Hawkinsight Crude Oil Market Daily (1.5) International oil prices fluctuate lower as refined oil products accumulate significantly.

International oil prices shook lower yesterday as weekly gasoline and distillate inventories rose sharply, overshadowing the impact of crude oil inventories falling more than expected。

January 5 (Thursday) Asian morning market, international oil prices rose slightly。

Market Review

On Thursday, January 4, international oil prices shook lower as weekly gasoline and distillate inventories rose sharply, overshadowing a larger-than-expected decline in crude inventories.。By the close, WTI main crude oil futures closed down 0.$51, down 0.7%, reported 72.$19 / bbl; Brent main crude futures close down 0.$66, down 0.84%, reported 77.$59 a barrel; INE crude futures close down 0.14% at 551.5 yuan。

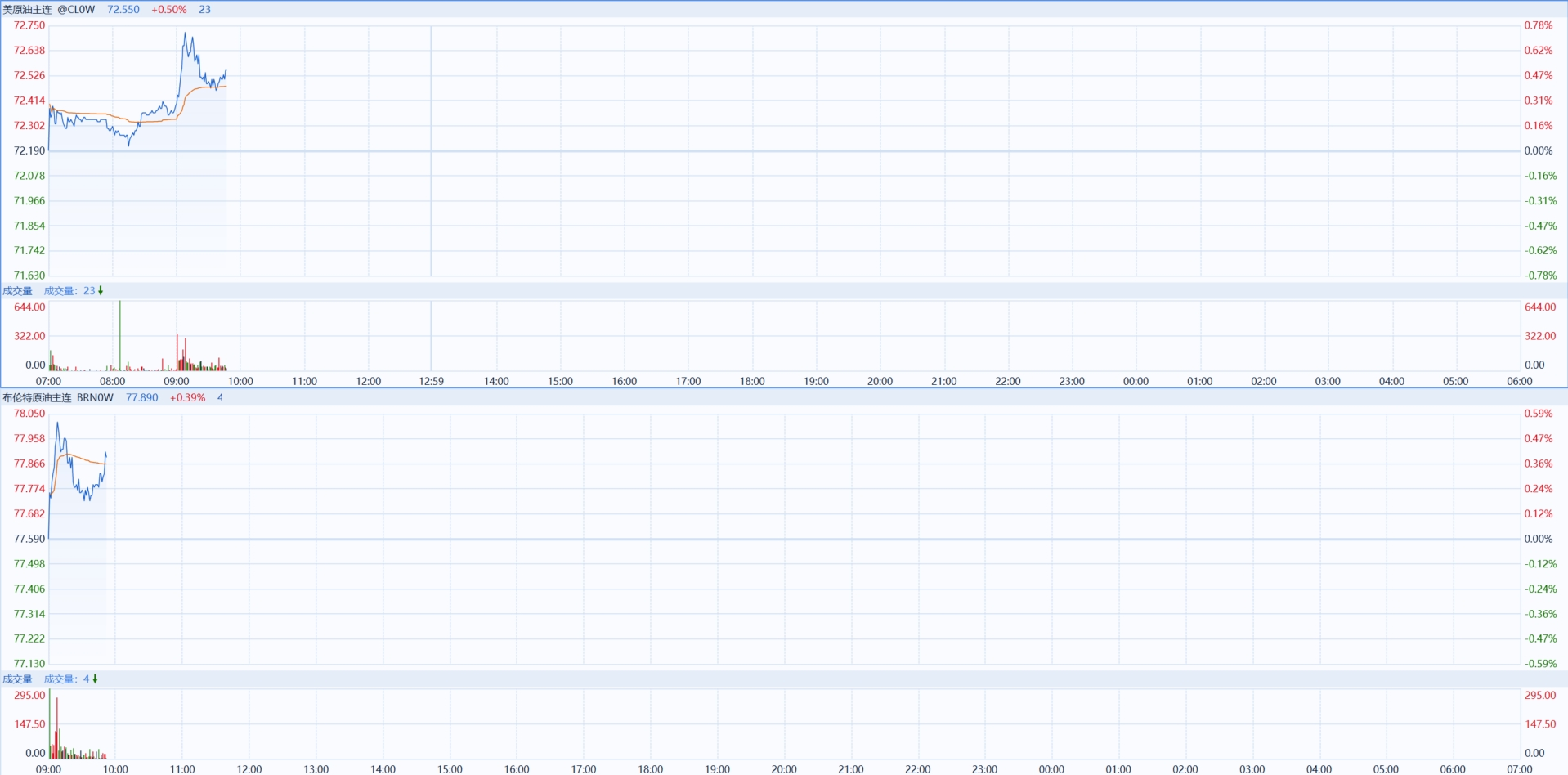

As of press time, WTI's main crude oil futures prices rose 0 today.50% at 72.$55 / bbl; Brent main crude futures up 0 today.39%, reported 77.89 USD / barrel。

important news

l EIA releases crude oil inventory data for the week to December 29: crude oil inventories down 550.30,000 barrels, crude oil production fell 100,000 barrels per day; gasoline inventories increased by 10.9 million barrels to 2.3.7 billion barrels, the highest weekly increase in more than 30 years; distillate inventories rose by 10.1 million barrels last week to 1..25.9 billion barrels。EIA data shows supply of distillate products, which represent demand, fell to lowest level since 1999。

Refiners and crude buyers turn to U.S. markets amid Red Sea crisis: Mizuho said EIA data showed crude inventories fell 5.5 million barrels this week, but much of it reflected disruptions in Red Sea shipping。The bank also said the situation in the Red Sea had forced many refiners and crude buyers to travel to the United States instead of sailing around the Horn of Africa.。

Weak European economic data: Business activity in the euro area continued to contract at the end of 2023 due to the continued downturn in the dominant services sector, indicating that the euro area economy is in recession。Eurozone December Markit composite PMI final revised to 47.6, expected at 47, but still below the 50 mark for the seventh month in a row。

l German inflation rose in December: according to preliminary statistics released by the German Federal Statistical Office on January 4, German inflation rose 3% year-on-year in December 2023..7%。The data also show that the German inflation rate for the whole of 2023 is 5.9%。

l Islamic State declares responsibility for Iran's Kerman bombing: The Islamic State said in a statement that two attackers carried out a suicide bombing in the city of Kerman, but did not specify the group that carried out the attack.。Some counter-terrorism analysts have said they suspect that the Islamic State branch, Khorasan Province, may be the murderer.。

Technical analysis

Rémy GAUSSENS, director of research at TRADING CENTRAL, said that on the 30-minute line, U.S. crude oil (WTI) and futures (G4) are expected to rise restrictively during the day, with technical analysis showing the RSI technical indicator below the 50% neutral zone and reversing upward.。

Trading Strategy: At 71.30 above, bullish, with a target price of 73.20, then 74.00; Alternative strategy: at 71.30 under, bearish, target price set at 70.35, then 69.30。Support level: 70.35, 69.30; resistance level: 73.20, 74.00。

This week's important schedule

Tuesday, January 2

04: 00 Eurozone December Manufacturing PMI Final Value

04: 30 UK December Manufacturing PMI

09: 45 US December Markit Manufacturing PMI Final Value

10: 00 Monthly Rate of US Construction Expenditure in November

Wednesday, January 3

10: 00 US December ISM Manufacturing PMI

10: 00 US November JOLTs Job Vacancies

16: 30 US API Crude Oil Inventory for Week to December 29

20: 45 China's December Caixin Services PMI.

Thursday 4th January

04: 00 Eurozone December Services PMI Final Value

04: 30 UK November Central Bank Mortgage Permit.

04: 30 UK December Services PMI

07: 30 U.S. December Challenger Corporate Layoffs

08: 15 U.S. ADP Employment in December

08: 30 U.S. to December 30 Initial jobless claims for the week

09: 45 US December Markit Services PMI Final Value

11: 00 US to December 29 week EIA crude oil inventories

11: 00 U.S. to December 29 Week EIA Oklahoma Cushing Crude Oil Inventories

11: 00 U.S. to December 29 Week EIA Strategic Petroleum Reserve Inventory

Friday, January 5

05: 00 Eurozone December CPI Initial Annual Rate

05: 00 Eurozone December CPI Monthly Rate

05: 00 Eurozone November PPI Monthly Rate

08: 30 U.S. Unemployment Rate in December

08: 30 US non-farm payrolls after December quarter adjustment

10: 00 US December ISM Non-Manufacturing PMI

10: 00 U.S. November Factory Orders Monthly Rate

13: 00 Total number of oil rigs for the week from the United States to January 5

* * The above schedule is US Eastern Time (UTC-05: 00) * *

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.