US June ISM data: 9 sectors fell back for the third consecutive month of contraction

Among the six traditional manufacturing industries in the United States, only the chemical products industry has achieved growth.

On July 1st, according to data released by the American Institute for Supply Management (ISM), the U.S. June ISM Manufacturing Index fell for the third consecutive month and remained in the contraction zone, indicating that the U.S. manufacturing industry is facing the pressure of recession again in the second quarter after a brief restocking in the first quarter.

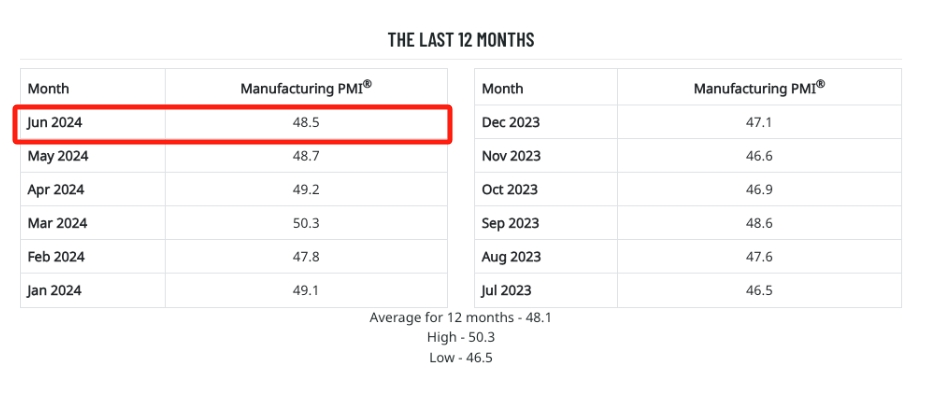

The data shows that the U.S. June ISM Manufacturing Index was 48.5, lower than the expected 49.1, and the previous month's reading was 48.7, both below the 50 boom-bust line.

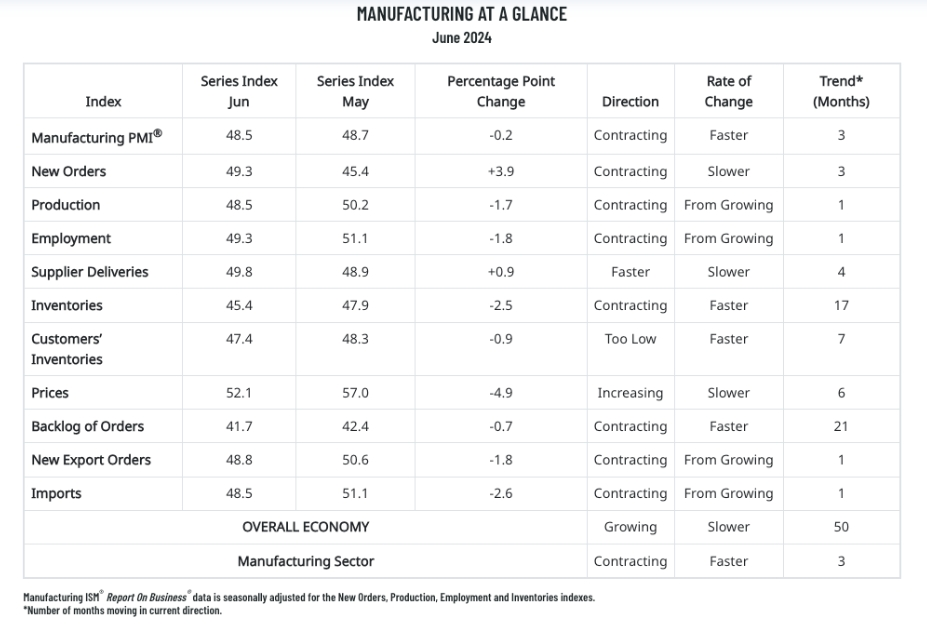

Specifically, the U.S. June New Orders Index reached 49.3, expected to be 49, with the previous reading at 45.4. Although the New Orders Index is still in the shrinking range, it rebounded nearly 4 points in a single month to 49.3, indicating that the order volume is approaching stability; the production index fell from 50.2 to 48.5, entering the contraction range; the price payment index was 52.1, the slowest cost increase of the year, expected to be 55.8; the price index fell sharply by 4.9 points in a single month, the largest drop since May last year; the employment index was 49.3, expected to be 50, with the previous reading at 51.1. The weakness of economic activity also helps to ease inflationary pressure.

In terms of industry, there were eight manufacturing industries that showed growth in June, ranked by the increase in order: printing and related auxiliary activities, petroleum and coal products, primary metals, furniture and related products, paper products, chemical products, miscellaneous manufacturing, and non-metallic mineral products. It is worth noting that among the six traditional manufacturing industries in the United States, only the chemical products industry achieved growth.

There were nine manufacturing industries that shrank in June, ranked by the contraction range in order: textile mills; machinery; metal products; wood products; transportation equipment; plastics and rubber products; food, beverages, and tobacco products; electrical equipment, appliances, and components; and computers and electronic products.

In this regard, Timothy Fiore, Chairman of the ISM Manufacturing Business Survey Committee, said that due to current monetary policy and other conditions, companies are unwilling to invest in capital and inventory, so demand remains low. The production execution rate has decreased compared to last month, which may lead to a decrease in income and put pressure on profitability. Suppliers continue to have capacity, delivery times have improved, and shortages are not as severe.

Fiore also said that in June, 62% of the manufacturing industries related to GDP shrank, a higher number than the 55% in May. More worryingly, in June, the comprehensive purchasing managers' index (PMI) reached or fell below 45% of the industry GDP share at 14%, an increase of 10 percentage points from May.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, believes that the S&P Global PMI survey shows that U.S. manufacturers struggled in June, unable to achieve strong production growth, dragged down by weak domestic and export market demand. Although the PMI was positive in five of the first six months of 2024, compared to only one month in 2023, the growth momentum is still depressingly weak.

In the past two years, factories have been hit by the post-epidemic demand shift from goods to services, and at the same time, high prices and concerns about long-term high interest rates have weakened the consumption capacity of households and businesses. These adverse factors have continued into June, and as the U.S. presidential election approaches, people's uncertainty about the country's economic prospects has also increased.

Business confidence has therefore fallen to its lowest level in 19 months, indicating that the manufacturing industry is preparing to face further difficult times in the next few months.

After the data was released, U.S. long-term Treasury yields rose sharply, with the 30-year Treasury yield increasing by 8 basis points, reaching a new high above 4.64%. The 20-year U.S. debt yield rose by about 9 basis points, reaching a new high of 4.7469%. The 10-year U.S. debt yield rose by about 8 basis points, reaching a new high above 4.47%. Gold was heavily sold off, quickly falling to its lowest point of the day, with the last transaction price of August gold futures at $2,331.30 per ounce, down 0.30% for the day.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.