Three days and three nights, price cuts don't stop?Tesla cuts prices in Singapore, Denmark on same day

Recently, Tesla has set off a wave of price cuts around the world.。

Recently, Tesla has set off a wave of price cuts around the world.。

On April 14, Tesla Singapore's official website (Tesla Inc) showed that the company has lowered the price of its Model 3 and Model Y models in Singapore by 4.3% to 5%。

According to the official website, Tesla will reduce the price of the real-wheel drive version of Model 3 and Model Y by 4,000 Singapore dollars (about 20,000 yuan), and cut the dual-motor all-wheel drive version of these two models by 5,000 Singapore dollars (about 2.60,000 RMB)。

This is Tesla's second price cut in Singapore this year, after it offered discounts of up to $10,000 to Singaporean buyers who agreed to buy the Model 3 or Model Y in existing stock in January.。

In addition to Singapore, Tesla also cut its price in Denmark on the same day。

According to Tesla's Danish official website, the price of the high-performance version of the Tesla Model 3 has been reduced by 9.1% to 42.6.99 million kroner (approximately RMB 28.50,000 yuan), Model Y high-performance version of the price cut 9..2% to 45.650,000 kronor (approximately RMB 30.50,000 yuan)。

Similarly, this is Tesla's second price cut in Denmark this year, after Tesla's Model 3 standard and long-range versions announced price cuts of 7% to 8% in Denmark in February.。

Musk: It's not that people don't want to buy it, they can't afford it, drop it!

As US prepares to roll out tougher standards to limit electric car tax credits。Last week, Tesla announced its fifth price cut in the U.S. market this year.。

Of these, the Model 3 is down $1,000 for the whole series; the Model 3 is down $1,000 for the whole series; and the Model S and Model X are down $5,000.。Since the beginning of this year, the Model 3 has been cut by 11%, and the Model Y has also been cut by nearly 20%.。

Specifically, stricter U.S. standards would reduce the $7,500 tax relief available for the Model 3.。Eligible electric vehicle tax relief under the Inflation Deduction Act of 2022 up to $7,500 from January 2023。It is worth noting that the Model 3 rear-wheel version will be reduced from $7,500 to $3,750 from April 18.。

In addition, two days ago, Tesla also announced that it will adjust the price of Model 3 and Model Y in Hong Kong, China on April 15, by up to 14.7%。

According to reports, the biggest reduction in this price adjustment is Model 3 Performance, "one for one" price from 44.From HK $03.35 million, a decrease of 14.7%; followed by the Model 3 long-range version, "one for one" price of 39.HK $94.85 million, a decrease of 11.06%; as for the Model Y long-life version and the Performance version will also be reduced by 8.7% and 9.03%, to 45.From HK $96.85 million and 48.From HK $72.05 million。

In fact, Tesla has been fighting a price war around the world since October last year.。In the Chinese market, Tesla at the beginning of the year on the Model 3 and Model Y two models of a substantial price adjustment, the decline of 20,000 to 4.$80,000, Model 3 starts at 22.990,000 yuan, the largest price cut of the base version of the Model Y fell as much as 20%。

In January this year, there was a wave of price cuts around the world, and on January 6, Tesla slashed the prices of related models in Asian markets such as China, Japan, South Korea and Singapore, and less than a week later, Tesla announced that it would cut the prices of all models in the United States.。

In response to such frequent price cuts, Tesla founder Elon Musk (Elon Musk) tweeted that the reason for the price cut is not that everyone has no demand for Tesla, but that everyone has no money to afford it, and the only way to really meet demand is to bring the price down.。

"Many wealthy critics don't understand that mass demand is limited by affordability.。There is a lot of demand for our products, but if the price is more than the money people have, then this demand is irrelevant。"Musk said。

Frequent price cuts around the world have tasted a lot of sweetness.

Tesla CEO Musk has warned that the prospect of a recession and rising interest rates means that Tesla may cut prices to maintain growth at the expense of profits.。

In January, Musk said orders had picked up after Tesla cut prices。Zach Kirkhorn, the company's chief financial officer, also acknowledged that the price cuts could erode Tesla's profitability, but said he believes Tesla's profit margins will "remain healthy and industry-leading."。

Global price cuts have had a significant effect on boosting sales。Tesla delivered a total of 42 in the first quarter of this year..290,000 new vehicles, up 4% month-on-month and 36% year-on-year, setting a new record for single-quarter deliveries。

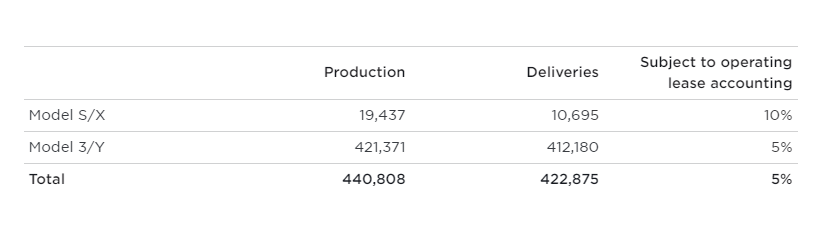

Specifically, on the evening of April 2, local time, Tesla released its first quarter 2023 vehicle production and delivery report on its website.。According to the report, Tesla delivered 422,875 vehicles worldwide in the first quarter of this year, slightly higher than the 421,164 previously expected by analysts, but lower than the 430,000 expected by Wall Street; in terms of production, Tesla produced 440,808 vehicles in the first quarter, which also exceeded the 432,513 previously expected by analysts.。

In response, Ben Rose, president of Battle Road Research, said: "This shows that demand for electric vehicles remains strong and Tesla is a safe choice for electric vehicle buyers.。While the exact impact of recent price cuts and tax credits is difficult to determine, both factors have contributed positively to sales.。"

Repeated price cuts, what does the market think?

Some analysts have expressed concern about Tesla's recent frequent price cuts, as multiple price cuts could put Tesla's industry-leading profit margins at risk。

Bernstein and Citi analysts agree that Tesla's recent price cuts are unlikely to be the last, and with the electric car maker about to report fiscal quarter results, the price cuts have put the market in focus on the company's profit margins.。

In addition, Guggenheim Securities analyst Ronald Jewsikow wrote in a note to investors on Monday: "We expect investors to view the price cut as a headwind, as it runs counter to the strong demand implied by Tesla's investor day."。"

Wells Fargo also expressed deep concern about Tesla's gross profit margin in the first quarter of this year, and has lowered the company's first-quarter gross profit forecast to 18.3%, lower than Tesla's own forecast of more than 20%。

However, since Tesla dares to cut prices so frequently, it naturally has its bottom line.。When Tesla China cut prices in January this year, Tesla Vice President of External Affairs Tao Lin posted on Weibo, saying, "Behind Tesla's price adjustment, covering countless engineering innovations, is essentially a unique excellent law of cost control: including not limited to vehicle integration design, production line design, supply chain management, and even millisecond-level optimization of the robotic arm collaboration route... From 'first principles', adhere to cost-based pricing。"

But Pete Bannon, Tesla's vice president of hardware design engineering, compared Tesla's cost reduction process to "peeling carrots": "Peeling won't have any effect, but repeating it will have a huge impact, such as through manufacturing methods, vertical integration and other technological innovations, Tesla's BOM costs have increased from 8 in 2017..$40,000 reduced to 3.$60,000。"

It is worth noting that Tesla announced on April 10 that it plans to build a new energy storage plant in Shanghai, dedicated to the production of the company's energy storage product Megapack。In this way, Tesla's subsequent price cuts will be more confident.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.