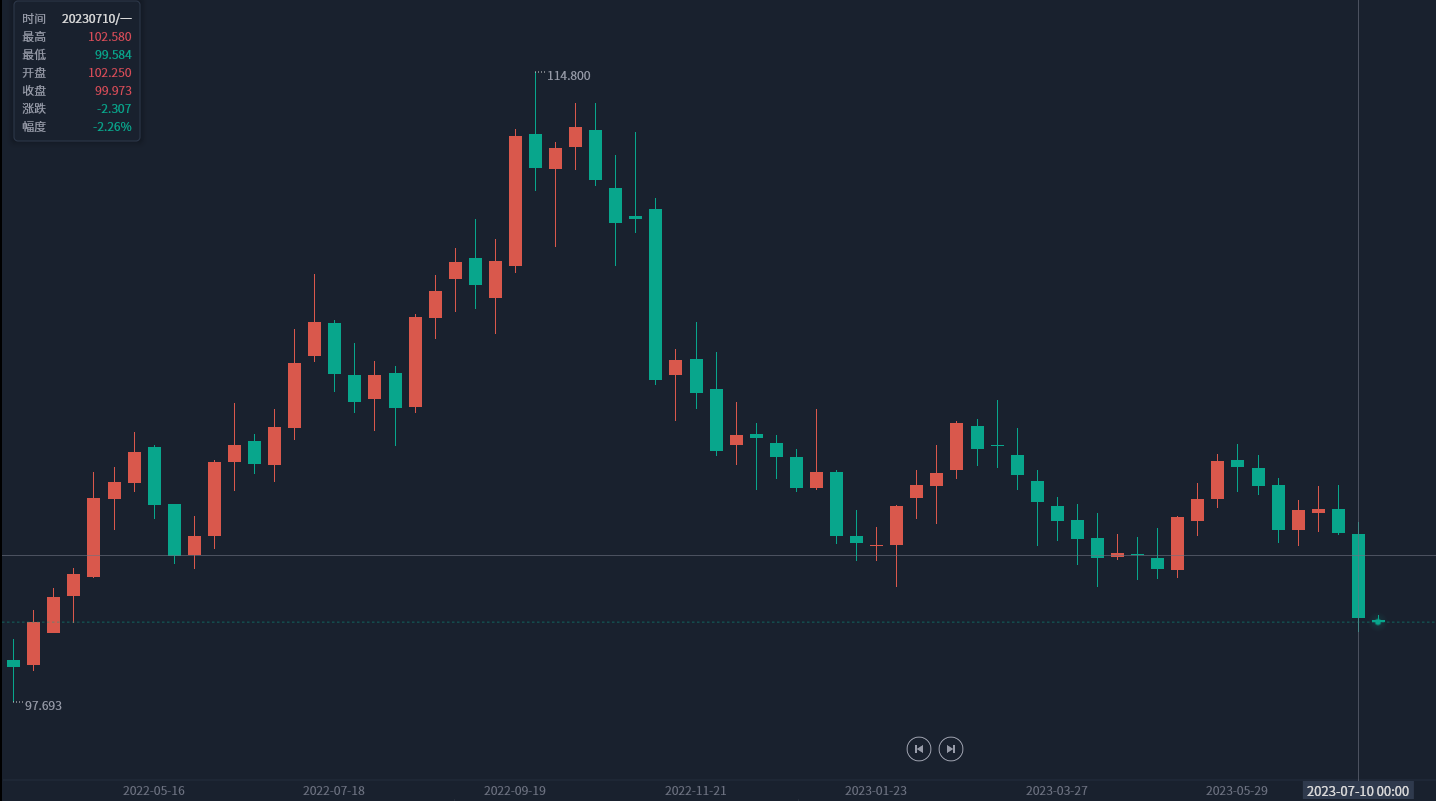

WTI crude oil continued its decline this week after traders took profits and left the market.

Dollar volatility affects commodity prices, and the end of negative events could also lead to increased oil market supply in the short term。

On July 17, WTI crude oil traded at 74.Near $43 / bbl, down 0 on the day.96%, did not stop the previous decline。

This week, oil prices continue to run weak, "terror data" will be released again.

On Friday, WTI crude fell nearly 2.5%, ending the previous three consecutive positive trends at the daily level.。Traders analyzed that oil prices fell as the dollar strengthened during the session and traders took profits to leave the market.。Last week, the U.S. index in the first four trading days all the way down, although on Friday to stop the plunge, the weekly level is still down more than 2%。

Expectations that the Fed is about to end its rate hike cycle have risen further due to recent weak U.S. economic data。However, according to CME Fed Watch, the probability of the Fed raising interest rates by 25 basis points in July has come to 96.1%, the rate hike has been almost fully priced in by the market, and the bank's probability of keeping the policy rate cap unchanged this month is only 3.9%。

Now, before the July 25-26 meeting, Fed officials have entered a period of silence, in the absence of more information, the market can only wait and see what happens。On the data, before July 26, the United States has a series of manufacturing data and real estate data has not yet been released, but is expected to have little impact on the overall interest rate hike.。

In addition, the monthly rate of retail sales in the United States, known as "terrorist data," will be released on July 18.。Because consumer spending accounts for a large share of U.S. GDP, the data generally attracts market attention。According to economists, the data will record 0.5%, higher than the previous value of 0.3%。It is worth noting that since March this year, the data only published in June is higher than the forecast, the rest are below the forecast。

Libya Protests End Market Worries Oil Prices Under Pressure

Dollar volatility affects commodity prices, and the end of negative events could also lead to increased oil market supply in the short term。

Last week, according to media reports, Libya temporarily closed one of its largest oil fields, the Sharara oil field, due to protests.。According to two engineers at the field last week, oil production in Shalala had been gradually halted on Thursday and completely shut down on Friday.。The country's 70,000 bpd Elephant (El Feel) oil field has also been attacked by protesters.。

Separately, Shell suspended the loading of Nigerian Fecados crude due to a possible leak at one terminal.。

A series of incidents caused quite a stir in the oil market last week.。Brent September crude oil futures closed up 1 on Friday..$25, up 1.56%, reported 81.$36 / bbl, 11-week high。In response, PVM analyst John Evans said that the loss caused by the interruption of Libyan crude oil supply is estimated at 370,000 barrels per day, while the loss caused by the interruption of Nigerian crude oil supply is estimated at 22..50,000 barrels per day。

On July 17, the protest finally came to an end.。According to the media, the Shalala oil field has resumed production after the protesters ended their demonstrations, and last Sunday, the Elephant oil field was restarted.。Market fears that an increase on the supply side of crude oil from Libya will keep oil prices under pressure。

Chang'an Futures said that last week, international oil prices as a whole strong run, but the weekend time a certain degree of decline, Monday U.S. oil opened also weak run。The agency expects oil prices to be briefly weak in the short term or under the influence of the resumption of supply from Libyan oilfields, but there is still strong support below oil prices, given the expected recovery on the demand side and the difficulty of seeing changes in the supply side's continued tight state.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.