What is common stock?

Common stock is a major type of security, and investors can purchase a portion of a company's shares with each share of stock。Common stock usually has some benefits, such as the right for investors to vote for a company's board of directors and even the right to vote to change company policy。

About 400 years ago, the East India Company first introduced "common stock" on the Amsterdam Stock Exchange.。In the United States today, common stock is most commonly traded on the New York Stock Exchange and Nasdaq。

Common stock is the main type of security that represents partial ownership of a company and is a type of stock that gives investors ownership of the company, usually with some voting rights。

There are often benefits, such as the right of investors to vote for company board members and even the right to vote in decisions that change company policy; but there are also considerations, such as owning stocks is sometimes riskier than owning bonds。

Common stock is also different from preferred stock, which gives investors priority in income (dividends) based on the number of preferred shares they hold.。Common stockholders also sometimes receive dividend income, but only after preferred stockholders receive dividends。

What are the characteristics of common stock??

- Availability: This is the most common way investors own part of a company。

- Voting rights: These shares often come with voting rights that give investors a say in some decisions, such as selecting board members, and certain corporate events, such as mergers, acquisitions, or stock splits。

- Dividends: Maybe not every company will pay dividends。But when the company pays dividends, common shareholders have the opportunity to receive dividends (after preferred shareholders receive dividends)。

What is the difference between common and preferred shares??

Both common and preferred shares give investors the opportunity to own a portion of the company.。But as the name suggests, preferred shares have some benefits:

- Enjoy dividends: If the company pays a dividend, the preferred shareholders will receive the dividend first, and then the common shareholders will see the possible remaining dividends.。If the company eventually suspends its dividend, the preferred shareholder's dividend will accrue。If the company resumes dividends, preferred shareholders receive dividends first, and then common shareholders receive a penny。Common stockholders do not accrue any missed dividends。

- Dividend amount: The dividends paid to preferred shareholders are fixed (similar to the interest payments on bonds are fixed), while the dividends paid to common shareholders are variable and vary according to the decision of the company manager。

- Less risk: if the company fails, preferred shareholders have a priority claim on the company's remaining assets relative to common shareholders (assuming the company has remaining funds after repaying creditors)。

- Stock class conversion: Preferred shareholders sometimes have the opportunity to convert their preferred stock into common stock, which is known as convertible preferred stock。This is a stock that means that in the future the owner of the stock, the company's board of directors, or the company may convert preferred stock into common stock on the plan date。

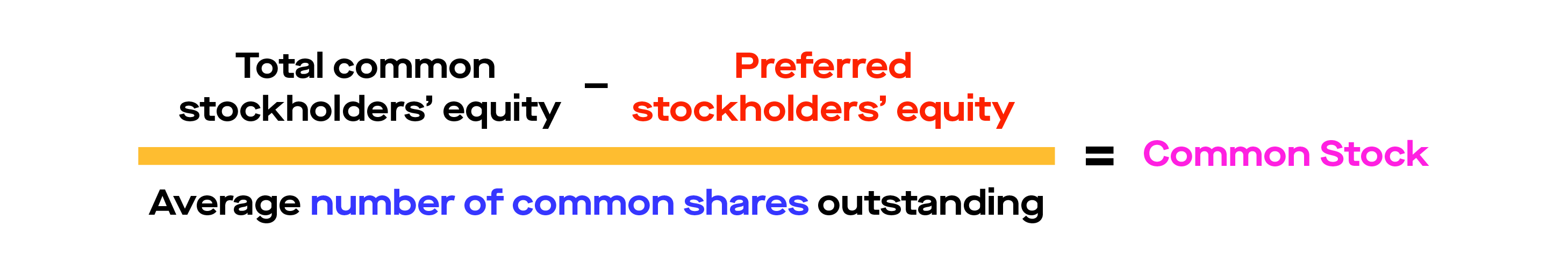

How to Calculate the Book Value of Common Stock?

In the balance sheet, common stock is usually listed in the shareholders' equity section, which appears on the balance sheet along with other types of stock such as preferred stock and treasury stock。Treasury stock usually refers to the company's previously issued common stock, which has been purchased from shareholders, but the company has not yet retired.。

The book value of common stock rarely matches the market value of common stock - market capitalization is driven by stock market investors, while book value is driven by company assets and accounting。

Why do companies issue common stock??

Private and public companies usually have common stock.。However, within private companies, common stock is often left to founders, investors and even some employees。When private companies go public, they can sell their shares in a similar way for cash through an initial public offering (IPO), but so that their shares can be publicly traded。

For companies, issuing additional common stock or through an initial public offering process can be a means of raising capital and an alternative to raising debt。Companies can use the proceeds from the sale of common stock to invest in their own development, repay debt, acquire another company, or simply keep more cash。

Issuing common stock is an attractive alternative to debt because companies can pay dividends to common stockholders when they have cash, without having to pay interest on the debt。But the problem is that selling shares means that the company sells its partial ownership (or even voting rights), diluting the ownership of all other shares.。

How to Buy Common Stock?

Common shares can be purchased on the open market or through the private market (less flexible, less easy to enter, and less easy to buy and sell)。In the open market, shares can be traded on the stock exchange throughout the day。In most cases, investors buy shares through traditional brokers, online brokers and sometimes directly from companies.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.