Oversupply + hedge funds bearish international oil prices continue to be under pressure

Predictably, international oil prices will continue to be under pressure for some time.。

International oil prices rise ahead of Fed's December rate decision。Oil distribution up 0.73%, reported 76.$71 / bbl, US oil up 0.77%, at 72.$13 / barrel。

Oil prices rose on Tuesday mainly as investors remained cautious ahead of the interest rate decision and inflation data, but market concerns about oversupply of crude oil and slowing demand growth still held back oil prices, analysts said。IG market analyst Yeap Jun Rong (Yeap Jun Rong) said in the latest research paper: "All attention will be focused on today's U.S. CPI data, which may set the tone for the upcoming meeting of U.S. policymakers."。

On Tuesday, the United States will release the November quarterly CPI annual rate, according to economists forecast, the CPI data will be further slowed from the previous month, the forecast value of 3.1%, the previous value is 3.2%, to achieve two consecutive decline。It is worth noting that the release of the inflation data will coincide with the Fed's December meeting, the market's relatively optimistic sentiment on inflation is also indirectly reflected in the relevant interest rate futures market.。According to CME "Fed Watch," the probability of the Fed keeping interest rates unchanged in December has reached 98.4%, the probability of a 25 basis point rate hike is only 1.6%。

The market's only scruples are that the Fed mentioned in the minutes of its November meeting that policymakers remain concerned that inflation may be stubborn, suggesting that the FOMC committee may still vote to restart rate hikes in December.。With the market almost completely pricing interest rates unchanged, this Fed decision will certainly have a shock to the market。

In the oil market, according to two U.S. defense officials, a cruise missile fired from Houthi-controlled Yemen hit a commercial chemical tanker on Monday, causing fire and damage, but no casualties.。A Houthi attack on ships in the Red Sea would escalate geopolitical tensions in the region and heighten safety risks for tankers on vital shipping lanes, boosting oil prices somewhat this week.。

Still, the market is concerned about supply problems in the oil market。While OPEC + has pledged to cut production by 2.2 million bpd in the first quarter of 2024, production growth in non-OPEC + countries is expected to lead to an overall oversupply in the oil market next year, including the United States.。ANZ Bank Research analysts said in a note: "Growth in the U.S. shale oil business continues to rise surprisingly, and production from other non-OPEC + producers has also risen unexpectedly.。"

On this issue, analysts and traders agree that this level of production cuts will not go far enough to boost oil prices, as physical and futures prices of crude oil are already showing increasing signs of excess before the production cuts are implemented.。

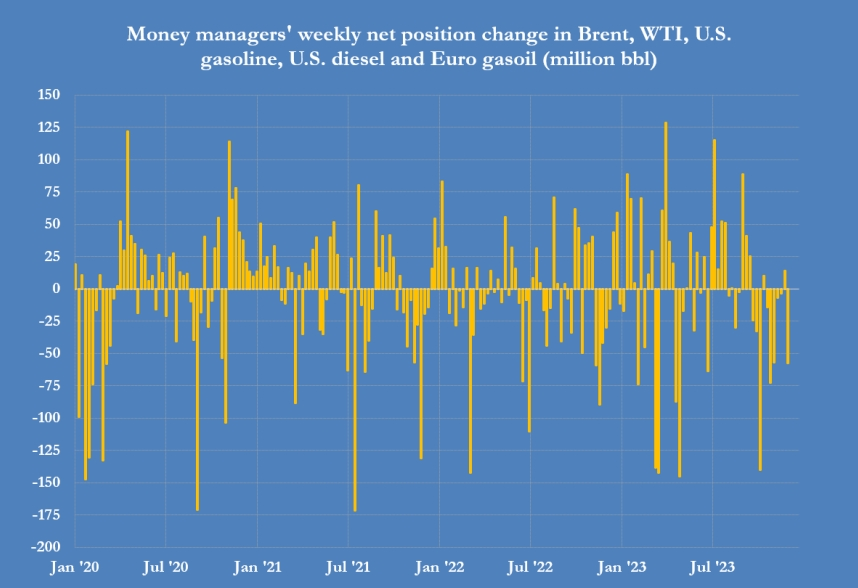

From the trading market, investors are also constantly bearish on the outlook for crude oil。According to the position data disclosed by traders, the bearish situation encountered by crude oil at present is quite rare.。In the seven days ended Dec. 5, hedge funds and other money managers sold the equivalent of 58 million barrels of the six most important oil futures and options contracts.。Separately, according to exchange and regulator records, since Sept. 19, fund managers have sold off oil in nine of the last 11 weeks, shedding a total of 3.8.5 billion barrels。

Fund managers seem to have concluded that under the current circumstances, Saudi Arabia and its OPEC + partners are no longer able to boost prices with further production cuts.。At the same time, the increasing energy production in the United States has also continued to put pressure on the already high supply of crude oil, resulting in the spot price of international oil prices being kept down.。While current oil prices are already slightly below the long-term average after adjusting for inflation, that still doesn't stop hedge fund bearish sentiment from heating up。

Predictably, international oil prices will continue to be under pressure for some time.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.