What is a bear market?How to invest in a bear market?

When the stock market has experienced a prolonged decline and investors have shown negative investment sentiment, it is basically certain that the market is ready or has entered a bear market。

What is a bear market??

When the stock market has experienced a prolonged decline and investors have shown negative investment sentiment, it is basically certain that the market is ready or has entered a bear market。

By definition, an overall stock market price that has fallen more than 20% from its highs in the recent past can be called a bear market。

Bear markets are not common compared to bull markets, but they are often accompanied by severe recessions, and there have been seven textbook-grade bear markets in the U.S. history of nearly 150 years, all of which have affected global investment rules to some extent, such as the circuit breaker mechanism, which was invented based on the impact of Black Monday in 1987, and the establishment of the U.S. Securities Exchange Act and the Securities and Exchange Commission (SEC), which was caused by the Wall Street crash of 19。

The biggest feature of a bear market: the hope that stock prices will fall

The occurrence of a bear market often brings fear, which in turn triggers panic selling。In addition, market sentiment is tight, and the slightest bit of bad news can send stocks down again, which is why a bear market occurs。

And this fear can lead to a unique phenomenon: shorting is a higher percentage than going long.。

The so-called shorting (also known as selling short, shorting), refers to investors selling assets they have never owned, and expect the assets to depreciate and profit from it, which is very different from the general "buy low and sell high," the principle of shorting is "sell high and buy low," shorting will make the stock price fall, and investors do not want the assets will appreciate, otherwise they will lose money.。

When there are more short sellers in the market than there are more, the stock market will enter a downward cycle and the stock price will have difficulty rebounding, which in turn will increase the probability of a bear market.。

The reason for the bear market: fear

Usually the main reason for the bear market is that investors feel that the market is full of unknown fear, investors in order to avoid insecurity, had to sell the stock to cash out, some investors will even short the market, will let the stock market continue to fall, and thus cause a bear market.。

What causes fear??These reasons include excessive market speculation, excessive oil price volatility, over-leveraged trading, war, geopolitical crisis, hyperinflation, outbreak of epidemics, recession, etc.。

These fears can lead investors to take the most conservative actions, most commonly to recoup their money in case of a crisis, so there is no influx of money into the stock market and it is difficult for the share price to rise, while short sellers will take advantage of the emptiness and let the share price fall further.。

Three stages of a bear market

Bear Market Phase 1: Initial Warning

When the stock market first starts to fall, many investors will think it's just a bull market correction, not worried that the stock will fall again, and expect to rebound soon.。

At this time the stock market is indeed likely to pick up, but some companies' earnings have begun to appear hidden worries, but also began to decouple from the stock price, some investors who see the problem at this time has already recovered their funds, is quietly waiting for the stock market crash。

Bear Market Phase II: The Most Panic

When the second phase of the bear market occurs, the stock market has fallen a lot, but there are still some investors feel that the bull market is not over, and the remaining optimism in the market will still drive the entire stock market, but if something small happens in the market at this time, it is also likely to trigger panic selling。

But unlike the bear market period, the company's fundamentals are already showing clear signs of distress, and while the stock is up but the fundamentals have deteriorated, there will be a bigger wave of declines that are poised to take place.。

Bear Market Phase III: The Longest

After the optimism of the second phase of the bear market has disappeared, investors have realized that the company's fundamentals have long been decoupled from the stock price, and the company's poor performance, fiscal tightening and other bad news have emerged, the overall economy has been in a recession cycle.。

At this time, although the bear market is still falling, but the main decline will be concentrated in high-quality blue chips and growth stocks, when there is a decline in high-quality blue chips, you can think about the other way around, non-blue chip stocks have already fallen in the first and second phases of the bear market almost, that is to say, in the third phase of the bear market almost all stocks are not immune, the stock market into trouble。

The third phase of the bear market is the longest and largest, usually lasting at least six months to several years, most investors feel that the stock market has been plunged into darkness, it is difficult to find hope, so they are slow to enter, and a small number of investors will start buying some seriously undervalued stocks at this time, and expect a bottom rebound。

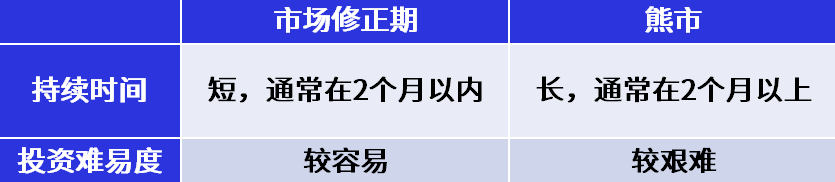

Bear vs market correction period

Duration

The most obvious difference between the two is the duration, the market correction period usually refers to the short-term decline of less than 2 months, the market will return in these 2 months, and continue to recover into the bull market; and bear market occurs not only 2 months, some even years to several years, such as the 2007 subprime mortgage crisis fell as long as more than a year, and the history of the longest decline in the bear market is 1929 Wall Street crash, when the stock。

Of course, there are exceptions, the bear market triggered by the new crown epidemic in 2020 only experienced 19 days of decline, and fell by as much as 33%, but then rebounded and continued to hit new highs, although the decline and recovery is very rapid, but because the 33% decline has exceeded the definition of a bear market of 20%, so it is also a unique "bear market."。

investment difficulty

In addition to duration, there are differences in the ease of investing between the two, and the decline in the stock market during a market correction provides a good entry point for value investors who will see a return if it goes well.。

But bear markets are difficult to provide investors with a suitable buying point, because it is difficult to determine where the bottom of the stock market, if you want to make money from the bear market, it will be much more difficult than the market correction period.。

3 Examples of Bear Markets

US bear market: COVID-19

In early 2020, an outbreak of pneumonia began in China and a blockade began, causing stock prices to begin to be affected, and then the disease began to spread outside China, and the global epidemic gradually became uncontrolled and stock prices fell further.。

During the same period, the failure of negotiations between Saudi Arabia and Russia led to sharp fluctuations in oil prices and became a minor factor in the outbreak of a bear market in 2020.。

The last straw that crushed the camel was the announcement by the Global Health Organization (WHO) that new coronary pneumonia was a "global pandemic," and many countries were on alert to deal with it, causing the overall economy to almost shut down in a short period of time, leaving many investors feeling great fear, leading to another sharp fall in share prices, with only 19 days before and after, and the stock market falling more than 30%。

U.S. Stock Bear Market: Subprime Crisis

At the beginning of the 21st century, real estate and the stock market are very hot, especially the real estate market, banks will even lend money to people with poor credit to buy real estate, and the borrower's "ability to repay the money" problem is ignored, so a threatening bubble formed.。

In 2007, New Century Financial declared bankruptcy, which has since sounded the alarm, and then in 2008 Fannie Mae and Freddie Mac were taken over by the U.S. government, while the 150-year-old Lehman Brothers filed for bankruptcy, and financial institutions fell one after another, leaving many investors feeling great fear, eventually leading to a stock market crash into a bear market.。

It took five years and two months for the bear market to return to its pre-bear highs in January 2013, and the subprime mortgage crisis event was not only the largest bear market of the 21st century so far, but also one of the well-known bear markets in U.S. stocks in 150 years.。

The recent bear market in Hong Kong stocks

In 2021, U.S. stocks and most other markets are experiencing most of the first market, but it has been a torrid year for Hong Kong stocks, which began to fall after late February and continued all the way to the end of the year.。

The initial reason was an upward trend in U.S. interest rates, with 10-year Federal Reserve yields rising to 1.7%, in addition to U.S. technology giants such as Apple, Facebook, Google, Microsoft and others have fallen, resulting in Hong Kong stocks began to be affected, the Hang Seng Index from mid-February's 31183 high began to adjust, to the end of the second quarter of Hong Kong stocks Hang Seng Index to 28,000 points。

The Hang Seng Index was still around 29,000 in June and has not returned to its highs。Subsequently, China's "Didi Chuxing" ignored the advice and chose to go public in the United States in a hurry at the end of June, allowing overseas investors to quickly cash in and take profits, resulting in the Chinese authorities are very dissatisfied, ordered "Didi Chuxing" off the application, and launched an investigation, so that investors have a sense of insecurity about Chinese stocks, and thus drag down Hong Kong stocks.。

Since then, China has implemented a series of policies that have led to further declines in Hong Kong stocks, including antitrust investigations, restrictions on minors playing online games and restrictions on the operation of the tutoring industry, causing the Hang Seng Index to fall 23,223 points on December 19, a drop of 25 per cent since mid-February.。

How to Invest in a Bear Market?

Look long term

In a bear market, what you can't do is react intuitively, such as cashing out immediately after a stock price drop or being bearish, and from a historical perspective, getting in and out of the stock market too hastily has proven to be a behavior that can make performance worse than overall performance。

It's not hard to understand why many people do this, because when the market seems to be going down endlessly, investors' instinct is to sell as soon as it gets worse, but it's important to think that when the bear market is over and the bull market comes, it's likely to miss the best entry opportunity。

So be prepared to invest: own it for the long term and don't sell it because of a bear market.

Focus on value

When a bear market occurs, it does put many companies in trouble, but it also shows the good fundamentals of some companies。In other words, when a bear market comes, companies that are over-leveraged and have no competitive advantage will be hit the hardest, while some of the more stable companies will survive.。

So in a bear market, investors should look for companies with good fundamentals and ensure that their market competitiveness stands out from their peers。

Don't want to copy the bottom

The other mistake some people make in a bear market is to predict the bottom of the stock and put a lot of money into buying it, and hope that the stock will rebound from that。

But what history tells us is that no one will know that this is the bottom and that the stock price may even fall further, which will result in investors having no cash on hand to continue buying and watching the asset fall.。

So instead of thinking about bottoming out, buy stocks with a long-term investment mindset, and keep buying even if the stock price continues to fall。

Gradually build positions

Instead of thinking about making a profit at the bottom, buy in batches when the stock price has fallen below what you think is the value line.。

This also reduces risk, and if a mistake is found, you can cut your position with a minimum loss amount; or you find that the stock price has fallen to a new low and there is money to put into the purchase, rather than sitting back and staring red-eyed。

In other words, gradually building a position can suggest an organized portfolio with minimal risk and the opportunity to make higher profits and less losses than others。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.