Yi'an property insurance officially changed its name to BYD property insurance car enterprise layout insurance industry has become the norm?

On May 17, according to the enterprise check data show that Yi'an Property Insurance Co., Ltd. industrial and commercial changes, the company name changed to Shenzhen BYD Property Insurance Co.。The chairman and legal representative of BYD Property Insurance was changed from Zou Fei to Zhou Yalin.。Zhou Yalin is Vice President and Chief Financial Officer of BYD。

On May 17, according to enterprise survey data, Yi'an Property Insurance Co., Ltd. (hereinafter referred to as "Yi'an Property Insurance") industrial and commercial information change, the company name changed to Shenzhen BYD Property Insurance Co., Ltd. (hereinafter referred to as "BYD Property Insurance"), by BYD Automobile Industry Co., Ltd. (hereinafter referred to as "BYD") holding 100% of the shares.。The chairman and legal representative of BYD Property Insurance was changed from Zou Fei to Zhou Yalin.。At the same time, Cheng Sunlin served as general manager, Zhu Aiyun, Hu Xiaoqing, Li Jie, Zhou Lin and other directors.。It is reported that Zhou Yalin is vice president and chief financial officer of BYD.。

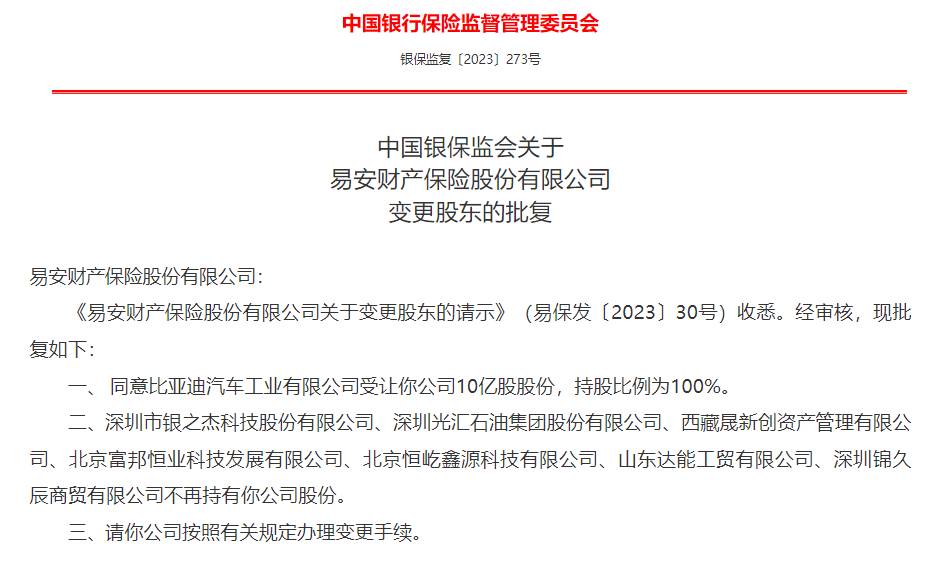

As early as May 9, the China Banking and Insurance Regulatory Commission issued a relevant announcement, agreed to BYD to transfer 1 billion shares of Yi'an property insurance, the shareholding ratio of 100%。

BYD takes over Yi'an Property Insurance, and may apply for auto insurance qualification for it later.

Yi'an Property & Casualty Insurance is one of the four domestic professional Internet insurance companies approved by the CIRC and was approved to open on February 16, 2016 with a registered capital of RMB 1 billion.。According to the company's data, the number of customers broke 20 million in July 2017 and was awarded the highest rating of Class A in the risk composite rating in 2018.。So far, the cumulative number of protected customers has exceeded 48 million, and the number of policies issued has exceeded 1.200 million orders。

Taken over by CBIRC in 2020 due to solvency issues。On July 15, 2022, the CBI announced that Yi'an Property & Casualty Insurance entered bankruptcy reorganization proceedings。

In the end, Yi'an Property & Casualty Insurance was taken over by BYD, and interestingly, Yi'an Property & Casualty Insurance's licensed business program did not include auto insurance.。

According to the enterprise survey data, the licensed business items of Yi'an Property Insurance are: enterprise / family property insurance, freight insurance, liability insurance, credit guarantee insurance, short-term health / accident insurance directly related to Internet transactions;。

The industry expects BYD to apply for auto insurance business qualifications and launch related auto insurance products after taking over.。

A number of new energy vehicle companies layout insurance industry, ideal, Weilai are listed

Car companies entering the insurance industry is nothing new。In recent years, some car companies have either set up their own insurance brokerage firms or chosen to take a stake in an insurance company, and the two have gone hand in hand.。

Weilai had established Weilai Insurance Brokerage Limited in January 2022, but by March 10 this year, the insurance brokerage announced its cancellation.。

In October 2022, Weilai established Anhui Weilai Data Technology Co., Ltd., with a registered capital of 100 million yuan, with Weilai founder Li Bin holding 80% of the shares.。In December, the company acquired Huiding Insurance Brokerage Co., Ltd., with a 100% stake.。At the same time, the legal representative was changed from Sun Mu to Qu Yu, and the executives were all changed.。The company still exists today.。

In addition to NIO, Ideal also acquired an insurance company last month。According to the enterprise check data show that on April 25 this year, Yinjian Insurance Brokerage Co., Ltd. industrial and commercial changes, the original shareholder Beijing Yinjian Investment Company withdrew, car and home financial technology (Jiangsu) Co.。Chehejia Financial Technology (Jiangsu) is a subsidiary of Beijing Chehejia Information Technology Co.。

In addition, Tesla, Xiaopeng, etc. have also been involved in the insurance field.。

New energy vehicles have exclusive insurance products, "new car-building forces" or have certain advantages

At the end of 2021, the China Insurance Industry Association issued the "Exclusive Terms of Commercial Insurance for New Energy Vehicles (Trial)," clarifying that new energy vehicles no longer follow the traditional commercial auto insurance terms, but have exclusive insurance products.。Because new energy vehicles in addition to the traditional traffic accident risk, there are power battery fire, deflagration caused by major accidents and other new risk factors, for these risks, the need for product innovation, in the insurance protection and insurance services to achieve upgrading.。

According to data from the China Association of Automobile Manufacturers, from January to April this year, the domestic production and sales of new energy vehicles totaled 229.10,000 vehicles and 222.20,000 vehicles, up more than 40% year-on-year, with a market share of 27%.。The domestic new energy vehicle market is growing, and the market for new energy vehicle exclusive insurance is also expanding, so new energy vehicle companies naturally want to get a piece of the action.。

According to Shen Wanhongyuan analysis, car companies have obvious advantages in the new energy car insurance market, including new energy car companies can simplify the new energy vehicle claims process, can design innovative car insurance products that better match claims, etc.。

For new energy vehicle companies, in addition to mastering first-hand customer data, the battery and vehicle structure of electric vehicles can also form certain advantages in the field of new energy vehicle insurance.。But the new energy vehicle exclusive insurance, although different from the traditional car insurance, but still in the traditional car insurance to upgrade the。Therefore, the acquisition of traditional insurance companies can avoid the dilemma of "starting from scratch" and become the choice of more new energy car companies.。As more and more new energy vehicle companies join this field, the field may usher in a reshuffle.。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.