Downside Tasuki Gap Candlestick Pattern - What Is And How To Trade

Learn all about the Downside Tasuki Gap candlestick pattern.What is, how to trade, and all the best trading strategies.

The "Rising Window" is a classic Japanese candlestick pattern widely used in technical analysis. This pattern typically appears after a downtrend and serves as a reversal signal, indicating a potential upward trend. It is considered a bullish reversal pattern and usually forms at the bottom of a downtrend.

Identifying the "Rising Window" Candlestick Pattern

The "Rising Window" candlestick pattern consists of three candles, characterized by:

- Two consecutive red solid candles: The first two candles are red, showing a continuous decline in price. This indicates market selling pressure.

- A noticeable gap: There is an upward gap between the closing price of the second red candle and the opening price of the third candle, indicating a sudden change in the market price.

- The third candle: The final candle is typically green, with an opening price higher than the highest price of the previous two candles, and a closing price higher than the opening price, reflecting a bullish trend.

_389915805_30.png)

Variants of the "Rising Window" Candlestick Pattern

In practical application, the "Rising Window" pattern may exhibit the following variants:

- Wicks on Candles: Candles may have different upper or lower wicks, affecting the visual appearance of the pattern.

- Size of the Gap: The gap between the opening price of the last candle and the closing price of the previous candle may vary depending on market volatility.

_389915805_30.png)

How to Trade

Trading the "Rising Window" pattern involves more than just recognizing its shape; it also requires understanding the pattern’s context and market environment. Here are some trading strategies:

-

Trade Entry Signal: Enter a trade when the low of the third candle is broken. This is a conservative trigger for a short position.

-

Stop-Loss Setting: To manage risk, set a stop-loss level on the opposite side of the pattern. This protects your capital from market fluctuations.

-

Risk Management: Setting appropriate stop-loss and take-profit levels is crucial for trading success. Ensure you can handle potential market volatility.

_389912988_702.png)

Trading Strategy

When trading the "Rising Window" candlestick pattern, it's essential not only to recognize the pattern itself but also to combine it with other market analysis tools and strategies to enhance accuracy and success rates. Here are the detailed trading strategies:

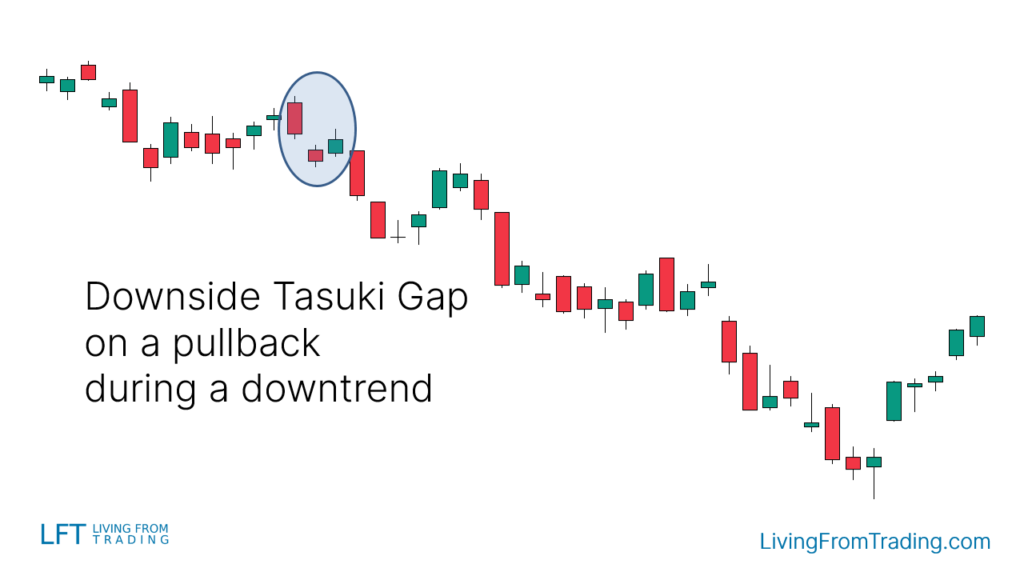

1. Pullback Trading on the Naked Chart

In a clearly downtrending market, the "Rising Window" candlestick pattern often signals a pullback. This strategy involves waiting for a price pullback and the formation of a "Rising Window" pattern to capture the continuation of the trend.

Steps:

- Identify the Trend: First, confirm that the market is in a downtrend by observing the high and low points of the price movement.

- Wait for a Pullback: In a downtrend, the price often experiences a rebound or pullback. Observe if a "Rising Window" pattern forms during this pullback.

- Execute the Trade: When the pullback ends and a "Rising Window" pattern appears, confirm that the pullback is complete and prepare to initiate a sell trade.

- Set Stop-Loss: Place the stop-loss above the high of the last candlestick to protect against adverse price movements.

Suppose the market experiences a downtrend followed by a pullback, and then a "Rising Window" pattern forms. You can execute a sell trade when the price returns to the downtrend line, setting stop-loss and take-profit points accordingly.

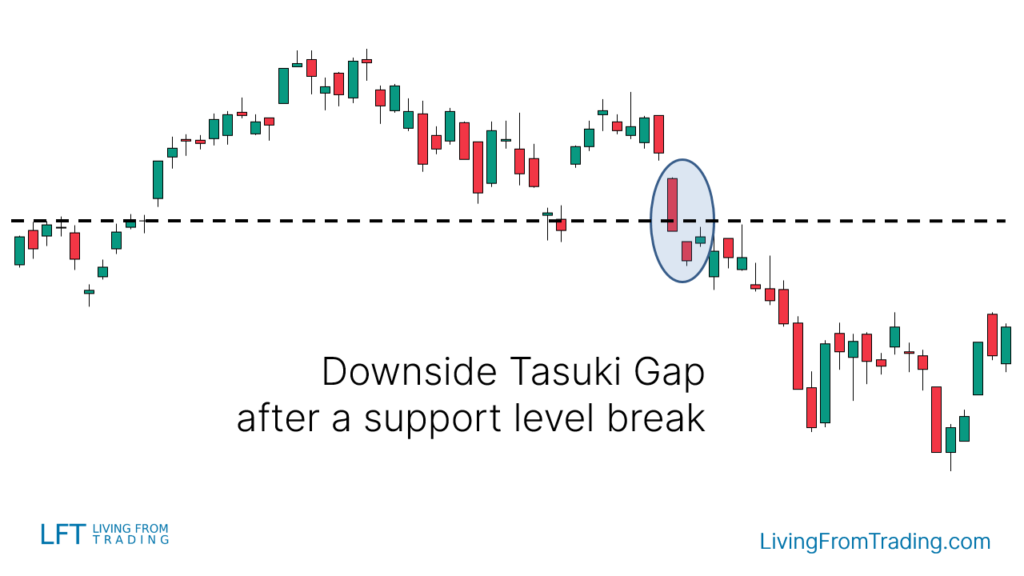

2. Trading with Support Levels

After a support level is broken, if a "Rising Window" pattern appears, it often indicates that the support level has been breached and may lead to further declines.

Steps:

- Draw Support Levels: Mark significant support levels on the chart. These are price levels where the price has repeatedly touched but failed to break through.

- Price Breaks Support Level: Wait for the price to break through the support level and retest it. After the support level is breached, the price usually retests it.

- Confirm the "Rising Window" Pattern: During the retest, if a "Rising Window" pattern appears, it indicates a bearish signal at the broken support level.

- Execute the Sell Trade: Once the "Rising Window" pattern is formed, sell when the price breaks below the low of the last candlestick.

- Set Stop-Loss and Take-Profit: Place the stop-loss above the high of the "Rising Window" pattern, with the take-profit level set near the next support level.

For instance, if the market breaks through an important support level and then retests it, forming a "Rising Window" pattern, you can initiate a sell trade with well-defined stop-loss and take-profit levels.

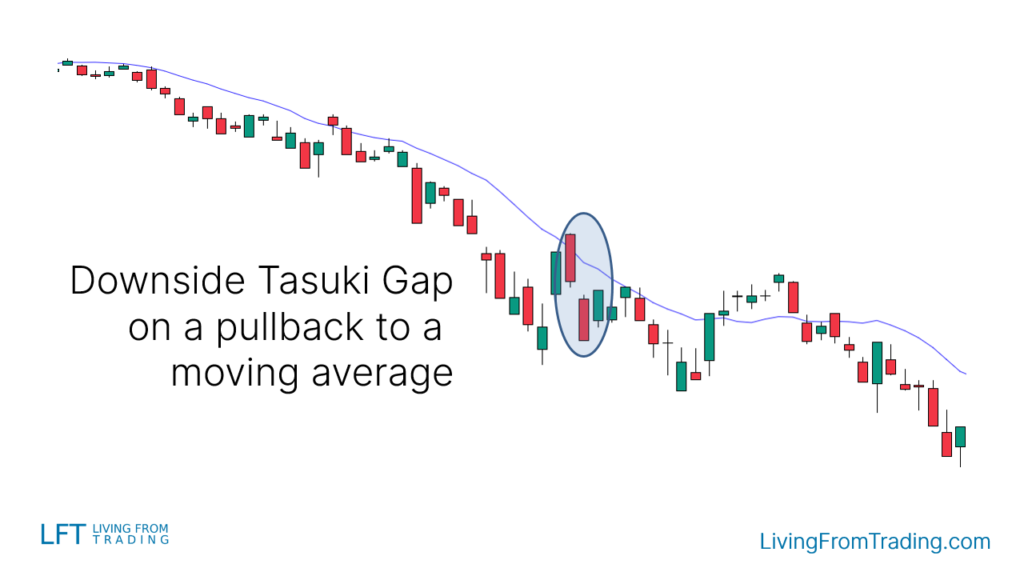

3. Trading with Moving Averages

Moving averages act as trend-following tools to confirm market trends. When the price retraces to the moving average and forms a "Rising Window" pattern, it typically signals the continuation of the trend.

Steps:

- Determine Moving Averages: Choose an appropriate moving average (e.g., 50-day or 200-day) to confirm the long-term trend.

- Wait for Price to Reach Moving Average: During a downtrend, wait for the price to retrace and touch the moving average.

- Observe the "Rising Window" Pattern: When the price touches the moving average, check if a "Rising Window" pattern forms.

- Execute the Sell Trade: Once the "Rising Window" pattern is formed, sell when the price breaks below the low of the last candlestick.

- Set Stop-Loss and Take-Profit: Place the stop-loss above the high of the "Rising Window" pattern, with the take-profit level set according to the market downtrend.

Suppose the market, in a downtrend, touches the 50-day moving average and forms a "Rising Window" pattern. You can then sell and set stop-loss and take-profit points based on market conditions.

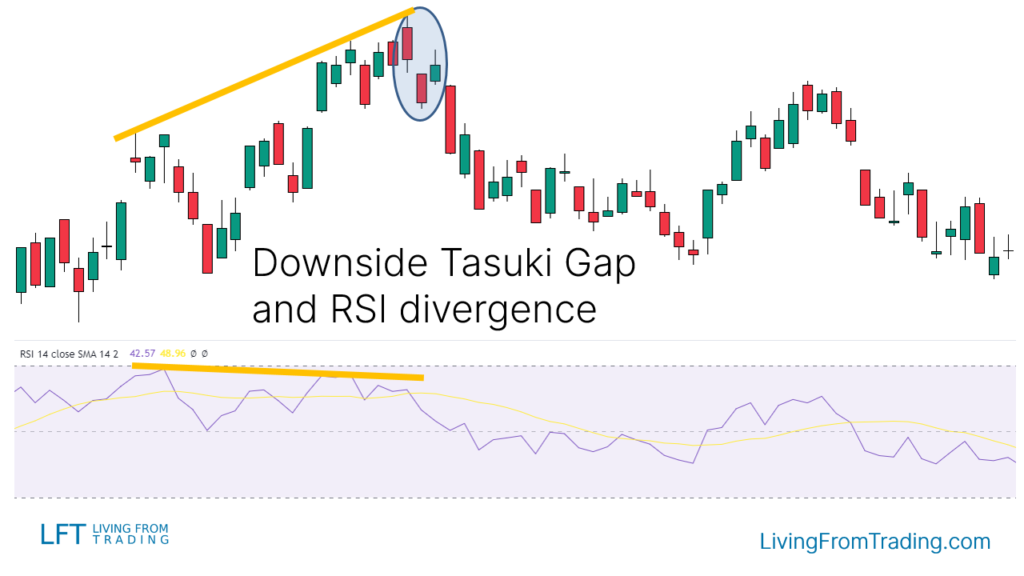

4. Trading with RSI Divergence

RSI (Relative Strength Index) divergence is a common technical analysis tool. When the price makes a new high while the RSI shows a lower high, it usually signals potential trend reversal.

Steps:

- Identify Divergence: In an uptrend, mark the price highs and compare them with RSI highs. If the price continues to make new highs but RSI fails to do the same, it indicates divergence.

- Wait for the "Rising Window" Pattern: If the price makes a new high and forms a "Rising Window" pattern, it signals a potential reversal.

- Execute the Sell Trade: After the "Rising Window" pattern forms, sell when the price breaks below the low of the last candlestick.

- Set Stop-Loss and Take-Profit: Place the stop-loss above the high of the "Rising Window" pattern, with the take-profit level set based on the expected market decline.

For instance, if the market is making new highs while RSI shows a lower high, and a "Rising Window" pattern forms, consider selling and setting appropriate stop-loss and take-profit levels.

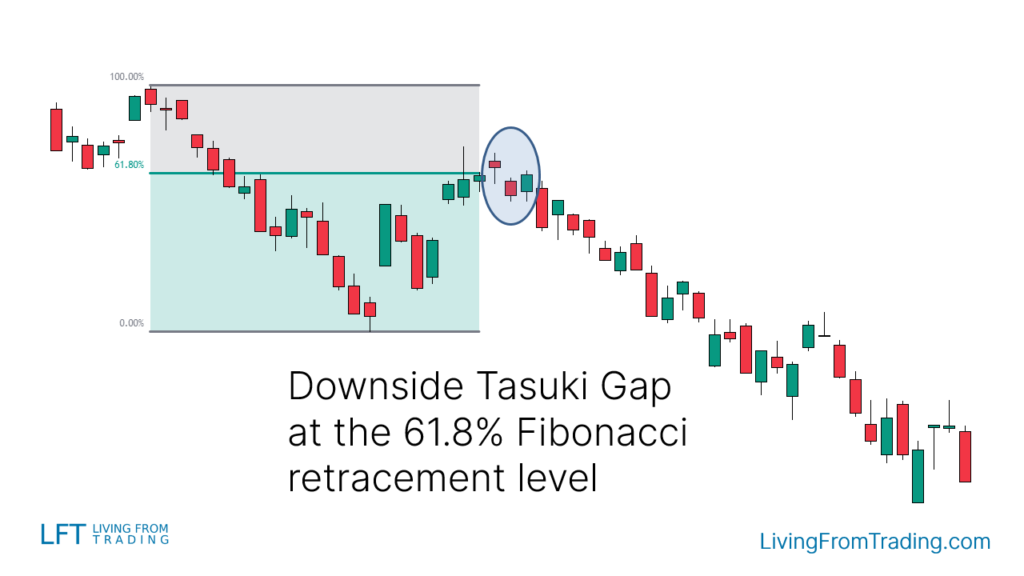

5. Trading with Fibonacci Retracement

Fibonacci retracement levels are used to identify potential reversal levels. When the price retraces to a Fibonacci level and forms a "Rising Window" pattern, it can signal a selling opportunity.

Steps:

- Draw Fibonacci Retracement Levels: Plot Fibonacci retracement levels between significant high and low points on the chart.

- Wait for Price to Reach Fibonacci Levels: During a downtrend, wait for the price to retrace to Fibonacci levels.

- Observe the "Rising Window" Pattern: Check if a "Rising Window" pattern forms when the price reaches Fibonacci levels.

- Execute the Sell Trade: Once the "Rising Window" pattern appears, sell when the price breaks below the low of the last candlestick.

- Set Stop-Loss and Take-Profit: Place the stop-loss above the high of the "Rising Window" pattern, with the take-profit level set near the next support level.

Suppose the market retraces to the 61.8% Fibonacci level during a downtrend and forms a "Rising Window" pattern. You can sell and set stop-loss and take-profit levels accordingly.

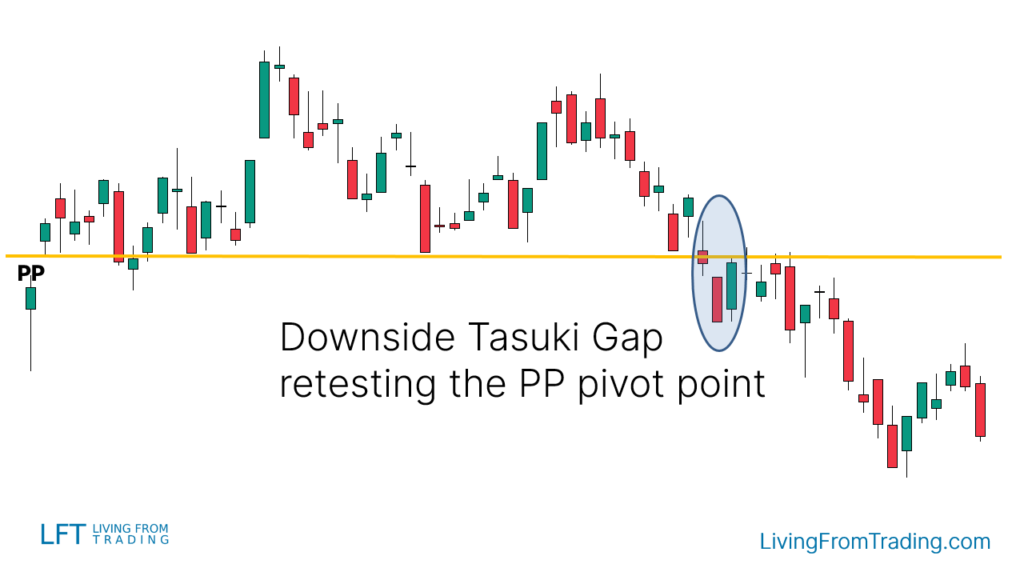

6. Trading with Pivot Points

Pivot points are calculated levels that serve as potential support and resistance levels for day trading and long-term trend analysis. Combining the "Rising Window" pattern with pivot points provides additional trading signals.

Steps:

- Set Pivot Points: Activate pivot point indicators on your chart and mark support and resistance levels.

- Wait for Price to Reach Pivot Points: Observe if the price touches or breaks through the pivot points.

- Observe the "Rising Window" Pattern: Check if a "Rising Window" pattern forms when the price interacts with pivot points.

- Execute the Sell Trade: Once the "Rising Window" pattern appears, sell when the price breaks below the low of the last candlestick.

- Set Stop-Loss and Take-Profit: Place the stop-loss above the high of the "Rising Window" pattern, with the take-profit level set near the next support level.

If the market, in a downtrend, touches a daily pivot point and forms a "Rising Window" pattern after breaking it, consider selling and setting stop-loss and take-profit levels accordingly.

Summery

The "Rising Window" K-line graphic has a success rate of 54% and is somewhat effective in predicting market trends, but in order to increase the success rate of trading, it is recommended to combine it with other technical analysis tools to make a comprehensive judgement.

By understanding and utilizing the "Rising Window" candlestick pattern effectively, you can enhance your trading strategy. Combine it with market conditions and other technical indicators to increase your trading success rate.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.