Intel Q4 results exceeded expectations, why after-hours trading still fell more than 10%?

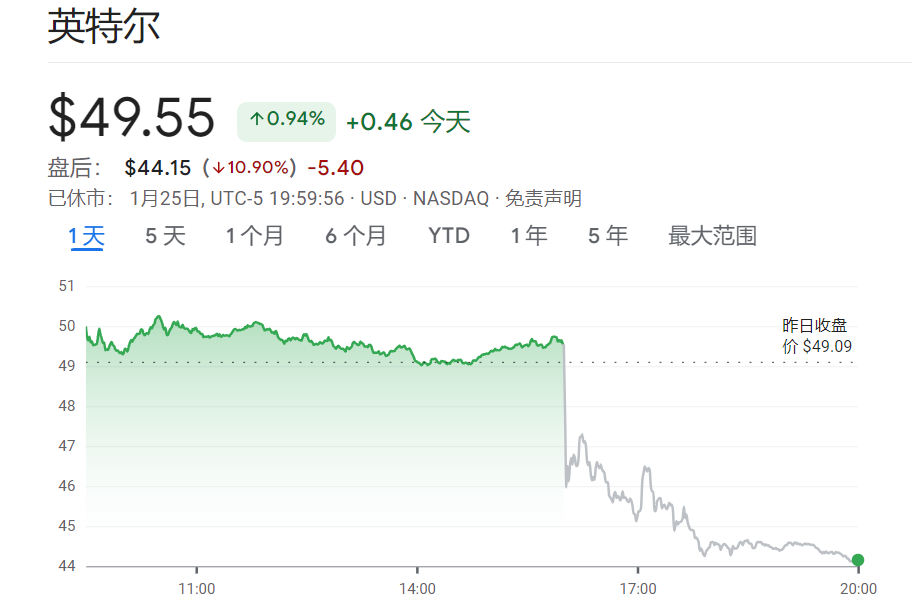

Intel announced its fourth-quarter and full-year results after hours.。Performance data show that the company's revenue and profit in the fourth quarter exceeded analysts' expectations.。But at the same time, Intel's guidance for the first quarter was weaker than expected, causing its stock market to plunge more than 10 percent

On January 25, local time, global computer processor manufacturing giant Intel announced its full-year results for the fourth quarter of 2023.。

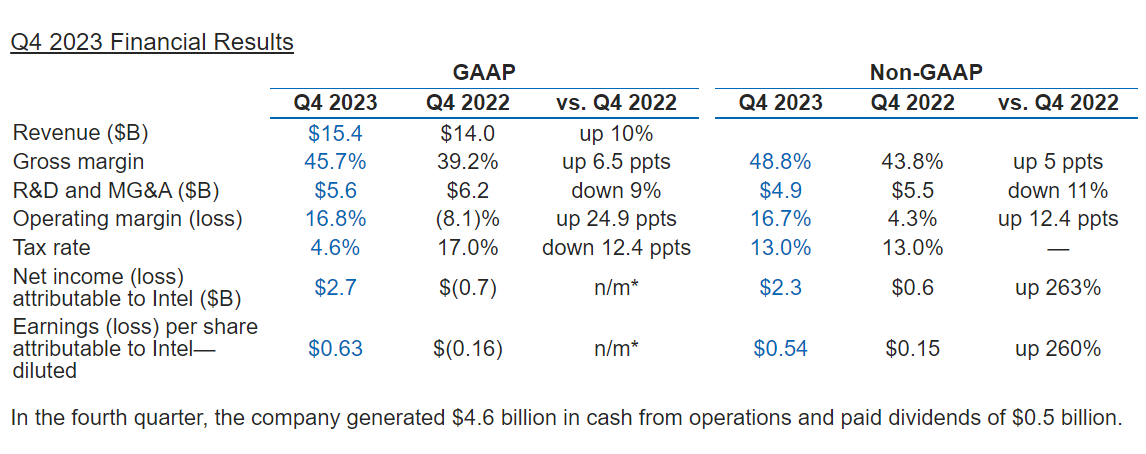

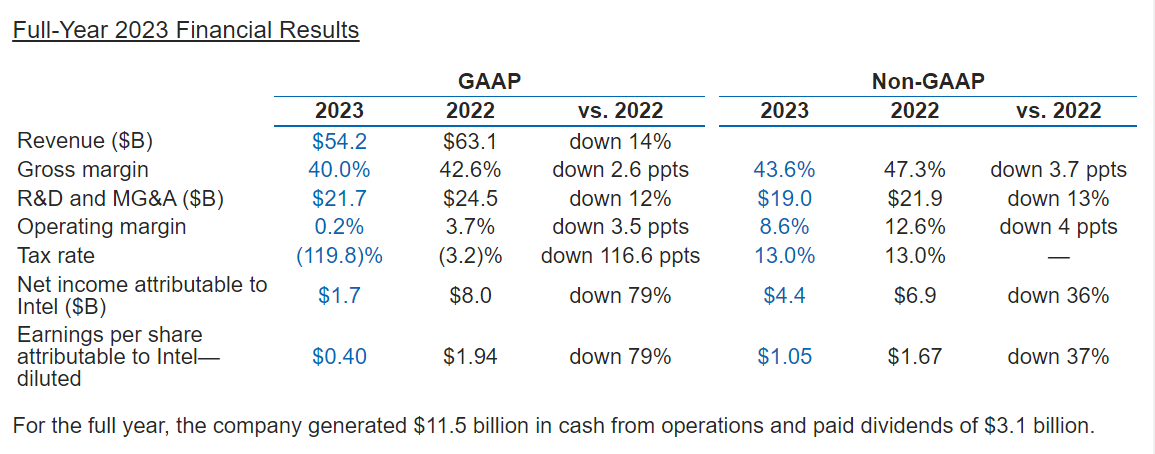

Intel's fourth-quarter revenue was $15.4 billion, better than analysts expected 151.$700 million, up 10% year-over-year, reversing seven consecutive quarters of revenue decline.。

Under non-GAAP, net profit was $2.3 billion, up 263% year-over-year.。Diluted EPS 0.$54, more than analysts expected 0.44美元。Gross margin of 48.8%, up 5 percentage points year-on-year, 2 higher than market expectations.3%。Operating margin of 16.7%, up 12.4 percentage points。In the fourth quarter, the company generated $4.6 billion in cash from operations and paid $500 million in dividends.。

For the full year, revenue was $54.2 billion, down 14% year-over-year。Net income was $4.4 billion, down 36% YoY, diluted EPS 1.$05, down 37% YoY。For the full year, Intel generated $11.5 billion in cash from operations and paid $3.1 billion in dividends.。

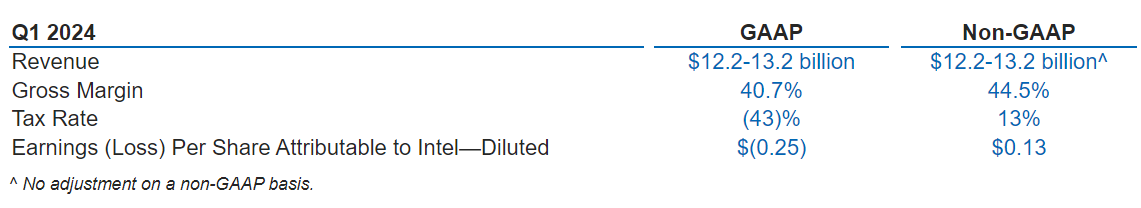

The original fourth-quarter results beat expectations, and the stock should have risen in response.。But in its earnings report, Intel's guidance for the first quarter of 2024 was weaker than expected, directly pouring cold water on the market and its share price plummeted。Intel shares fall more than 10% in after-hours trading。So far this month, the stock has dropped 1.4%, behind the Philadelphia Stock Exchange Semiconductor Index 7.1% increase。

Intel expects revenue of $12.2 billion to $13.2 billion in the first quarter of 2024, which is higher than the same period last year but significantly lower than the average analyst estimate of $142 billion..500 million dollars。Intel, meanwhile, expects first-quarter non-GAAP earnings per share of 0.$13, while analysts give an average forecast of 0.42 USD。

This unexpected outlook caused Intel executives to be "mobbed" by analysts in a subsequent conference call.。

Intel CEO Pat Gelsinger admitted in a phone call that the first quarter was not as good as expected, but he was also trying to "calm people down."。He said the situation is expected to improve quarter by quarter for the rest of 2024.。

Kissinger said Intel's efforts to return to the manufacturing frontier are still on track, which is essential to improve products and remain competitive.。He also claimed that Intel no longer loses sales to competitors in the PC and data center segments。"We know we have a lot of work to do as we work to regain and consolidate leadership in the various areas we are involved in."。"

Despite Kissinger's efforts to calm market sentiment, the situation is not optimistic from the perspective of various business units。Especially from the full year, its core business is still in a state of contraction.。

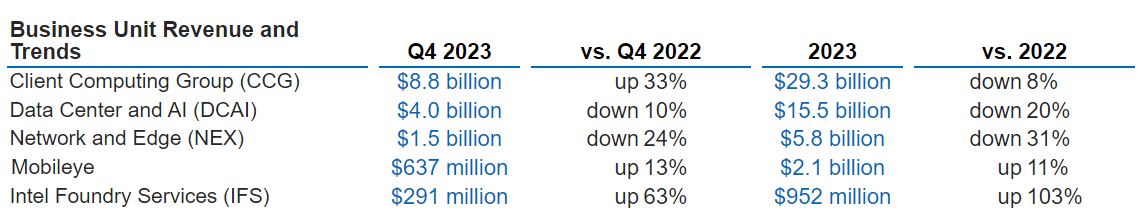

● Client Computing Group ("CCG"): This business, one of Intel's core businesses, performed well in the fourth quarter of last year。CCG's fourth-quarter revenue was $8.8 billion, up 33% year-over-year。Better than analysts expected 84.$200 million, which was also the main driver of better-than-expected business in the fourth quarter.。But for the full year, the business was down 8% year-over-year.。

In the PC market segment, Intel said it was emerging from an inventory glut and its biggest customers were resuming ordering parts.。Kissinger said that due to the demand for new machines for artificial intelligence software and services, total PC shipments should increase to about 300 million units per year.。He said that total Intel shipments in 2023 will be about 2.700 million, will grow by a few percentage points this year。

● Data Center and AI ("DCAI"): As another core business of Intel, DCAI's revenue in the fourth quarter was $4 billion, down 10% year-on-year, less than 40%..$800 million average forecast。For the full year, revenue from the business fell 20% year-over-year to $15.5 billion.。

DCAI business is seen as an important "battlefield" for Intel to compete with competitors such as NVIDIA and AMD。Last December, Intel introduced the Core Ultra series of PC chips。Intel claims the chip will allow consumers to run AI applications directly on laptops and desktops。Kissinger said in a conference call that Intel will make progress in the artificial intelligence chip market。Growth in the AI industry will also increase demand for Intel's regular data center processors, he said.。

In the server space, Intel used to have more than 99% market share, but the company is facing growing competitive pressure。On the one hand, old rivals such as AMD recently launched a powerful chip, and claimed to have won the favor of customers。On the other hand, some large technology companies such as Amazon and Microsoft are also developing their own processors, adding to the pressure on Intel.。

Other than the two main businesses mentioned above, the performance of the other businesses was not much of a bright spot.。

● Network and Edge (NEX): Revenue in this business unit was $1.5 billion in the fourth quarter, down 24% year-over-year and slightly below the 15% forecast by analysts..500 million dollars。

Mobileye: This business segment includes the development and deployment of advanced driver assistance systems (ADA) and autonomous driving technologies and solutions。Mobileye's fourth-quarter revenue was 6.$3.7 billion, up 13% year-on-year and slightly above analysts' expectations of $600 million。

● Intel Foundry Services ("IFS"): This part of the business's second-quarter revenue increased 63% year-on-year to 2.$9.1 billion, but still below market expectations of 3.500 million dollars。

Foundry services are still in the early stages for Intel。Intel previously pledged to invest heavily in building a global network of foundry factories to further boost the business。But the company has not made public the list of major clients involved in the project.。Intel said the company has $10 billion worth of long-term orders to make and package chips for other companies.。But Kissinger also admitted that the order was not large enough。"Obviously we need to get bigger numbers and that's exactly what we're going to do."。"

Earlier this week, Intel announced the opening of its latest chip manufacturing facility in New Mexico。Ahead of the earnings release, Intel also announced that it would work with contract chipmaker UMC。The two companies will collaborate to develop a 12nm semiconductor process platform to meet the high-growth market needs of mature nodes。These markets include mobile, communications infrastructure and networking。Intel is looking to get back to the top of the chip world after market share continues to be eaten away by rivals such as TSMC and AMD。

Kissinger said in a press release that the company remains "relentlessly focused on achieving process and product leadership this year, continuing to build our external foundry business and large-scale global manufacturing, and executing on our mission to bring AI to the world while delivering long-term value to our stakeholders."。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.