Recently, news came that after Chifeng, Fu is also preparing for a Hong Kong stock IPO on Saturday.

This is the fifth time that Fu has hit the IPO on Saturday.

The first time was in 2019, when Saturday Fu prepared to rush to the main board of the Shenzhen Stock Exchange, but was not approved because the above believed that the growth in Saturday Fu's main business income was too high and the franchise model needed to be explained; the second time was in October 2020. On Saturday Fu replaced the sponsor institution with Minsheng Securities. The then IEC had doubts about its operation and was rejected again.In June 2022, Saturday Fu fought three times on the main board. However, due to the local and overseas capital market conditions, the company voluntarily withdrew its listing application in November 2023.At this point, Saturday Fu's listing journey on the main board ended.

In June 2024, Saturday Fu switched to the IPO of Hong Kong stocks, but it failed.This IPO is the company's fifth listing.According to the prospectus, the co-sponsors of this listing application are CICC and CITIC Construction Investment International, and plan to use the raised funds to: open and upgrade self-operated stores, support franchisees, improve product design and development capabilities, and strengthen brand awareness.

Let's take a look at the basic situation of Saturday Fortune.

Founded in 2004, Zhou Liufu integrates the development and design, procurement and supply, franchising and brand operation of jewelry products.As of December 31, 2024, Saturday Fu has 4125 stores (including franchised stores and self-operated stores) in 305 prefecture-level cities and prefecture-level administrative regions in 31 provinces in China.As of the same day, Saturday Fu also opened 4 stores overseas (two franchise stores in Thailand and one franchise store each in Laos and Cambodia).

According to Frost Sullivan, based on the number of stores in China, Saturday Fook has remained among the top five brands in the China jewelry market for seven consecutive years from 2017 to 2023; among China jewelry brands, Saturday Fook is the fastest company from establishment to reaching the milestone of 4000 stores.

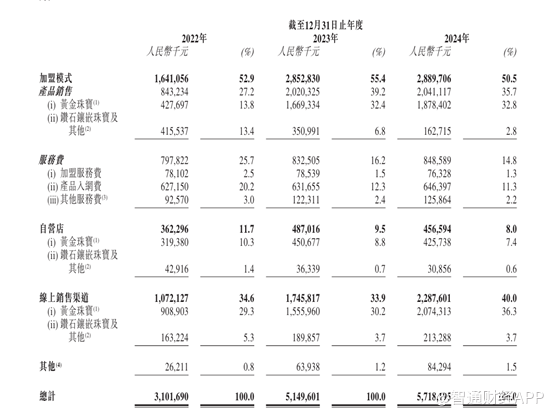

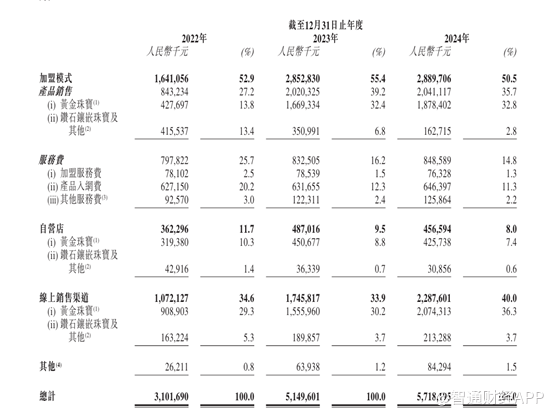

Financial data.From 2022 to 2024, Saturday Fu's revenue was 3.102 billion yuan, 5.150 billion yuan and 5.718 billion yuan respectively, with a compound annual growth rate of 35.8%; during the same period, Saturday Fu's net profit was 575 million yuan, 660 million yuan and 706 million yuan respectively, with a compound annual growth rate of 10.8%.

The rise of Saturday Fu relied on light assets.

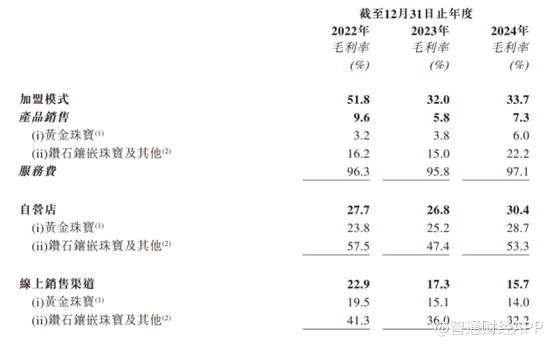

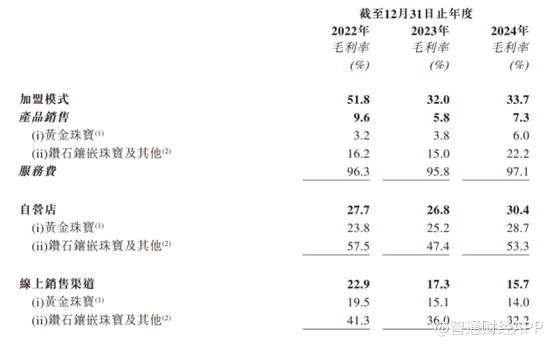

As of the end of 2024, 97.7% of its 4129 stores are franchised stores, which far exceeds that of leading brands such as Chow Tai Fook (about 80%). The franchise model achieves high gross profit by charging service fees (such as product access fees and franchise fees). In 2024, the service fee contributed 55.7% of the gross profit, of which the gross profit margin of product access fees is close to 100%.

However, over-reliance on franchisees leads to weak brand control: from 2022 to 2024, there were more than 3400 complaints involving product quality, price fraud and other issues, and the number of complaints on the Black Cat platform surged by 55% to 3722 in 8 months.What is even more serious is that the number of franchisees will decrease by 250 in 2024, the first negative growth in a decade, reflecting the reality that franchisees 'confidence has been frustrated due to fluctuations in gold prices and intensified market competition.

In order to hedge against the contraction of offline channels, Saturday Fu found a way to break the situation by accelerating the layout of e-commerce.

The prospectus shows that from 2022 to 2024, the compound growth rate of online sales on Saturday will reach 46.1%, and online revenue will account for 40% in 2024, which is significantly higher than that of peers such as Zhou Dasheng (about 25%).According to Frost Sullivan, based on the compound annual growth rate of online sales revenue from 2021 to 2023 and the proportion of online sales revenue to total revenue in 2023, Fortune ranked first among national jewelry companies in China on Saturday.

On Saturday, Fu lost repeatedly. Behind the repeated defeats and repeated IPOs is the eager ambition to break the situation.

Currently, China's jewelry industry is undergoing structural adjustments: the proportion of gold jewelry will increase from 53% in 2018 to 63% in 2023, and consumer preferences will shift to products with stronger investment attributes.Although gold is the main category on Saturday, its R & D investment is less than 0.35% of revenue. Of the 852 patents, 289 are designs, and technical barriers are weak.

In contrast, Chow Tai Fook has launched traceability blockchain technology, Lao Fengxiang has strengthened ancient technology IP, and Saturday Fook's lag in product innovation may weaken its premium ability.In addition, in a high gold price environment, international gold prices will rise by 26% in 2024, terminal consumer demand will be suppressed, and the overall growth rate of the industry may drop from 11% to 9.4%, and stock competition will intensify.InvalidParameterValue

If this IPO is successful, Saturday Fu plans to use the funds raised for self-operated store expansion, franchisee support and product development, in an attempt to reverse the decline by enhancing channel control and product differentiation.However, the capital market may be cautious about its valuation: the average P/E ratio of the Hong Kong stock jewelry sector is less than 15 times, and investors generally discount brands that rely on the franchise model.

In the early spring of 2025, the Hong Kong stock market is experiencing a "gold rush".

Chifeng Gold launched an IPO in the range of HK$13.72 -15.83, becoming the third "A+H" gold stock after Zijin Mining and Shandong Gold; Laopu Gold rose 70% on the first day and Mixue Ice City froze HK$1.8 trillion. The grand occasion has pushed the capital fever of the Golden Track to the boiling point.Coupled with the fifth IPO impact on Saturday, Hong Kong stocks have hit a new Xiaoyangchun.

Judging from industrial fundamentals, the underlying logic of global central banks 'continued increase in holdings of gold is undergoing qualitative changes.

World Gold Council data shows that global central bank purchases will reach 1045 tons in 2024, breaking the thousand-ton mark for three consecutive years. This is not only a safe haven for the loosening of the US dollar credit system, but also a strategic move for emerging economies to restructure the international reserve structure.In this context, gold producers 'resource control has become the core of valuation-Chifeng Gold ranks among the top five in the country with 12.5 million ounces of gold resources. Its overseas assets account for 65.2% and the cost of processing gold is only US$1179 per ounce., the cost advantage of 14.4% lower than the industry average makes it more profitable when expectations of the Federal Reserve to cut interest rates rise.InvalidParameterValue

The differentiation of capital heat in different links of the gold industry chain essentially reflects the transfer of value distribution rights.Upstream mining companies rely on resource scarcity to obtain beta gains on gold prices. Midstream processors are limited by homogeneous competition and have difficulty retaining premiums. While downstream retailers need to find a balance between brand premiums and channel efficiency.It is worth noting that the current average first-day gain of 4.2% for Hong Kong stocks and new stocks, but the performance of individual stocks varies greatly-Laopu Gold has achieved a cumulative increase of 101% due to its high-end positioning, while Mengjinyuan's gross profit margin as low as 5.3% has put its valuation under pressure.

Faced with the risk of gold price fluctuations brought by the swing of the Federal Reserve's monetary policy, Smart Funds have begun to deploy structural hedging strategies.Some institutions capture the redistribution of profits in the industry chain through pairing transactions of "multiple minerals and empty jewelry", while others manage risk exposure through a combination of gold ETFs and mining company options.

For retail investors, the discount space of Chifeng Gold's H shares compared with A shares, the reshaping of the valuation caused by the proportion of online channels on Saturday exceeding 40%, and the liquidity premium brought by the potential transfer of Hong Kong Stock Connect have made the market outlook continue to open up the imagination.

WeChat can be added to technical exchanges between Hong Kong and US stock brokers