After yesterday's shock, U.S. stocks are facing a "panic moment" again today.?

Good news may turn into bad news at any time, and today's U.S. stocks may have another "moment of panic."。

On July 6, local time, the US ADP employment data was released, which was expected by the market.。

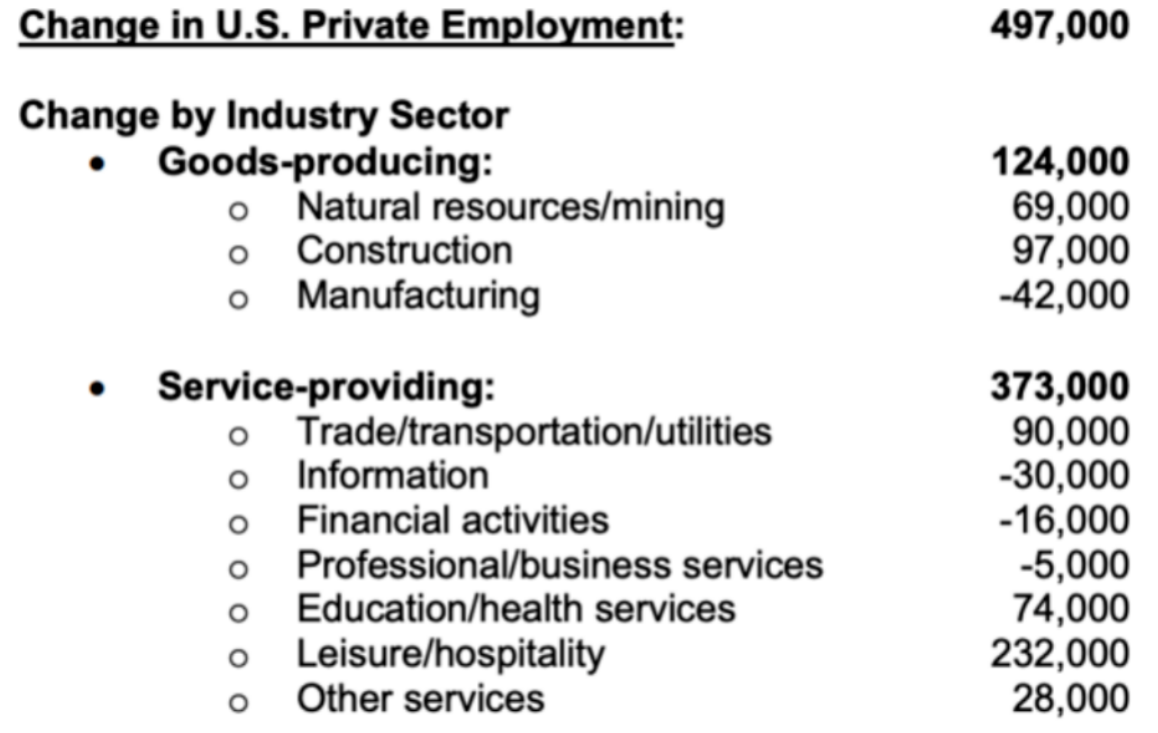

U.S. ADP up 49 in June.70,000 service sectors contribute significantly

U.S. employment jumped 49 in June, data shows.70,000, well above the expected 22.50,000, more than double that number。In addition, the former value of this data is given by 27.80,000 revised down to 26.70,000, making June ADP data gains more exaggerated。

Judging from this report, the recent U.S. job market is still hot, and the "cumulative and lagging effects of tight monetary policy" expected by Fed officials seems to have failed to be reflected in this report.。According to another report released on the same day, challenger companies in the United States recorded 40,709 job cuts in June, significantly lower than the previous value of 80,089 and the lowest since October last year.。

Specifically, employment growth in the service sector contributed greatly。Among them, the leisure and hotel industry added 23.20,000 employees, leading the private sector as a whole, followed by trade, transport and utilities, with 90,000 new employees, and education and health, with 70,000 new jobs..40,000 people。In terms of commodity production, the construction industry performed particularly well, creating 9 in June..70,000 jobs。

By business classification, U.S. companies with fewer than 50 employees contributed most of the job growth in this report, an increase of 29.90,000 jobs。Companies with more than 500 employees shed 8,000 jobs, while medium-sized companies added 18.30,000 jobs。

In terms of wage growth, this report recorded an annual wage growth rate of 6.4%, a relative slowdown, which is one of the few data that gives comfort to the Fed。Although the bank has quickly pulled monetary policy back into tight territory over the past year, it hopes to bring inflation back down in the shortest possible time and reach its 2% policy target in the long term。

However, the persistently hot job market still recorded an unexpectedly large increase in June, with two job openings for each worker now.。You know, that month was the first month the Fed pressed the rate hike pause button, and bank officials are closely monitoring every move in the economy。

Apparently, there have been some officials who have gotten wind of。Yesterday, the 2023 FOMC Vote Committee, Dallas Fed President Logan (Lorie Logan) said that it is currently skeptical about the significant impact of the lag effect of interest rate hikes。He also said that in order to achieve the objectives of the FOMC, more stringent policies need to be implemented, and further interest rate hikes may be necessary.。

The good news is the bad news. Financial markets shook yesterday.

Yesterday, the Fed released the minutes of its June monetary policy meeting。According to the minutes, almost all officials expect more rate hikes for the rest of the year and have even foreseen a slowdown in the economy.。The minutes said participants hoped that "a period of below-trend real GDP growth and weakening job market conditions" would bring aggregate supply and aggregate demand into better balance in order to keep inflation down.。

In addition, the minutes revealed that this rate hike pause is essentially the result of an extremely hawkish compromise。At the meeting, there were originally members who wanted to continue raising interest rates by 25 basis points at that meeting and never considered stopping the pace of rate hikes at all。At the time, in their eyes, the labor market was still strong, the momentum of economic activity was greater than previously expected, and there were no clear signs that inflation would enter a long-term 2% downward path.。

It is reasonable to guess that this strong ADP employment data will give these extreme hawks more say at the July policy meeting, pushing the policy rate cap reasonably high to 5.5%, not even ruling out the possibility that they will push for a second rate hike on the dot plot during the year.。

Sure enough, this better-than-expected employment data spooked the market.。The three major U.S. stock indexes collectively opened lower, the Dow's biggest intraday decline of more than 500 points, as of the close, the Dow fell more than 1%, the Nasdaq fell 0.82%, the S & P 500 fell 0.79%。Weakness in U.S. stocks even implicates European markets。

In addition, the yield on the interest-sensitive U.S. 2-year Treasury note rose sharply during the session, rising above 5.10% mark, the highest level since June 2007; U.S. 10-year Treasury yields rose above 4.08%, a four-month high。

In addition, the European government bond market also suffered a heavy setback, the UK 10-year benchmark government bond yield once hit 4.70%, an intraday high since October 2008; 2-year UK bond yields rose above 5.50%, an intraday high since 2008。

It is worth noting that in the context of global inflation governance, the European market is also expected to raise interest rates.。For now, investors are fully priced in, with the Bank of England set to raise rates by another 50 basis points this August.。

On July 7, local time, the United States will release the June non farm payrolls report。After the release of the ADP data exceeded expectations, the entire market looked a bit jittery about the report。Following last month's unexpected surge of 33.After 90,000, economists expect non-farm payrolls to record 240,000 this month。

But as far as the ADP data is concerned, good news may turn into bad news at any time, and today's U.S. stocks may usher in a "panic moment."。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.