GoTo Ride-Hailing Service Gojek to Exit Vietnam Market

Indonesia's GoTo will withdraw from the Vietnamese market, ending its competition with Grab and Shopee, and its travel and delivery services will focus on Indonesia and Singapore.

GoTo is gradually withdrawing from the Vietnamese market.

Recently, GoTo Group, an Indonesian online car-hailing service provider, issued a statement saying that Gojek, a subsidiary of the group responsible for online car-hailing, food delivery and express delivery services, will stop its business in Vietnam on September 16. The group said: "We will provide necessary support to all affected parties and comply with current regulations and laws throughout the transition period."

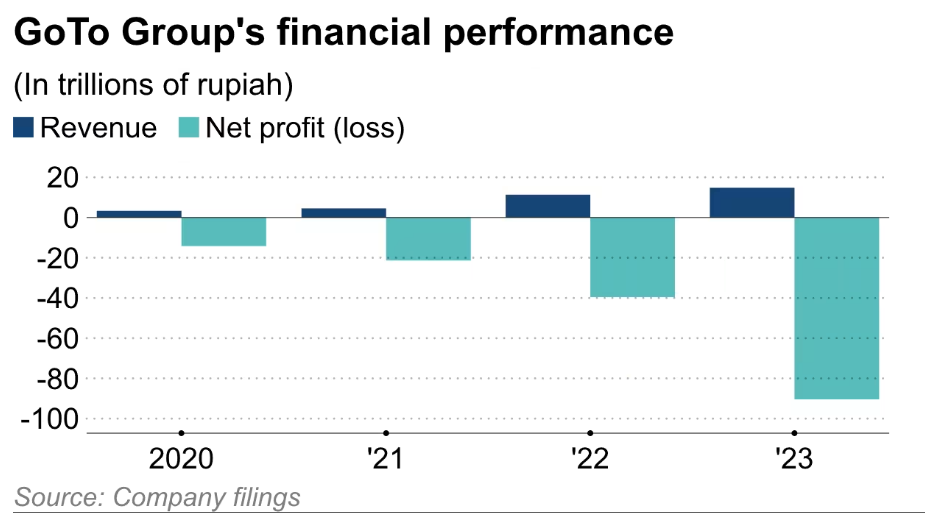

Financial report data shows that GoTo suffered a net loss of 2.8 trillion rupiah in the first half of this year, and the Vietnamese market accounted for less than 1% of GoTo's total transaction volume in the second quarter. Withdrawing from the country will not affect the company's financial situation. After that, GoTo Group will concentrate its resources on Indonesia and Singapore to help the group turn losses into profits and achieve profitability.

It is understood that Gojek was founded in 2010 and its app was launched in Indonesia in January 2015.

In August 2018, Gojek successfully entered the Vietnamese market under the brand name Go-Viet with $500 million in funding, supported by investors such as KKR, Google and Temasek. This was also GoTo's first attempt in overseas markets, and Indonesian President Joko Widodo attended the launch ceremony in Vietnam. Two months later, it launched an online food delivery service called GoFood.

At first, Gojek served as a motorcycle taxi service in Vietnam, and later expanded to car transportation and other services. However, GoTo, which has been losing money for years, has been besieged by Singapore's Grab in markets such as Vietnam, and the company has cut spending due to slowing user growth.

Moreover, fragmented competition, leadership changes and the failure to fully launch financial services through WePay, which was acquired in 2020, made it difficult for the company to gain a foothold. By the time GoViet was renamed Gojek Vietnam in 2020, the problem had already emerged. In 2021, GoTo announced its exit from the Thai market and sold its loss-making e-commerce business Tokopedia to ByteDance's TikTok for $1.5 billion at the end of last year.

Despite thousands of massive layoffs and drastic cuts in marketing spending, GoTo's net income has not returned to positive. In 2023, after Patrick Walujo took over as CEO, the company has gradually approached its profitability target, but its stock price has still fallen by more than 80% since its IPO in 2022.

GoTo also reiterated that the group expects adjusted EBITDA to turn positive for the full year. Although TikTok's transactions and costs have reduced GoTo's financial pressure, the weak market environment has launched a new round of competition between the company and its competitors.

In Indonesia, Gojek's total transaction volume in the second quarter of this year increased by 18% year-on-year, the number of completed orders increased by 24%, reaching a record level, and its market share in Singapore also increased by 3 percentage points.

In fact, GoTo Group management has been rethinking its Southeast Asian strategy. It is reported that GoTo and Grab have resumed discussions on merging core businesses this year to cut costs and enhance competitiveness as much as possible.

According to earlier reports, Malaysia's AirAsia Group announced that it would acquire Gojek's Thailand business for shares worth US$50 million, and Gojek will acquire a 4.76% stake in the airline's lifestyle platform. The company also plans to enter the Philippine market, but faces regulatory challenges in foreign ownership.

According to market research firm Q&Me, among Vietnam's online car-hailing brands, Grab has a 42% market share, followed by Be of Vietnamese integrated service company Be Group, Xanh SM under Vingroup and Gojek, with market shares of 32%, 19% and 7% respectively.

In addition to local leader Grab, Be Group, a local startup in Vietnam's online car-hailing service, is also a very strong competitor. So far this year, the company has raised about US$30 million to accelerate its growth in markets such as online car-hailing and delivery.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.