Saudi Arabia has been "backstabbed."?Russian crude oil shipments increased instead of decreasing. WTI crude oil erased this week's gains.

On June 7, WTI crude oil fluctuated within a narrow range during the day and is currently trading at 71.Near $28 / bbl, completely erasing gains from the first trading day of the week due to the production cut agreement, the weekly level fell nearly 1%。

The stimulus to oil prices from the OPEC-plus production cut seems to have come to an abrupt end.。

On June 7, WTI crude oil fluctuated within a narrow range during the day and is currently trading at 71.Near $28 / bbl, completely erasing gains from the first trading day of the week due to the production cut agreement, the weekly level fell nearly 1%。

Russia to "sneak away" Saudi production cuts to stabilize oil prices or backfired

On Sunday, June 4, OPEC + reached an agreement to extend the production cuts already agreed in 2023 until the end of the year and to adjust its production target to 40.46 million barrels per day from 2024.。Separately, Saudi Arabia said it would implement an additional 1 million bpd production cut in July, and has since raised its official oil sales price for all regions in July.。Boosted by news, WTI crude oil opened up 3% this week at 74.$11 / barrel。

Originally, Saudi Arabia's move was intended to stabilize crude oil prices, and OPEC + together "proactive, pre-emptive," with the actual production cuts to help stabilize the crude oil market.。But contrary to expectations, according to people familiar with the matter, at least three Asian refiners are considering reducing the amount of crude they bought from Saudi Arabia in July in favor of buying more from Russia and Africa, and may use the spot market to obtain cheaper shipments.。

While some traders have said that buyers may find it difficult to obtain spot crude oil as the usual trading cycle passes and there is little spot in July, Saudi Arabia's market share is actually shrinking due to refiners' "backstabbing."。In response, SDIC Essence Futures Co (SDIC Essence Futures Co..) Gao Mingyu (Gao Mingyu), chief energy analyst in Beijing, said the (Saudi) move is contrary to the market and will make alternatives such as Russian crude more attractive to buyers.。

In fact, after the OPEC + ministerial-level meeting, in addition to Saudi Arabia, Russia also announced its plan to extend production cuts.。On the same day, Russian Deputy Prime Minister Alexander Novak said that the country's measures to reduce crude oil production by an additional 500,000 barrels per day will be extended until the end of 2024, which was originally scheduled to end at the end of this year.。It is estimated that by 2024, Russian crude oil production is expected to be cut to an average of 932 per day..80,000 barrels。

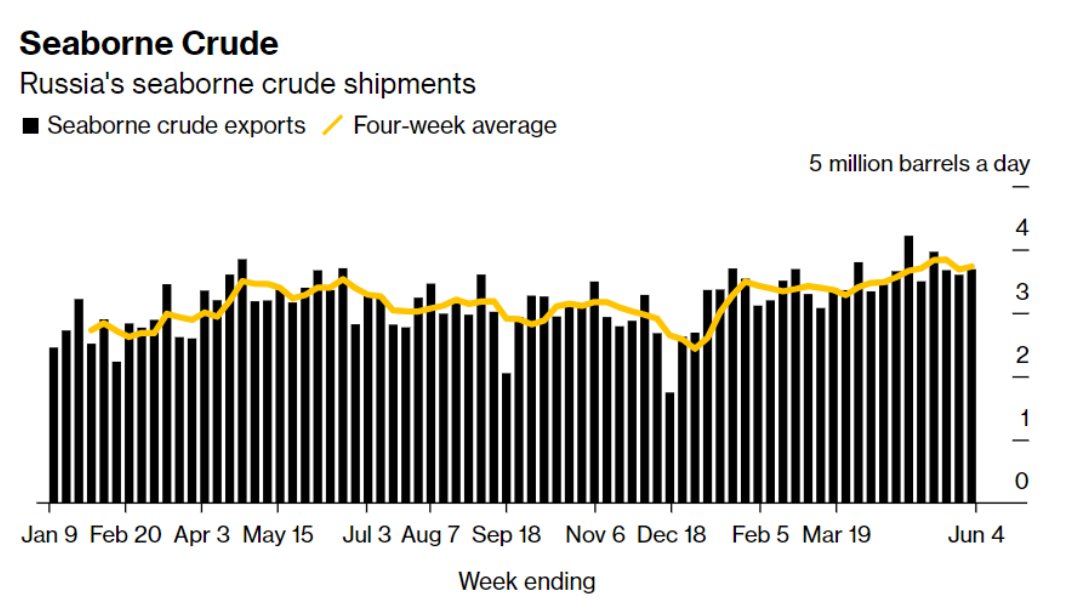

Surprisingly, according to tanker tracking data compiled by the statistical agency, Russian crude oil flows to international markets have increased rather than decreased。Russia's average weekly seaborne shipments were slightly higher as of June 4, rising to 3.73 million bpd from a revised 3.68 million bpd as of May 28.。According to statistics, Russia's crude oil flow to the international market increased by more than 1.4 million barrels per day compared with the end of last year, which far exceeded the export increment caused by pipeline flow transfer or refinery operating rate decline.。

In fact, this is not the first time Russia has "stolen"。In early April this year, the Russian Ministry of Energy revealed that the country's oil production in March fell by about 700,000 barrels per day, according to media reports citing people familiar with the matter.。Russia had previously promised a reduction of 500,000 barrels per day between March and December, and according to this set of claims, Russia actually had to cut production by an additional 200,000 barrels per day in March.。However, according to the market's tanker tracking data, in the seven days ended March 31, the country's crude oil shipments surged by 1 million barrels per day, even reaching a new high of 4.13 million barrels per day, completely in line with Russian energy ministry commitments.。

Regardless of the actual situation, Russia is likely to eat the dividends of OPEC + production cuts and Saudi volume and prices in this event, earning a lot of money before the summer season.。It's just that the boost to oil prices from the production cut effect didn't last long: previously, ANZ had said the likelihood of a sharp rebound in oil prices had risen sharply。

EIA expects U.S. crude oil production to increase year after year, World Bank warns of weak economic growth this year and next.

Fundamentally, there's bad news。

According to the U.S. Energy Information Administration (EIA), U.S. crude oil production is expected to rise to 12.6 million barrels per day this year from 11.9 million barrels per day in 2022 and is expected to reach 12.8 million barrels per day in 2024.。Separately, the World Bank said on Tuesday it expects global economic growth this year to rise from 3 percent in 2022..1% slowed to 2.1 percent, and warned of weak economic growth this year and next, as rising interest rates slow consumer spending and business investment and threaten the stability of the financial system.。

It's worth noting that Goldman Sachs today lowered its chances of a U.S. recession over the next 12 months, from 35 percent to the current 25 percent, as pressure on the banking sector eased and the two parties reached an agreement to suspend the U.S. debt ceiling.。

In response, Goldman Sachs chief economist Jan Hatzius (Jan Hatzius) said: "We are more confident in our benchmark estimates that banking pressures will only cause zero real GDP growth this year..A moderate drag of 4 percentage points as regional bank share prices stabilized, deposit outflows slowed, loan volumes remained unchanged and loan surveys showed limited future tightening。Plus, the tail risk of a damaging debt ceiling fight is gone。"

However, the bank also admits that its own views are much more optimistic than those of its peers。It is understood that Wall Street generally believes that the probability of a recession is 65%。In addition, Goldman Sachs forecasts U.S. economic growth for 2023 at 1.8%, while the general consensus of the foreign media survey is 1.1%。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.