How is INFINOX? Is it Reliable?

INFINOX is a global CFD broker established in 2009, with offices in Latin America, Asia, and the Middle East and North Africa, offering a variety of trading products, trading platforms, and customer support services to traders worldwide.

Introduction to INFINOX

INFINOX is a global CFD broker established in 2009, committed to providing traders around the world with convenient, transparent, and intelligent access to financial markets. The company has offices in Latin America, Asia, and the Middle East and North Africa, operating across over 15 countries.

INFINOX offers competitive trading conditions and high-quality customer service. The trading products include stocks, indices, and futures markets, with compatibility across multiple industry-leading trading platforms and various types of client accounts. The company provides award-winning trading platforms to ensure a smooth experience from order placement to execution, supported by a 24/7 customer support team available to assist clients at all times. All accounts are protected by international regulatory safeguards.

INFINOX holds regulatory licenses in three major regions, including the Financial Services Commission (FSC) and the Securities Commission of the Bahamas (SCB), and offers a range of products for trading.

INFINOX Security

INFINOX is an accredited trading broker regulated internationally since its inception in 2009, with traders' accounts protected by licenses from internationally recognized financial regulators.

- International Regulation: INFINOX holds regulatory licenses issued by the Financial Services Commission (FSC) and the Securities Commission of the Bahamas (SCB).

- Comprehensive Compliance: The global compliance team has conducted thorough reviews of trader services and benefits to ensure the highest standards of security.

- Traders' funds are kept in segregated client accounts with the Commonwealth Bank of Australia. Funds held by INFINOX can only be returned to the owner, and segregated funds will not be used for other purposes.

Under the deposit insurance policy, traders may receive compensation up to $500,000 per claimant if INFINOX goes bankrupt, subject to policy limits, terms, and conditions. Claims must meet the following criteria:

(i) Be an eligible claimant in the event of bankruptcy;

(ii) Submit a claim (including claim form) to the bankruptcy practitioner within 12 months from the date of the bankruptcy event;

(iii) Submit an investor compensation form to the insured within 12 months from the date of the bankruptcy event. Details of the policy can be provided upon request.

INFINOX Service Features

Traders can gain faster insights into the market with INFINOX.

- INFINOX offers tailored market analysis, technical research, and educational articles designed to help both beginners and experienced traders gain new knowledge and improve trading skills.

- The company provides up-to-date market commentary, technical analysis, and trend forecasts to keep traders informed about market dynamics.

- Educational content is available for traders of all experience levels.

- Traders can access the latest news and event information through daily market reviews.

INFINOX provides excellent customer service, offering trading assistance and answers to questions.

- Localized Customer Support Team

- Support in over 15 languages

- 24/7 instant support

- Contact via phone, email, or instant messaging

INFINOX Account Types

INFINOX offers ECN and STP accounts, both with strong liquidity, powerful execution, and comprehensive platforms and tools. STP accounts route orders from different liquidity providers, while ECN accounts route orders through a network that acts as the primary liquidity source. ECN accounts offer low spread trading, while STP accounts allow commission-free trading.

Comparison of Accounts:

| STP Account | ECN Account | |

|---|---|---|

| Spreads | From 0.9 | From 0.2 |

| Leverage | Up to 1:1000 | Up to 1:1000 |

| Fees | From £0 / €0 / $0 / A$0 | From £3 / €3 / $3 / A$3 |

| Min. Trade Size | From 0.01 lots | From 0.01 lots |

| Main Account | Yes | No |

| Sub Accounts | Yes | Yes |

Margin calls occur if the account's net equity falls to 50% of the required margin. Margin stop-loss is set at 20% of the required margin.

INFINOX offers demo accounts for all traders. Beginners can use demo accounts to understand how CFD trading works, while professionals can test new strategies risk-free.

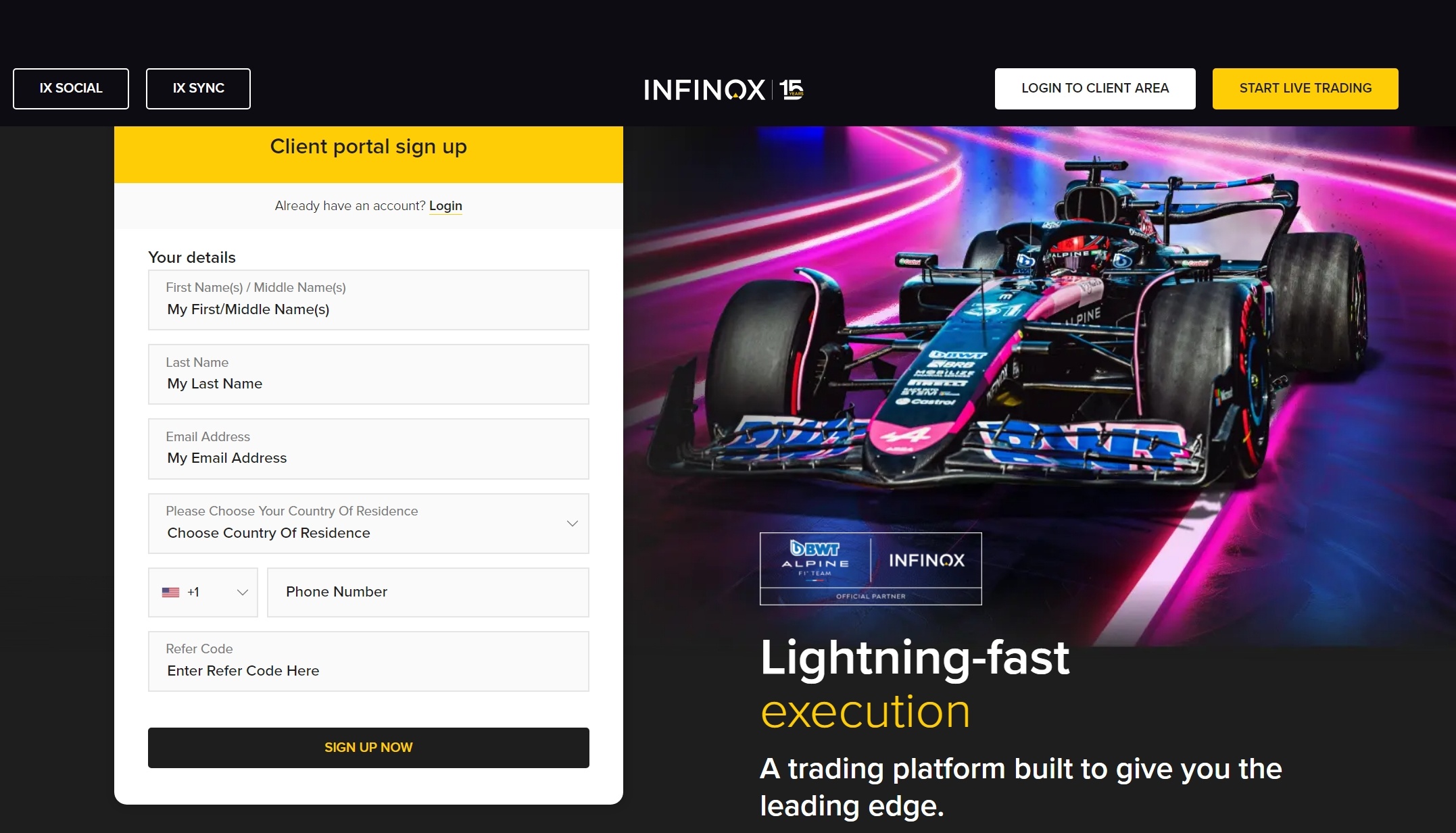

INFINOX Account Opening Process

Opening an account with INFINOX is straightforward. Click "Open an Account with INFINOX Now!"

- Visit the INFINOX website and click the "OPEN LIVE ACCOUNT" button at the top right of the page.

- Enter personal details (name, email, phone number, etc.) and click "SIGN UP NOW."

- Upload identity and address verification documents and complete verification.

- Verification usually takes one business day. Once approved, fund the account and start trading.

To verify a trader's identity, valid proof of identity is required, such as a passport, ID card, or driver's license. Some regions may also require address proof within the last 3 months, showing the name and address, such as utility bills or bank statements.

INFINOX Deposit and Withdrawal

Deposit Process

INFINOX offers 10 flexible deposit options in various base currencies, including credit/debit cards, digital wallets (Skrill and Neteller), bank transfers, and wire transfers.

For example, with Skrill:

- Log in to the "Client Area."

- Navigate to the "Cashier" tab and select "Deposit."

- Click the Skrill icon to choose this deposit option.

- Enter or select the deposit amount and bonus code (if applicable), then click "Deposit." Ensure the amount is less than or equal to the amount in the Skrill account.

- Complete the transaction on the Skrill website.

- After receiving the "Order Approved" message, click "Confirm" to return to the cashier and see the successful deposit message.

Notes:

- Minimum deposit amount is $50 or equivalent in base currency, with no maximum deposit limit.

- INFINOX does not accept or recognize third-party deposits, which may lead to termination or rejection of the deposit.

Withdrawal Process

Traders must use the same method for withdrawals as for deposits, meaning the initial deposit amount will always be returned to its source. Profits can be withdrawn using methods other than debit and credit cards, such as bank transfers and digital wallets.The withdrawal process is as follows:

- Log in to the "Client Area."

- Click "Withdraw" in the left menu.

- Select the trading account and withdrawal method, and enter the withdrawal amount.

- Click "Request Withdrawal."

Notes:

- Withdrawals are processed within one business day but may require processing or bank clearing.

- Withdrawals can be requested with open trades, and the amount will be automatically deducted from the account.

- INFINOX charges a $15 fee for withdrawals via bank wire, Skrill, and Neteller. This fee is waived if only one withdrawal per month. INFINOX does not cover any additional fees charged by intermediary banks.

- Withdrawal requests from the client area take 24 hours to process. Depending on the bank and withdrawal method, it may take up to 5 business days to complete.

INFINOX Trading Platforms

MT4

Trading with INFINOX on MT4 offers access to algorithmic trading, technical and fundamental analysis tools, extensive price analysis features, and trading signals.

- Advanced Charts: MT4 provides a wide range of interactive charts and trading tools for complex strategies.

- Technical Analysis: 30 built-in technical indicators, analysis objects for entry and exit points, 4 pending orders, 9 time frames, and more.

- One-Click Trading: Execute trades with a single click without additional confirmation, optimizing order execution speed.

- Algorithmic Trading: Use Expert Advisors (EAs) to analyze and execute trades automatically.

MT5

MT5 is an upgraded version of MT4, allowing trading in more products, using a broader range of time frames and indicators, and exploring additional trading features.

- Flexible Trading: Supports netting and hedging order accounting systems, as well as instant, request, market, and exchange execution modes.

- Technical Analysis: 38 built-in technical indicators, market depth, hedging and netting, 6 pending orders, 21 time frames, and more.

- Fundamental Analysis: Economic calendar with macroeconomic indicators and news reports affecting trading.

- Virtual Hosting (VPS): Runs trading robots continuously and ensures minimal delay in order execution, operating even when the computer is off.

IX SYNC

Trade all INFINOX products on IX SYNC, including forex, commodities, stocks, cryptocurrencies, indices, and futures. IX SYNC is a multi-asset trading platform with integrated client areas, multiple chart and technical indicator options, a customizable dashboard with over 40 widgets, and enhanced trading tools.

- Multi-Asset Trading Platform: Over 900 tools for trading across various asset classes, including forex, stocks, indices, commodities, and cryptocurrencies.

- Integrated Client Area: Deposit, trade, and withdraw with one login. Various payment methods are supported, enabling market entry and trading on a single platform.

- Mobile and Web Platform: Trade anytime, anywhere with the IX SYNC platform, available on desktop and mobile devices for a complete IX SYNC experience.

- User-Friendly and Fully Customizable: Choose visible content, create personalized layouts, and use multiple charts on one screen, real-time news via IX Intel, or currency heat maps.

IX Social

- Automated Copy Trading: Easily replicate top traders' strategies and earn similar returns.

- Advanced Risk Management Tools: Protect accounts with different drawdown levels, adjust and reset drawdown levels to control risk exposure, and manage risk with warnings, soft stops, and hard stops.

- Stay Updated: Keep up with new market trends, popular community topics, top trades of the day, and latest prices. Traders can customize notifications for real-time updates.

INFINOX Trading Products

INFINOX offers over 900 financial products, including Forex, stocks (CFDs), indices, commodities, bonds, futures (CFDs), and cryptocurrencies (CFDs).

- Forex: Traders benefit from low-cost, tight spreads and leverage that can amplify trading potential. You can trade major USD currency pairs, stable non-USD minor pairs, or exotic pairs. With an INFINOX account, traders can access over 45 currency pairs, opening up new opportunities in the $6.6 trillion daily Forex market.

- Stocks (CFDs): Trade selected stocks on major global exchanges, including the NYSE, London Stock Exchange, Frankfurt Stock Exchange, Madrid Stock Exchange, Paris Euronext, and Amsterdam Euronext. Diversify your portfolio with companies across various sectors, such as technology, healthcare, and automotive. INFINOX offers commissions and fees starting from 0.10% of the trade value or $0.02 per share.

- Commodities: Diversify and hedge your portfolio with global traded commodities, including energy, metals, and agricultural products. INFINOX provides access to commodities ranging from highly volatile to safe-haven assets.

- Bonds: Traders can access a range of government bonds on the INFINOX platform, taking advantage of opportunities in the bond market.

- Futures (CFDs): Trade futures contracts across various markets, including energy, precious metals, indices, and Forex on INFINOX.

- Indices: Use leverage to expand your overall exposure when trading indices on INFINOX. Enter the market without additional upfront funding, with leverage significantly amplifying trading outcomes. INFINOX offers competitive pricing on major global indices such as the S&P 500, Nasdaq 100, DAX 40, and VIX.

- Cryptocurrencies (CFDs): INFINOX provides over 40 cryptocurrency CFDs with competitive spreads and leverage. Cryptocurrencies available for trading include BTC, ETH, DOG, ADA, and more.

FAQs

Can I open multiple accounts?

- After opening a real trading account with INFINOX, you can apply for up to 10 accounts with the same name, excluding archived and closed accounts, to meet the need for trading different base currencies.

Are there additional fees if I don't use my trading account for a long time?

- Accounts with a zero balance and no activity for over three months will be marked as inactive. INFINOX does not charge inactivity fees.

Do Skrill or Neteller email addresses need to match my INFINOX email address?

- No, it is not required. Only proof of Skrill or Neteller email name matching the trader’s account name is needed.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.