Hawkinsight Gold Market Daily (1.2) | Holiday trading is cold and spot gold continues to fluctuate during the day.

Spot gold changed little by holiday。

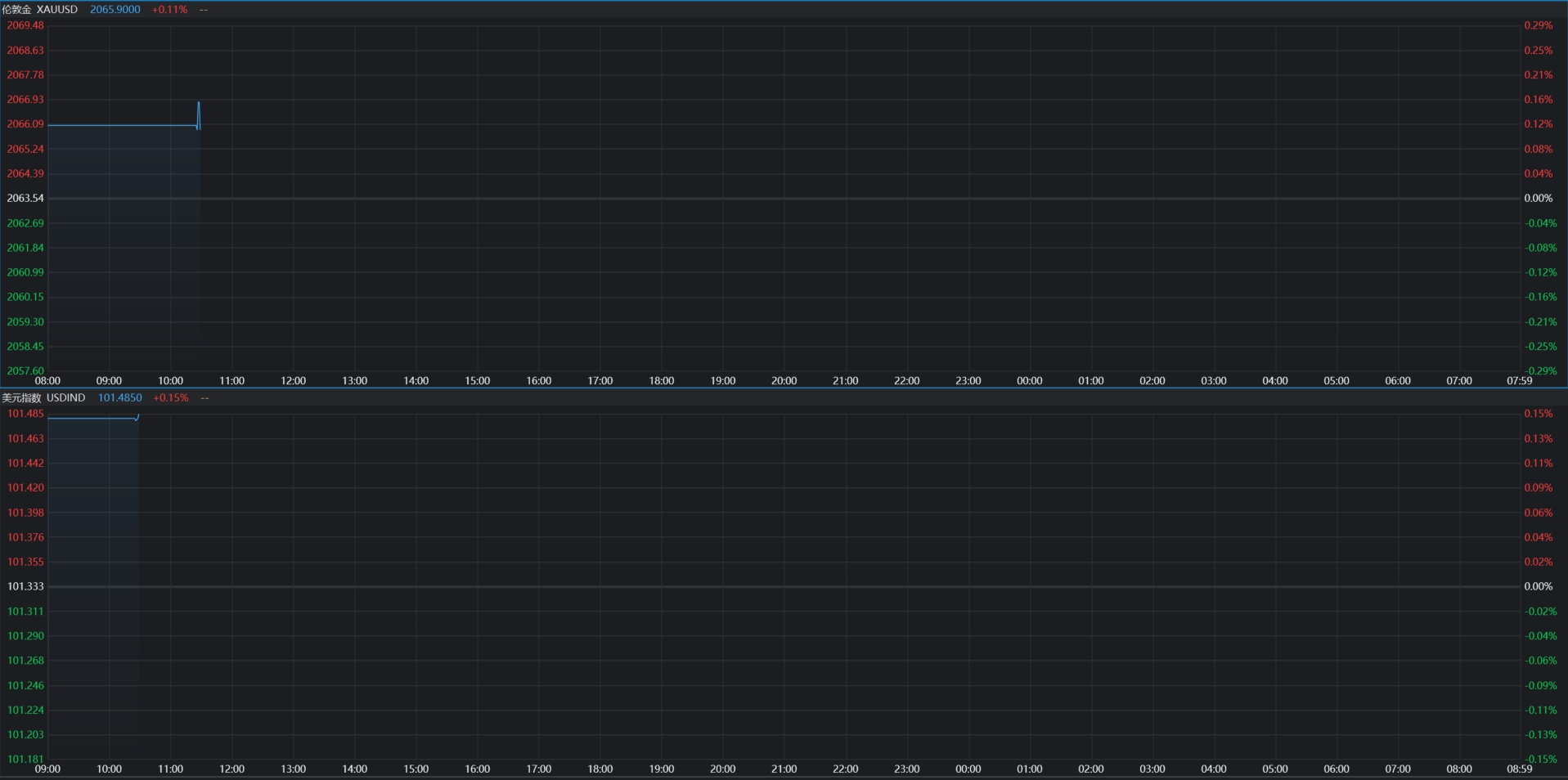

Hawkinsight APP - January 2 (Tuesday) Asian morning market, the spot gold day to maintain volatility, today's opening at 2062.$65 an ounce, touching as high as 2069.$79 an ounce, hitting a low of 2062.$24 / oz。

Market Review

On Monday (January 1), spot gold moved modestly due to the holiday, stabilizing near $2062 / oz.。Last week, spot gold rose for the third week in a row, boosted by a weaker dollar, with gold closing at 2062.$74 an ounce, up 0 weekly.5%。Spot gold hit as high as 2088 in intraday trading last week.$43 / oz。

Spot gold up 0 in the day as of press time.11%, reported 2065.$90 / oz; dollar index up 0 on day.15% at 101.49。

important news

Wall Street predator Peter Schiff predicts high inflation will return to view。Schiff says the big surprise in 2024 is not only a recession, but a comeback of high inflation。He added that the technical side of the dollar index is collapsing and the Fed is planning to cut interest rates, which will put new upward pressure on inflation。

According to the World Gold Council, there are three factors that could boost gold's performance in January.。They are: portfolio rebalancing at the beginning of the year; quarterly weakness in real yields; and East Asia's re-stocking of gold ahead of the Lunar New Year.。

More than 70% of central banks expect global gold reserves to increase in the future.。The World Gold Council says more than 70% of central banks surveyed expect global gold reserves to increase in the next 12 months。Global central banks bought 1,136 tonnes of gold in 2022, a record high, and the trend continues in 2023。

Technical analysis

Rémy GAUSSENS, director of research at TRADING CENTRAL, said that on the 30-minute line, spot gold expects intraday support at 2057..00, the analysis is that the market is in 2057..A supportive bottom is formed near 00, which will bring stability to the trend in the short term。

Trading Strategy: In 2057.00 above, bullish, target price 2074.00, then 2080.00; alternative strategy: in 2057.Below 00, bearish, target price set at 2051.00, then 2047.00。Support level: 2074.00, 2080.00; resistance level: 2051.00, 2047.00。

This week's important schedule

Tuesday, January 2

04: 00 Eurozone December Manufacturing PMI Final Value

04: 30 UK December Manufacturing PMI

09: 45 US December Markit Manufacturing PMI Final Value

10: 00 Monthly Rate of US Construction Expenditure in November

Wednesday, January 3

10: 00 US December ISM Manufacturing PMI

10: 00 US November JOLTs Job Vacancies

16: 30 US API Crude Oil Inventory for Week to December 29

20: 45 China's December Caixin Services PMI.

Thursday 4th January

04: 00 Eurozone December Services PMI Final Value

04: 30 UK November Central Bank Mortgage Permit.

04: 30 UK December Services PMI

07: 30 U.S. December Challenger Corporate Layoffs

08: 15 U.S. ADP Employment in December

08: 30 U.S. to December 30 Initial jobless claims for the week

09: 45 US December Markit Services PMI Final Value

11: 00 US to December 29 week EIA crude oil inventories

11: 00 U.S. to December 29 Week EIA Oklahoma Cushing Crude Oil Inventories

11: 00 U.S. to December 29 Week EIA Strategic Petroleum Reserve Inventory

Friday, January 5

05: 00 Eurozone December CPI Initial Annual Rate

05: 00 Eurozone December CPI Monthly Rate

05: 00 Eurozone November PPI Monthly Rate

08: 30 U.S. Unemployment Rate in December

08: 30 US non-farm payrolls after December quarter adjustment

10: 00 US December ISM Non-Manufacturing PMI

10: 00 U.S. November Factory Orders Monthly Rate

13: 00 Total number of oil rigs for the week from the United States to January 5

* * The above schedule is US Eastern Time (UTC-05: 00) * *

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.