Hawkinsight Gold Daily (12.28) Gold hits three-week high as price pressures fade

Spot gold rises in Asia as U.S. price pressures fade and markets strengthen bets on Fed rate cuts。

Hawkinsight APP News - December 28 (Thursday) Asian morning market, as the U.S. price pressure subsided, the market strengthened bets on the Federal Reserve to cut interest rates, spot gold rose in Asia。

Market Review

On Wednesday (December 27), spot gold prices hit a three-week high of 2084..$39, last closed at 2077.$15, up 0 for the day.5%; the dollar index hit a five-month low of 100.98, the annual line fell for the first time since 2020, and the yield on the benchmark 10-year U.S. Treasury note also hit its lowest level since July 24.。

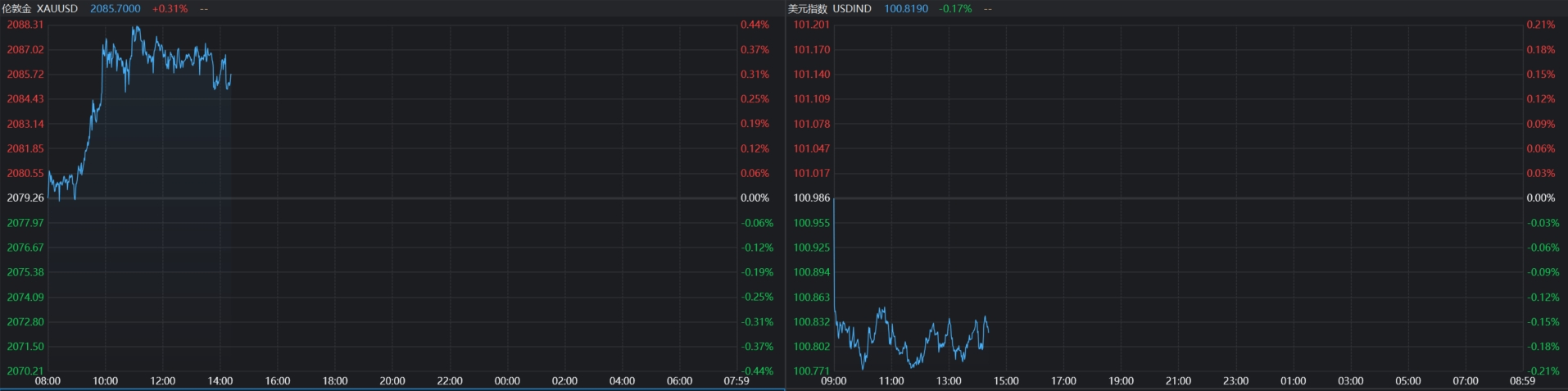

Spot gold up 0 in the day as of press time.31% at 2085.$67 / oz; dollar index down 0 on day.17%, reported 100.82。

important news

l London Bullion Market Association speaks out: London gold price benchmark climbs to 2069 troy ounces, says association.An all-time high of $40, surpassing the previous record set in August 2020。

l U.S. manufacturing data worse than expected: U.S. Richmond Fed manufacturing index recorded -11 in December, market expectations of -5, published data significantly worse than expected, data show that the U.S. manufacturing sector is weak, the economic outlook is not optimistic。

l Fitch says U.S. and European corporate defaults will rise: U.S. employers expect to reduce hiring in 2024, a trend expected to constrain wage growth and ease inflationary pressures, according to surveys by several U.S. regional Federal Reserve banks。Regional Fed data shows Fed rate hikes are affecting the economy。This result implies a slowdown in employment。

l Fitch says the Fed's shift will be much weaker than market expectations: the rating agency believes the Fed's shift will be much weaker than market expectations and expects rates to be cut by just 75 basis points next year, bringing the federal funds rate down to 4.75%。

l Fed may close bank term funding program (BTFP) in March next year: according to the latest Fed data, lower costs pushed BTFP borrowing to a record $131 billion in the week ending December 20。The program's role as an emergency liquidity backstop is diminishing as bank financing conditions ease。

l CME "Fed Watch": Fed keeps interest rates at 5 in February next year.25% -5.The probability of the 50% interval being constant is 81.4%, the probability of a 25 basis point rate cut is 18.6%。The probability of keeping interest rates unchanged by March next year is 9.8%, with a cumulative probability of a 25 basis point cut of 73.9%, with a cumulative probability of a 50 basis point rate cut of 16.4%。

Rémy GAUSSENS, director of research at TRADING CENTRAL, said that on the 30-minute line, spot gold is expected to rise restrictively during the day.。RSI technical indicators run complex trends and tend to rise。

Trading Strategy: In 2076.00 above, bullish, target price 2090.00, then 2100.00; alternative strategy: in 2076.00, bearish, target price set at 2070.00, then 2060.00。Support level: 2076.00, 2070.00, 2060.00; resistance level: 2110.00, 2100.00, 2090.00。

Important schedule

Friday, December 29

08: 30 U.S. to December 23 Initial jobless claims (10,000)

10: 00 Monthly Rate of US Existing Home Contract Sales Index for November

Saturday 30th December

09: 45 US December Chicago PMI

* * The above schedule is US Eastern Time (UTC-05: 00) * *

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.