Tesla Earnings Interpretation 2024

Summarize Tesla's fiscal 2024 quarterly results for your reference。

Tesla recently released its latest financial report data, which is particularly crucial for investors, analysts, and global observers of the automotive industry. In the highly anticipated financial report, we were able to glimpse Tesla's outstanding performance in various business areas during different fiscal quarters and the overall financial health of the company. Here is a brief analysis of Tesla's latest financial report:

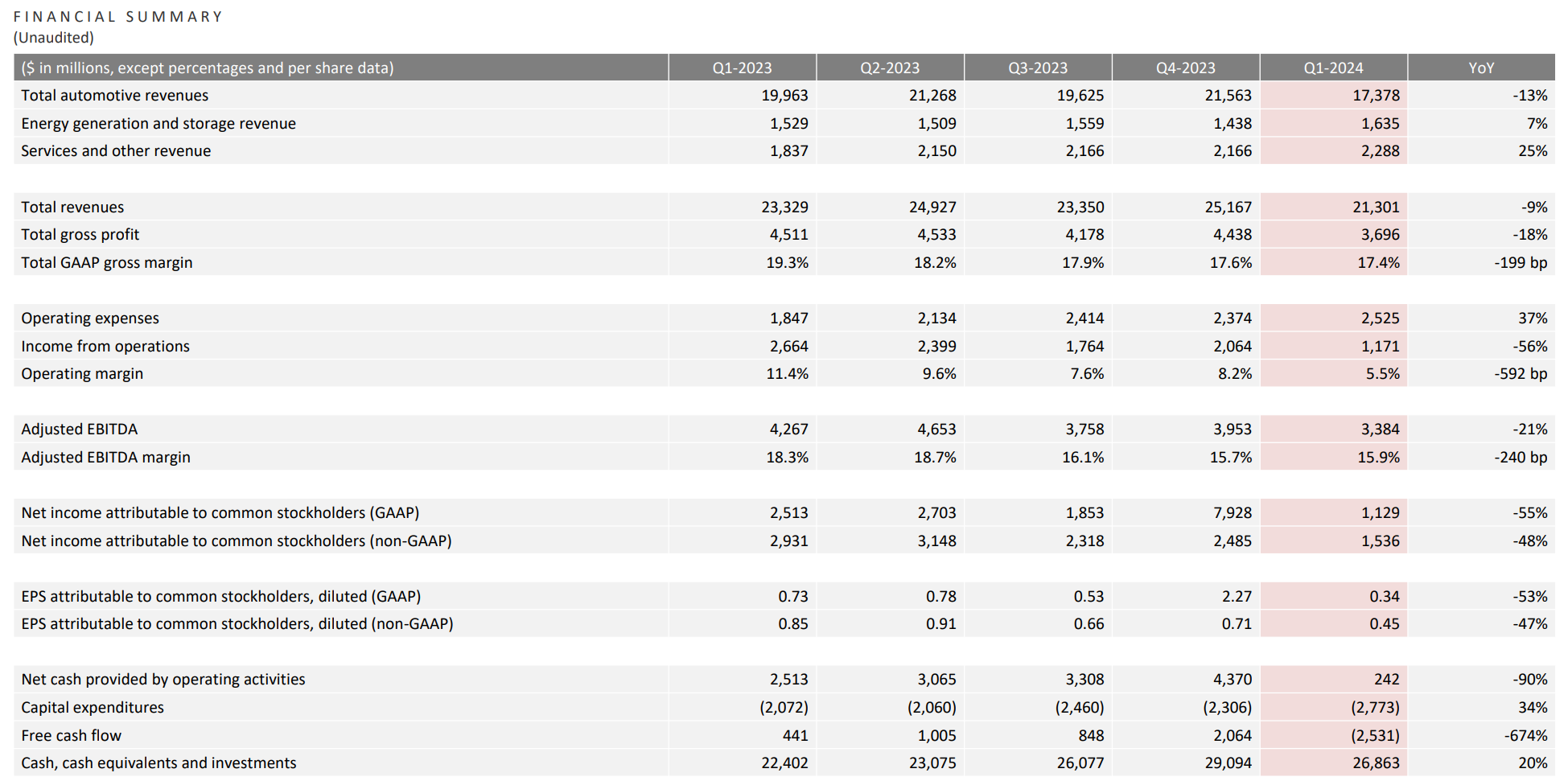

Tesla Q1 Results Report 2024

After the U.S. stock market on April 23, Tesla announced its first quarter results。Specifically, Tesla's first-quarter revenue of $21.3 billion was lower than the $22.3 billion expected by analysts, down 9% year-over-year and the largest year-over-year decline since 2021.。

In terms of earnings, Tesla's adjusted net profit for the first quarter was 15.$3.6 billion, down 48%。Adjusted EPS 0.$45, below analyst expectations of 0.$52, down 47% YoY, lowest level since Q1 2021 (31 cents per share)。

Tesla's first-quarter gross margin still recorded a year-over-year decline, but it was better than market expectations, reaching 17.4%, after analysts expected 16.5%。Tesla's gross margin for the same period last year was 19.3%, with a gross margin of 17% last quarter..6%。

Despite Tesla's poor first-quarter results, the stock surged more than 13% after the session。This surge was mainly boosted by the latest news about Tesla's new generation of low-cost vehicles (called Model 2)。

In the first quarter of this year, Tesla delivered 386,810 vehicles worldwide, down 8.5%, well below market expectations of 449,080 vehicles。This raises concerns about Tesla。Against the backdrop of slowing electric vehicle growth and increased competition in the industry, investors are confused about Tesla's growth momentum。As a result, the Model 2 is widely regarded as the "hope" for Tesla's next car business.。

Full earnings analysis please refer to: Tesla Q1 results fell short of expectations Musk said will accelerate the launch of a new generation of cars

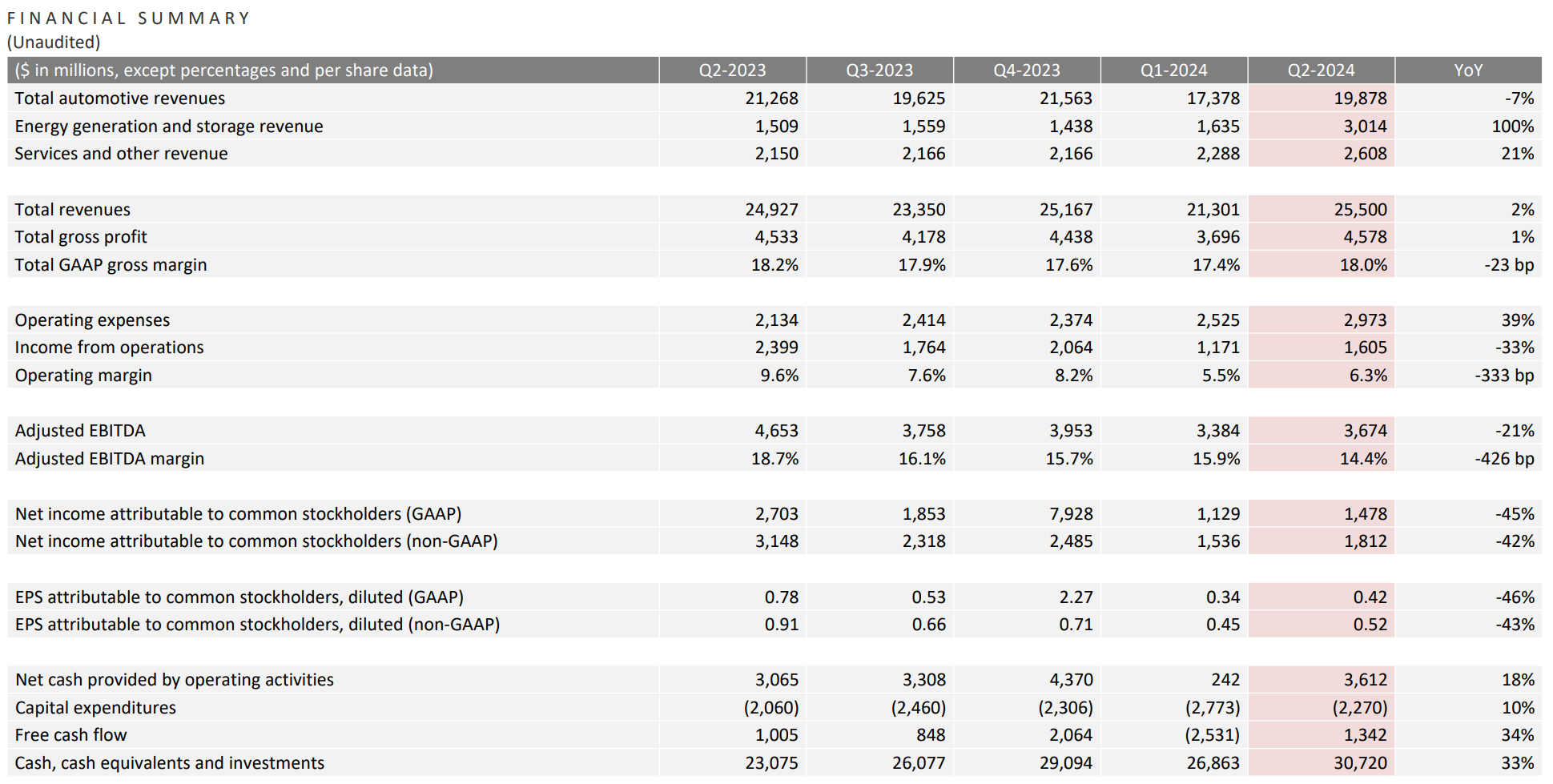

Tesla Q2 Results Report 2024

After the U.S. stock market on July 23, Tesla released its second quarter earnings this year.。Tesla's after-hours plunge as net profit nearly halved in earnings。

Tesla's revenue in the second quarter was $25.5 billion, up 2 percent from a year earlier, better than analysts expected 247..$200 million。Among them, the revenue of the electric vehicle business was 198.$7.8 billion, down 7% YoY。Revenue from the power generation and energy storage business was 30.$1.4 billion, up 100% YoY。Revenue from services and other operations was 26.US $0.8 billion, up 21% year-on-year。

In terms of earnings, Tesla's adjusted net profit for the first quarter was 18.$1.2 billion, down 42%。Adjusted EPS 0.$52, down 43% year-over-year, below analyst expectations of 0.62 USD。

The good news is that Tesla's gross margin numbers are not ugly。Gross margin was 18% in the second quarter, though down from 18% in the same period last year..2%, but better than the 17 that analysts expected.4%。Automotive gross margin of 14.6%, lower than market expectations。

Free cash flow (FCF) for the second quarter was 13.$4.2 billion, up 34% year-over-year, below analyst expectations of 19.$200 million。

In addition to operating performance indicators, the progress of Tesla's various businesses is also of interest to the market.。

In terms of electric vehicles, Tesla's global vehicle production in the second quarter of this year was 410,813, down 14.3%, down 5.2%。Deliveries were 443,956 vehicles, down 4.7%, up 14.7%。In the first half of 2024, Tesla's cumulative sales were approximately 83.10,000 vehicles, down about 7% year-on-year。

In the second quarter, Tesla's energy business performed very well.。According to the financial report, in the second quarter, Tesla deployed Megapack and Powerwall energy storage products to 9.4Gwh, record single-season high。

For the humanoid robot Optimus, Tesla revealed that Optimus has been in the Tesla factory to perform processing battery related tasks。

Musk is very optimistic about the potential of Optimus.。He believes Optimus could contribute more to the company's revenue in the future than all other business units combined.。Because in his view, global customer demand for humanoid robots will reach 22 million units, and Optimus will be in the lead.。

Full earnings analysis please refer to: Q2 net profit is close to halving!Tesla shares plunge after hours

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.