Dragonfly Doji Candlestick Pattern - What Is And How To Trade

Learn all about the Dragonfly Doji candlestick pattern.What is, how to trade, and all the best trading strategies.

Introduction to the Dragonfly Doji Candlestick Pattern

The Dragonfly Doji is a type of Japanese candlestick pattern, specifically a form of Doji candlesticks. It is a bullish reversal pattern that typically appears after a price decline, indicating a rejection of lower prices. The appearance of a Dragonfly Doji suggests a potential reversal to the upside, marking a possible end to the downtrend. The Dragonfly Doji is essentially a mirror image of the Gravestone Doji candlestick pattern.

How to Identify the Dragonfly Doji Candlestick Pattern

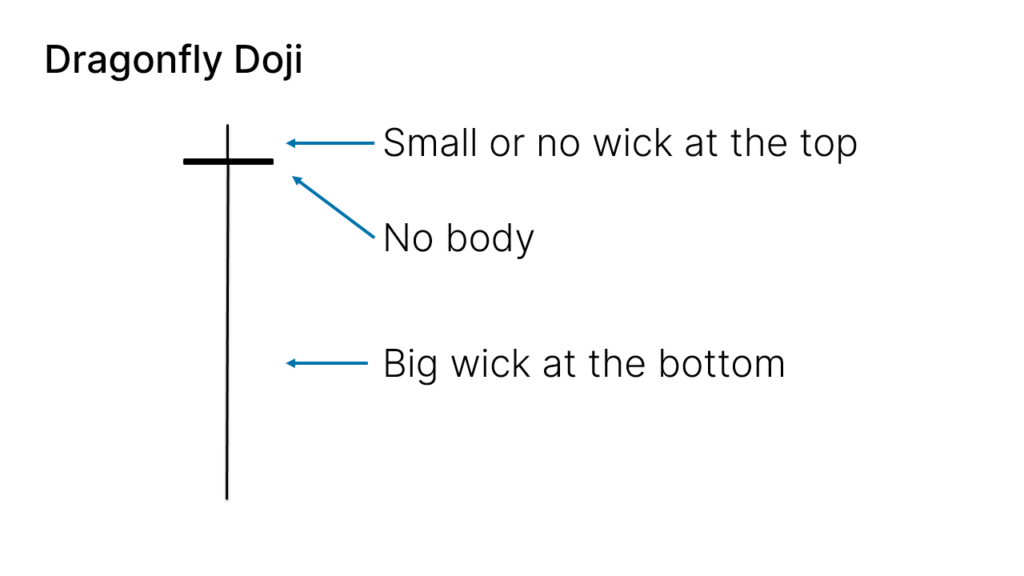

The Dragonfly Doji pattern is represented by a single candle with the following characteristics:

- The candle body is very small, with almost no visible body.

- The wick at the bottom is long.

- The candle has no or very small upper wick.

On charts, the Dragonfly Doji pattern generally appears as follows:

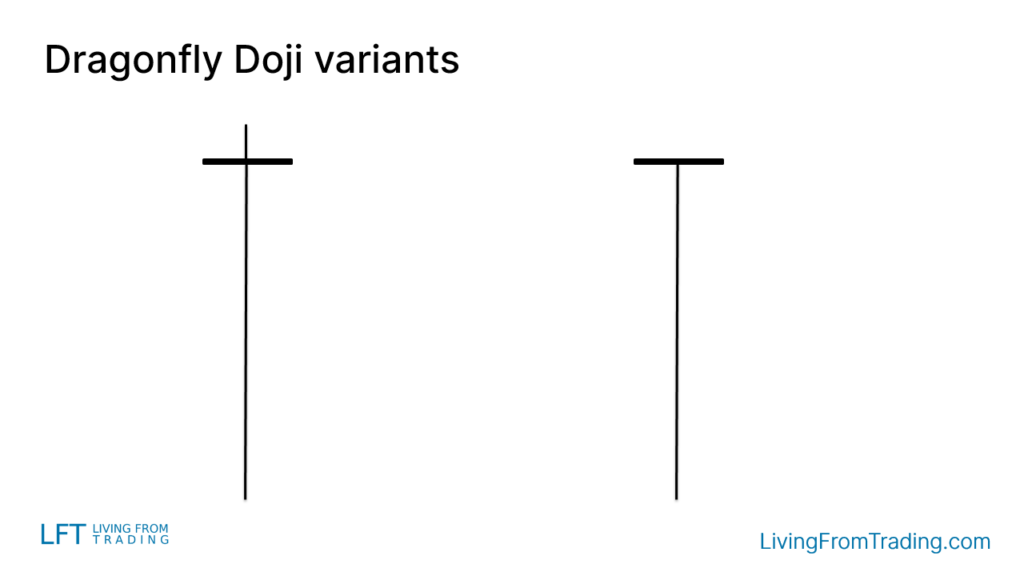

Variants of the Dragonfly Doji Candlestick Pattern

The Dragonfly Doji pattern may appear slightly different on charts. It might have a small upper wick, but if present, it should be minimal.

Trading Strategies

Identifying the Dragonfly Doji pattern alone is not sufficient for trading. The validity of the pattern also depends on its location. The Dragonfly Doji is more significant if it appears after a bearish move, indicating a potential bullish reversal. Consider the following strategies to trade the Dragonfly Doji:

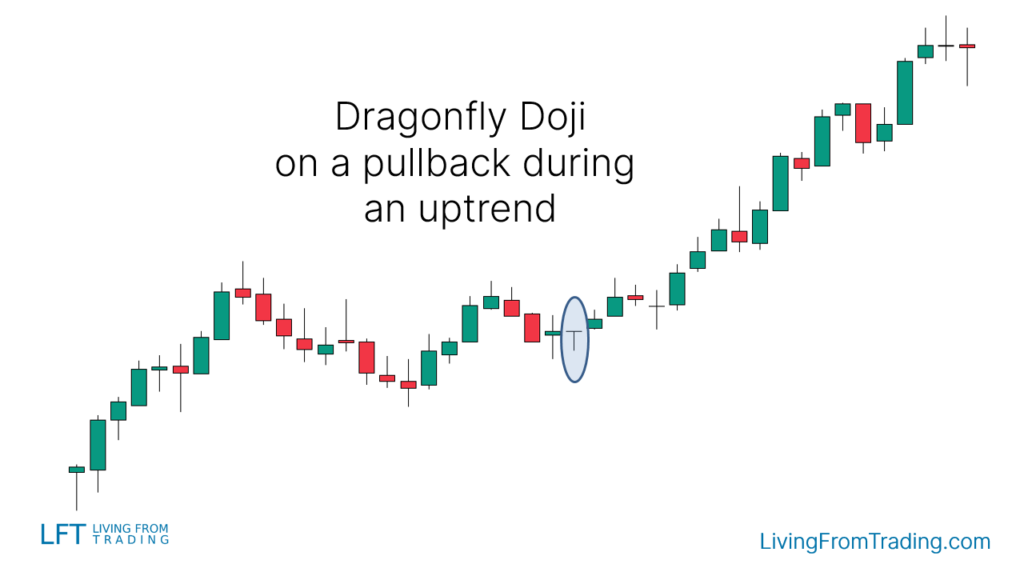

Strategy 1: Pullbacks on Naked Charts

As a bullish reversal pattern, the Dragonfly Doji is particularly useful when the price is in an uptrend. Observe for pullbacks, and look for the Dragonfly Doji during these pullbacks. This often signals the end of the pullback and the beginning of a new upward leg. Steps include:

- Watch for pullbacks in an uptrend.

- Identify the Dragonfly Doji during the pullback.

- Enter a long position when the price breaks above the Dragonfly Doji's high.

- Set stop-loss orders at the opposite side of the pattern.

- Define profit targets, typically at previous highs or other technical levels.

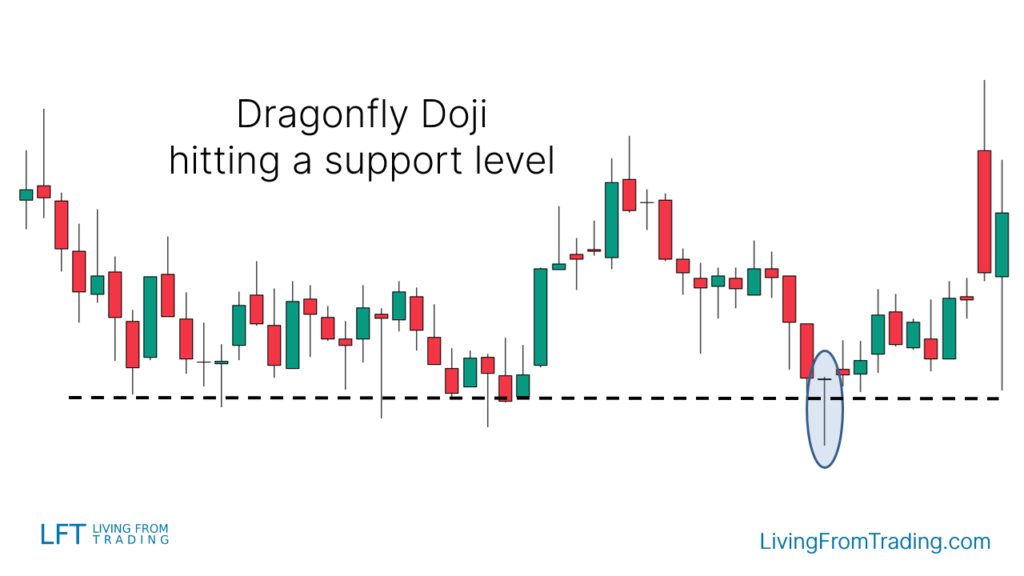

Strategy 2: Trading the Dragonfly Doji with Support Levels

Support and resistance levels are key points for price reversals. Use support levels to trade the Dragonfly Doji for potential upward moves. Steps include:

- Mark support levels on the chart.

- Wait for the price to decline to the support level.

- Check if the Dragonfly Doji appears at that level.

- Enter a long position when the price breaks above the Dragonfly Doji's high.

- Set stop-loss and take-profit levels, anticipating an upward move.

Strategy 3: Trading the Dragonfly Doji with Moving Averages

Moving averages are useful for trend trading. Combine Dragonfly Doji with moving averages to trade price pullbacks. Steps include:

- Identify an uptrend with the price above a moving average.

- Wait for a price decline to the moving average.

- Check if the Dragonfly Doji appears at the moving average.

- Enter a long position when the price breaks above the Dragonfly Doji's high.

- Set stop-loss and take-profit levels, expecting another upward move.

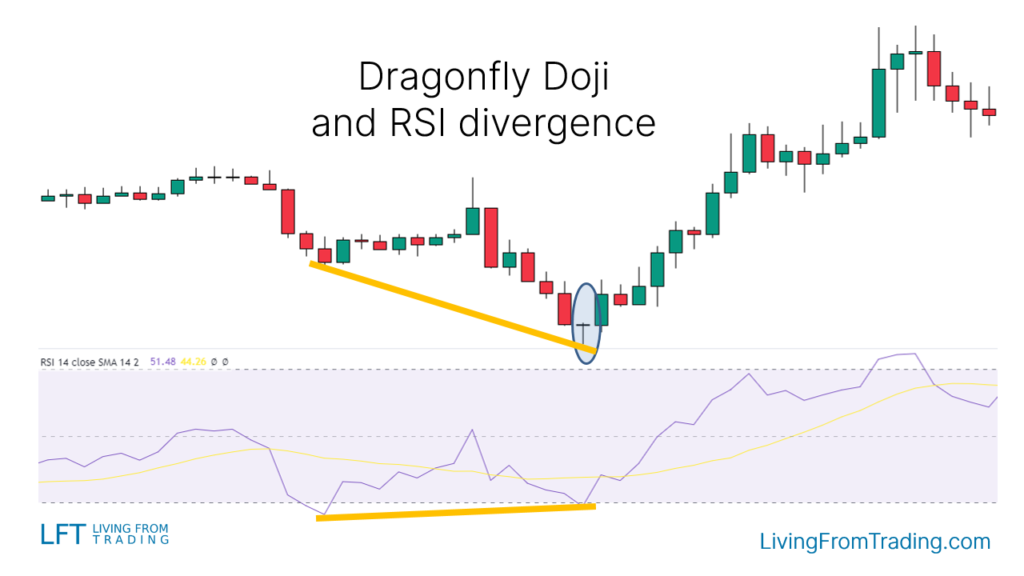

Strategy 4: Trading the Dragonfly Doji with RSI Divergences

This strategy involves using RSI divergences to find bullish signals. Steps include:

- Identify a downtrend and mark price lows.

- Compare these lows with the RSI indicator.

- Look for RSI making higher lows while the price makes lower lows (divergence).

- Wait for a Dragonfly Doji to appear at a lower price low, aligned with RSI's higher low.

- Enter a long position when the price breaks above the Dragonfly Doji's high.

- Set stop-loss and take-profit levels, anticipating an upward move.

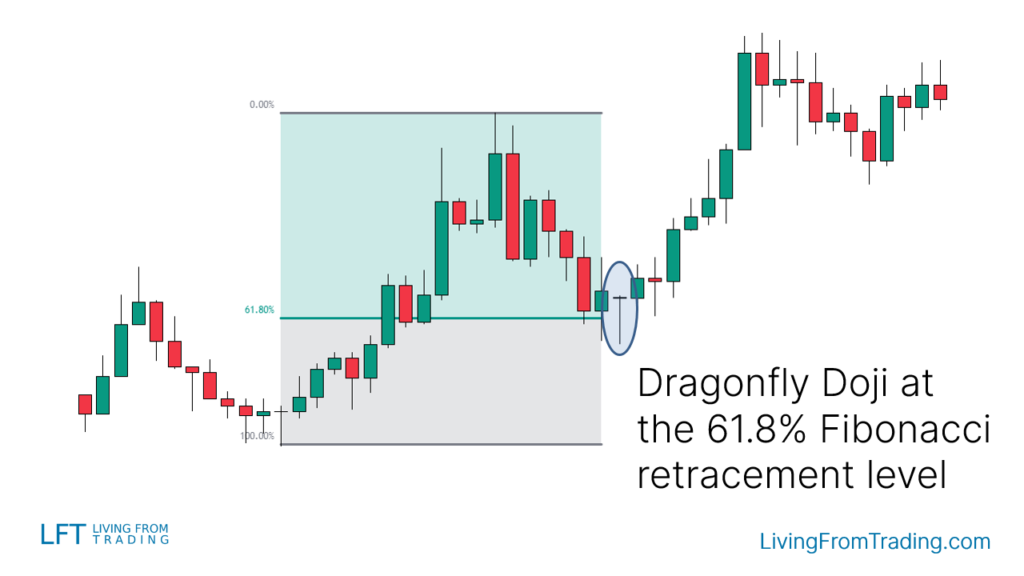

Strategy 5: Trading the Dragonfly Doji with Fibonacci

Fibonacci retracement levels can be used to trade Dragonfly Doji patterns. Steps include:

- Ensure the price is in an uptrend.

- Wait for a price decline to Fibonacci retracement levels.

- Draw Fibonacci levels from the low to the high of the move.

- Enter a long position when the price hits a Fibonacci level and forms a Dragonfly Doji.

- Set stop-loss and take-profit levels, expecting an upward move.

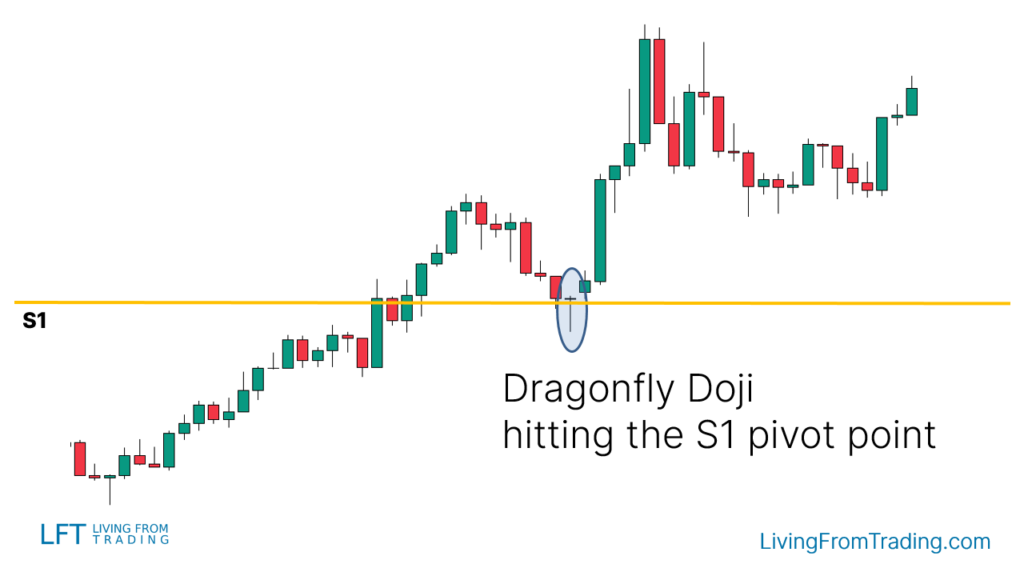

Strategy 6: Trading the Dragonfly Doji with Pivot Points

Pivot Points provide automatic support and resistance levels. Use these levels to trade the Dragonfly Doji pattern. Steps include:

- Activate the Pivot Points indicator on the chart.

- Identify Pivot Points below the current price, which act as support.

- Wait for a price decline to a Pivot Point level.

- Check for a Dragonfly Doji at that level, indicating rejection.

- Enter a long position when the price breaks above the Dragonfly Doji's high.

- Set stop-loss and take-profit levels, anticipating an upward move.

Summary

The Dragonfly Doji is a bullish reversal pattern that appears after a price decline, signaling a potential market reversal. To enhance trading accuracy, combine the Dragonfly Doji with other technical analysis tools, such as pullbacks, moving averages, RSI divergences, Fibonacci retracements, and Pivot Points. The success rate of the Dragonfly Doji pattern is 51%.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.