the medium term.。

Meanwhile, preliminary data on Friday showed that Singapore's economy grew by 0% year-on-year in the July-September quarter of this year amid weak external demand..7%, compared with 0 in the previous quarter.5% growth compared to the accelerated。

According to the Ministry of Trade and Industry, Singapore's export-oriented manufacturing sector shrank by 5% from the same period last year..0%, while domestic demand-oriented services grew by 1.9%, the construction industry increased by 6.0%。(Preliminary GDP figures are based on the performance of the first two months of each quarter。)

Singapore's third-quarter GDP up 1, seasonally adjusted.0%, compared to growth of 0 in the first three months.1%。

Shivaan Tandon, Asia economist at Capital Economics, wrote in a note on Friday: "This strong momentum is unlikely to continue, as adverse factors such as weak external demand, rising interest rates and cooling labor markets will drag down economic growth in the short term.。"

While Singapore's aviation and tourism-related businesses continue to benefit from the region's economic openness, the manufacturing sector, particularly electronics, has faced weak demand from major trading partners.。

Official statistics show that Singapore's benchmark non-oil domestic exports fell 20% year-on-year in August as exports of electronic and non-electronic products to the United States, Europe and China fell..1%, the 11th consecutive month of year-on-year decline。

In August, Singapore raised its annual economic growth forecast for this year from zero..5% -2.5% narrowed to 0.5% -1.5%。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.