Domestic Autos Lead the Way: Malaysia Q2 Auto Sales Catching up with Indonesia

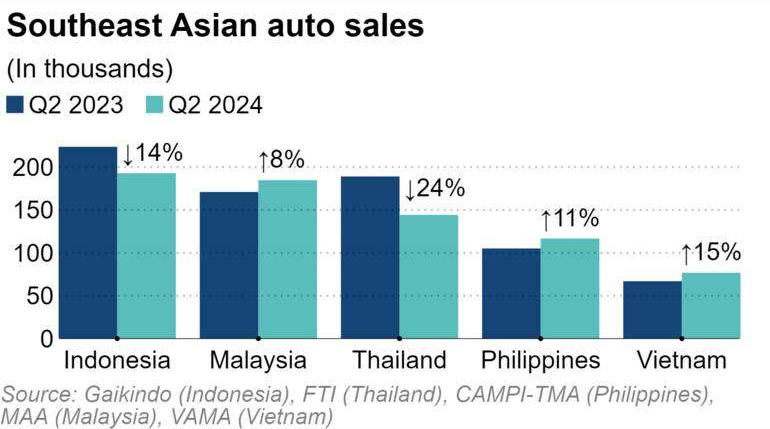

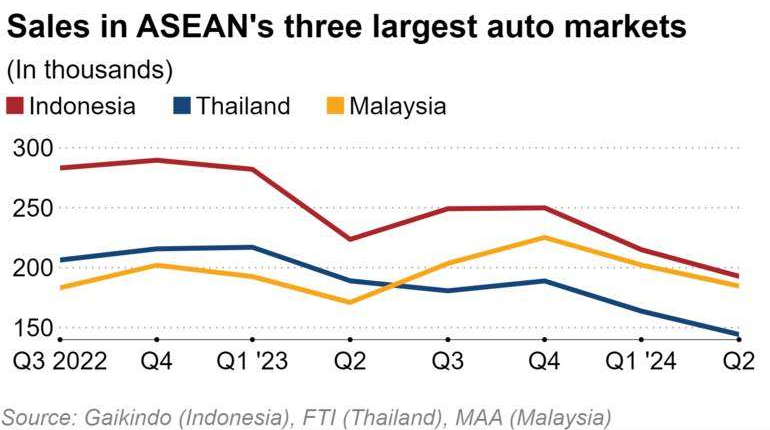

Malaysia’s auto sales are closing in on ASEAN leader Indonesia, with the gap between the two regional markets narrowing to 8,000 units in the second quarter.

As the second-largest automotive market in Southeast Asia, Malaysia's automotive market in the second quarter is catching up with the region's largest market, Indonesia, due to strong economic growth driving consumer spending.

Recently, Malaysia surpassed Thailand to become the second-largest market, and with its active growth, alongside declines in Indonesia and Thailand, it reflects significant changes in the emerging automotive markets of Southeast Asia.

Sales data released by the automotive industry organizations of Indonesia, Malaysia, Thailand, the Philippines and Vietnam showed that from April to June, Malaysia's car sales were only 8,134 units less than Indonesia, which was a significant improvement compared with the gap of 89,474 units from January to March 2023.

The Malaysian Automotive Association reported that vehicle sales in the second quarter increased by 8% year-on-year to 184,702 units, with domestic brands Perodua and Proton making significant contributions.

During this period, Malaysia's economy grew in sync, with an annual growth rate increasing to 5.9%. Official data shows that despite a low inflation rate of 1.7% to 2.0%, private consumption remained strong, and the strengthening of the ringgit against the US dollar provided support for consumers considering high-priced items like autos.

Proton and Perodua are popular due to their competitive pricing. On the other hand, the Malaysian government supports domestic brands through high import duties, consumption taxes, and sales taxes on foreign vehicles. Perodua benefits from its affordability and reliability, collaborating with Daihatsu and Toyota to launch enhanced models and providing good after-sales service, regular maintenance, and high fuel efficiency.

Electric vehicles and hybrid autos have driven sales growth. From January to June, the total sales of electric vehicles were 10,663 units, 2.4 times that of the same period last year; hybrid vehicle sales totaled 11,722 units, up 21.8% year-on-year.

Vincent Wong, a salesperson at BYD in Shah Alam, Selangor, believes that the sales performance of electric vehicles this quarter "exceeded expectations." From January to July, BYD's Seal and Atto 3 models sold 2,062 and 1,990 units respectively, leading the Malaysian market. Tesla's Model Y and Model 3 followed with 1,794 and 1,599 units.

Rasman Abdullah, a auto dealer at Honda's Glenmarie showroom, noted that demand for hybrid vehicles surged in the first half of the year, increasing by about 30%.

"Honda hybrid model orders are backed up, including HR-V, CR-V, and City. Demand has been exceptionally high since early 2024. Additionally, bookings for the second and third quarters have increased, with demand expected to continue rising by the end of the year," he said.

Toyota's Corolla Cross hybrid remains the most popular model, with 3,869 units sold; followed by Honda's HR-V hybrid with 2,750 units sold. Overall, Honda dominates the hybrid vehicle market with strong performances from its City, CR-V, and Civic models.

Malaysia's rise in the Southeast Asian automotive market is also attributed to the slowdown in Indonesian automotive sales. The Indonesian Automotive Industry Association reported a 14% year-on-year decline in automotive sales for the second quarter. Although this decline is smaller than the 24% drop in the first quarter, monthly sales have been falling year-on-year for 13 consecutive months since July 2023.

Soraya, a sales assistant at a Japanese auto dealership in North Jakarta, said that inflation concerns are deterring consumers from purchasing new autos. Despite Indonesia's inflation rate remaining below 3% this year, it hovered around 5% at the end of 2022 and the beginning of 2023. Additionally, customers are concerned about rising gasoline prices and maintenance costs.

Jongkie Sugiarto, vice chairman of the association, said, "The high current policy rate (6.25%) and the weakening of the rupiah against the dollar have dampened consumers' purchasing power."

Electric vehicles, particularly those from China, are competing fiercely with Japanese autos. However, Sugiarto mentioned, "For consumers looking to switch from traditional fuel vehicles to electric vehicles, price remains an issue, and the lack of charging stations and related infrastructure cannot be overlooked."

On the other hand, Thailand's automotive market is also in a slump. According to the Federation of Thai Industries, automotive sales in the second quarter fell by 24% year-on-year, following a 25% drop in the first quarter. Monthly sales have been decreasing year-on-year for 14 consecutive months since June 2023.

Surapong Paisitpattanapong, spokesperson for the Federation of Thai Industries' automotive club, said, "The decline in automotive sales in the first half of the year reflects weaker domestic consumer spending, while exports continue to grow."

Another factor suppressing consumption is the tightening of auto loans by Thai banks in mid-year due to high household debt (91% of GDP).

Subsequently, the Federation of Thai Industries has revised its forecast for domestic and export automotive sales for the year from 1.9 million units to 1.7 million units. Thailand produced 1.84 million vehicles in total for 2023.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.