Microsoft Q4 earnings revenue net profit exceeded expectations why the stock price turned down.?

On January 30, Microsoft announced its fiscal 2024 second-quarter results, with revenue and profit exceeding expectations.。But instead of rising after the earnings release, Microsoft's stock fell more than 1% after the session。

Local time on Tuesday (January 30), Microsoft announced the second quarter of fiscal year 2024 (that is, the fourth quarter of 2023) earnings。

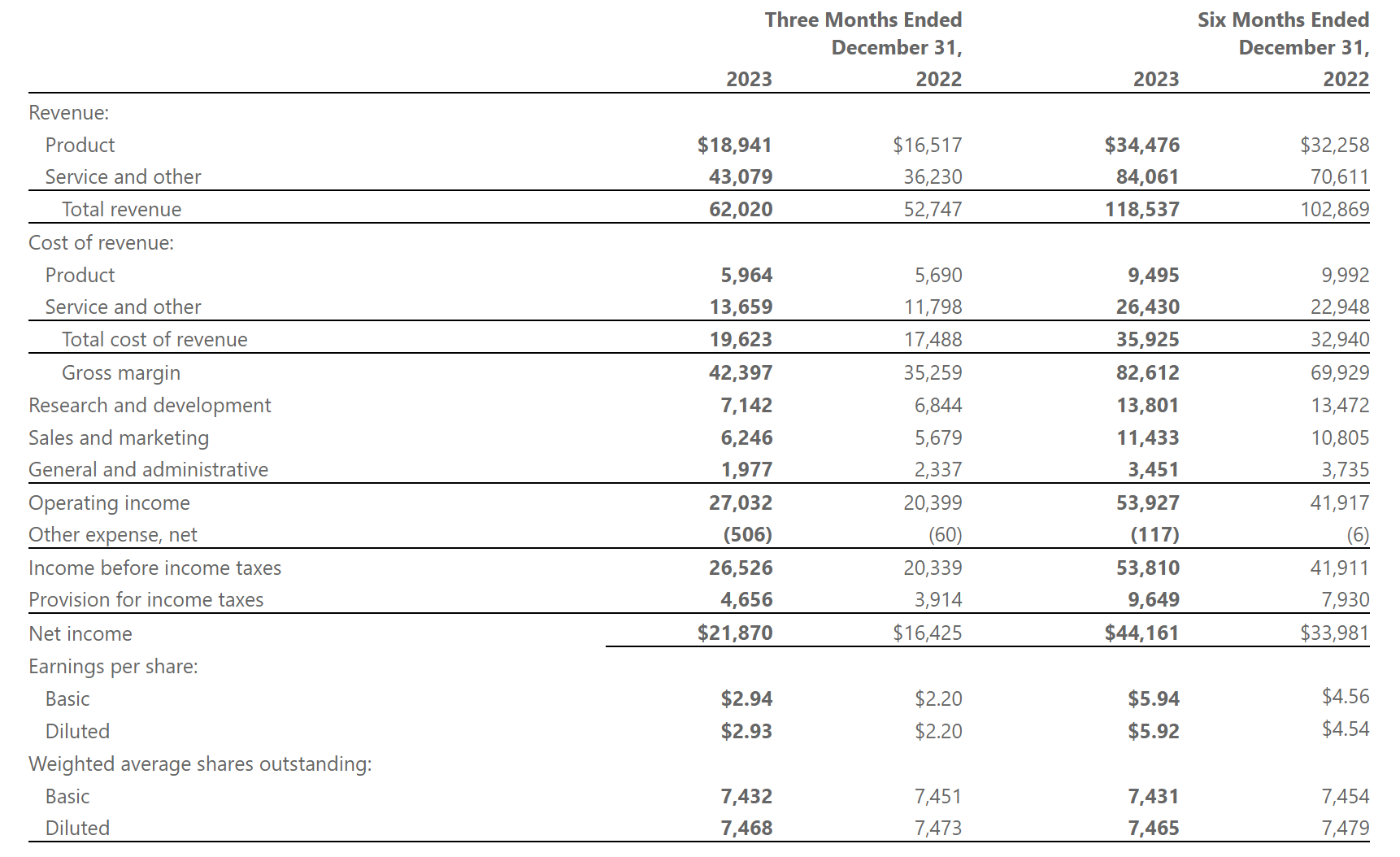

In the second fiscal quarter, Microsoft's revenue reached $62 billion, better than market expectations of $61.1 billion, up 17.6%, Microsoft's strongest revenue growth since 2022。On the earnings front, the company reported net income of $21.9 billion and adjusted earnings per share of 2.$93, up 33% year-over-year, above analyst forecasts of 2.78美元。

Azure grows faster than expected

By business, in the second quarter, Microsoft's Intelligent Cloud business unit (Intelligent Cloud) recorded 258.$800 million in revenue, up 20.4%, higher than market expectations of $25.3 billion。

Among them, Azure and other cloud services, the most concerned by the outside world, recorded a 30% year-on-year growth rate, exceeding the 28% growth rate predicted by analysts and slightly higher than the 29% growth rate in the previous quarter.。In a subsequent conference call, Microsoft said Azure's growth would be "solid" this quarter.。

The growth of Azure "gratifying," and artificial intelligence is not unrelated。

In an earnings call, Microsoft Chief Financial Officer Amy Hood said AI services contributed 6 percentage points to Azure revenue growth, up from 3 percentage points in the previous quarter.。Looking ahead, she said, interest in AI products will drive customers to increase their use of basic services such as storage and computing power.。Hood said, "We want to be the place where people can run AI models with the most confidence.。"

But Sanford C.Bernstein & Co.Analyst Mark Moerdler pointed out that the fact that artificial intelligence contributed 6 percentage points to Azure revenue growth means that "the rest of Azure continues to slow down."。

Satya Nadella, chairman and CEO of Microsoft, said: "We have moved from talking about artificial intelligence to applying artificial intelligence at scale.。"By incorporating AI into every layer of our technology stack, we are winning new customers and helping drive new benefits and productivity gains in every industry."。"

A number of businesses exceeded market expectations

In addition to the intelligent cloud division, Microsoft's other business performance in the second quarter is also remarkable.。

Microsoft's Microsoft Cloud revenue rose 24% to $33.7 billion。Amy Hood, Microsoft's executive vice president and chief financial officer, sees strong execution from sales teams and partners as a major factor driving Microsoft's cloud revenue growth.。

Microsoft released the enterprise version of its artificial intelligence assistant Copilot to its major customers on November 1 last year。This month, Microsoft expanded its Copilot Enterprise customer base and released a $20 consumer version.。In addition to existing subscription services, these new tools require businesses to pay some additional monthly fees。These fees are also thought to be a recurring source of revenue for Microsoft in the future.。

Hood revealed that in the second fiscal quarter, the number of paying customers for Microsoft's cloud services for enterprise users exceeded 400 million, up from 3 in April 2023..8.2 billion。

Nadella said: "We have gone from talking about artificial intelligence to large-scale application of artificial intelligence.。"By incorporating AI into every layer of our technology stack, we are winning new customers and helping drive new benefits and productivity gains in every industry."。"

In the More Personal Computing business unit, revenue recorded in the fiscal second quarter rose 19% year-over-year to $16.9 billion, slightly above the average analyst forecast.。The division includes the Windows operating system, Xbox gaming, Surface hardware, Internet search and advertising, and businesses such as Microsoft's newly acquired Activision Blizzard.。

According to market research firm Gartner Inc.Global PC sales up 0 in quarter.3%, the first increase in two years, indicating that market demand is stabilizing。

Last week, Microsoft cut 1,900 jobs across its gaming division, many of them right at Activision Blizzard.。On Monday, Activision Blizzard's new president, Johanna Faries, took office, and it is believed that Microsoft is trying to consolidate the acquired businesses and drive growth in gaming revenue.。

In addition, Microsoft Productivity and Business-processes (Productivity and Business-processes) second-quarter revenue increased 13% year-over-year to 192.$500 million, higher than expected $19 billion。This segment includes Office software, Dynamics, and LinkedIn Business, among others.。

Share price falls

After the release of earnings, Microsoft shares did not usher in a rise。Its shares fell more than 1% after hours。

Microsoft CEO Nadella said in a phone call, "There is growing evidence that artificial intelligence will play an important role in the transformation of work.。Our own research, as well as external research, shows that using generative AI to handle specific work tasks has increased productivity by 70%, while early Copilot users of Microsoft 365 have increased their overall speed in a range of tasks such as searching, writing, and summarizing by 29%。"

While there are signs that Microsoft's efforts to incorporate AI into various well-known products such as Azure, Office and Windows are starting to pay off, for some investors, it's not enough.。Hargreaves Lansdown analyst Sophie Lund-Yates wrote in a note to clients: "Microsoft has a lot to do this quarter.。She added that the company "achieved a series of healthy results, but not enough to appease the market."。"

In addition, Microsoft's share price decline is also related to its guidance。Microsoft gave guidance for fiscal third-quarter revenue of $60 billion to $61 billion, the median of which was slightly below consensus expectations of $61 billion.。

Microsoft has been one of the biggest beneficiaries of the AI boom, with its shares up 57% in the past year.。Since 2024, Microsoft has accumulated about 9% and pushed its market value to exceed $3 trillion.。As of Tuesday's close, Microsoft was the world's most valuable company by market capitalization, outpacing longtime rival Apple.。

Microsoft and OpenAI will invest in startup Figure AI

On January 31, according to people familiar with the matter, Microsoft and OpenAI are negotiating to participate in the financing of humanoid robot startup Figure AI。Microsoft will invest about $95 million and OpenAI will invest $50 million, according to people familiar with the matter.。

Figure AI is currently focused on developing AI-powered robots that look and act like humans.。Founder and CEO Brett Adcock said the robots have great potential in handling dangerous tasks in warehouses.。However, the company also admits that it will take about five years for the robot to be more widely used.。The robot will be piloted in some commercial areas in the next two years.。

In early 2023, the company reportedly received $70 million in investments led by Parkway Venture Capital.。The startup then plans to talk to companies such as Microsoft and OpenAI to attract more investors.。Founded in 2022, the company has a team of 50 people, including former employees from companies such as Boston Dynamics, Tesla, and Google Lunar Lab.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.