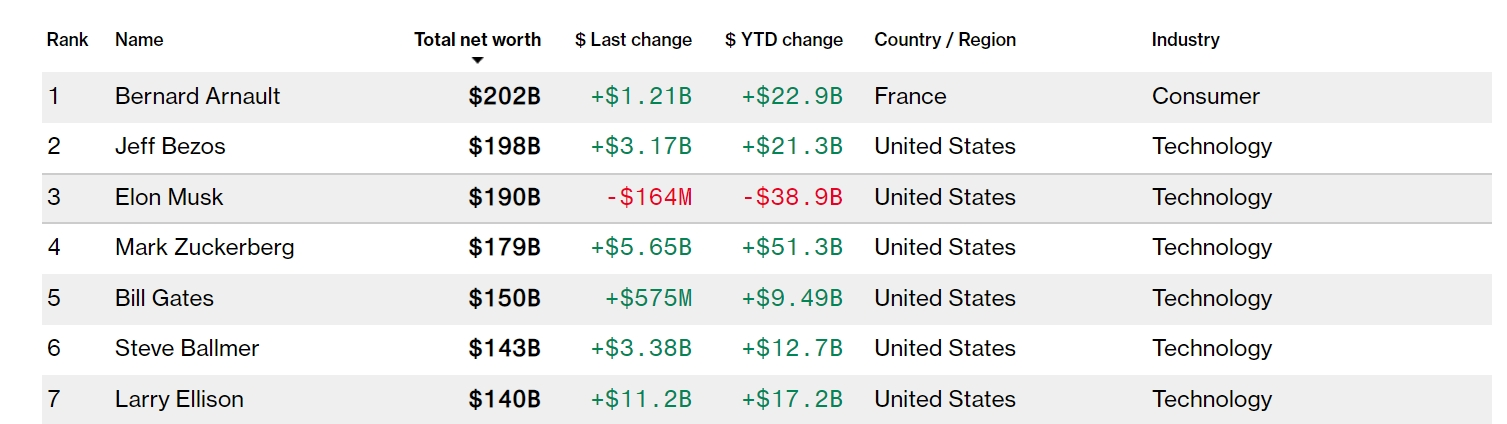

Bloomberg global rich list: Zuckerberg's worth skyrocketed by $51 billion, about to surpass Musk

The data shows that Zuckerberg's net worth is currently $179 billion, not far from Musk's $190 billion, whose wealth has shrunk by nearly $40 billion this year.。

On March 13, Bloomberg's list of the world's richest people showed that Meta CEO Mark Zuckerberg's worth has increased significantly, surging by $51 billion this year.。It may soon overtake Tesla CEO Elon Musk to become the third richest person in the world.。

The data shows that Zuckerberg's net worth is currently $179 billion, not far from Musk's $190 billion, whose wealth has shrunk by nearly $40 billion this year.。

Zuckerberg's worth surges as Meta shares rise

The bulk of Zuckerberg's fortune comes from his 13% stake in Meta, whose shares have surged 43% this year.。The surge in Meta's share price is inseparable from its outstanding performance。

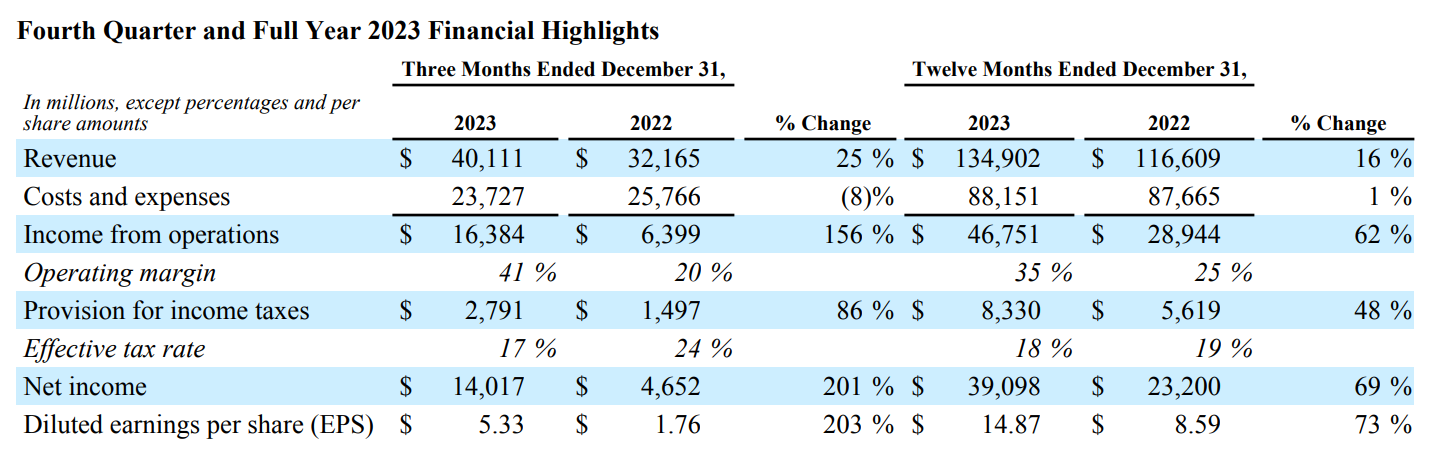

On February 2, according to Meta's financial results for the fourth quarter of 2023 (ended December 31) and the full year 2023, Meta's fourth quarter revenue was as high as 401.$1.1 billion, up 25% from the same period last year; net profit increased 201% to 140%.$1.7 billion, with growth rates climbing over several quarters。In addition, Meta's full-year revenue in 2023 is 1,349.$0.2 billion, up 16% YoY; net profit up 69% YoY to 390.$9.8 billion。

Meta's performance surged, mainly due to the outstanding performance of the advertising business.。Meta's advertising revenue was 387 in the fourth quarter, data show.$06 billion, exceeding expectations of $37.8 billion, with the business accounting for more than 96% of total revenue.。For the full year 2023, Meta ad impressions grew 23% year-on-year, directly reversing the downward trend in ad unit prices in the fourth quarter to a positive growth of 2%。

For the future, Meta also announced strong performance expectations。In the first quarter of 2024, Meta expects total revenue to fall in the $34.5-37 billion range, with a corresponding change of 20% -29% year-over-year growth, significantly exceeding consensus expectations of $33.6 billion and continuing to lead the industry.。

Institutional analysis, Meta can still lead the industry in 2024。On the one hand, this is mainly due to the fact that Temu is still expanding its territory around the world, and with the penetration of Temu in the area covered by Meta, Meta is still able to eat Temu's advertising;。

Global electric vehicle demand slows Tesla shares underperform

Tesla shares, by contrast, are down about 29 percent this year, largely due to investor concerns about slowing global demand for electric vehicles.。

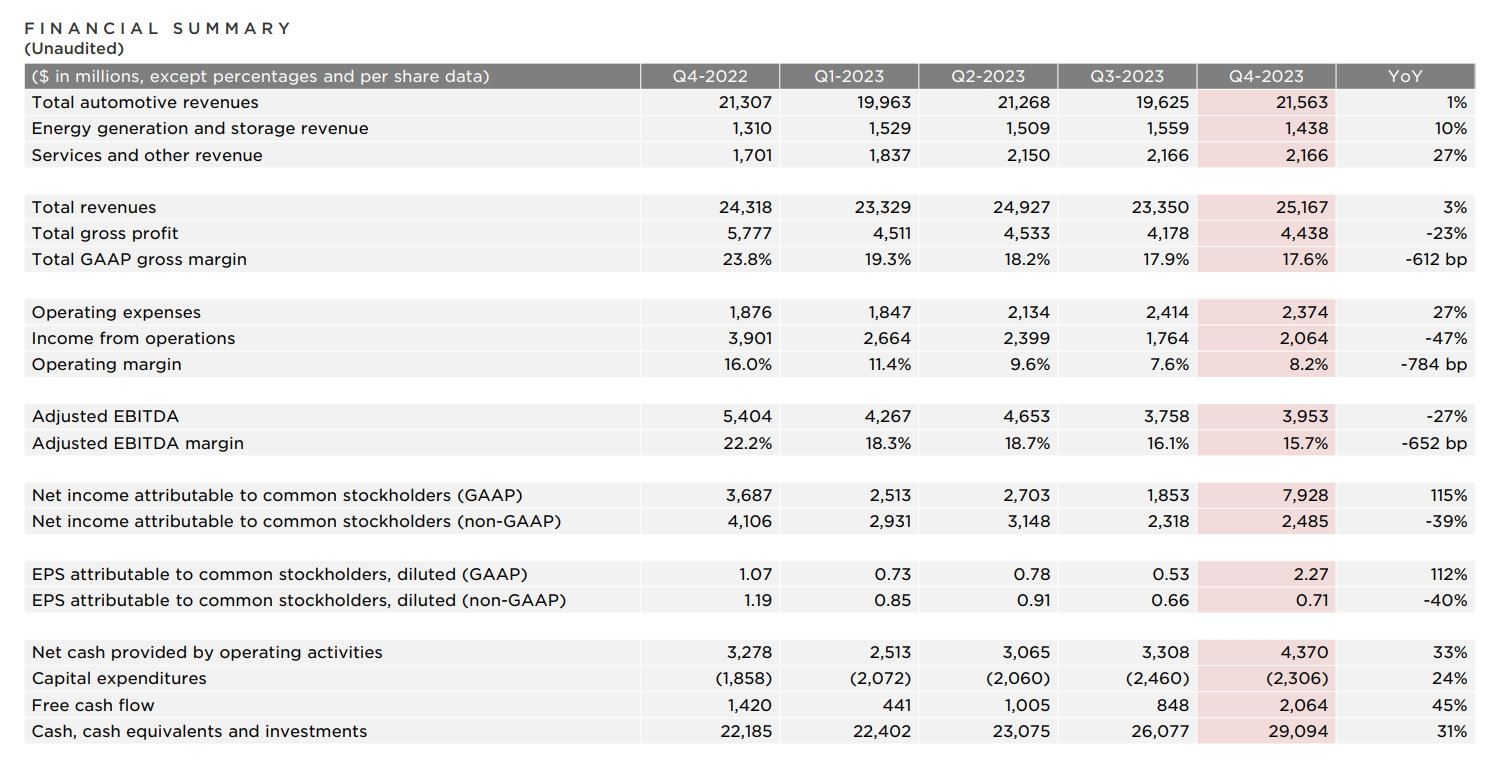

According to Tesla's fourth-quarter and full-year results for 2023。Data show that Tesla's revenue reached 251 in the fourth quarter of 2023.$700 million, misses analyst expectations; achieves net profit of 79.$2.8 billion; gross margin fell to 1.7.6%。

In its earnings report, Tesla said the company is currently in between two major waves of growth and said delivery growth in 2024 could be significantly slower than in 2023.。

According to an analysis by Bernstein, a well-known Wall Street investment firm, 2024 "looks difficult" for Tesla, and "investors will gradually question Tesla's growth prospects, especially as we believe that Tesla's deliveries will grow at less than 20% in 2024 and 2025," a figure well below Tesla's previous 50% annual growth target.。

For the full year 2023, Tesla delivered a total of 180.860,000, up 38% YoY; production was 1.85 million, up 35% YoY。In other words, Bernstein believes that Tesla will deliver up to 2.17 million vehicles in 2024.。Based on the "disappointing" delivery growth rate and the impact of car price cuts, Tesla's profitability will also be further reduced in 2024, and gross profit margin may fall to 15.7%, lower than the market consensus of 17.8%。

HSBC also believes that Tesla electric vehicle demand "seems to have stabilized"。HSBC analysts said that while Tesla will remain price competitive, slowing demand for electric vehicles will give other EV makers more "lead time" and Tesla will face tougher competition.。

By the close of trading on March 12 EST, Tesla was down 0.13%, closed at 177.$54, down 28 since the beginning of the year.55%; Meta has been soaring, rising again yesterday by 3.34%, closed at 499.$75, up 41 since the beginning of the year.34%。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.