Hawkinsight Gold Market Daily (12.29) | Gold profit-taking triggered by low dollar recovery

Dollar Index Up 0 on Thursday.3%, and the yield on the benchmark 10-year bond also rose, moving away from its lowest level since July.。

Hawkinsight APP - December 29 (Friday) Asian morning market, stimulated by a small increase in U.S. preliminary data, spot gold rose slightly in early Asian trading。

Market Review

On Thursday (December 28), spot gold prices fell back, having previously hit a three-week high of 2088.$29 an ounce, down 0 in late trading.4%, at 2069.$79 / oz。Dollar Index Up 0 on Thursday.3%, and the yield on the benchmark 10-year bond also rose, moving away from its lowest level since July.。

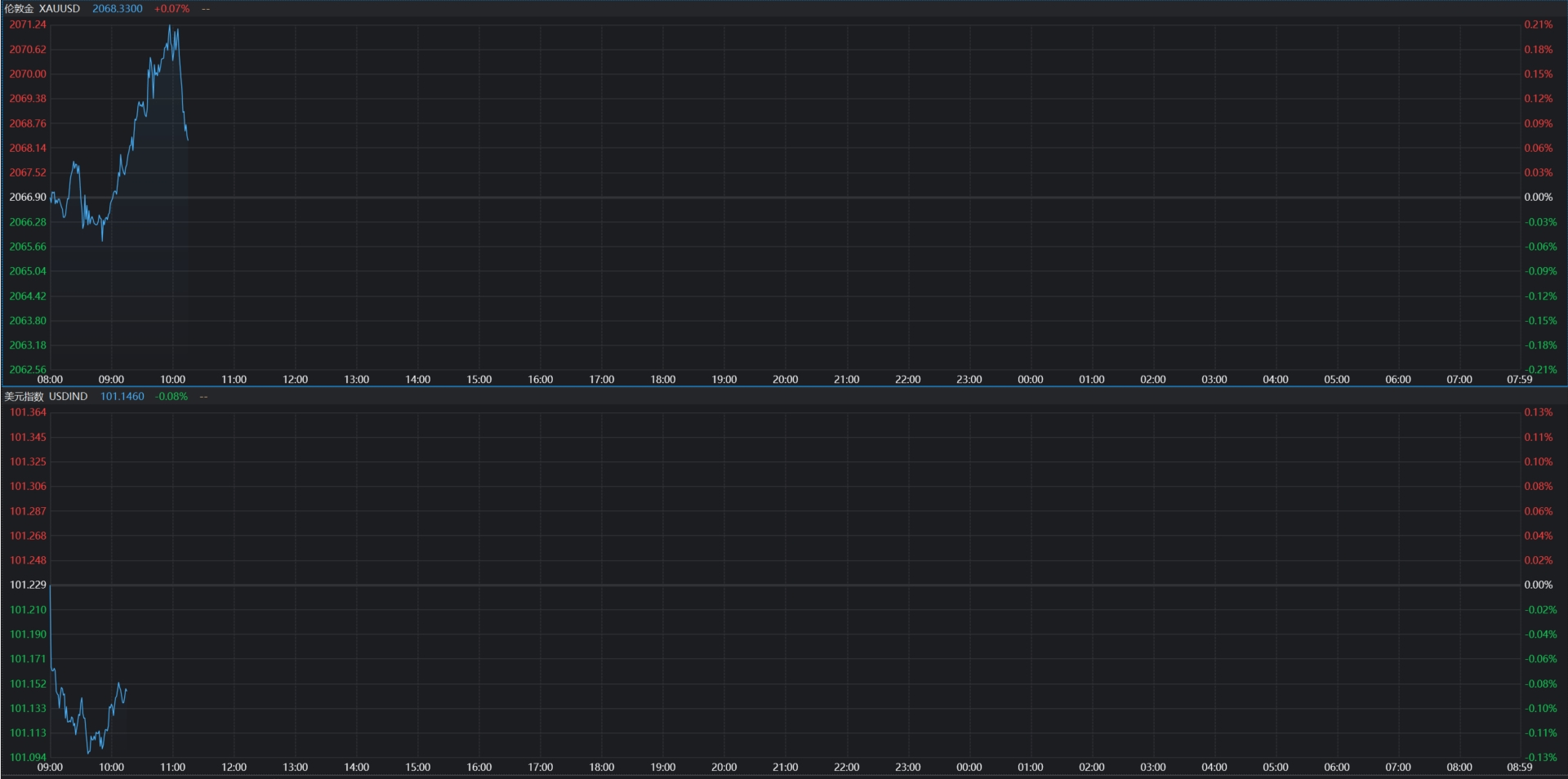

Spot gold up 0 in the day as of press time.07% at 2068.$33 / oz; dollar index down 0 on day.08%, reported 101.15。

important news

U.S. mortgage rates fall to new lows since May: U.S. mortgage rates continue to fall, ending the year at their lowest level since May。Freddie Mac said in a statement Thursday that the average rate on a 30-year fixed loan is 6..61%, down from 6 last week..67%。

U.S. initial claims data slightly increased: the U.S. Labor Department reported 21 U.S. initial jobless claims..80,000, up slightly from last month。The expected value is 210,000。The four-week moving average is 21.20,000, the lowest since the end of October last year。

l China's gold imports from Hong Kong increase: China's gold imports from Hong Kong reportedly rose 37% in November after the People's Bank of China eased some import restrictions to meet expected demand for the Lunar New Year。

l Central bank "gold rush" unabated: Ing noted that central banks have been buying the commodity at a "record pace" in the gold market this year, resisting the downward trend of the dollar。

l CME "Fed Watch": Fed keeps interest rates at 5 in February next year.25% -5.The probability of the 50% interval being constant is 83.5%, the probability of a 25 basis point rate cut is 16.5%。The probability of keeping interest rates unchanged by March next year is 11..7%, with a cumulative probability of a 25 basis point cut of 74.1%, with a cumulative probability of a 50 basis point rate cut of 14.2%。

Technical analysis

Rémy GAUSSENS, director of research at TRADING CENTRAL, said that on the 30-minute line, spot gold is expected to fall restrictively during the day.。Technical analysis for RSI technical indicators bearish, there is a further downward trend。

Trading Strategy: In 2076.00 below, bearish, target price of 2060.00, then 2051.00; alternative strategy: in 2076.00, bullish, target price set at 2082.00, then 2088.00。Support level: 2051.00, 2046.00; resistance level: 2082.00, 2088.00。

This week's important schedule

Friday, December 29

08: 30 U.S. to December 23 Initial jobless claims (10,000)

10: 00 Monthly Rate of US Existing Home Contract Sales Index for November

Saturday 30th December

09: 45 US December Chicago PMI

* * The above schedule is US Eastern Time (UTC-05: 00) * *

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.