RBA's August interest rate resolution: inflation rebounds, does not rule out future rate hikes

Australia's hold this time is mainly due to fear of rebounding inflation.

Australia has formally ruled out the possibility of a short-term interest rate cut.

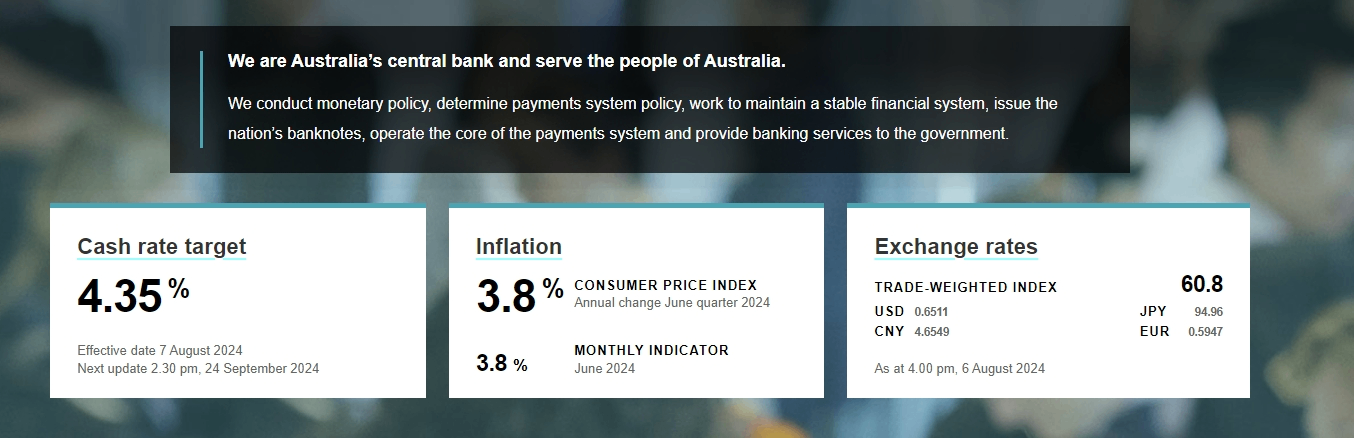

On August 6th, Australia continued to maintain its interest rate at a 12-year high of 4.35%, and raised its expectations for inflation and economic growth.

Reserve Bank of Australia Governor Michele Bullock stated at a press conference that the RBA will not consider lowering interest rates in the near future to maintain control over core inflation.

Bullock emphasized that the market has prematurely predicted a rate cut in November, but in reality, the possibility of a rate cut in the next approximately six months is not great.

Australia's current inaction is mainly due to concerns about the rebound in inflation.

This year, Australia's inflation fight started well but ended poorly, with the first quarter's inflation rate performing excellently, only recording 3.6%, far below the 7.8% peak in December 2022. However, from the second quarter, the country's inflation has rebounded significantly, with an estimated year-on-year increase of 3.9% to 4.1%, a significant increase from the first quarter.

At the same time, the interest rate setting committee stated in a declaration, "The policy needs to remain sufficiently restrictive until the committee is confident that inflation is moving consistently towards the target range."

The RBA also stated that it does not rule out any future policy actions, which may imply that there is still a possibility of raising interest rates.

Subsequently, in the interest rate decision, the RBA raised its expectations for core inflation and economic growth, citing stronger demand. It now expects that by the end of this year, the core inflation rate will fall to 3.5%, and then reach 3.1% by the middle of 2025. Before the end of the forecast period, this indicator is not expected to reach the RBA's 2.5% target midpoint.

An unknown factor facing the RBA is the impact of Australia's personal income tax cuts and living cost refunds on electricity bills, which started on July 1st. Economists say these measures will help support a weak economy, and Bullock recently said she expects these measures will not have a significant impact on the RBA's inflation forecasts.

Regarding the RBA's decision, State Street Global Markets' Head of Asia-Pacific Macro Strategy, Dwyfor Evans, said that the Australian central bank is essentially hawkish and steady, with some optimism brought by the softening of inflation in the second quarter basically abandoned, replaced by comments that continue to consider potential inflation data as 'too high'.

Analyst Chris Bourke said that for Bullock, inflation is still too high. The RBA insists on not ruling out any policy possibilities, which is not surprising, especially in a macro environment full of unexpected shocks. This reminds people that the central bank is aiming for the midpoint of its inflation target, although the inflation rate has been declining since the beginning of last year, but for the RBA, the possibility of deviating significantly from the downward track is too great.

After Bullock's speech, the Australian dollar rose, with the AUD/USD up by 0.7% at one point.

At the same time, the money market began to cut bets on a rate cut in November, and fully expected a rate cut in December.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.