Does the "stock god" stop buying stocks?

On November 15, Berkshire Hathaway, a subsidiary of Buffett's "stock god", submitted its 13F position report as of September 30, 2024.For specific details, Hawk Insight brings you.

In terms of market value, Buffett continued to sell U.S. stocks in the third quarter.The total market value of Berkshire Hathaway's holdings fell 14 billion to $2,660 from $280 billion, net selling of U.S. stocks for the eighth consecutive quarter.In the second quarterly report, Berkshire's cash reserves peaked at US$276.9 billion, but in this third quarterly report, Berkshire's cash reserves still increased by 17.4%, reaching an astonishing US$325.2 billion. Buffett's cash was "hoarding crazy."

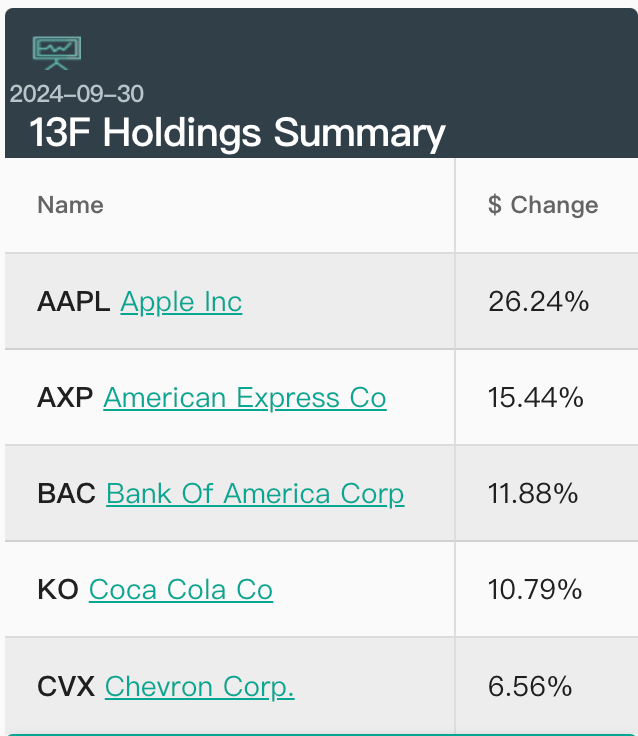

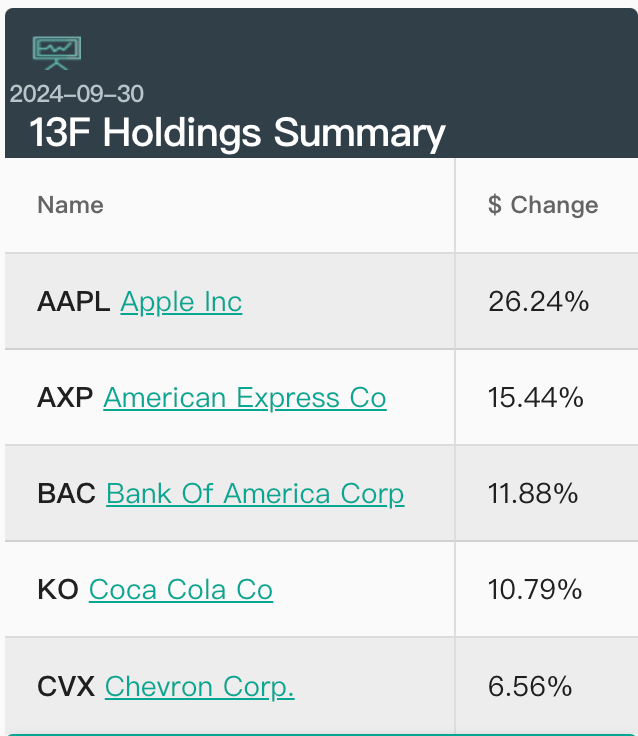

Among the top five biggest stocks, Buffett's favorites are still Apple, American Express, Bank of America, Coca-Cola, and Chevron.

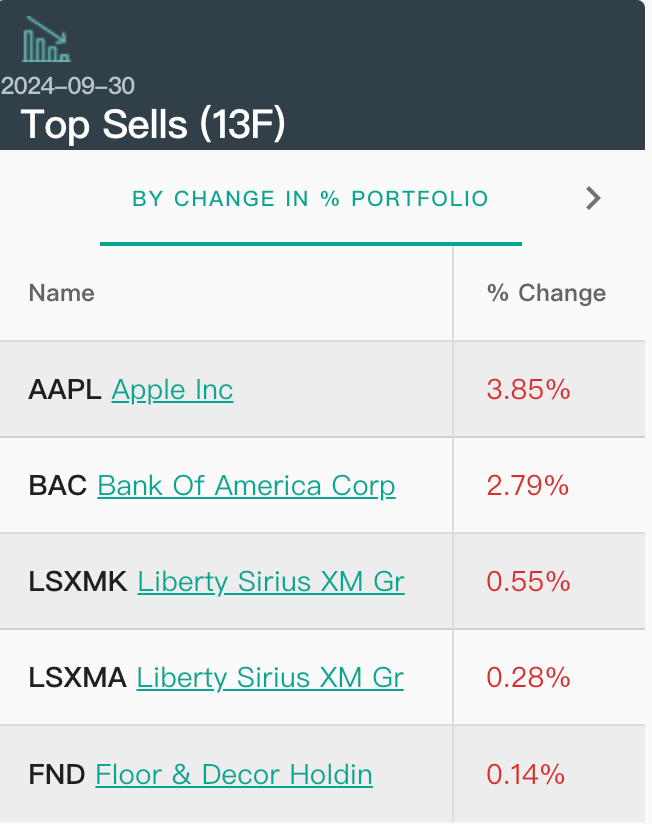

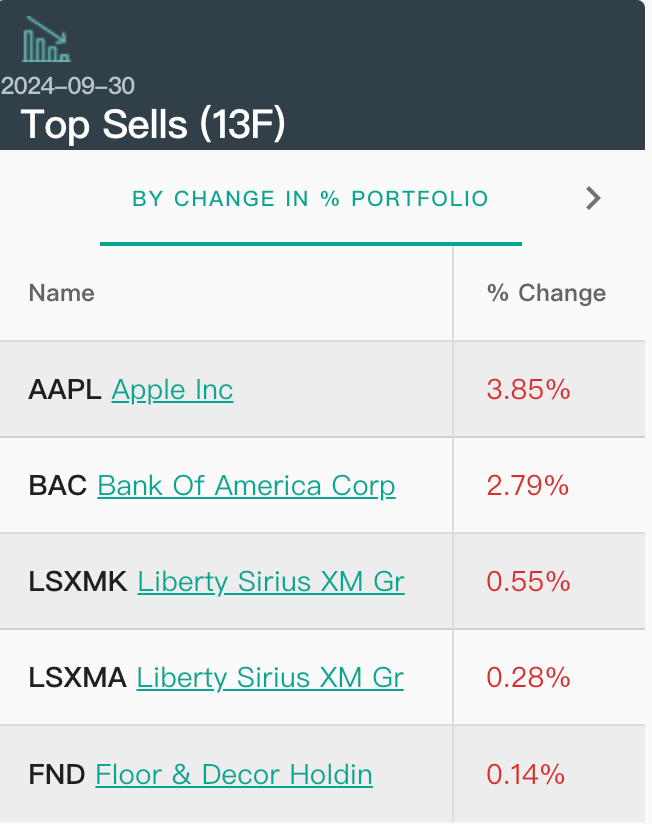

It is worth noting that Buffett once again reduced his holdings of Apple's largest holding stock in the third quarter, reaching 100 million shares, and his holdings fell to 26.24% from 30.09% in the previous quarter.Analysts said that Buffett reduced his holdings of Apple may be due to reasonable control of positions.Buffett has previously said that he believes short-term U.S. bond yields are more attractive than "alternative investments in the stock market."According to FactSet, Apple currently trades on a price-to-earnings ratio of 30 times.

In addition to Apple, Berkshire's reduction in Bank of America is also continuing. As of the end of the third quarter, Bank of America's shareholding ratio has also dropped to 10.4%.Regarding Buffett's continuous reduction of heavy positions, the analysis believes that the market does not need to over-interpret it.Bill Stone, chief investment officer of Glenview Trust, told reporters: "Stock prices, including Apple and Bank of America, have not gotten cheaper since then.Maybe it's that simple.”

Another event worthy of attention is that the position Buffett accidentally established in the second quarter of this year on U.S. beauty retail giant Ulta Beauty has almost been cleared.Analysts believe that Buffett cleared Ulta mainly because the company's second-quarter earnings fell short of expectations and lowered its full-year outlook.

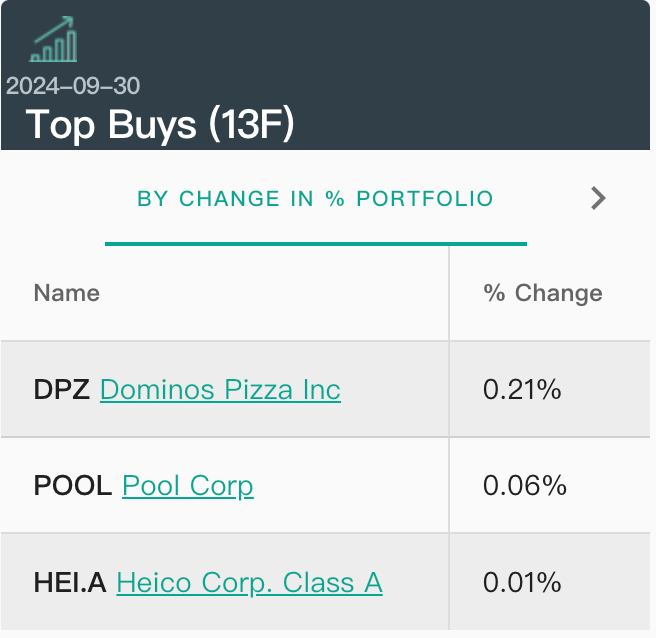

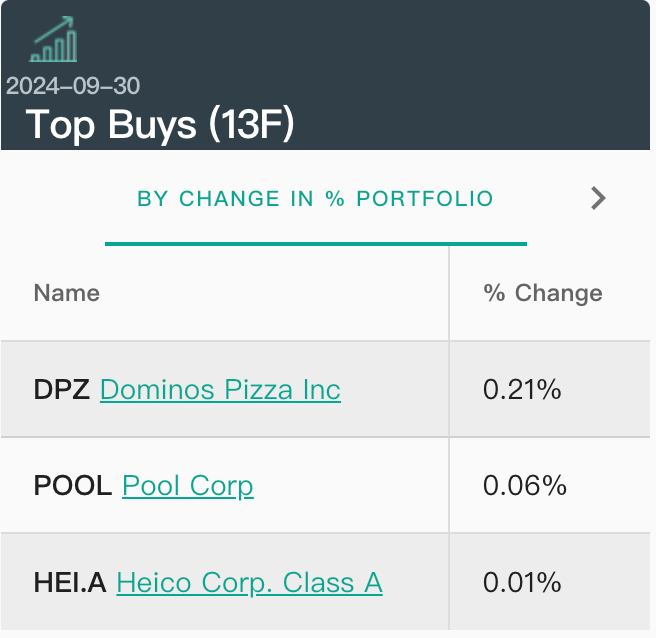

In terms of increased holdings, Berkshire Hathaway bought Domino's Pizza, pool supplies distributor Pool and Haike Airlines in the third quarter, with Domino's Pizza and Poole buying for the first time.The market believes that both Domino's and Poor's have lagged behind the overall market this year, and the low valuation is precisely one of the reasons why Buffett chose to open a position.

Looking at Berkshire's 13F report this season, Buffett has continued his steady style this year.By the end of September, he had purchased only $5.8 billion worth of shares, but sold shares worth as much as $133.2 billion.Some analysts believe that these sales reduce Berkshire's stock risk and provide sufficient liquidity for future investments in case of emergencies during stressful times.

Some analysts said Buffett sold stocks and hoarding cash in order to create funding conditions for his successor.It is understood that the 93-year-old Buffett has chosen a successor after retirement-Greg Abel, 61, vice chairman of Berkshire's non-insurance business, and Buffett's eldest son Howard may become the company's non-executive chairman.

On the other hand, for Berkshire itself, the company also needs to maintain large cash reserves: its investment portfolio needs to be prepared at all times to meet the compensation needs of its huge insurance business.