Meta's first-quarter results were bright, but low guidance and high spending "scared" the market

Meta's revenue and profit in the first quarter exceeded analysts' general expectations. However, Meta's Q2 sales guidance was lower than expected, and the company warned that this year's expenses would exceed expectations, leading to a post market drop of over 15% in its stock price.

Social media giant Meta released its first quarter performance report after the US stock market closed on Wednesday (April 24th).

The company's reported revenue and profit exceeded the general expectations of analysts. However, Meta's Q2 sales guidance was lower than expected, and the company warned that this year's expenses would exceed expectations, leading to a post market drop of over 15% in its stock price.

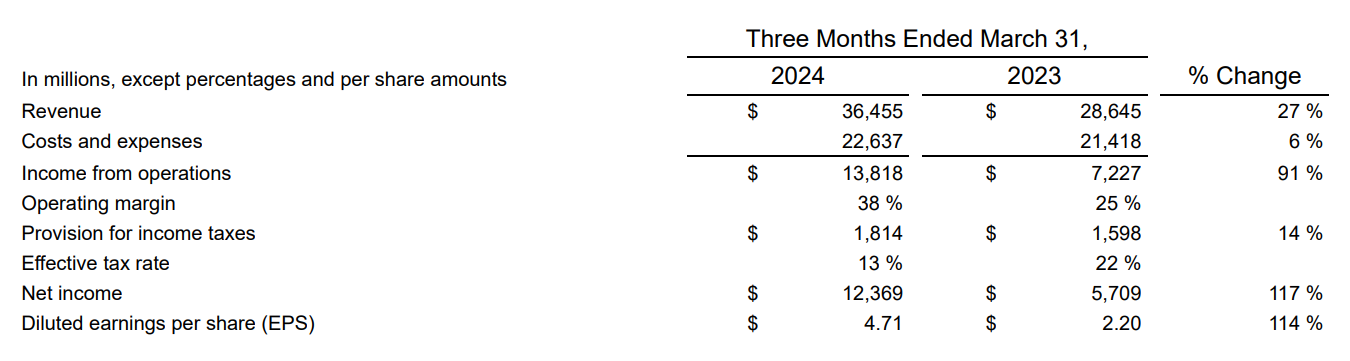

Q1 Performance Exceeds Market Expectations

Meta's performance in the first quarter of this year was very impressive.

The revenue reached $36.455 billion, higher than the analyst's expected $36.14 billion, a year-on-year increase of 27%, and the fastest growth rate since 2021.

In terms of profitability, Meta's net profit in the first quarter was $12.37 billion, a significant increase of 117% year-on-year. Adjusted earnings per share were $4.71, exceeding analyst expectations of $4.32, a significant increase of 114% year-on-year.

Specifically for each business.

Firstly, there is the Family of Apps (FoA). FoA includes Facebook, Instagram, Reels, Threads, WhatsApp, and more. Meta's revenue is mostly contributed by the advertising revenue of these applications.

The revenue of FoA in the first quarter was $36.015 billion, a year-on-year increase of 27%, higher than the expected $35.53 billion. The operating profit was 17.664 billion US dollars, a year-on-year increase of 57%, lower than the expected 17.76 billion US dollars.

FoA's advertising revenue was $35.635 billion, a year-on-year increase of 26.8%, slightly higher than the expected $35.57 billion.It is worth noting that this financial report is Meta's first one that did not disclose monthly and daily active user (DAP) data for Facebook. In its latest financial report, Meta disclosed data for the entire FoA user base. According to the financial report, the average DAP of the entire FoA in March 2024 was 3.24 billion, a year-on-year increase of 7%. The number of advertisements displayed in the application series increased by 20% year-on-year, and the average price of each advertisement increased by 6% year-on-year.

The performance of Meta's other business unit, Reality Labs (RL). RL includes consumer hardware, software, and content related to augmented reality (XR), mixed reality (MR), and virtual reality (VR).

In the first quarter, RL achieved a revenue of $440 million, a year-on-year increase of 30%, lower than the expected $490 million. Currently, RL is still in a loss making state, recording an operating loss of $3.846 billion in the first quarter, which is narrower than the $3.992 billion loss in the same period last year and better than the market's expected loss of $4.51 billion.

Low guidance and high spending 'spook' markets

The reason why the stock price plummeted after the market despite such good performance is related to Meta's revenue guidance and capital expenditure for the second quarter.

In its financial report, Meta expects a total revenue of $36.5-39 billion in the second quarter of 2024, with a median of $37.75 billion. The median is lower than the analyst's forecast of $38.25 billion.

Based on this median, Meta's revenue for the second quarter will increase by approximately 18% year-on-year, compared to its revenue growth of 27%, 24.7%, and 23.2% in the first three quarters, respectively. The slowdown in growth has suddenly accelerated.

Analysts predict that Meta's growth rate will slow down this year as the company will face more difficult year-on-year growth due to the impact of last year's high base.

In addition, the upward adjustment of Meta's capital expenditure guidance for the next quarter has also surprised the market.According to the financial report, Meta expects its full year capital expenditure to be between $35 billion and $40 billion, higher than the company's previous guidance of $30 billion to $37 billion. Regarding the increase in capital expenditure, Meta explained that this is because the company will continue to accelerate infrastructure investment to support its artificial intelligence roadmap.

In addition, Meta also updated its overall expenditure for the entire year of this year, stating in its financial report, "Due to rising infrastructure and legal costs, we expect total expenditure for 2024 to be between $960-99 billion, an update from the previous forecast of $94-99 billion."

Meta is currently facing ongoing legal issues, including antitrust lawsuits in the United States and Europe, and has been sued by 33 states in the United States. These states claim that this technology giant has had a negative impact on children's mental health.

Meta also warned that capital expenditures will continue to increase next year, "as we will actively invest to support our ambitious artificial intelligence research and product development efforts."

Max Willens, senior analyst at Emarketer, stated that it is not surprising for Meta to change its guidelines. He said, "Companies investing in the field of AI, especially those Meta is investing in, may face cost issues in the short term."

During the post performance conference call, Meta CEO Mark Zuckerberg emphasized the company's recent AI achievements, including the latest version of the chat robot Meta AI launched last week and the large language model Llama 3.

"I believe that the results our team has achieved here are another important milestone, demonstrating our talent, data, and capabilities to expand infrastructure and build world leading artificial intelligence models and services." Zuckerberg said, "This makes me believe that we should invest more in the coming years to build more advanced models and the world's largest artificial intelligence services."

Meanwhile, Zuckerberg also warned that it will take several years to build "leading artificial intelligence". However, he also stated that Meta has a good record of monetizing its work, especially after spending time building its products.

Despite Zuckerberg's efforts to calm the market, the decline in stock prices still reflects investor concerns. Jefferies analyst Brent Thill wrote in a client report on Wednesday, "The lower than expected revenue guidance for the second quarter, as well as the increase in total expenses and capital expenditure guidance, may put pressure on the stock."

Prior to the release of the financial report, Meta fell 0.5% in Wednesday trading and closed at 493.50 points. Before the post market decline, the stock rose nearly 40% this year and has risen 138% in the past 12 months. In contrast, the S&P 500 index has risen 6.3% this year, and among the seven giants in the US stock market (Mag-7), Meta's performance is also among the top, second only to Nvidia.

TikTok ban bill beneficial for Meta?

As Meta released its financial report, US President Biden officially signed a TikTok bill. The bill mentioned that TikTok's parent company will be given 9 months to spin off TikTok from the company, or the application will be prohibited from entering the United States.

Once TikTok is truly banned from entering the United States, it is good news for Reels, a short video software under Meta. Reels has always regarded TikTok as a significant threat.

During a conference call, Meta's CFO Susan Li stated that in response to the aforementioned incident, Meta has been closely monitoring the possibility of a TikTok ban, but it is still too early to comment on its impact on Meta's business.

"We have no plans to make any outlook on the potential impact of Reels' products on the company's revenue in the future, but we believe that this business will continue to contribute positively to the overall growth of the company. We are also confident in continuing to improve its performance and increase the supply of related products," said Susan Li.

In addition, some analysts have previously warned that slowing spending from Chinese advertisers may become a hidden concern for Meta's advertising revenue.

Susan Li stated during a conference call that the company did not quantify the contribution of the Chinese market in this quarter, but she stated that advertising revenue in the Asia Pacific region increased by 41% compared to the same period last year, making it the fastest-growing region, mainly driven by online commerce and gaming. She also stated that considering that Chinese advertising clients are gradually recovering from the adverse environment affected by the previous pandemic in 2023, Meta expects to have very good growth demand throughout 2024.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.