Apple FY24Q2: iPhone revenue fell sharply Streaming business outperformed

On May 2rd, Apple Inc. officially released its highly anticipated financial report for the second quarter of fiscal year 2024.

On May 2rd, Apple Inc. officially released its highly anticipated financial report for the second quarter of fiscal year 2024.

According to the report, Apple achieved a total revenue of $90.75 billion in Q2 FY2024, a 4.31% year-on-year decline, but still surpassing market analysts' expectations of $90.33 billion. The company’s net profit was $23.64 billion, down 2.15% year-on-year, with earnings per share at $1.53.

These figures indicate that despite challenges such as global economic uncertainty and slowing consumer demand, Apple continues to maintain strong market competitiveness and profitability.

Performance by Business Segment:

iPhone Business:

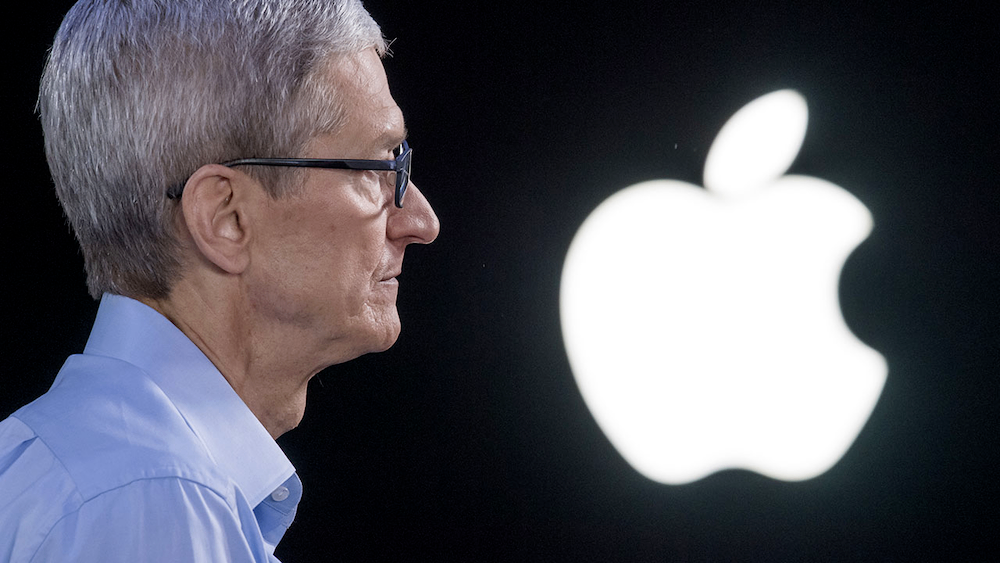

As Apple's core business, iPhone performance in this quarter was particularly notable. Although revenue reached $45.96 billion, it represented a 10.46% year-on-year decline. This reflects the current saturation of the smartphone market and consumer anticipation for new product releases. However, CEO Tim Cook noted that iPhone sales met analysts' expectations and would have remained stable without the impact of last year’s high base effect. This suggests that despite challenges, the iPhone maintains a strong market position and consumer loyalty.

Streaming Services:

In stark contrast to the decline in iPhone business, Apple's streaming services performed excellently this quarter. Service revenue reached $23.87 billion, up 14.2% year-on-year, making it a highlight of the financial report. This growth is mainly driven by the continuous expansion of subscription services like Apple Music, iCloud, and Apple TV+. Apple’s increasing focus on subscription services not only helps offset the decline in hardware sales but also provides a more stable revenue source for the company.

Mac Business:

The Mac business achieved steady growth this quarter, with revenue of $7.45 billion, up 3.9% year-on-year. This success is primarily due to the strong performance of the new MacBook Air models. Powered by the M3 chip, the MacBook Air has received widespread market acclaim for its outstanding performance and design, becoming a key driver of growth for the Mac business.

iPad Business:

The iPad business underperformed this quarter, with revenue of $5.56 billion, down 16.64% year-on-year. This decline is mainly due to the lack of new iPad releases since 2022. However, Apple expects to release a new iPad on May 7th, which is anticipated to rekindle market demand for this product line.

Wearables, Home, and Accessories:

Revenue from wearables, home, and accessories totaled $7.91 billion this quarter, down 9.7% year-on-year. Despite facing certain market pressures, Apple remains a leader in this segment. With growing consumer interest in health and fitness, Apple’s wearable devices are expected to continue unlocking their potential.

New Product Launches and Market Strategy

This quarter, Apple introduced its first major new product category in years—the Vision Pro virtual reality headset. Priced at $3,500, the device is expected to have modest sales, but its launch marks Apple’s official entry into the augmented reality (AR) and virtual reality (VR) markets. Tim Cook emphasized that this is only the first step for Apple in the AR/VR space, with more innovative products to come.

Additionally, Apple plans to unveil new iPads and possibly other innovative products at the upcoming iPad launch event next week. These product releases will further enrich Apple’s product lineup, catering to diverse consumer needs.

Beyond new iPad Pros, larger iPad Air models, and new Magic Keyboard and Apple Pencil, there will be much discussion around artificial intelligence.

New Product Launches and Market Strategy

This quarter, Apple introduced its first major new product category in years—the Vision Pro virtual reality headset. Priced at $3,500, the device is expected to have modest sales, but its launch marks Apple’s official entry into the augmented reality (AR) and virtual reality (VR) markets. Tim Cook emphasized that this is only the first step for Apple in the AR/VR space, with more innovative products to come.

Additionally, Apple plans to unveil new iPads and possibly other innovative products at the upcoming iPad launch event next week. These product releases will further enrich Apple’s product lineup, catering to diverse consumer needs.

Beyond new iPad Pros, larger iPad Air models, and new Magic Keyboard and Apple Pencil, there will be much discussion around artificial intelligence.

Apple's Artificial Intelligence

Amid the growing wave of artificial intelligence (AI), concerns have arisen regarding Apple’s perceived lag in the AI deployment race. However, Tim Cook finally addressed this in the earnings call.

During the company’s quarterly earnings call with analysts, Cook pointed out that AI is about to become a focal point.

"We remain very optimistic about our opportunities in the field of generative AI. We are making significant investments and look forward to sharing some very exciting things with our customers soon," Cook stated.

Although Apple has long refrained from using the AI buzzword, opting for “machine learning” instead, this is indeed changing.

Cook continued: "We believe in the transformative power and potential of AI. We believe the unique combination of hardware, software, and services we possess, the groundbreaking Apple chips, along with our industry-leading technical neural engine, and our unwavering commitment to privacy—which underpins everything we create—will make us stand out in this new era."

Additionally, Cook revealed that Apple is preparing for the Worldwide Developers Conference (WWDC) in June, where it is expected to release the latest versions of iOS, macOS, watchOS, iPadOS, and VisionOS. One of the most important announcements at the event could be how Apple plans to integrate generative AI into its various products.

Although Apple has been slower than other tech companies in the generative AI field, it has not been idle. The company has been busy acquiring AI companies and building its own large language model, potentially to drive its AI efforts. Reports indicate that Apple is heavily investing in generative AI technology.

According to Mark Gurman, Apple has already started discussing potential collaborations with other AI companies like OpenAI and Google to bring its AI products up to standard.

Generative AI remains a relatively niche product among consumers. While Google and Samsung have integrated generative AI features into their smartphones, and PC manufacturers are increasingly leaning towards so-called AI PCs, these applications largely still resemble tech demos rather than game-changing features that significantly drive sales. Apple has an opportunity to change this status quo.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.