Oil weekly recorded the largest increase in nearly three months Inflation concerns may affect the Fed's rate cut plan.

Since lower interest rates can reduce consumer borrowing costs, thereby boosting the economy and boosting oil demand, if the central bank delays the pace of rate cuts in the future because inflation is rising again, this could in turn hit oil prices.。

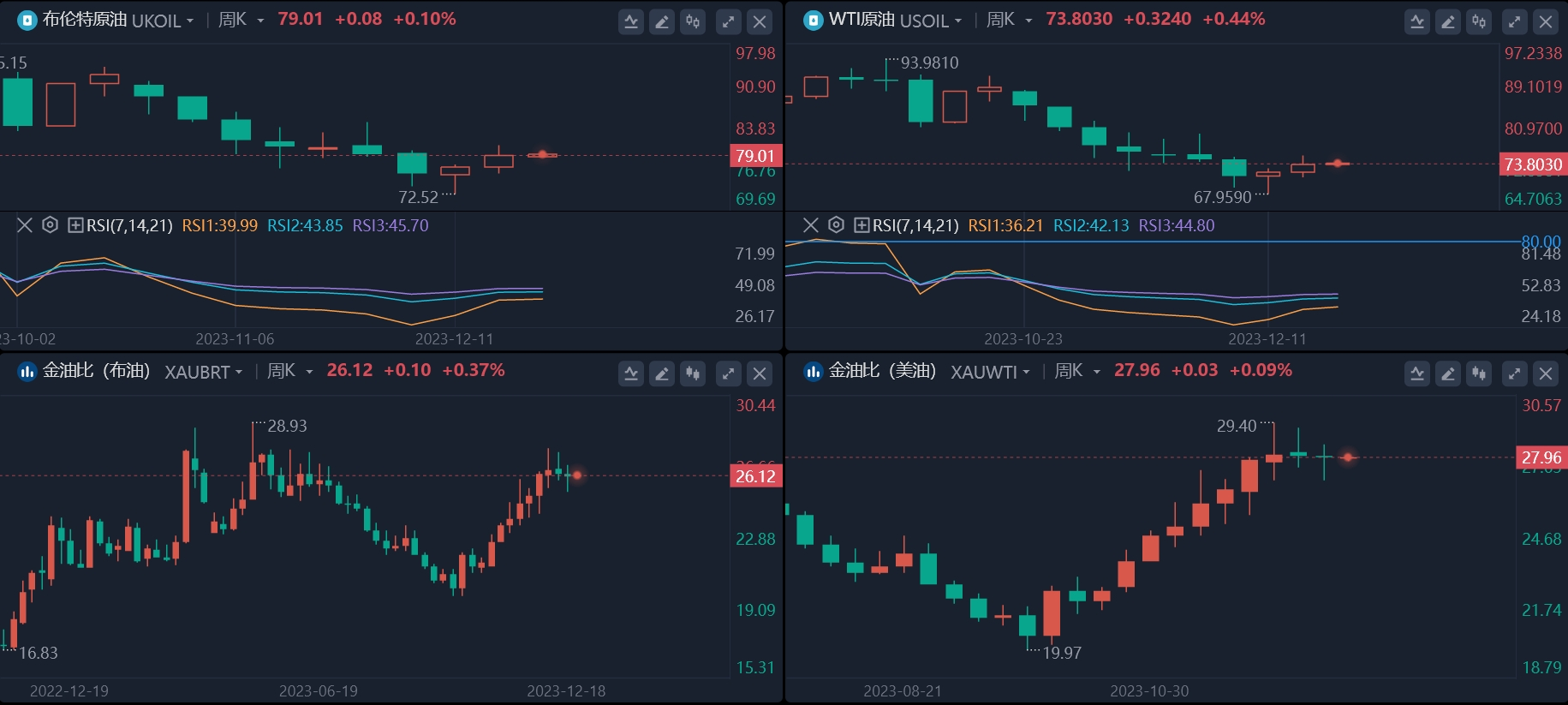

December 26 Asian market, international oil prices continue to maintain consolidation。Investors continue to focus on geopolitical tensions in the Middle East, Fed rate cuts, and optimism to boost global economic growth and fuel demand。Brent up 0 as of press time.1% at 79.01 USD / bbl; WTI crude up 0.44%, at 73.$80 / barrel。

Trading is relatively light as some markets remain closed due to the Boxing Day public holiday。Analysts expect a possible lack of liquidity in the crude oil market in the week between the Christmas and New Year holidays。First, the total number of open positions in major oil contracts has been lower since the middle of the month; second, the implied volatility of crude oil trading has also declined in recent weeks.。

Last week, tensions in the Middle East were heightened as Houthi attacks on ships in the Red Sea-Suez Canal corridor disrupted global shipping and trade.。Affected by the news, the global benchmark Brent oil prices rose more than 3% last week, the biggest gain since October, once exceeded $79 / barrel, WTI crude oil prices are close to $74 / barrel。In addition, the term spread of Brent crude oil has recently risen to 18 cents a barrel, in a state of backtracking, which is a bullish signal for oil prices.。

Still, according to analysts, the recent rally in international oil prices is expected to only help scale back the quarterly decline, but its full-year price could still fall by about 8 percent。Traders are also concerned that the global crude oil market could face oversupply next year, which would put pressure on oil prices by making OPEC + plans to cut production.。

In addition, under the Houthi attacks, shipping companies have been forced to choose to divert routes, which will result in higher shipping costs, which will not be passed on to the consumption segment in the future, thus exacerbating inflation levels.。

According to Clarkson Research Services, the gross tonnage of container ships arriving in the Gulf of Aden last week plummeted by 82% compared to the first half of the month.。If you choose to detour around the Cape of Good Hope in Africa, the route will be forced to add 3,000-3,500 miles and the voyage will be extended by 10 to 14 days, and last week the market prices of some Eurasian routes rose to a three-year high.。Logistics experts expect that once the Red Sea route is affected for more than a month, the supply chain will feel inflationary pressure, which will then eventually be borne by consumers.。

Inflation moving from the upstream cost side to the downstream may also have other negative effects.。For example, rising inflation could force the central bank to reconsider tightening monetary policy or slow the pace of interest rate cuts, a move that could affect markets。Since lower interest rates can reduce consumer borrowing costs, thereby boosting the economy and boosting oil demand, if the central bank delays the pace of rate cuts in the future because inflation is rising again, this could in turn hit oil prices.。

In response, former Goldman Sachs chief economist and Goldman Sachs Asset Management Chairman O'Neil (Jim O'Neil) said recently that the experience of the past few years shows that prices may be severely affected by uncertainty and unknowns.。

In addition, UBS CEO Sergio Ermotti (Sergio Ermotti) also believes that he does not believe that central banks have controlled inflation.。In an article published in the middle of this month, he said, "One must never try to make predictions about the coming months - it's almost impossible.。The trend seems to be favorable, but we'll have to see if it continues。If inflation in all major economies is close to the 2% target, central bank policy may ease somewhat。In today's environment, it's important to be flexible.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.